Hotel giant Marriott International (NASDAQ: MAR) priced US$1.6bn worth of investment-grade notes to stellar demand, despite the beleaguered hospitality industry’s continued suffering from travel bans and drop in tourism.

High-grade corporate debt sales have been surging recently amid the Federal Reserve’s recent actions to support the economy, with another hefty round of offerings Tuesday that tallied nearly US$13.5bn.

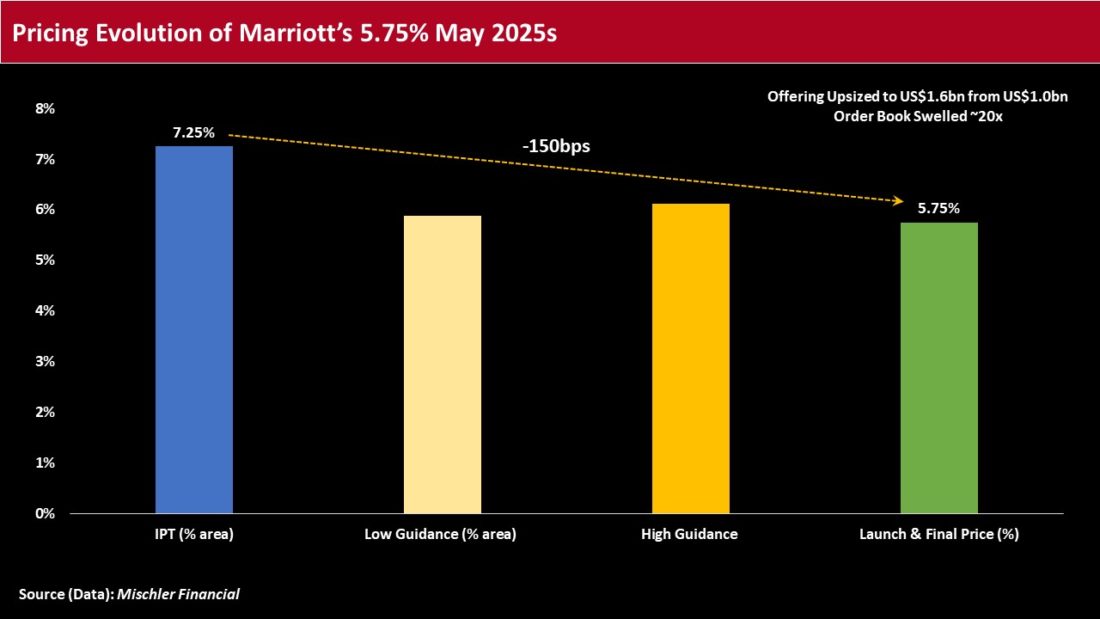

Among the deals, Bethesda, Maryland-headquartered Marriott entered the high-grade corporate primary market with a ‘BBB’-rated, five-year fixed-rate note sale, which priced to yield 5.75% at maturity.

The yield on the five-year U.S. Treasury note Tuesday was bid at around 0.424%.

Marriott said it intends to use the net proceeds from the sale for general corporate purposes, which may include working capital, capital expenditures, acquisitions or repayment of outstanding commercial paper or other borrowings.

The issuance, jointly led by BofA Securities, J.P. Morgan, Goldman Sachs, Deutsche Bank Securities and US Bancorp, was a testament to the recent fervor among fixed-income investors – having upsized by US$600m from its original amount and selling at a yield that was roughly 150 basis points lower than its initial price talk.

The order book on the offering was also touted as having been oversubscribed by around 20x – for a whopping total of around US$20bn.

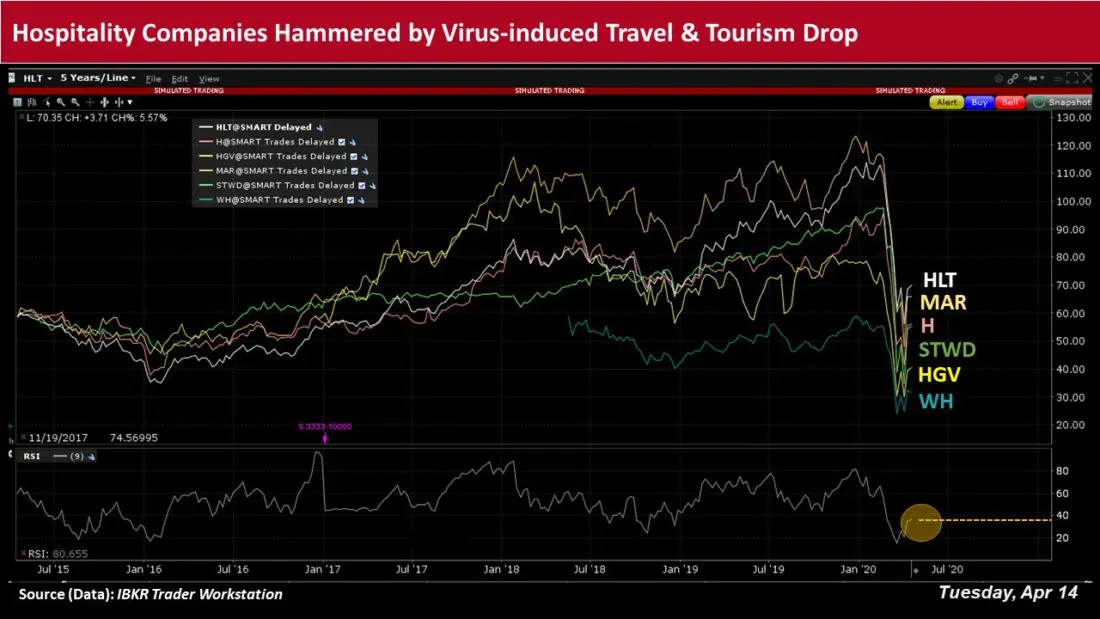

However, while bond investors have been generally more optimistic about high-grade credits, lodging and leisure-related businesses continue to combat a virus-spurred plunge in consumer spending, with occupancy rates at U.S.-based hotels likely to remain at significantly low levels for a prolonged period.

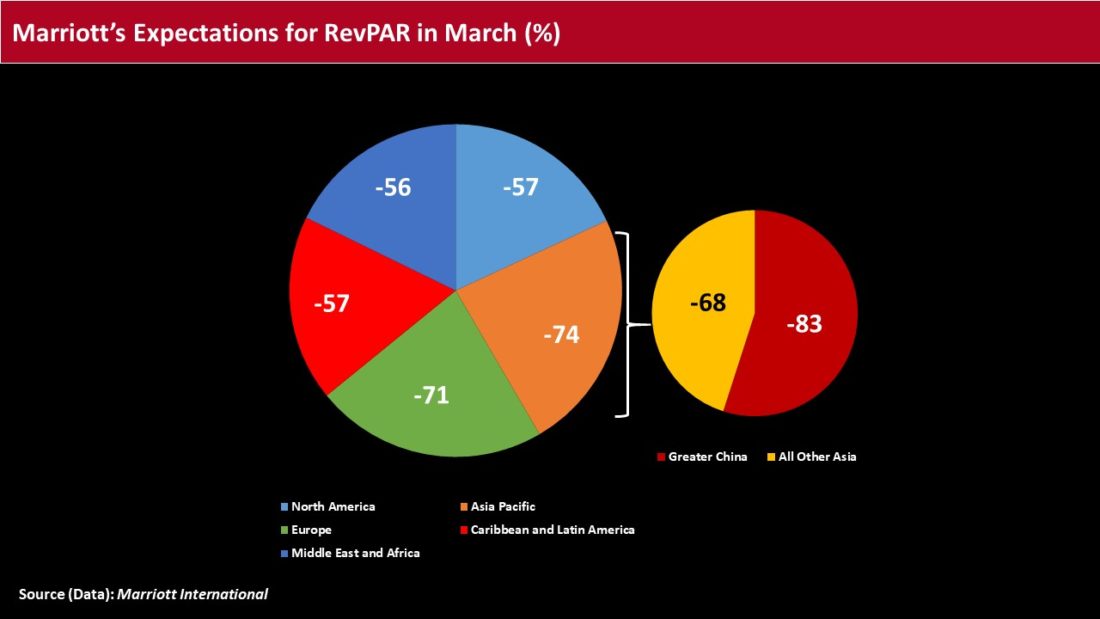

Marriott, for example, has been contending with a host of COVID-19-induced dilemmas, including material declines in revenue per available room (RevPAR), as well as a recent rating downgrade.

The company noted that occupancy levels at its North American hotel properties hover at around 10%, while more than 870 hotels, or 16%, are temporarily closed – with additional closures expected.

Moreover, Marriott said it expects RevPAR in March to have plunged by an estimated 60% worldwide, reflecting declines of around 57% in North America, 74% in Asia Pacific (with declines of 83% in Greater China and 68% in the rest of Asia), 71% in Europe, 57% in the Caribbean and Latin America, and 56% in the Middle East and Africa.

While shares in the hospitality giant rose a little more than 5% intraday Tuesday, year-to-date in 2020, Marriott’s stock has shed close to 46.3% of its value.

Access to Credit

Among other measures to ensure funding, the company noted that it entered into a commitment letter Monday for a US$1.5bn 364-day senior unsecured revolving credit facility, which will generally be reduced by new equity and debt issuances (including senior notes), as well as asset sales.

At the same time, it amended the terms of its credit agreement dated as of June 28, 2019, in large part to waive its quarterly-tested leverage covenant through, and including, the first quarter of 2021.

The amendment also increases the credit facility’s interest and fees for the entire period the waiver of the leverage covenant remains in effect. It also tightens certain existing covenants for the duration of the waiver period, including tightening the lien covenant and the covenant on dividends, share buybacks, and distributions, and imposes new covenants limiting asset sales, investments and discretionary capital spending.

A monthly-tested minimum liquidity covenant will also apply for the duration of the waiver period.

Marriott said the credit agreement continues to provide for US$4.5bn worth of effective bank commitments, which has been fully drawn down.

Liquidity Check

S&P Global Ratings, which assigned a ‘BBB-’ credit rating to Marriott’s latest note sale, noted that it expects the company to use the proceeds from the issuance to bolster its cash balances and its liquidity position “given the significant negative impact of the coronavirus pandemic.”

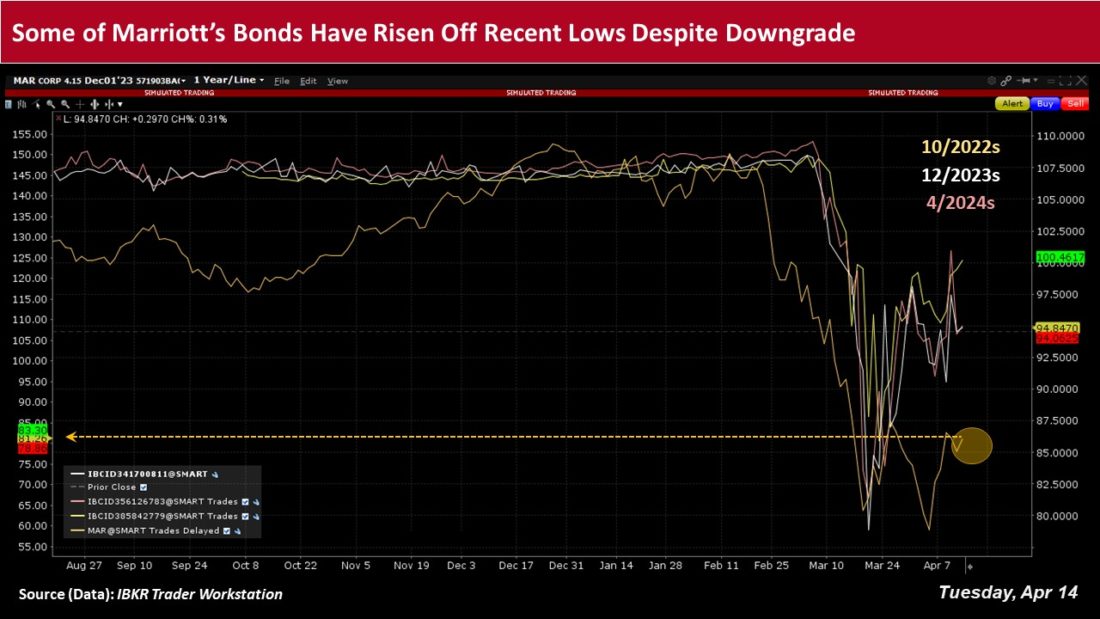

S&P cut Marriott’s credit rating in mid-March by one notch to ‘BBB-’ from ‘BBB’ and placed the issuer on CreditWatch with negative implications.

Given Marriott’s net excess liquidity of US$1.5bn under its currently fully drawn US$4.5bn revolver, as well as its new US$1.5bn unsecured 364-day revolving credit facility and amended credit facility, S&P said that while company is likely to experience “material negative cash flow while hotels are closed or running at very low occupancy,” it will have “adequate liquidity assuming recovery in the second half of 2020 to refinance upcoming note maturities.”

Spreads on many of Marriott’s bonds in the secondary market tightened Tuesday, including its 2.125% notes due October 2022 (-14bps to 478bps); its 4.15% bonds due December 2023 (-40bps to 498bps); and its 3.6% debt maturing April 2024 (-25bps to 518bps).

Aggregate OAS spreads on investment-grade, consumer discretion debt compressed by nearly 10bps on the day Tuesday to a little more than 230bps, according to Bloomberg.

Meanwhile, Marriott competed with other high-grade issuers on the docket Tuesday, including a US$2.5bn, two-year note from Swiss bank UBS (NYSE: UBS); an US$800m issuance from financial servicer USAA Capital Corp; and a US$1.5bn debt deal in two parts from transport fuel producer Valero Energy (NYSE: VLO).

A total of nearly US$39.5bn worth of high-grade corporate bonds priced to date this week, already surpassing most syndicate managers’ outlooks for US$35bn, and despite expectations of a slowdown due to earnings season blackouts.

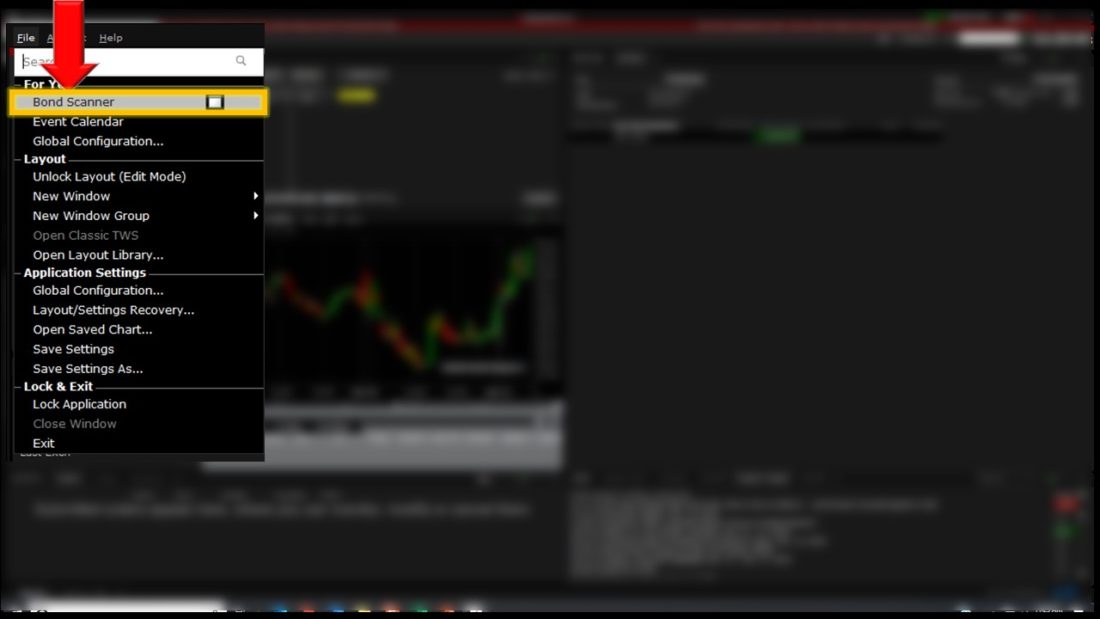

For more insights, use the global bond scanner in the IBKR Trader Workstation to locate corporate bonds that are available to trade in the secondary market, along with U.S. Treasuries, municipal bonds, non-us sovereign debt and more.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Author Security Holding: No Positions

The author does not hold any positions in the financial instruments referenced in the materials provided.