By: Christopher Gannatti, CFA, Jeremy Schwartz, CFA

As we have recorded the June 2, 2023, edition of Behind the Markets, we remind listeners that the usual path of human estimates is to be too optimistic in the short term and not optimistic enough in the long term.

With respect to generative artificial intelligence (AI), this translates to investors likely being too optimistic about how it could impact certain companies, like Nvidia, in 2023, but not recognizing massive potential growth 5 or 10 years into the future.

But, nothing is ever certain, and that is why it was a pleasure to be able to leverage the expertise of Eric Rothman, Portfolio Manager, Real Estate Securities, with CenterSquare. CenterSquare is a dedicated real estate investment manager, with about $14 billion under management, and Eric has been with them for 17 years. We note that WisdomTree has licensed the CenterSquare New Economy Real Estate Index, which is tracked by the WisdomTree New Economy Real Estate Fund (WTRE).

Big Picture Macro—Housing

June 2, 2023, saw the June release of the monthly jobs data, so it made sense to start the discussion by looking at some of the big picture macroeconomic issues impacting real estate. Housing has to be at the top of that list. From a commercial perspective, the number-one reason someone moves out of an apartment is to buy a home. With affordability as challenged as it is presently, it is looking like many people will keep renting. In the U.S., it’s true that there has been an undersupply of new residential housing, particularly in the multi-family real estate space.

Based on demographics, millennials are entering their peak home-buying years, but there is an affordability issue, so the life situation of many millennials requires a different living arrangement.

Eric noted that CenterSquare has found an interesting opportunity in single-family homes available for rent. There are companies that own large pools of single-family homes, but they rent them, and this was something that arose out of the global financial crisis of 2008 and 2009.

Office Space—Is ‘Remote-First’ Here to Stay?

Eric noted that office real estate is in a very tough spot, and CenterSquare has been concerned for about three years. There was a question as to how many people would return to the office after the pandemic, and it looks like normalization has stalled with about two-thirds of people relative to 2019 levels going into office over last year and a half. Some cities may have seen up to 75% of people returning to the office. Elements of remote-first are starting to feel more permanent.

Now, even in those higher level cities, this doesn’t mean that there is a commensurate 25% reduction in demand—maybe you still have the office and it’s configured differently. Maybe the usage is changing. However, many people forget that ‘office space’ is very small when considering the broader real estate market. Maybe 15–20 years ago, it would have been somewhere around 15%–20% of the benchmark.1 In the private real estate market, it is still bigger. However, in today’s real estate investment trust (REIT) market, office represents about 3%. The main reason for this—new economy real estate has been growing.

New Economy Real Estate

What is new economy real estate? Eric explained there is so much beyond the traditional ‘four food groups’ of real estate, meaning retail, office, residential and industrial.

In CenterSquare’s definition of the ‘new economy real estate’ space, Eric noted that the larger components include data centers, cell phone towers and warehouses dedicated to new economy logistics—things like e-commerce fulfillment. Eric used the expression ‘not your grandfather’s warehouses’ because he wanted to emphasize that this is far from traditional industrial real estate.

Some of the smaller segments include life sciences, cold storage and office space that is uniquely tailored to technology tenants, typically located in specific cities with focused pools of technology talent. Such cities include Seattle, San Francisco and New York.

The Nvidia Story—$1 Trillion to Be Spent?

Today, in 2023, saying $1 trillion is a big number and a nice headline, but the first thing we recognize is that it is extremely difficult to forecast something like where generative AI will take us. Eric noted that DLR has forecast that generative AI will be even bigger than cloud computing, and that where we are today may be like where the cloud was 15 years ago. Some people say it is like inventing the wheel or the personal computer. Only time can tell us what will prove accurate.

If people are thinking about ‘data center REITs’ as an investment, they have to understand that data centers only provide power, cooling and connectivity. Data center REITs do not actually own the computers. The tenants invest in the computers. One thing that is absolutely true, however, is that as an owner, you love to see the tenants putting money into the space that they are renting. Why? This makes it less likely they are going to leave.

Eric’s conclusion, whether about the impact of generative AI on data center REITs or on cell phone tower REITs, was that the move in share prices so far hasn’t reflected where we could be going. Connectivity will be important, data centers will be important, but it’s not yet clear how or when investors are going to reflect that in real estate prices. Eric noted that investors frequently forget about the buildings until later in a cycle or a trend.

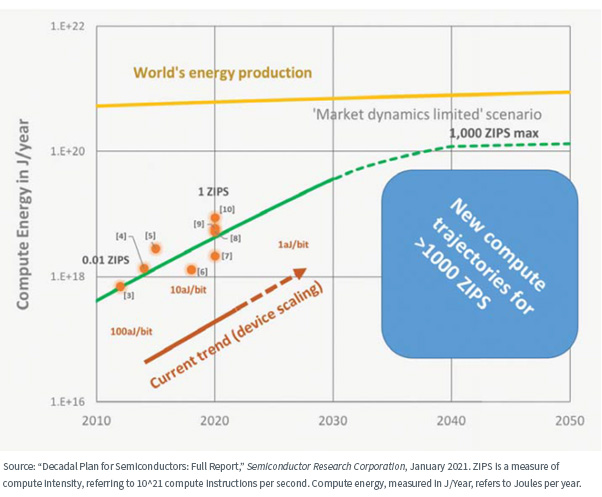

Another aspect that we discussed was energy usage. Eric estimated that newer AI-focused semiconductors draw more power—not just a little bit more power but a step change in power consumption.

In figure 1, we show a chart from the “Decadal Plan for Semiconductors,” a research report put out by Semiconductor Research Corporation. A critical point to keep in mind is the expression that ‘something’s gotta give,’ in the sense that simply continuing to add computational capacity without thinking of efficiency or energy resources will eventually hit a wall. However, if history is any guide, we should expect that as demand and investment in computational resources increases, there is the potential for gains in efficiency, improved model design and even different energy resources that may not yet exist today.

Figure 1: Comparing Compute Energy to the World’s Energy Production

Since many investors may be less familiar with cell phone towers, Eric made sure to mention just how strong a business model he believes this to be. Now, it’s true that these REITs have not performed well in the past 18 months, but we are right in the middle of the current 5G rollout. Tenants have long leases, there is lots of demand, and there are even CPI escalators that impact the rent that can be collected.

Conclusion—A Different Way to Think About Real Estate

It was great to be able to spend some time speaking with Eric and to learn about what’s happening, both in the broader real estate market as well as in the more specific, new economy, ‘tech-focused’ market.

Click Here to Listen to the full discussion

1 Benchmark can refer to the FTSE EPRA/Nareit Developed Index.

—

Originally Posted June 8, 2023 – Has the Future Spending on Generative AI-Related Chips from Nvidia Been Underestimated?

Important Risks Related to this Article:

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in real estate involve additional special risks, such as credit risk, interest rate fluctuations and the effect of varied economic conditions. A Fund focusing on a single country, sector and/or emphasizing investments in smaller companies may experience greater price volatility. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.