Mat Cashman, Principal of Investor Education at the OCC joins IBKRs Senior Trading Education Specialist Jeff Praissman to discuss the option lifecycle, exercises, assignments, open interest, and how it is calculated.

Contact Information:

For more free options education from The Options Industry Council (OIC), an industry resource provided by OCC, visit OptionsEducation.org.

Have an options-related question? Contact the OCC Investor Education team at options@theocc.com or via live chat on OptionsEducation.org.

Connect with OIC Instructor, Mat Cashman.

Note: Any performance figures mentioned in this podcast are as of the date of recording (May 15, 2023).

Summary – IBKR Podcasts Ep. 79

The following is a summary of a live audio recording and may contain errors in spelling or grammar. Although IBKR has edited for clarity no material changes have been made.

Jeff Praissman

Hi everyone, welcome to IBKR Podcast. I’m your host, Jeff Praissman, Interactive Brokers’ Senior Trading Education Specialist, and it’s my pleasure to welcome back to the IBKR Podcast studio, Mat Cashman, Principal of Investor Education at the Options Clearing Corporation, or OCC. Hey, Mat, how are you? Welcome back.

Mat Cashman

I’m doing great, Jeff. It’s good to be here. I’m excited to talk about options.

Jeff Praissman

Super excited for this podcast episode, and today we’re going to discuss the life cycle of an option. Kind of start from the beginning, right? The initial trade, if you could go through the exchanges’ purposes and the OCC’s purpose in that initial trade and then we can kind of just take it from there and walk the listener through.

Mat Cashman

Yeah, absolutely. It’s a great place to start because it’s really the nexus of and the genesis of where all of all of the trades happen and begin and the beginning of the life cycle of the option. So, really the purpose of the exchange is to provide a format for the exchange of risk. It’s where people come to exchange their risk and it started way, way back in the day when people needed to hedge the risk of generally speaking, crops or commodities or things of that nature. And then eventually it developed into — as during the 70s in the United States — specifically that these financial products started to trade. Then we started to get these financial products that traded as well, but they all happened, and they all traded, and they all exchanged risk at these exchanges, a place where people come to exchange risk. Now the interesting thing about the way that it’s designed and the way that the actual mechanism works now is that the OCC, which is the Options Clearing Corporation — By the way, the Options Clearing Corporation is named that because they clear all of the centrally cleared options that are traded on United States equity and index exchanges in the US right now. So, currently the OCC clears all of these trades, meaning that the OCC, when two people are trading on an exchange, is actually the buyer to every seller and the seller to every buyer. That’s essentially what a centrally cleared contract means, that there is a central counterparty between the buyer and the seller. That actually is the buyer to the seller and the seller to the buyer. And what that does is that it presents. A centralized point in between those two people that guarantees that that trade back and forth is going to be good no matter what happens as far as the risk is concerned.

Jeff Praissman

The OCC’s really taking away that counterparty risk so that buyers and sellers have one less thing to worry about. They don’t need to worry about any sort of default from the other side. The OCC is really guaranteeing that it’s a safe trade as far as the counter side.

Mat Cashman

Absolutely, and that’s part of why I think that the United States equity market has grown in the way that it has, especially over the last decade or so. You know, the OCC clears north of 40 million contracts a day at this point, which works out to about 10 billion contracts, more than 10 billion contracts a year, and all of those contracts are centrally cleared. They are centrally settled by the OCC and all of the people that are involved in those trades back and forth have the actual confidence behind that organization that’s been doing this over and over and over every day, every single trade for the last however many years. 50 years now at this point. And that’s part of the reason why I think now that the United States options market indexes and equity options has grown to the point that it has.

Jeff Praissman

And I would assume that since the OCC is interacting with you know the exchanges and the brokers and the traders that there must be some requirements that the OCC has for the exchanges and the counterparties to clear for them, I guess.

Mat Cashman

Yeah, absolutely. I’m not going to get too deep into the weeds as far as the actual requirements per each clearing member firm, but suffice to say there are clearing member firms that are part of OCC. And each one of those firms that is a clearing member, as part of their duty to this centralized clearing facility has to actually put in a certain amount of capital that has pledged to this kind of centralized risk waterfall system that actually ensures that even if one of the large players in this marketplace goes under, that there is enough capital pledged by all of the rest of those member firms to cover the actual clearing and the actual liabilities that exist for all of those contracts that would be out there by that large … If there were a default scenario like that where there have been I think maybe there have been small ones and there have been some over the years, but it has never gotten to the point where it’s been systemic enough that the risk waterfall hasn’t been able to handle all of that.

Jeff Praissman

We’re taking this option life cycle, this journey that options have and you have the buyer, the seller, you have the OCC providing basically the insurance to make sure that everything is going to be smooth. And now that the trades have been made and I want to talk about something that a lot of maybe casual option traders may have heard about, or maybe not so sure how it’s calculated, open interest. What is open interest and how is it calculated?

Mat Cashman

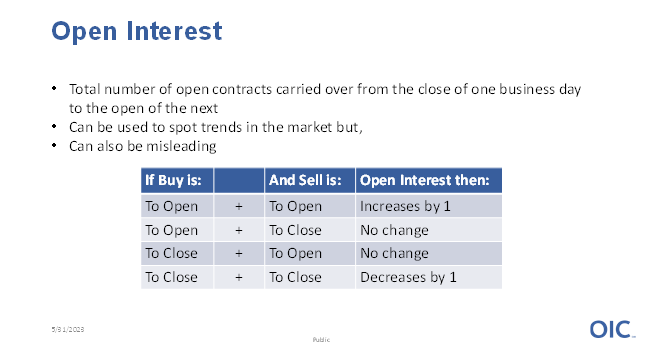

Open interest is one of those concepts that has kind of a nebulous and kind of esoteric, but a lot of people don’t understand exactly how it works. So let me give you a breakdown of exactly the nuts and bolts of open interest. Open interest is essentially just a measure of the total number of open contracts carried over from the close of the previous business day for that contract. So you can get open interest numbers for futures out there that are out there. A lot of people look at open interest for commodity futures. There’s open interest for index options. There’s open index for equity options and they are per strike per call or per put right, they are that very single option. How many of that option exists out there as an open contract? Now a lot of people like to look at it and try to kind of what I call “read the tea leaves” as to dealer positioning based on open interest. But really what you need to understand as far as the nuts and bolts are concerned, trying to read those tea leaves can be a little misleading, but let me give you a real nuts and bolts way to look at it. The first thing you need to understand is the only time when open interest is going to increase is if the buy on the buy side is an opening trade and the sell side is an opening trade, meaning the person who bought that option and the person who sold that option did not have a position in that option before they traded it. So, if the buyer and the seller are both opening, then the open interest will increase by one for each one lot of contracts that trades in that case. The only way that the open interest will decrease is the exact opposite of that. If the buyer and the seller are both closing a pre-existing option contract, then the open interest will decrease by one if the buyer and the seller are both closing. Meaning, if the buyer is long and selling that contract and the seller is short and buying that contract, they are closing out their position, then the open entries will decrease by one for every one lot of contracts that are traded. If they are mismatched, meaning the buy is to open and the sell is to close, there will be no change in open interest. And conversely, if the buying is to close and the sell is to open, there will also be no change in open interest. So you need to really think about it as just it’s a measure of how many contracts are open on that strike as far as options are concerned that are carried over from the close of the of the previous business day.

Jeff Praissman

Yeah, the OIC has been kind enough to provide us with a great slide that we’re going to include in the study notes as well for our listeners if they want to take a look.

Two types of options, there’s American and European style, so European style cannot be exercised or assigned early and they have to go all the way out to expiration. But what I really want to talk about right now is American style options that can have an early exercise. And I wanted to kind of discuss with you what can happen the kind of the pathway that that process is … if a trader decides to exercise earlier, or if they’re assigned early. So, if you could maybe walk the listener through that.

Mat Cashman

This is a big difference in the options world, and you can essentially like you said, bisect the entire options world, the entire listed options world really into American style and European style options. European style options can only be exercised at the moment of their actual.

Jeff Praissman

At the expiration date.

Mat Cashman

European style options can only be exercised at the moment of their expiration date, sorry. However, American style options maintain the ability to be exercised at any point during the lifetime of that option, up to and including their expiration. So, I want you to think about this, if I were to tell you that these two options existed side by side and were the exact same strike, same underlying, same everything, which one would you pay more for? The one that had the right to actually exercise at any point in time, or the one that you can only exercise once at its actual expiration date. Most people are going to say the added optionality that exists in the American style option is worth something, right? Like we don’t know what it’s worth, but it’s worth something. And so that’s generally speaking, where that price differential comes between those two types of options. But let us focus really on the American style options like you said and talk about why people might actually exercise that right and exercise the option before it actually expires.

So, think about this, when you own an option, let’s say you own a call, you own the right to buy the stock at the strike price, up to and including that expiration date. If you own the option, you don’t actually have the right to the dividend if there is a dividend paid on this stock. If it’s a dividend paying stock, in order to get the dividend, you actually have to own the stock. Owning the call, even if the call is a deep in the money call is not sufficient in order to actually get the dividend because the dividend is paid out after the record date and the company actually takes a picture basically of all of their shareholders on their record date and if you’re not on the list, you don’t get the dividend. Well, if you own calls, you’re not on that list. If you exercise your calls and convert them into a long underlying stock position, then you are an actual shareholder of record. If you’re a shareholder of record on the record date, you would then get the dividend. So if someone were, if a company were to actually come out and say they’re going to pay, maybe an unexpected dividend, you might see people all of a sudden decide that the long call position that they have isn’t sufficient for them to actually get the dividend. They might actually exercise those calls before their expiration date in order to convert their position into a long underlying position and thus get the actual dividend. A lot of times you’ll see this happen when there are special dividends that people announce that were surprising, or in the case of maybe large dividends that make a big difference in whether or not you own the calls or whether or not you own the stock. That can be a big difference and can be a real contributing factor and a situation in which people could exercise their options early. Keep in mind you can only do this with an American style option. You cannot do this with the European style option.

Jeff Praissman

And then what happens if, say, you sell me a call and there’s a dividend and I decide to exercise early? Are you getting assigned or does it … how does the assignment process work?

Mat Cashman

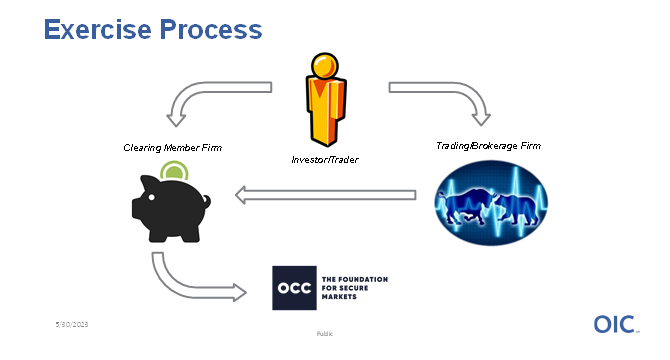

Yeah, that’s a really good question and one I think … this process itself doesn’t get talked about enough, honestly, in how people talk about options in general. I think part of it is not that there’s misconceptions about this process, it’s that like I said, it just doesn’t get talked about enough. And part of the reason why is because it’s not the sexiest part of options trading, right? Like exercise and assignment, although it plays a huge part of P&L and whether or not an option is going to be profitable or not profitable in that case, it’s not always what people think about initially when they start trading, right. People always love to think about, like, oh, I’m going to buy all these calls and the stocks going to go to the moon, and I’m going to make all this money and blah blah blah. That of course is wonderful to think about, but it’s really important that you understand how the actual process of exercise and assignment works behind the scenes. So, let’s talk about that when. When someone sells you a call or let’s say Jeff, you sold me a call, okay, and I decide that I want to actually exercise it. When I make that decision, I have to tell my brokerage firm, my brokerage or trading firm then has to actually tell the actual clearing firm that has a direct relationship with OCC and then the clearing firm aggregates all of those exercise notices from people who are long these contracts and then that goes to the OCC from the clearing member firm. Now you have to think about this, it’s coming into the OCC from multiple clearing member firms who are then attached to multiple brokerage and trading firms, but it’s all coming from the end user saying I want to exercise my contract. Now as these exercise notices come into OCC, they all get aggregated. One of the things that you need to understand as an end user is that every single one of these brokerage firms and trading firms has their own cut-off time as to at what point they will stop allowing you, from a time perspective to actually exercise your options. You have to tell them by a certain point in time.

I always tell people that it’s important that you actually know what that number is and have a conversation with your trading or brokerage firm specifically so that you understand when your cutoff time is. Brokerage and training firms do that to control their own operational risks because you have to understand they have a bunch of different people that have a bunch of different positions and they have to like, make those positions good essentially for their clients. So, you need to understand when your cut off time is but the thing that exists as far as OCC and its member firms is that all exercise notices must be in the OCC’s hands by 6:30 PM Central. That is the cut-off time for all the member firms to tell OCC. So that’s — The brokerage and trading firm cutoff will be before that but from the member firm to OCC its 6:30 Central.

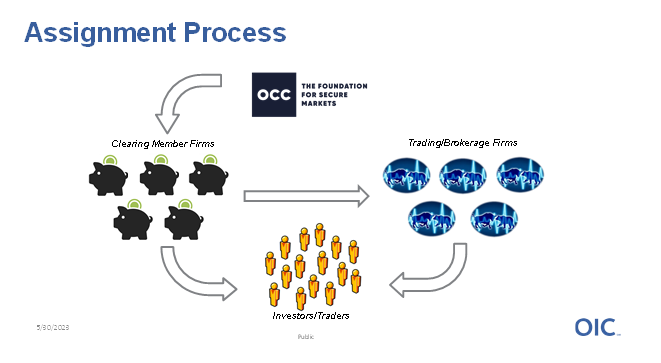

Now, once all of those come in, also keep in mind that the exercise process happens first, right? When you are long the option you maintain the right to exercise. So, the exercise process happens first, comes into OCC, then the OCC matches it through like a random algorithm feature that we have that then matches the long position that’s being exercised with the short position and then the assignment process happens the exact same way but in the opposite direction. And we have two slides, I think that are in the in the notes, that will show you this. Once those things get actually matched up, they then go back out the door, same rails, opposite direction. From OCC, the assignment notice now goes out the door to the clearing number firm, the clearing member firm tells the brokerage firm. The brokerage firm most of the time has its own matching engine, which will then actually decide within its list of clients, who are all short the same option, who gets assigned. And so, then it goes from the brokerage firm out to the individual end user and that’s how the actual exercise process happens. 1st on the way into OCC matched then goes out the door back to the other people who are actually being assigned on those options, who are short those options.

Jeff Praissman

Got it. So, the two parties involved with the initial trade … it’s completely random if the one who’s long decides to exercise. The person who sold it to them may not be assigned at all from that person, but maybe paired up with a different trader at some point.

Mat Cashman

Yeah, that’s definitely a possibility that you might be short options and not be assigned on them even if a large number of people actually decide to exercise the options. It’s all a matter of chance and all a matter of random algorithm matching, both at the OCC and at your own brokerage and trading firm.

Jeff Praissman

Now is it the case that only in-the-money options are exercised earlier have a chance to exercise early? Is there is there ever a reason that someone would exercise a out-of-the-money option early?

Mat Cashman

There are some reasons for that and what you need to really think about in that case is if you are long options, if you are long, especially American style options, you always maintain the right to exercise. So you can exercise whenever you want and whatever option you actually want. You need to obviously keep in mind that people are incentivized financially to exercise certain options more than other options, right? Like in-the-money options. Obviously, you have a financial incentive to exercise them rather than out-of-the-money options. If you’re exercising an out-of-the-money call you are buying that underlying at the strike price when you exercise that option. Now, if for instance, it’s a commodity and it’s trading 300 and you own the 310 call and you exercise it, you’re paying 310 for a commodity that you theoretically might be able to pay 300 for in the fair market. Now, I used to trade soybean options and there were sometimes when occasionally the open interest, again that that open interest situation that we talked about earlier would be very concentrated on one strike and as we would get close to that strike and expiration, all of the market makers would have the same position on it. We’re all market makers, we’re all making the same prices and generally speaking we would all have the same position on. Well, there was one time when the soybeans were trading, I think 1200 and we were all short the 1205 calls and it expires. Soybeans expire at 115, ding the bell rings and they print 1201 or something very very close to the 1205 call. Well, we were all wiping the sweat off of our brow thinking that we had all escaped unscathed from this process and then guess what? We found out after the close that the one customer who was long like 70%. of the open interest on that strike decided to exercise the 1205 calls. And so what happens when that happens? Well, you’re short the call and then you have to start to do the math to figure out what percentage of the open interest do I actually have in my position and what is my actual likelihood of being assigned? And thus, if I am assigned, how many am I going to get assigned and how short am I? Because when you’re short the call and someone assigns you, you’re actually selling the future to the person who’s exercising the call. So, in that case, you have to do the math and figure out like how many futures do I need to buy? Which obviously is the reason why this person exercised all the calls. They knew that they owned all of the open interest. They knew that they could do that to the marketplace and it’s one of those situations that’s a very kind of niche little marketplace and it was very small at the time. Those things don’t generally happen in the equity market because it’s a much more liquid, much bigger marketplace, but in situations like that you have to remember people who are long options, maintain the right to exercise their options right up until the point when that option expires. So that’s something you have to keep in mind as you’re trading because there are times when people have exercised out of the money options before, certainly.

Jeff Praissman

If you either are assigned early or if you exercise earlier, even if it goes right to expiration, are there differences in timing for delivery? Like physical versus cash versus equity. How does that exactly work? I got assigned and all of a sudden now I got to put forth the stock or the soybeans or indices or future.

Mat Cashman

As far as the options are concerned, the thing that you should really understand, especially — let’s talk about equity options specifically. Once you buy an option and you are along that option, you maintain the right to exercise that option. If you exercise that option, at that moment in time, you are theoretically converting that to a stock position and thus you are either long or short that amount of stock. Now, your relationship with your brokerage or trading firm has its own set of rules as to when your brokerage or trading firm is going to settle that actual trade, how that trade is going to be settled, whether or not they give some sort of grace period as far as whether you have to actually have the stock in your position in order to exercise those options. So, there can be slight differences as to how those actual positions settle, but it’s really important that you understand how your brokerage firm treats the product that you’re actually trading and when you exercise, or if you are assigned, how quickly after that you are incurring either the liability of having a short or a long position in the underlying. Or you are exercising the option and then have that underlying position that you can maybe trade against or do things against that. There’s often times people will do things like exercise calls after like, right after the market closes if there’s an earnings announcement or something like that where the stock moves again. Like I said before, it’s really important that you understand when your cutoff time is, because that’s going to affect when you can exercise, but theoretically after you exercise, you have that position. You have the actual underlying position, and you need to understand from your brokerage or trading firm how real that position is as far as whether or not you can trade against it immediately.

Jeff Praissman

Got it, got it. We’ve start at the beginning, trade was made. One investor has the option — is long the option, the other investor is short the option. We go throughout the life cycle, let’s just say that we don’t early exercise, we haven’t been assigned and now were coming up to the expiration and so it’s expiration day. Could you walk the listener through what happens at expiration? How auto expiration works? If there’s a threshold, and then as far as like the OCC, what you view as far as exploration?

Mat Cashman

This is a really interesting part, and one that we get a lot of questions about on the investor education desk as to A: people really want to know what the threshold for automatic expiration is, obviously because of those situations that I just detailed previously, which is when do I know when my option position has automatically been turned into a stock position? And that’s a really good thing to understand.

If an option is part of the auto expiration process, most options are, the actual threshold for that option is .01 or one penny. Meaning if the option is 1 penny or more in the money and it’s part of the auto X process, that option will be automatically exercised. So, if the stocks trading 55 even and. you own the 45 calls, that call obviously gets exercised. If you own the 54-half call and the stock is trading 55, that call obviously gets exercised. But the 55-half call does not because of the fact that that threshold is .01.

Now, the other thing that’s important is in extreme circumstances and you need to think about this in terms of possibly recent events, right? We’ve had a lot of extreme volatility in the banking market recently. Many times in situations where stocks get halted, you have to think about it from the OCC’s perspective. The OCC needs a reliable underlying price upon which to base whether or not they’re going to automatically exercise these options. If there is no reliable underlying price to base that auto X on, what the OCC does is it removes the actual option contracts from the Auto X procedure. We call it the X by X procedure. That’s the actual name that we have for the procedure, it’s called X by X. It’s called expiration by exception, meaning you don’t have to tell us every time you want to expire an option in the money like that. In the case of, let’s say a stock is halted and there’s not a reliable underlying price, OCC will remove those options from the X by X procedure. They will actually broadcast that to the marketplace through an information memo that we post on our website. We have an information memo search page where you can actually search by ticker, information memo number, date. There are all kinds of infinitely customizable ways you can search it, but you can find out when your options have been removed from the auto X procedure. Interesting thing here is most of the time when options are removed from the auto X procedure, you have to actually exercise them yourself. You have to tell your broker that you want to exercise the call or the put, even if that option is theoretically in the money. The reason being we don’t have a good, actual method to tell where the stock is. If it’s a stock that’s not trading, if it’s not actually trading and producing a price, we don’t know where that stock is and we’re not going to make that decision for you. So, we actually pull those options out and allow the investor to make the decision. As to the value of that option themselves, and then they must exercise those options themselves by telling the brokerage firm they want to actually exercise them. So that’s an interesting thing that you need to keep an eye out for it, especially if you’re trading a stock where you have an options position. Where the stock is halted or there’s an exceptional amount of volatility in it. Keep an eye on that Information memo search page at OCC.

Jeff Praissman

So Mat, this has been a great discussion. I think we really covered from beginning to end with the option life cycle. I just want to thank you for coming by our IBKR Podcast studio and for more from Matt and the OCC, please go to our website under Education to view previous OCC webinars as well as previous podcasts. I also want to remind everyone that you can find all our podcasts on our website under Education, scroll down to IBKR Podcast or on YouTube, Spotify, Apple Music, Amazon Music, Pod Bean, Google Podcasts and Audible. I’d also encourage you to leave a review if you like what you hear. Thanks for listening, until next time, I’m Jeff Praissman with Interactive Brokers.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Great content, please do another one about options strategies.

Thank you for the feedback, Ruben! Be sure to check out our upcoming webinars; there are a couple coming up that will focus on options strategies: https://ibkrcampus.com/webinar-categories/upcoming-webinars/. You can also tune into previous webinars.