Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

Mike Tyson, Trend Following & Swing Trading

What I have discovered over many years of technical investing is just how different trend following is from swing trading in terms of overall process, risk management, and most importantly, mindset and expectations. While both of these styles require a strong belief in process and an iron will to stick to that process, their similarities pretty much end there.

As with any approach to investing, both styles do face the gauntlet of the expectations formula below:

(%win rate * avg $profit per winning trade) + (%loss rate * avg $loss per losing trade)

Regardless of which path you choose, trend following or swing trading, if your trades produce a negative expectancy, stop what you’re doing immediately, and focus on the few variables in the formula above to find the fix. That alone is a discussion unto itself.

What I want to unpack today is just how different trend following is from swing trading, and how we as traders can get into trouble when we unwittingly combine elements of the two, to our demise. To cut to the chase, we want the multi-bagger outcomes inherent in long-term trend following, but we want the tight risk management of swing trading in order to avoid large drawdowns. In essence, we want our cake and eat it too. Let me explain.

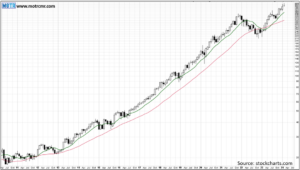

The chart below is a good representation of what most technical investors would like to capture. Indeed, most technical traders might look at this chart and conclude that they not only want this outcome, but they have what it takes to capture it. In the famous words of Mike Tyson, “Everyone has a plan, until they get punched in the face.”

This next image is a daily chart of just one of the several declines in excess of 20% that this stock endured during its journey to multi-bagger returns. It is one thing to say we will be rock steady when the first painful decline arrives, but in truth, we are not, particularly if the whole market is declining, and our short-term charts look like Armageddon has arrived. Ultimately, a short-term swing trader’s bear market is a long-term trend follower’s oversold uptrend. That is just the way it is, and it is up to us to honestly identify what we are willing to endure in order to thrive in our careers as technical investors.

I have come to appreciate that long-term trend following is more about opportunity management, while swing trading is more about risk management. To win as a long-term trend follower, you must capture the big winners in order to compensate for the potential of larger drawdowns. Another way to say this is that you must be prepared for larger drawdowns if you wish to capture the truly big winners.

To win as a short-term swing trader, you must be willing to give up multi-bagger returns at the individual position level in order to manage to a lower drawdown. A short-term swing trader with a 50% hit rate and a target max loss of -8% can do quite well with an average gain of just 24%, especially if annual turnover is high. What we must all avoid is trying to capture the big winners while managing risk so tightly that the long-term trend does not have room to breathe. We can’t have our cake and eat it too.

Believe it or not, the loosest form of long-term trend following in the stock market is passive index investing. I often call passive index investing “trend following without risk management”, because in essence, what an index does is buy and hold everything and let the winners run while the losers just keep getting smaller and smaller, until they either become irrelevant stub positions, or get removed from the index entirely. In other words, one way to guarantee you will catch every 100 bagger in the future is to buy the Russell 3000 ETF. Of course, along the way, you will also own every stock that fails. If history repeats, that will amount to a lot of losing positions, but the winners go up so much (thousands of percent) that they compensate for all those losses, plus enough to drive long-term returns to high single digits on average.

For a long-term trend follower, the goal of course is to try to own those multi baggers while avoiding the carnage of the majority of stocks that fail over time. In yesterday’s missive, I highlighted how this can be done by combining high performing, long-term price trends with a fundamental overlay, targeting those stocks that possess the fundamental attributes that have characteristically driven multi-baggers to the moon. Willaim O’Neil’s CANSLIM process is one example of this approach.

—

Originally posted on February 22nd 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.