Key News

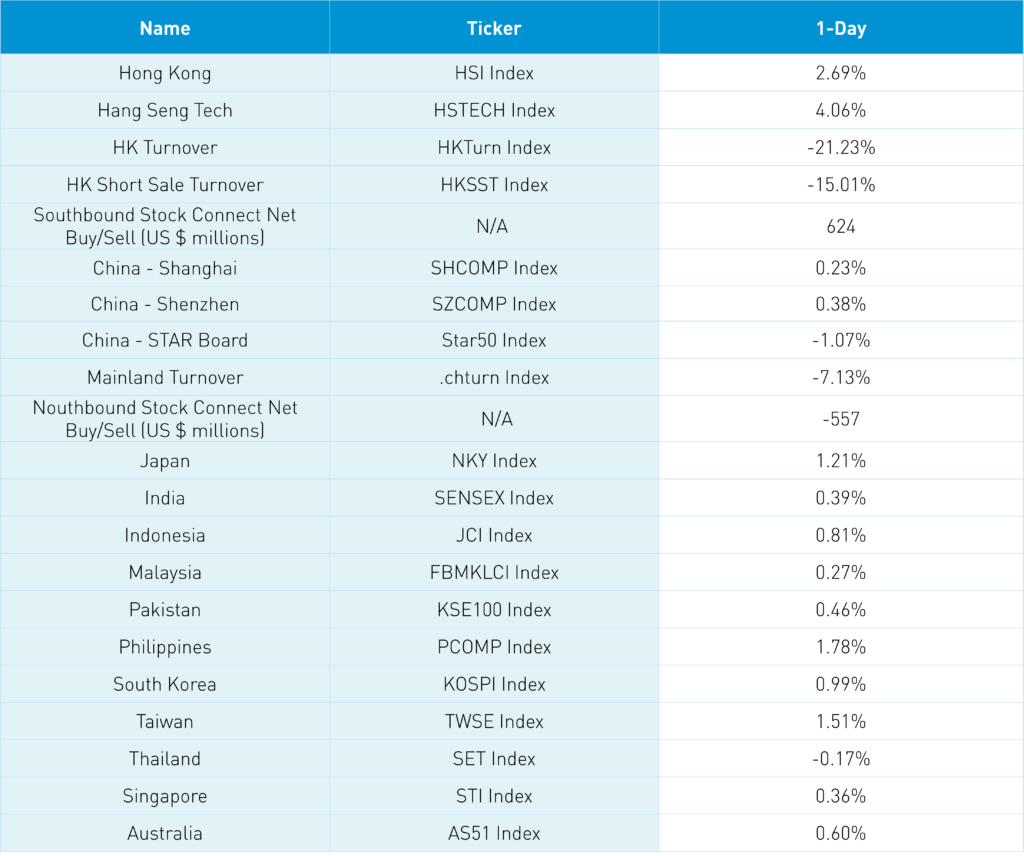

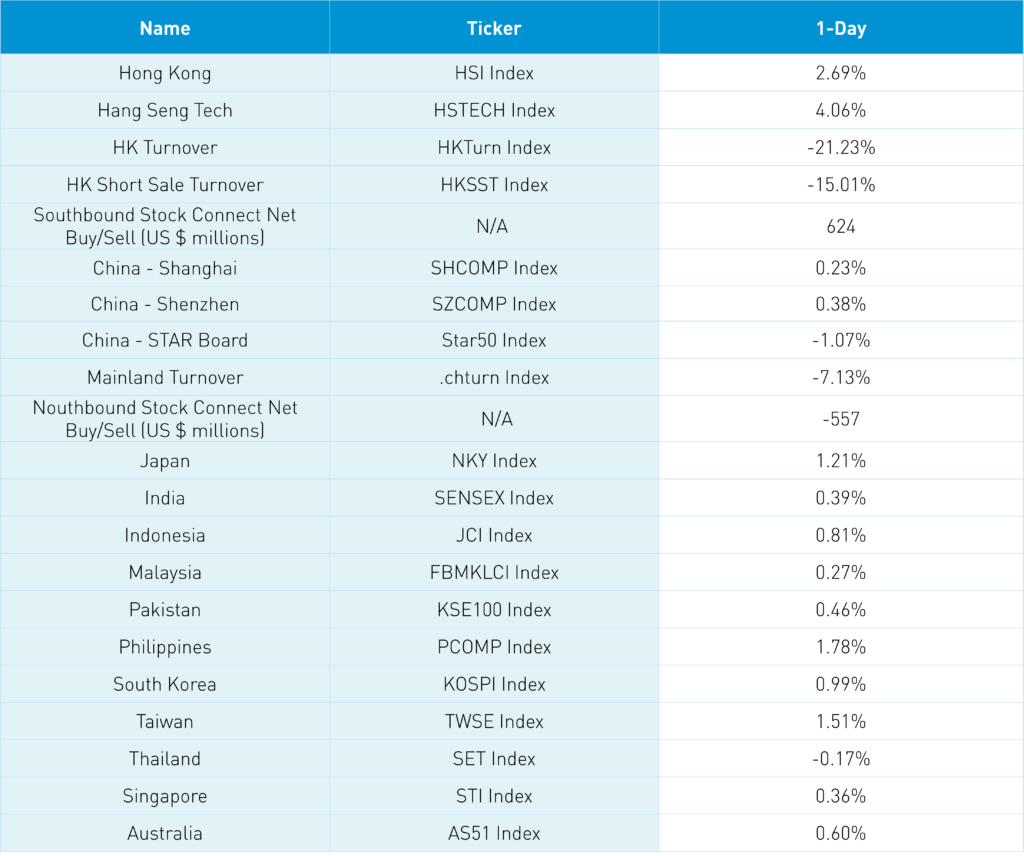

Asian equities had a nice start to the week as Hong Kong outperformed to the upside.

Investors continue to read the tea leaves on China’s reopening as small, incremental positives unfold. Yes, this weekend’s National Health Commission (NHC) meeting reiterated zero COVID policies, though this isn’t where a policy change would be announced. The reopening will likely occur incrementally, which is happening. The feasibility of a reopening is driving forward-looking stock prices higher.

President Xi’s speech at the China International Import Expo spoke to the continued opening of China’s economy to foreign investors as the leader stated: “we should steadily advance economic globalization… provide all nations with greater and fairer access to the fruits of development.”

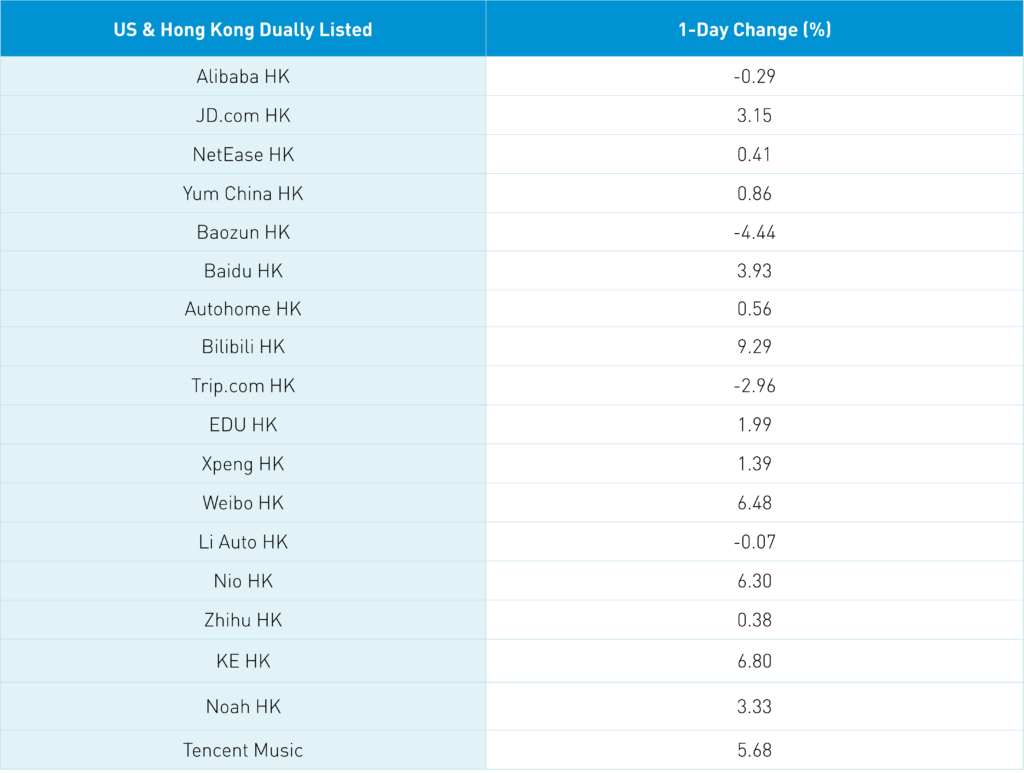

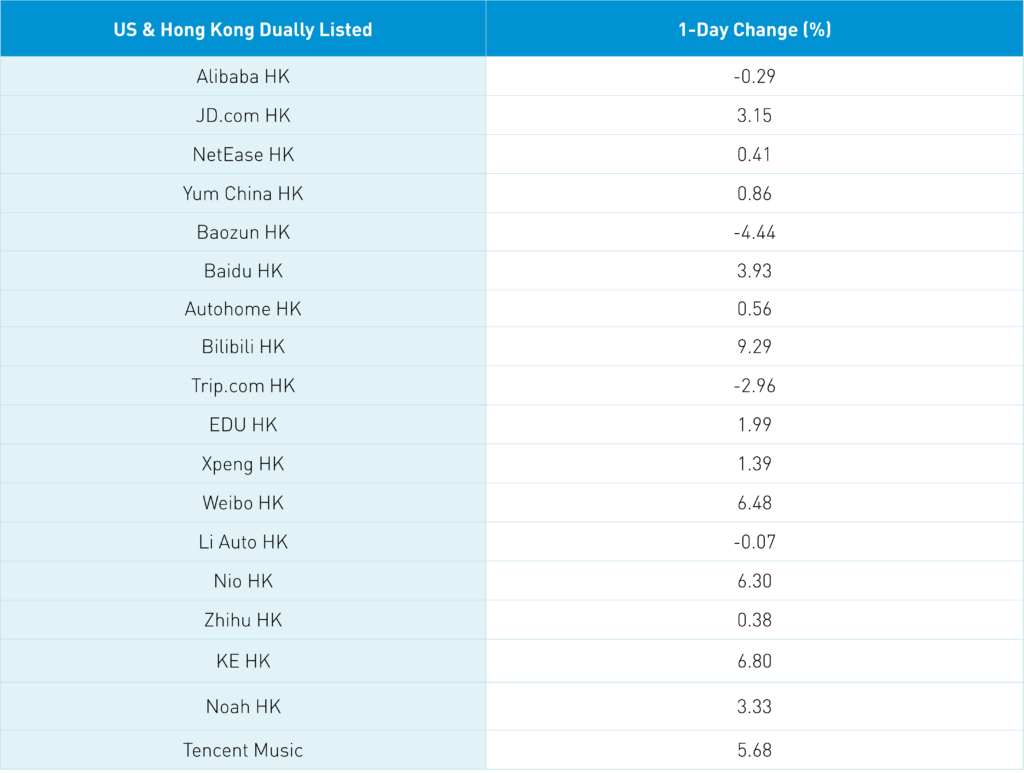

Hong Kong opened lower but rallied higher as Hong Kong’s most heavily traded stocks were Tencent, which gained +2.85%, Alibaba HK, which fell -0.29%, and Meituan, which gained +2.34%. We had $624 million worth of net buying in Hong Kong stocks from Mainland investors via Southbound Stock Connect overnight as Tencent saw another strong net buying day.

Short-selling volumes were moderate though individual stocks saw an increase, with 25% of Alibaba’s turnover short, 15% of Tencent’s, and 31% of JD.com’s. Remember that shorts did not double down last week, though today there was a pick-up.

Investors are also taking a positive view of the Public Company Accounting Oversight Board (PCAOB) auditors leaving Hong Kong after meeting with the “Big Four” auditors of Alibaba, JD.com, and Yum China.

Alibaba announced that its earnings will be reported on November 17th, while Singles Day officially kicks off on Friday.

Technology had a good day as investors noted a Chinese government white paper on cybersecurity and Artificial Intelligence (AI). Mainland markets managed small gains while the STAR Board was off a touch. Mega/large caps and foreign favorites were mixed. China’s October exports and imports declined in US dollars by -0.3% and -0.7% year-over-year, respectively, though they increased +7% and +6.8%, respectively, in CNY terms. China’s foreign reserves increased in October to $3.052 trillion from September’s $3.028 trillion. The Asia dollar index was off versus the US dollar though CNY gained +0.6% versus the US dollar to close at 7.22.

I don’t believe Apple’s iPhone issues have anything to do with China’s COVID policy, but rather weak demand.

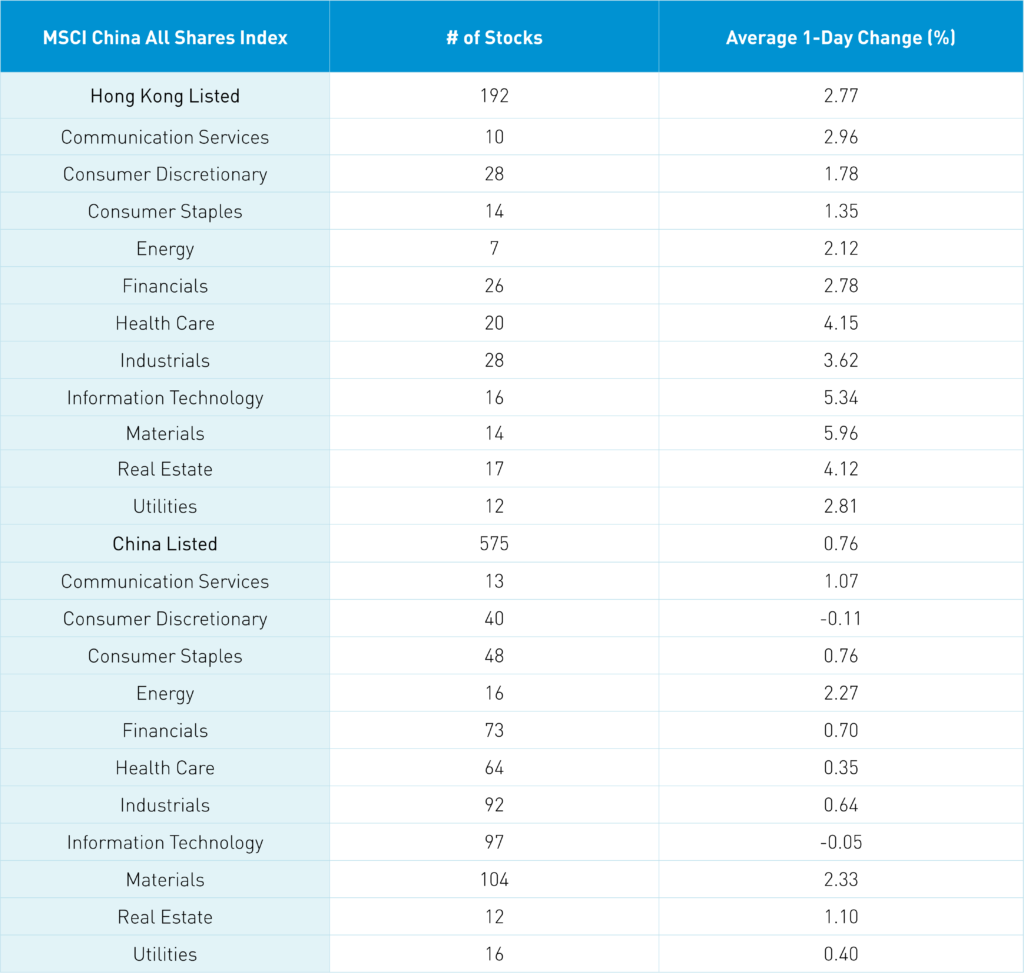

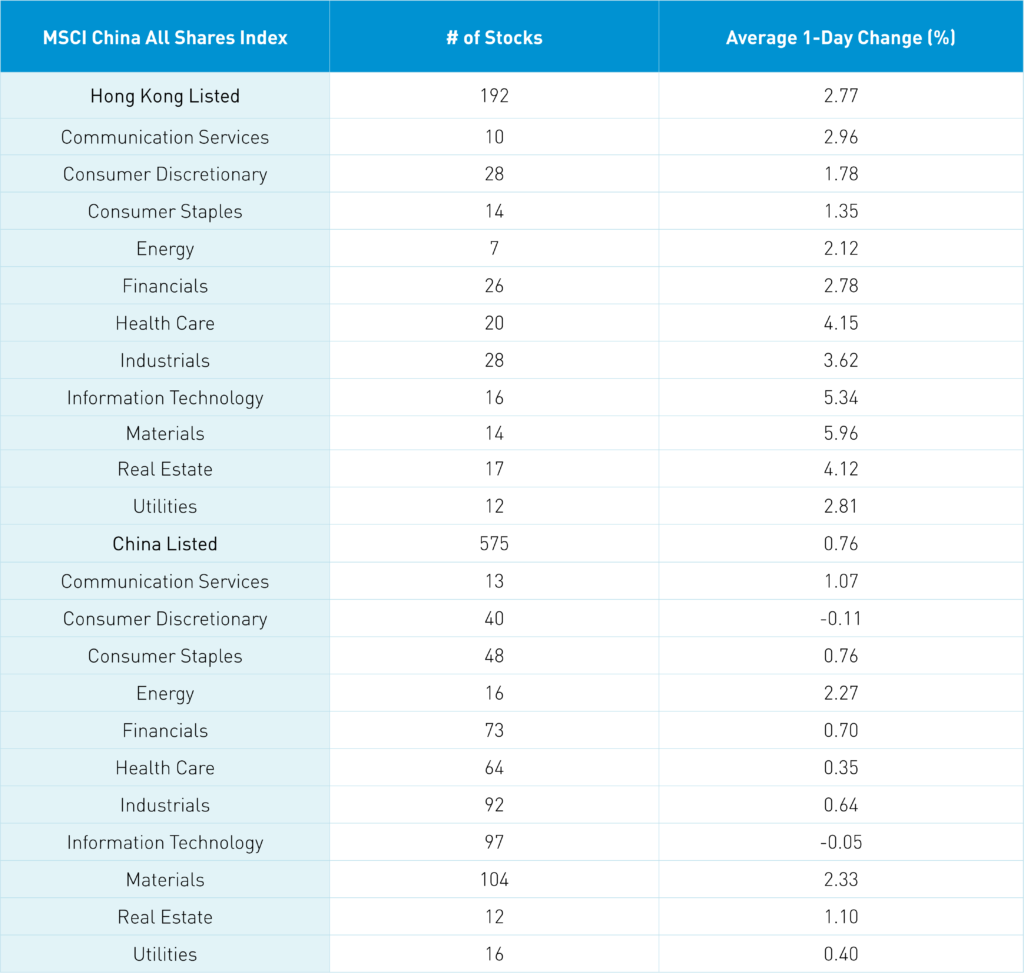

The Hang Seng and Hang Seng Tech indexes gained +2.69% and +4.06%, respectively, on volume that was down -21.23% from Friday, which is 120% of the 1-year average. 474 stocks advanced, while 36 stocks declined. Hong Kong short turnover declined -15.01% from Friday, which is 105% of the 1-year average, as 15% of turnover was short. Growth and value factors were mixed as small caps outpaced large caps. All sectors were positive as materials gained +5.96%, technology gained +5.34%, and healthcare gained +4.15%. Meanwhile, consumer staples lagged to gain only +1.35%. The top-performing subsectors included household products, materials, tech hardware, and semiconductors. Southbound Stock Connect volumes were very high as Mainland investors bought $624 million worth of Hong Kong stocks, as Tencent saw another day of net buying. Meituan and Kuaishou were also small net buys.

Shanghai, Shenzhen, and the STAR Board were mixed to close +0.23%, +0.38%, and -1.07%, respectively, on volume that declined -7.13% from Friday, which is 103% of the 1-year average. 2,936 stocks advanced, while 1,610 declined. Value factors outpaced growth factors, while small caps edged out large caps. The top-performing sectors were materials, which gained +2.33%, energy, which gained +2.27%, and real estate, which gained +1.1%. Meanwhile, technology and consumer discretionary fell by -0.05% and -0.11%, respectively. The top-performing subsectors included precious metals, oil & gas, forest & timber, and leisure products. Meanwhile, restaurants, airports, and defense were among the worst. Northbound Stock Connect volumes were moderate/high as foreign investors sold -$557 million worth of Mainland stocks. Treasury bonds rallied, CNY gained +0.6% versus the US dollar to 7.22, and copper gained +3.18%.

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.22 versus 7.19 Friday

- CNY per EUR 7.21 versus 7.11 Friday

- Yield on 1-Day Government Bond 1.25% versus 1.27% Friday

- Yield on 10-Year Government Bond 2.70% versus 2.70% Friday

- Yield on 10-Year China Development Bank Bond 2.82% versus 2.82% Friday

- Copper Price +3.18% overnight

—

Originally Posted November 7, 2022 – Hong Kong Rallies On Incremental Loosening Of Zero COVID

Author Positions as of 11/7/22 are KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB, KHYB, LI US

Charts Source: KraneShares

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.