Originally posted, 30 November 2023 – While global statements on climate goals remain important, it is policy action from individual countries that will help investors differentiate between beneficiaries and losers.

The United Nations Climate Change Conference provides an annual measure of progress and global commitment to climate action. This year, the 28th conference (COP28) will be held in the United Arab Emirates from 30 November until 12 December. It provides an opportunity for global leaders to reaffirm their commitment to action, and to meeting the gap between action and ambition highlighted by the recent Global Stocktake.

After 12-18 months of signs of faltering commitments and growth headwinds in many large economies, markets now reflect less ambitious expectations. Signals of commitment could help quell concerns. Nonetheless, we expect selectivity in climate investing to become more important than ever; the rising tide that lifted (and then lowered) companies in the most obviously exposed industries in recent years was unusual.

Meeting the commitments global leaders made in Paris in 2015 will require capital reallocation on a huge scale, and policy incentives and penalties to encourage transition, reshaping growth and competitive drivers across markets. That picture has not changed, but clear signals from governments that they will deliver the policy changes needed to meet the commitments they have made will help financial markets to differentiate beneficiaries from losers.

Whether that clarity emerges from COP28, or takes longer, the inevitable threats climate change poses means disruption looks unavoidable. We are committed to taking steps to anticipate those risks across the assets we manage for our clients, rather than waiting for them to crystallise.

What’s the background to this year’s conference?

In September, the UN published its first biannual Global Stocktake, providing a view of global progress and setting the scene for the upcoming meeting.

On the one hand, it highlights that the sum of global targets and policies falls far short of the commitments made in Paris in 2015 (see UNFCC for details), to hold “the increase in the global average temperature to well below 2°C above pre-industrial levels” and pursue efforts “to limit the temperature increase to 1.5°C above pre-industrial levels”. The UN’s analysis projects long run warming of 2.4-2.6°C (or 1.7-2.1°C in a best-case scenario where all pledges are met).

On the other hand, significant progress has been made. A decade ago, similar analysis pointed to long run warming of 3.7-4.8°C. When the Paris Accord was agreed in 2015, less than 5% of global emissions came from countries with net zero goals; today close to 90% are covered.

The Stocktake also sets the scene for a few topics that are likely to be a focus of COP28, including:

- Fossil fuel phase out, in particular coal, recognising the role of natural gas as a transition fuel and low-carbon hydrogen as an alternative energy source. This was referred to specifically in the Global Stocktake, after negotiations failed to include that language in the outcomes of last year’s COP27 meeting.

- The role of carbon markets as a mechanism for mitigating greenhouse gas emissions.

- Development and scaling up of low carbon technologies. At the G20 Leaders’ Summit in September 2023, members agreed to “pursue and encourage efforts to triple renewable energy capacity globally”, potentially setting the scene for firmer commitments. Commitments to double energy efficiency, triple renewable energy capacity to 11,000GW globally, and double hydrogen production to 180 million tonnes a year by 2030 will be put to governments at COP28.

- Nature-based solutions and ecosystem-based approaches to mitigation, as well as ocean preservation and restoration.

- Financial support to developing economies to facilitate their transition. Governments need to agree on how to make operational COP27’s main legacy: the loss and damage fund, set up as part of wider loss and damage funding arrangements.

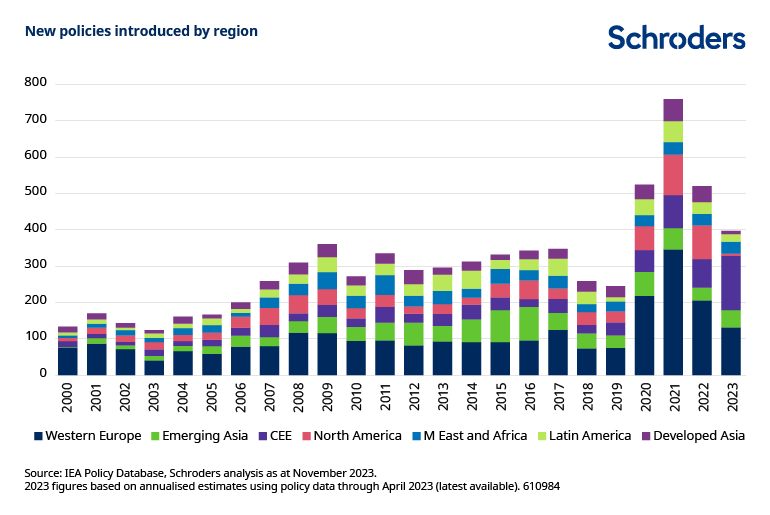

- Urgency of adaptation action, given the impacts climate change has already had on key sectors such as food production, biodiversity, human health, and economic growth. The UN Environment Programme has estimated developing countries’ annual adaptation needs at $160-340 billion by 2030 and $315-565 billion by 2050. These figures are dwarfed by the $7 trillion annual spending on fossil fuel subsidies as a point of reference (source: UN Adaptation Gap Report 2022)We expect those areas to be in focus for COP28, reflected in the agenda for the conference. All are important, though we doubt there will be breakthrough announcements across every area. In many ways, gauging the tone and commitment leaders demonstrate will be more important than new agreements in specific areas. From global to national to local and individualWhile the COP series is an important focus, the UN’s annual climate conferences are becoming less critical drivers of climate action and investment implications. For several years, the key focus of global climate action has been moving from global leaders’ statements of collective commitment, toward individual countries’ policy actions and the changes made by national institutions and individual companies. Global commitment matters and – as the Global Stocktake highlights – needs to go further to reflect the ambition leaders committed to in Paris in 2015. But the critical question for investors, and the climate, is the extent to which we see action to deliver those commitments. The pace of new policy introduction has risen in recent years but faltered more recently.

While COP 28 is unlikely to provide a stage for significant breakthroughs, the annual COP events nonetheless provide a valuable barometer of ambition, and sometimes a catalyst for tangible changes.

What are the investment considerations?

Whatever the outcomes of COP28, the structural need to decarbonise the global economy, industries and portfolios remains. We remain focused on identifying the risks and opportunities that transition will create and managing portfolios in anticipation of them, rather than waiting for them to crystallise.

In that context, risks and opportunities are a function of both the fundamental effects climate transition can have on companies and assets, as well as their valuation and the extent to which benefits or risks are reflected in their valuations.

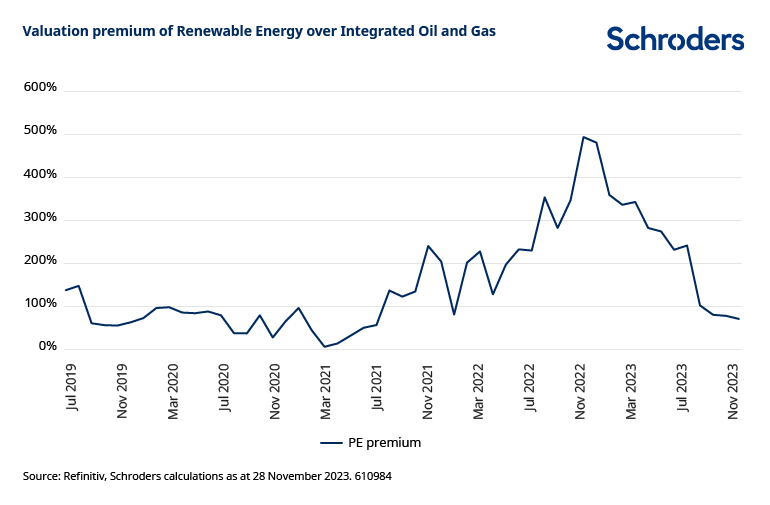

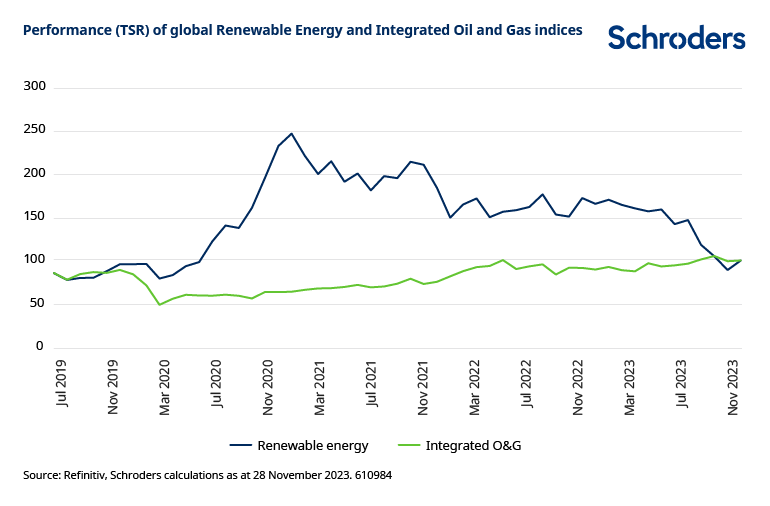

The contraction in valuations of some of the clearest beneficiaries of climate change over the last 12-18 months has left clean technology sectors on less demanding multiples and less exposed to risks of contracting multiples.

We expect that selectivity will become more important in those markets. Identifying the businesses able to benefit from the structural growth that market offers will be increasingly important, relative to hoping a rising tide for all clean energy companies will lift all players.

Beyond those narrow areas of the market most obviously set to benefit from climate action, similar principles apply to our approach to climate transition across the portfolios we manage. We aim to take a balanced and thoughtful approach to ensuring the decarbonisation journey for the portfolios we manage benefits from the valuation discrepancies that can emerge between future winners and losers.

Conclusions

The upcoming COP28 conference in the UAE will shed light on political leaders’ commitment to action and to making the changes that will be needed to deliver the commitments they have made. Global commitments are becoming less important than individual action to deliver those commitments, on which the Global Stocktake that sets the scene for this meeting underlines that more work is needed.

Against a backdrop of growing concerns and questions in many countries, indications of commitment should help markets to reward future beneficiaries. We do not expect to see major new announcements, but signs of progress will be valuable in key areas like global climate finance, national fossil fuel policies or delivering a framework to support investment in natural capital and more rigorous standards for carbon offsets.

In any case, selectivity and differentiation within climate investing is likely to become increasingly important. The need to reduce portfolio emissions should not be a constraint imposed on portfolios as much as a consequence of changes to the way investors assess and engage with companies and assets.

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.