It appears that the US economy has survived the global central bank tightening after the recent US readings showing a stabilized job market. However, even if one assumes the US will help the world get past the threat of recession, an improvement in global energy demand is unlikely to surface quickly.

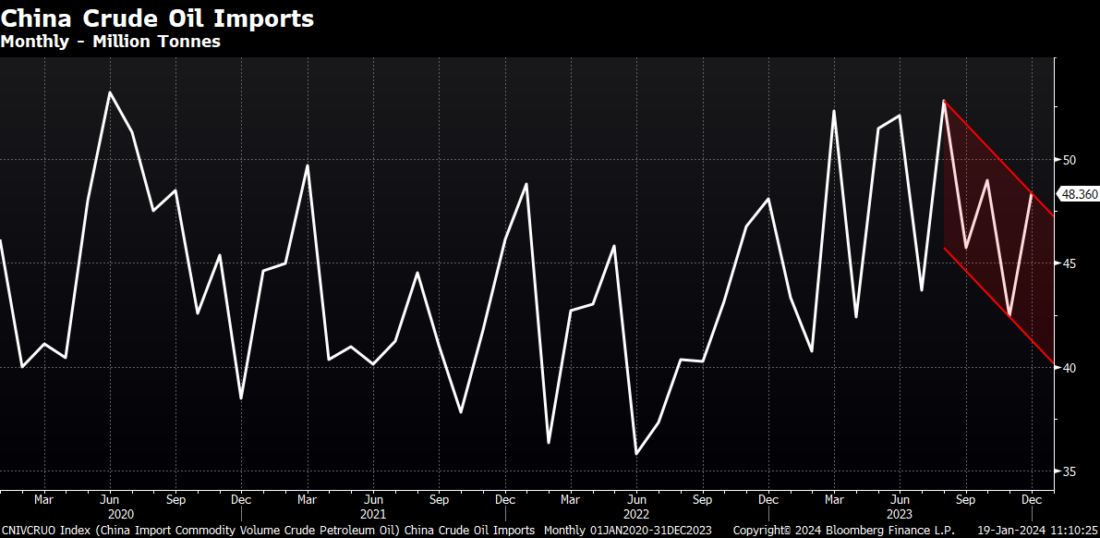

China’s economy might not have bottomed yet. Their data continues to disappoint. The leadership is discounting the prospects of stimulus, and there are reports that the government has ordered some heavily indebted local governments to halt infrastructure programs. In an ominous development, the Chinese brokerage firm Citic has put restrictions on short sales in the stock market, which raises suspicions that problems are unfolding under the surface. This suggests that their energy demand prospects could continue to deteriorate through the end of January, and because they are the world biggest consumer, this does not bode well for global demand, despite favorable forecasts from the IEA and OPEC last week.

With the petroleum markets bifurcated (crude oil supplies tight and product supplies burdensome) we expect crude oil prices to lag gasoline and diesel prices on any washout sparked by negative developments out of China. The case for crude oil to outperform the products is justified by recent US production outings due to extreme cold and by the fact that EIA crude oil inventories are running 18 million barrels below year ago levels while the product markets are 17–20 million barrels higher. We could see periodic surges in volatility from flash headline developments in the Middle East, which could also prompt crude to lead the markets higher.

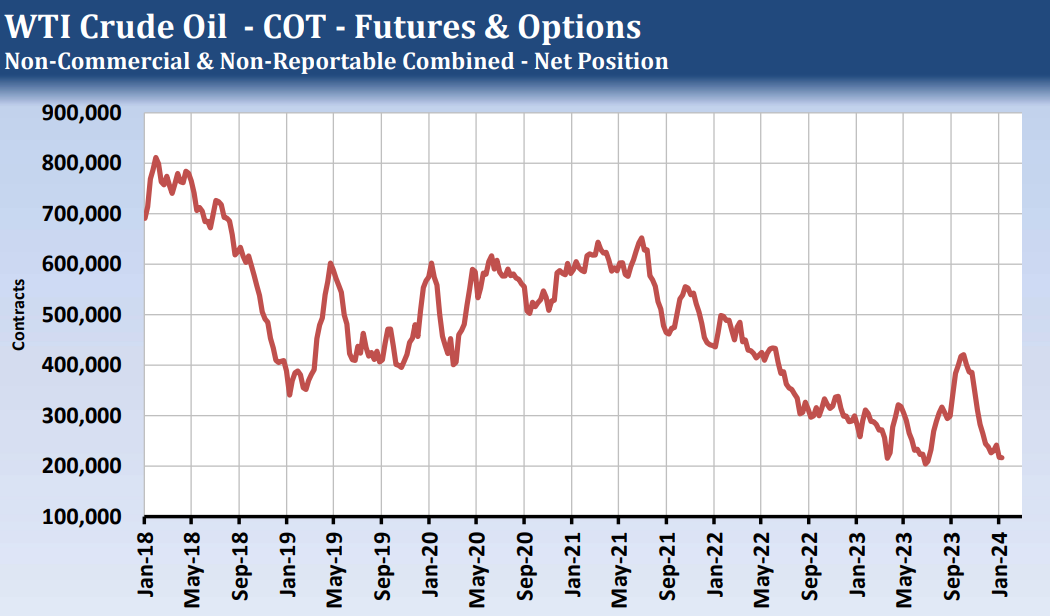

Recent Commitment of Traders reports showed the spec and fund net long in crude oil was near its lowest level since 2012. Open interest seemed to bottom out just ahead of the December spike low, which was a sign of value around $70. This leaves open the possibly of a strong rally if traders become convinced that events could result in Iranian crude being blocked from the market. Pushed into the market, we would favor weakness in the products, but we also think traders should position for a retest of the December low at $68.28 in March Crude Oil.

Source: CFTC

Past performance is not indicative of future results

Source: Bloomberg

Past performance is not indicative of future results

—

Originally Published January 2024

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.