In many weather markets there are drought-busting rains that stabilize yields and, in some cases, allow them to rebound. This year we have seen multiple rains events pass over the entire US growing region and register minimal rain amounts across a wide portion of the US growing belt. Even if conditions do stabilize, the crops will still be in a precarious position, especially corn, which is entering an important pre-pollination development stage.

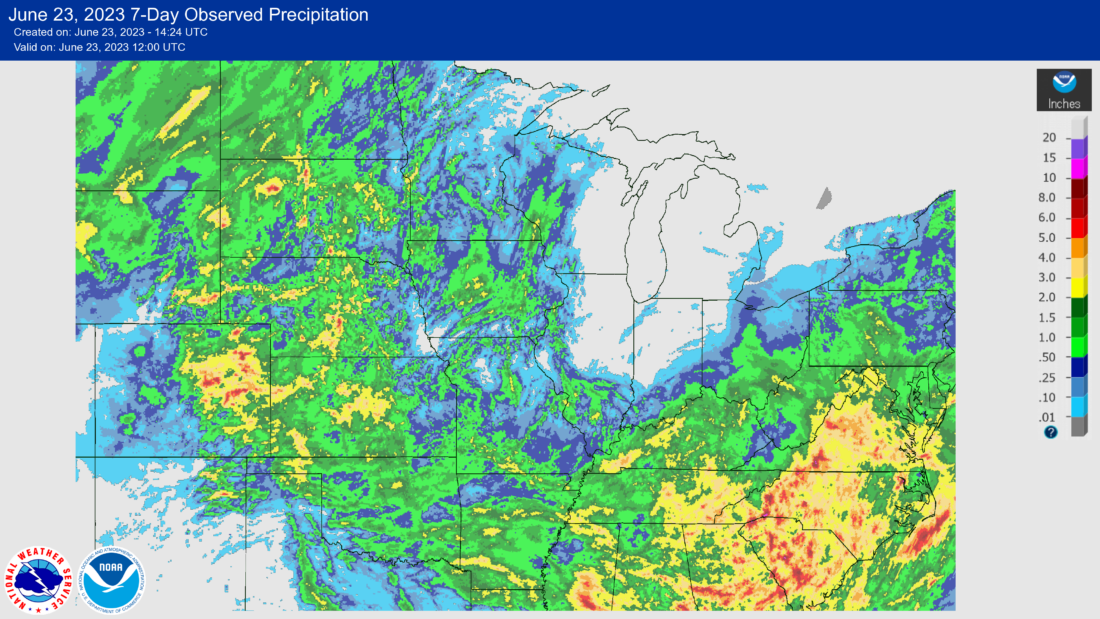

The precipitation maps for the past 72 hours show that much of Illinois and Indiana have received little or no rain, and approximately half of Iowa saw an inch or below and the other half less than ½ inch. The corn crop could be close to being irreparably damaged. The soybean crop has more time, as it can be resuscitated with a couple of broad-based rain events of greater than 1 ½ inches.

In the end, it appears that that the chances of achieving the high-end estimates for this year’s US corn and soybean production capacity have all but disappeared.

The coming week could be pivotal for the corn crop. The maps show decent rain coverage over most of Iowa with lighter amounts in Illinois and Indiana. The sheer breadth of the area involved seems to justify the hard setbacks the markets experienced at the end of this week. With the exchange expanding trading limits, volatility was allowed to expand as well. That and the expanding margins can exhaust speculative traders and send them to the sidelines.

Corn and soybeans gave back a good portion of their weather premium this week, but they will face a severe test from the US crop conditions report on Monday afternoon. With pollination approaching, we expect corn to exhibit more volatility than soybeans. Furthermore, with the soybean crop’s capacity to recover, it may have a greater potential to extend its downside move. If we see a repeat of this week’s weather pattern in the coming week and a further deterioration in crop conditions, corn prices could explode.

Previous Weather Markets

A recent article from Reuters suggested the current corn crop is in the worst shape since 1992. Other analysts have indicated the current year might closely resemble 2012.

December 1992 Corn reached its peak on June 9 of that year after rallying 11% (28 ¼ cents) off the low on May 1. In contrast, the rally this year from May to June was a whopping 28% (for a gain of $1.39). December 1992 Corn fell 25% (70 1/4 cents) from the June 9 high to its low on November 19.

In 2012 December Corn bottomed out in late June and then rallied $3.50 over the next 35 days.

—

Originally Published June 23, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.