Cocoa had a volatile week, rallying $120 rally early Monday to a 12 1/2 year high and then falling $280 from Monday’s high through midsession Tuesday. The market continued to slide over the rest of this week, reaching its four-week low early Friday.

This has resulted in key reversal tops on the weekly and nearby charts for the day sessions that could fuel more profit-taking and long liquidation. This month’s negative shift in global risk sentiment likely played a key role in the market’s weakness, but keep in mind that recent quarterly earnings guidance from several major chocolate manufacturers has projected sales growth, indicating the resilience in chocolate demand.

Another factor in this week’s decline has been a more positive take on west African weather. Drier conditions over the past week have allowed the mid-crop harvest to improve after heavy rains caused delays earlier this summer. Cocoa growers are claiming that the heavy rainfall in June and July has gotten the upcoming main crop off to a strong start, which would appear to offer some insurance against the dry conditions expected with the onset of El Nino.

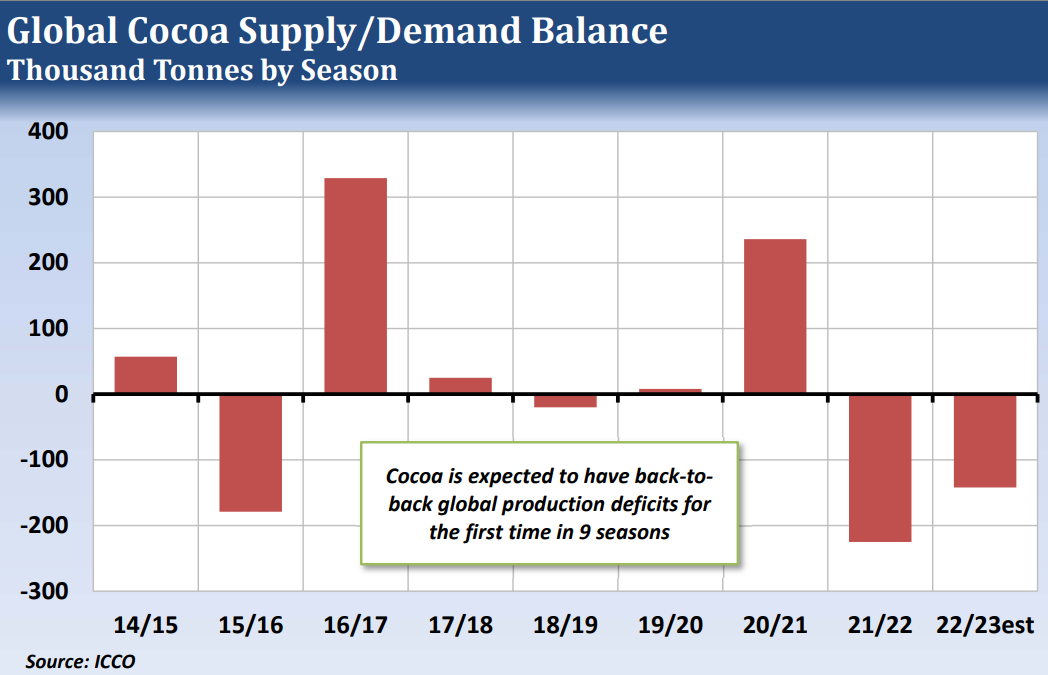

Cocoa’s supply outlook remains tight. The ICCO has forecast a second straight global supply deficit for 2022/23, and El Niño threatens a third one for 2023/24. Reduced fertilizer and pesticide usage have had a negative impact on this season’s output, and the heavy rainfall in June and early July has resulted in the spread of black pod and swollen shoot disease. The US Climate Prediction Center this week gave El Niño a 90% chance of lasting at least through the end of April. El Niño typically brings drier than normal conditions to West Africa and southeast Asia.

December cocoa has slowed its descent and has found support at the 50-day moving average. The RSI has fallen to 33.7 from 76.4 in late July, indicating that the overbought condition has been alleviated. A pullback to the late June and mid-July lows may provide an opportunity to approach the long side of the market.

—

Originally Published August 11, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.