After a failed recovery move in late July and early August, coffee prices traded to a seven-month low this week. The market has been pressured by a rebound in Brazil’s arabica production following the end of the La Niña weather event. In addition, sluggish global risk sentiment over the past few weeks has weakened the demand outlook on ideas it would have a negative impact on restaurant and retail shop consumption.

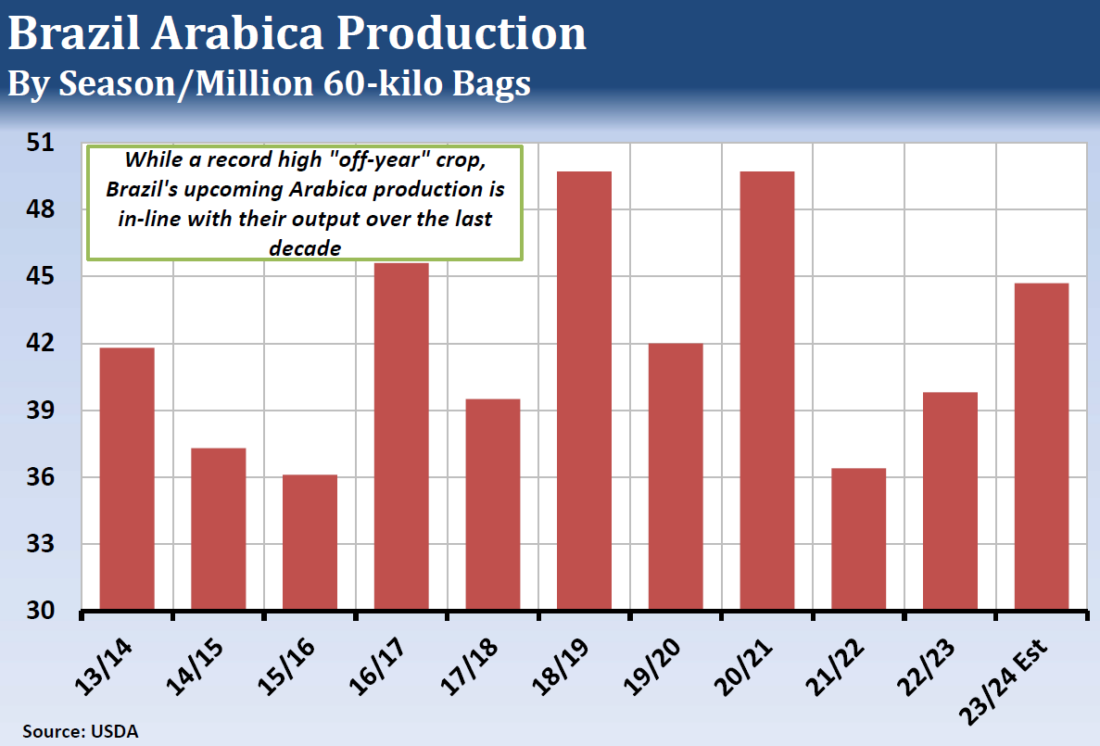

Brazil arabica production has a two-year cycle, with “on-year” crops usually outperforming the off years. The 2022/23 season was an on-year crop, but the Brazil’s coffee trees had come through two straight years of drier than normal conditions due to La Niña. With the end of La Niña earlier this year, 2023/24 is expected to be Brazil’s largest off-year crop on record. However, it is only expected to exceed the second largest off-year (2019/20) by 2.7 million bags and be roughly 5 million bags below the 2018/19 and 2020/21 crops.

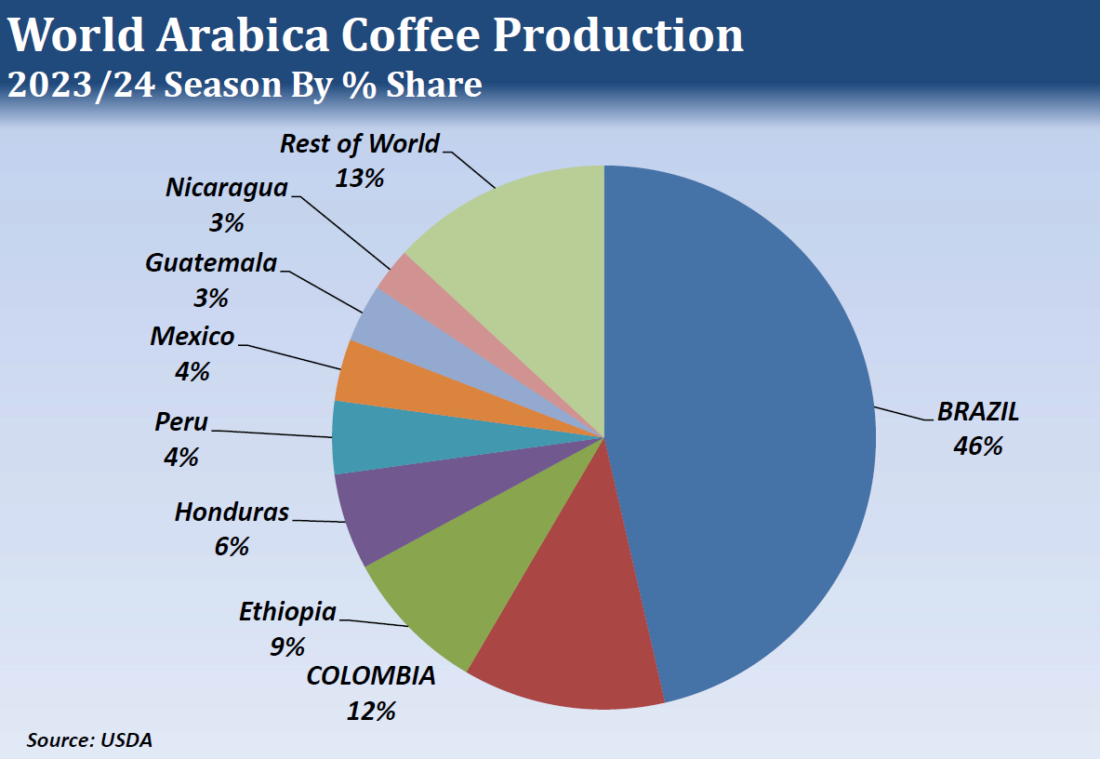

Colombia’s coffee production has seen little benefit from the end of La Niña. Their 12-month running production totals have seen incremental improvements in June and July, but nothing too impressive. The last four monthly readings have come in below an 11 million-bag annualized pace, and they are the lowest 12-month running totals since the end of 2013. The only major arabica-growing nation besides Brazil to have a significant jump in 2023/24 production has been Peru with an 15.8% increase. They represent 4% of global production versus 46% for Brazil and 12% for Colombia.

While out of home demand has been hurt by negative risk sentiment, it should benefit from the extended decline in inflation readings that have been seen across many developed economies. Coffee prices were last at these levels in mid-January, and that was followed by a 34.65-cent rally (23.9%) through the start of February. RSIs and stochastics are into oversold territory, but the stochastics have yet to flash a buy signal. The Commitments of Traders report showed the managed money traders were net short 27,282 contracts as of August 15, which is their biggest net short since January. This suggests that coffee has plenty of fuel for a short-covering rally.

—

Originally Published August 18, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.