It is an understatement to say that corn and soybeans have entered a “weather market.” Historically, such markets temporarily discount or even ignore most supply and demand fundamentals and instead are driven by aggressive speculative trading that usually consists of traders jumping on the bandwagon. Early, adverse growing conditions this year, consisting of broad areas of dryness and extreme heat, have likely removed the potential for top yields. And without good rain and wide coverage, the markets are probably correct in assuming that any improvement in conditions will be minimal and that the crops will remain vulnerable to any return of hot and dry weather.

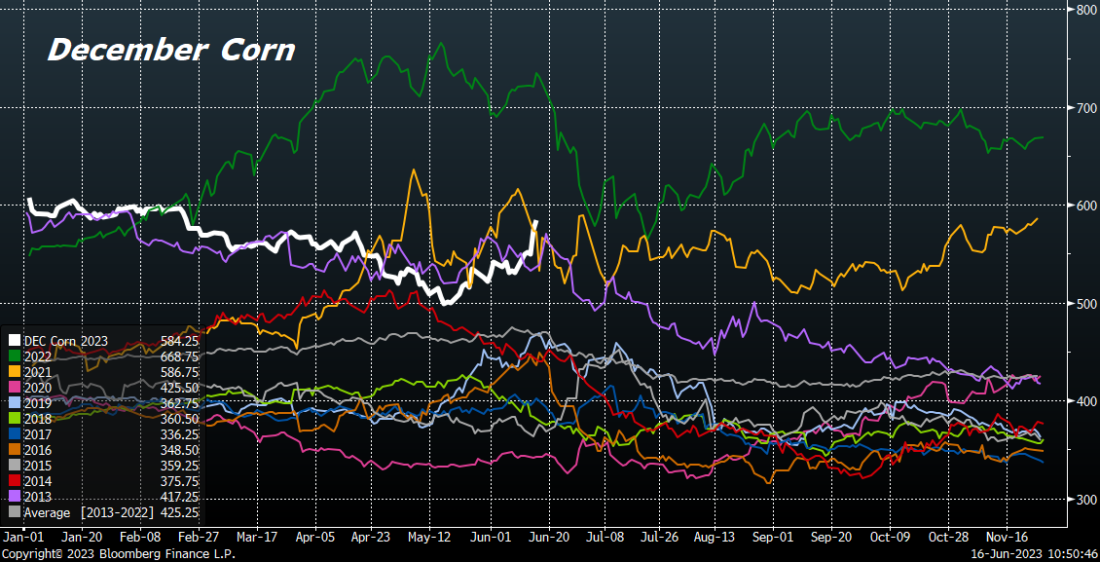

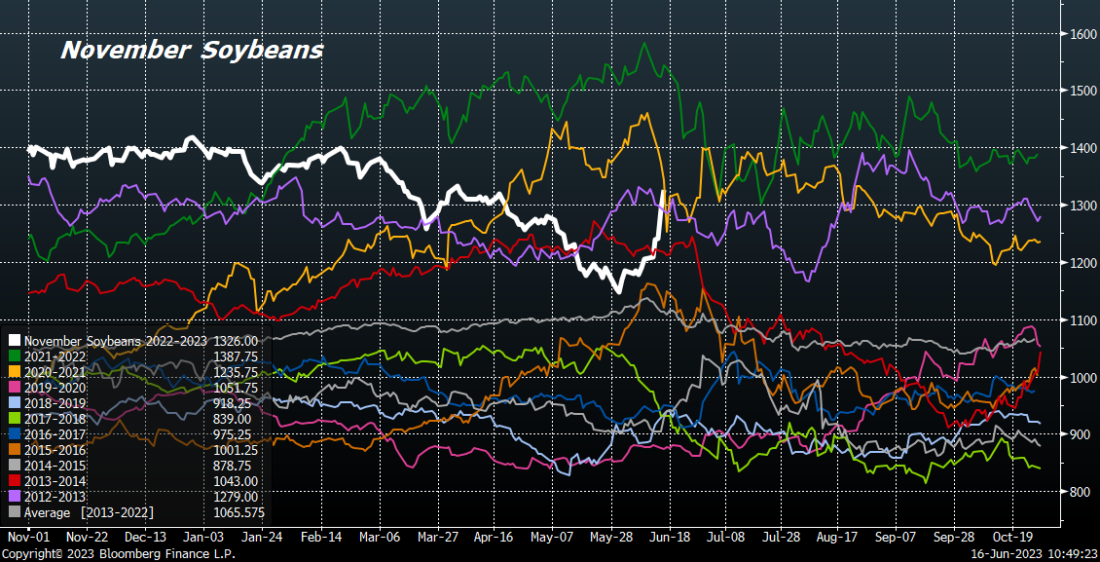

The steep rallies in December Corn and November Soybeans into the long holiday weekend indicate the trade is operating under the assumption that cumulative rainfall has been so low and widely dispersed that the crops have deteriorated substantially. Another major component of the bullish argument has been the market’s ability to discount waves of potential precipitation events stretching into next weekend.

The crops are off to a very poor start, with crop conditions deteriorating last week in most states, and the top-producing states below last year and below the 10-year average. But while gains already forged may have been justified, the high level of uncertainty ahead could expand the potential buying interest to a point where the market overreacts, and prices become too lofty. In the past, rainfall totals and coverage have been hard to predict, but with the series of systems forecast and a possibility of seeing 9–10 days with no definitive hot and dry pattern in place, it could be difficult for the hot and dry conditions to return suddenly and convincingly. The bull case has been very strong, but it is open to challenge, and the market could see a major fork in the road in the coming week.

Past price action is not indicative of future action, but seasonal studies provide evidence that the crops tend to experience major inflection points at the end of June or early July. Our advice for long speculators and producers is to implement some profit protection using near-to-the-money, close-to-expiration puts. For physical consumers and commercial buyers, we suggest securing cheap option coverage, as that will not eliminate the ability to buy at cheaper levels ahead. Keep in mind that aggressive gains from weather can also result in aggressive setbacks, especially with the crop still in the early stages of its production cycle.

Strategy Discussion

Given the combination of weather unpredictability, the recent, sharp rallies, eight days of overlapping and often conflicting weather systems, the possibility of several events occurring into next weekend, and the potential for yield damage to worsen significantly are a prescription for wall-to-wall volatility. Therefore, we suggest traders utilize risk-defined option strategies or futures and option strategies over the coming two weeks. While some will argue that option premiums are already expensive, paying up for some puts is likely to be less costly than taking on positions in which the risk is undefined.

This is not based on a prediction of the weather or the likelihood of certain fundamental outcomes. Instead, it is an attempt to benefit from a potential windfall from holding a contrary opinion.

—

Originally Published June 16, 2023

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

nice resource

We are glad to hear you found the article helpful.