Key Takeaways

- Copper is at the core of the core of the energy transition as an irreplaceable commodity and stands to benefit from the push towards clean technologies

- At the United Nations Climate Change Conference (COP28), world leaders have pledged to triple global renewable energy capacity by 2030. We believe this will create a surge in copper demand which will push prices higher and thereby incentivise more investment in primary (mining) and secondary (recycling) supply

- Copper is looking to redefine itself from being a cyclical commodity to one that has a structural tailwind from the energy transition behind it

The HMS Beagle, the naval vessel used by Charles Darwin for his voyages around the world, was built in 1825 with copper skins below the water line. The purpose of this copper sheathing was to protect the hull of the ship from biofouling, i.e., the attachment of unwanted organisms that can slow the vessel down and affect its longevity. Today, boats and ships often use copper-based paints to provide the same function.

Humans have been familiar with the qualities and diverse applications of copper for over 10,000 years. Around 4000 BC to 3500 BC, the science of metallurgy emerged in Egypt when copper was heated, moulded into shapes and alloyed to create bronze – giving rise to the Bronze Age1.

Today, copper is often referred to as the bellwether for the global economy, with its demand signalling how well the economy is doing. However, it is its strong electrical conductivity, energy efficiency, and its ability to be moulded into shapes and drawn into wires that have made copper a core energy transition commodity.

In this blog, we discuss copper’s role in the energy transition and key considerations related to its demand and supply.

Importance in the energy transition

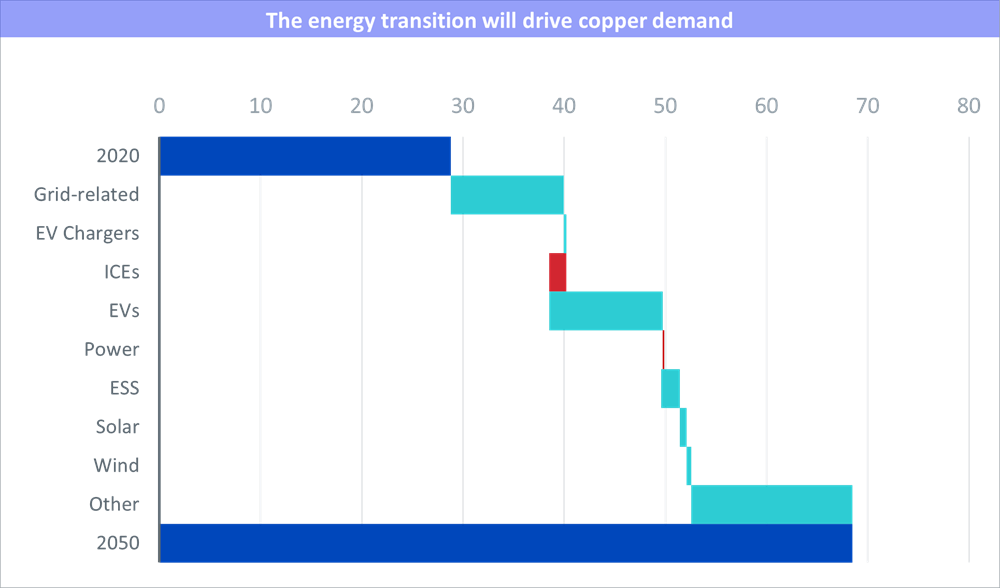

Being an enabler of electrification, copper is at the heart of the energy transition. According to our energy transition industry expert partners Wood Mackenzie, copper’s annual demand is expected to rise from around 28 million tonnes in 2020 to over 68 million tonnes2 by 2050 – driven almost entirely by emerging sources of demand like electric vehicles, charging infrastructure, renewable energy, and energy storage systems.

Source: Wood Mackenzie, 2023. Forecasts aligned to 1.5-degree scenario. Data presented in Millions of Tonnes. Negative growth in red. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

At the United Nations Climate Change Conference (COP28), world leaders have pledged to triple global renewable energy capacity by 2030. This audacious goal is only achievable through greater quantities of key raw materials like copper. But the production of copper through new mines takes time. According to S&P Global’s 2023 report, that studied 34 copper mining projects, going from discovery to production took an average of 16 years. At WisdomTree, we believe the push for green technologies will create a surge in copper demand which will push prices higher and thereby incentivise more investment in primary (mining) and secondary (recycling) supply. But supply could be playing catch-up with demand in the coming years. This is where the opportunity lies for investors.

Sources of demand

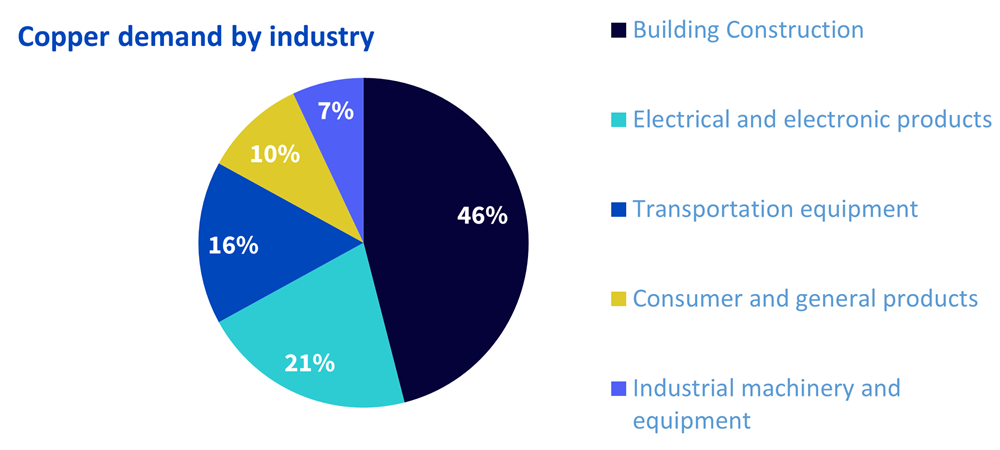

Today, copper and copper alloy products are used across a wide range of industries. Data from the US Geological Survey about copper’s domestic use illustrates this (see figure below):

Source: US Geological Survey Mineral Commodity Summaries, 2023. Data shows domestic use for the US.

In terms of countries, China is by far the biggest consumer of copper with an estimated consumption of 6.75 million metric tons in 2023. The United States ranks at number two with an estimated 2023 consumption of 3.8 million metric tons – out of a total global consumption of around 28 million metric tons3.

Because of China’s dominance as the biggest source of demand, manufacturing activity in the country is often used as a heuristic to gauge the cyclical prospects of copper. Moreover, given copper is deeply embedded across multiple industrial applications, it is seen as a cyclical asset with its fate tied to the ebb and flow of the economy. We believe the new structural source of demand growth from the energy transition is currently underappreciated by markets, which presents investors with an opportunity to view copper as a potential thematic investment.

In 2023, weak sentiment towards China’s economic growth was a drag on copper prices. But China is transitioning from using copper just for its traditional purposes like consumer electronics and construction to buying large quantities of the metal for electrifying its energy system. China is leading the world in its deployment of renewable energy, battery storage, electric vehicles, and charging infrastructure.

Sources of supply

Chile and Peru are the biggest suppliers of copper worldwide. Chile’s share of global supply stands at around 27% while Peru’s share is around 11%4. The Democratic Republic of Congo, China, and the United States are other key copper producers.

Five out of the 10 biggest copper mines are in either Chile or Peru. The largest mine in the world is the Escondida Mine in Antofagasta, Chile, which produced an estimated 1.06 million tonnes of copper in 20225. The mine is expected to operate until 2078.

This expected life of mines underscores another key point about copper supply. Copper is available in abundance in the earth’s crust. Global copper reserves – deposits that have been discovered, evaluated, and assessed to be profitable, currently stand at around 870 million metric tons. Copper resources – discovered deposits that are potentially profitable and undiscovered deposits based on preliminary geological surveys – currently stand at around 5,000 million metric tons6. However, in the decade after the global financial crisis, mining investment for commodities needed in the energy transition largely trended downwards7. We believe a tailwind behind commodities from the energy transition will incentivise more investment across the value chain of metals like copper.

Copper’s current supply concentration creates a risk to copper output. In recent years, miners in Chile and Peru have faced resistance from the masses for further expansion in mining activity, due to environmental concerns creating political pressure on the governments. With demands to produce more on the rise from the energy transition, if the countries move to tighten approval processes for expansion in mining activity, supply deficits in copper could widen despite the abundant availability of the metal in the earth. This issue can be exacerbated by declining ore grades (the quality of raw material extracted from the earth that is processed and purified), a constant challenge faced by miners that requires more investment to overcome.

Copper can be recycled repeatedly without losing its physical properties. Currently around a third of total copper supply comes from recycled metal8.

The silver lining for copper, to reduce its dependence on primary supply from mining, is recycling. Copper’s recyclability makes a compelling case for scaling up the recycling industry. More recycled metal will foster sustainable growth in copper supply and reduce the world’s dependence on new mining.

Conclusion

Thus, overall, copper is looking to redefine itself from being a cyclical commodity to one that has a structural tailwind from the energy transition behind it. We believe demand growth is expected to outpace supply growth in the years to come creating an opportunity for investors to consider copper, among other similar industrial metals, a thematic investment opportunity.

Sources

1 Copper.org, 2024.

2 Some sources of data refer to tonnes and others refer to metric tons. Both are used interchangeably in industry and refer to 1000kg of mass.

3 Statista, January 2024.

4 Statista, March 2023 based on production numbers from 2021.

5 Mining-technology.com

6 Copper Alliance, 2024.

7 FD Intelligence, 2023.

8 Copper Alliance, 2024.

—

Originally March 4, 2024 – Energy Transition Commodities – Spotlight on Copper

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.