We’ve been critical of Magellan Midstream’s (MMP) proposed sale to Oneok (OKE) for months (see Oneok Does A Deal Nobody Needs), mostly because it forces MMP unitholders to pay taxes now that didn’t need paying and for some may never be paid. But we do agree with MMP CEO Aaron Milford that the growth opportunities in crude oil and refined products where they operate are not as attractive as in natural gas and natural gas liquids. Of course, MMP investors didn’t need him to sell the company because of that, anymore than a merger to create a more diversified business is justified. Investors can create their own diversification or high growth portfolio without M&A by management. But Milford’s not the only energy executive with the conviction that growth is more gassy and less oily.

Energy Transfer’s acquisition of Crestwood brings natural gas gathering and processing assets and reduces crude oil transportation to 20% of ET’s cash flows. This deal also doesn’t create any tax issues for owners.

TC Energy (TRP) recently announced they’re spinning out their liquids business to a be a standalone entity, leaving them to be an “opportunity-rich, growth oriented natural gas and energy solutions company.” They expect their liquids business to offer “incremental growth and value creation opportunities.” This doesn’t sound very exciting. TRP had been lagging its peers because of its high capex. The spinoff announcement wasn’t well received because it caused investors to think a little more about the liquids business and its low growth prospects.

Blackrock and KKR recently sold their stake in an Abu Dhabi crude oil pipeline for $4BN.

Most long term energy forecasts are political documents nowadays. If your projections don’t show a rapid transition away from fossil fuels, climate extremists accuse you of destroying the planet. BP struggled with this in recent years. They handed off their Statistical Review of World Energy to the Energy Institute last year. In 2022 their projections had the Orwellian names Accelerated, Net Zero, and New Momentum. The third was the realistic one showing current trends – the other two were useless for capital allocation.

The US Energy Information Administration (EIA) makes long term forecasts that fortunately remain apolitical. Forecasts of crude oil demand become increasingly tenuous over time because the transportation sector dominates and public policy can more easily impact the move to electric vehicles. But natural gas is harder to replace, especially in the industrial sector where the EIA sees Incremental growth for the next three decades.

The Inflation Reduction Act is encouraging Foreign Direct Investment (FDI). Dutch fertilizer company OCI is investing $1BN to produce ammonia, a key fertilizer input, in Texas. Europe’s declining energy consumption following Russia’s invasion of Ukraine is in part due to de-industrialization caused by high energy prices. Chemical, metallurgic, glass, paper and ceramic industries have been closing factories across Europe. In a recent survey of 3,500 German companies, more than half felt the transition away from Russian natural gas and towards renewables was “very negative or negative” for their business. Some of these companies are transferring output to America. Since 2021 the US has been the world’s biggest destination for FDI.

US exports of Liquefied Natural Gas (LNG) are almost certain to enjoy strong growth as the US adds LNG terminals to send cheap US gas to foreign markets. Industry and LNG exports are the two main drivers of growth for US natural gas.

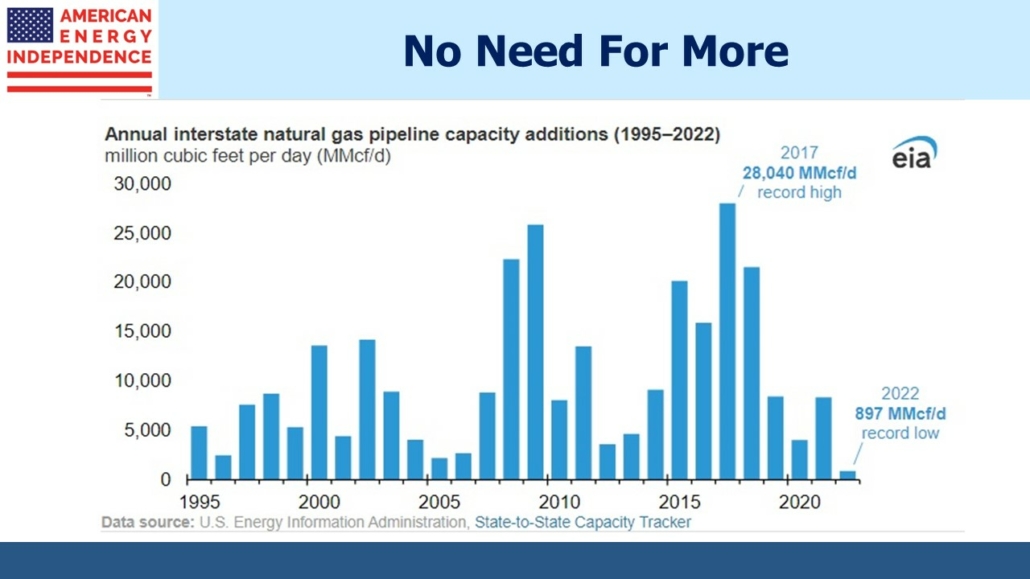

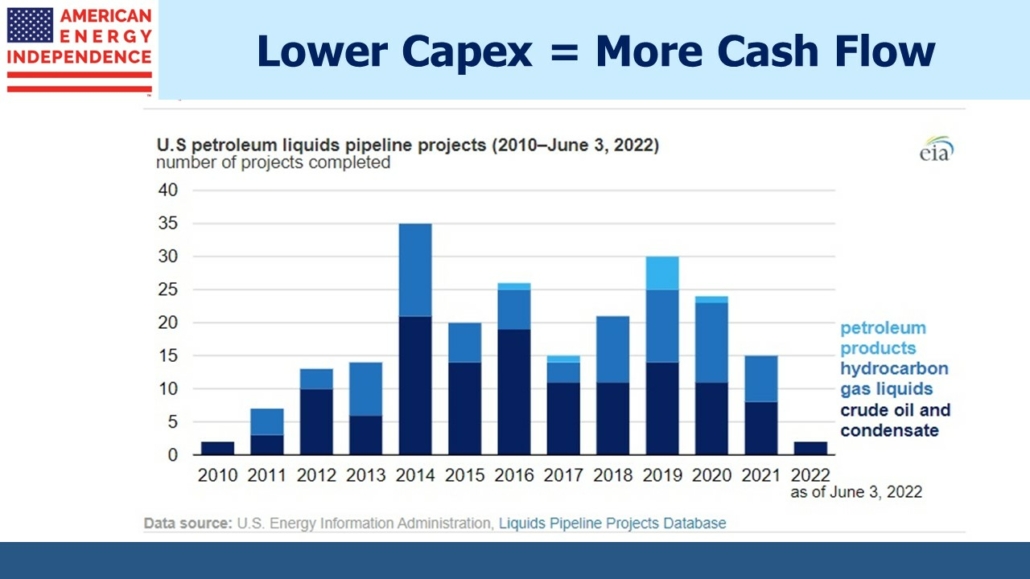

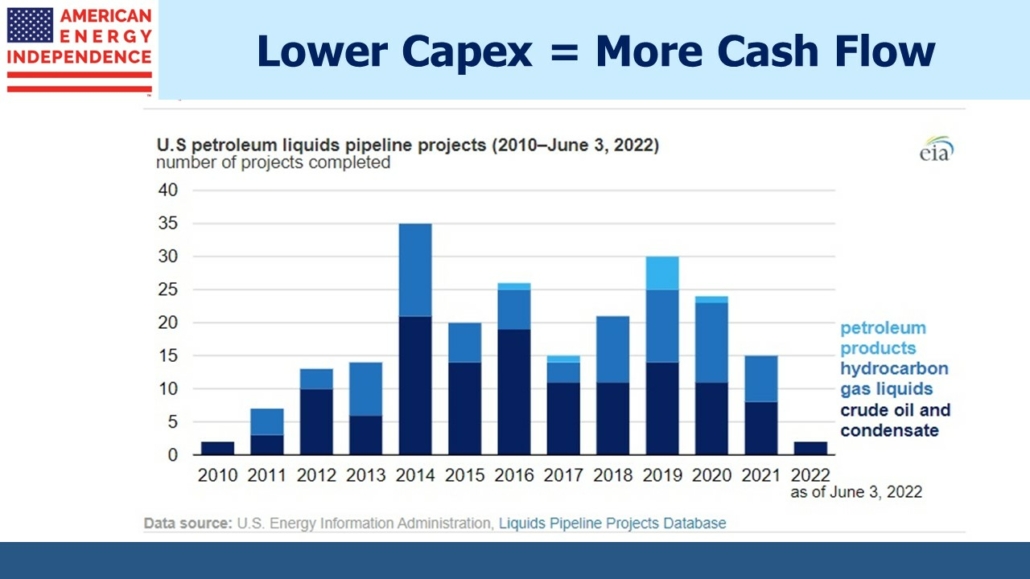

Construction of new pipelines for both crude oil and natural gas in the US is far below past years and is unlikely to recover anytime soon. We have what we need. This is why growth capex is down more than half from its peak, boosting cash flow and making the stocks attractive.

The only major crude oil pipeline project under construction in North America is the expansion of the Trans Mountain Pipeline which Kinder Morgan wisely sold to the Canadian Federal government in 2018 (see Governments And Their Energy Policies). Getting its oil to international markets is regarded as being in Canada’s national interest. But the same environmentalist activism and cost inflation that delay private sector projects have similarly hurt this one now owned by the public sector. The estimated cost has increased 4X since KMI’s sale.

Recently engineering difficulties in an approximately one mile stretch of tunnel through a mountain in British Columbia have triggered a request for regulatory approval to alter the route. The indigenous population is opposed. Further delays look likely, risking “significantly increased construction costs.”

Gas is a growth business. Capital and M&A decisions are starting to reflect that.

—

Originally Posted August 30, 2023 – Growth Is Gassy Not Oily

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Disclosure: SL Advisors

Please go to following link for important legal disclosures: http://sl-advisors.com/legal-disclosure

SL Advisors is invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from SL Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or SL Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.