In 2022, silver created a big divide in the commodities world: retail investors loved the metal, while institutional investors loathed it.

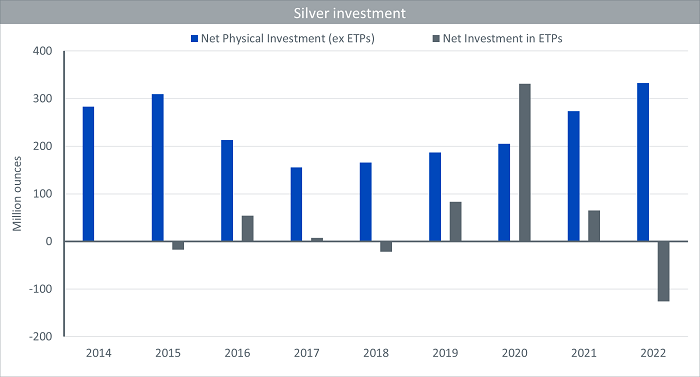

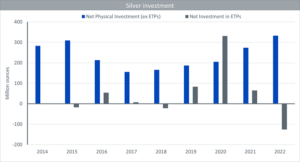

Source: World Silver Survey 2023, The Silver Institute, Metals Focus: 2014-2022. ETP = Exchange-Traded Product.

Historical performance is not an indication of future performance and any investments may go down in value.

Despite initial enthusiasm for the metal among both investor segments immediately after the Ukraine war, investment became bifurcated as the year progressed. Investment in bar and coin (net physical investment ex-exchange-traded product (ETP)), which was mainly retail investment, rose to new highs of 332.9 million ounces (10,356t), a 22%1 rise over the year and the fifth consecutive year of gain.

In sharp contrast, ETPs saw their largest net outflows since 2011, down 11% year-on-year2. Silver ETP investing is still very much driven by the institutional community.

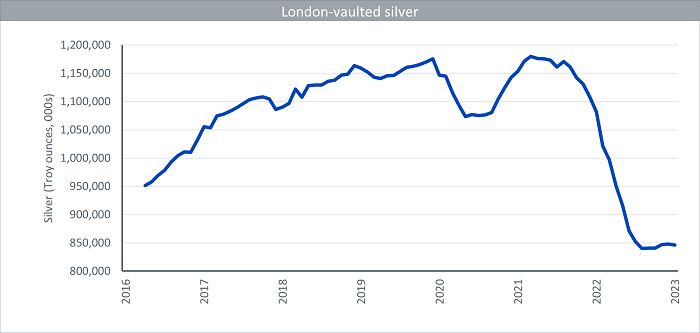

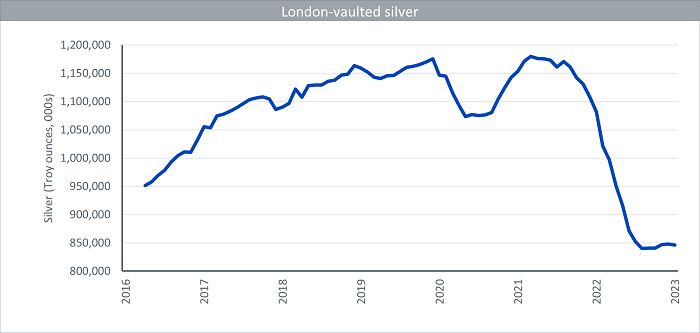

Corroborating these trends, we saw large outflows from London vaults, with silver falling to the lowest levels since the London Bullion Market Association (LBMA) started collecting the data. London-vaulted silver is once again dominated by ETPs and institutional flows.

Source: London Bullion Market Association. July 2016 – April 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

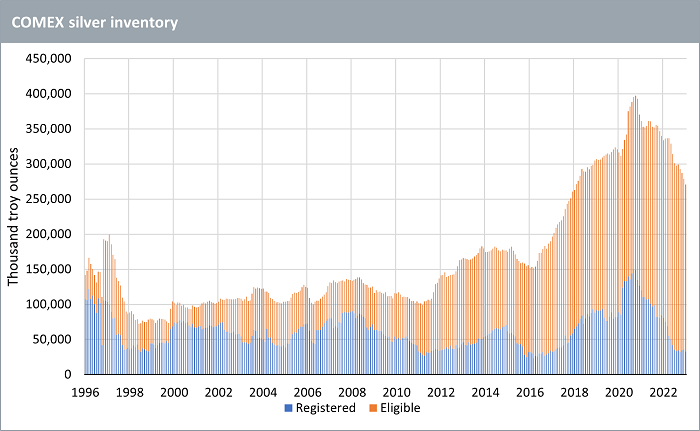

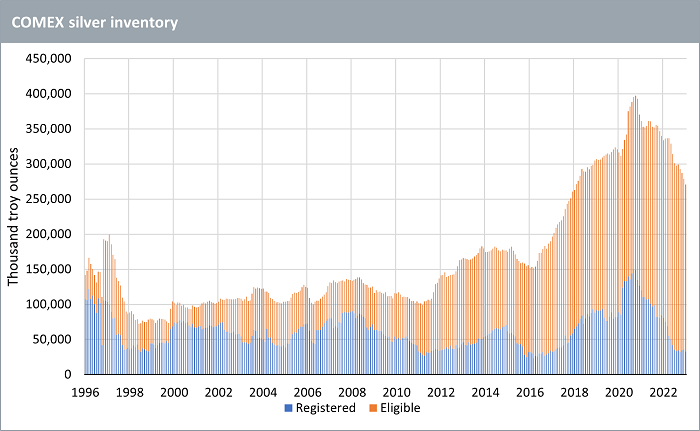

Silver stock decline was not unique to London though. Silver held in New York-based CME COMEX vaults (to meet the needs of the silver futures), also fell sharply. Registered inventory3 has fallen to the lowest levels since 2017, and considerably below the elevated levels reached during the COVID-19 pandemic when the CME deliberately increased available inventory to assuage market concerns about metal stocks at a time when transporting them was under stress. Eligible inventory4 has also fallen back to 2018 levels but remains more than double 2016 levels.

Source: Bloomberg, WisdomTree, January 1996 – May 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

Where did all the silver go?

The silver in institutionally dominated markets went to retail dominated markets.

US retail demand for bar and coin rose to a new high (134 million ounces), up from an average of 93 million ounces between 2010 and 20205. These flows appear quite sticky, with little indication of selling so far this year.

Building on the rally in 2021, which followed 2020’s heavy liquidations, Indian physical investment saw a staggering 188% jump last year and touched 79.4 million ounces (2,470t), its highest since the 2015 record. Importantly, while investment demand was lower than previous highs, it was still 40% higher compared to the pre-pandemic levels of 20196.

Export data from the UK shows considerable flows to India to satisfy the country’s retail markets. Exports to Canada were also elevated and CPM Group indicates that metal was delivered there from the US to meet demands from its retail markets.

Silver exports from United Kingdom to top countries, January 2022 to December 2022

Sources: CPM Group, UN Comtrade, May 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

Will institutional money rediscover silver this year?

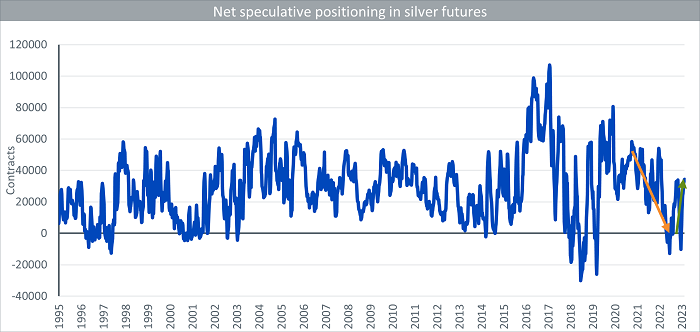

Speculative positioning in silver futures has been choppy in 2023, with the market being net short in early March. However, the onset of banking woes, triggered by the collapse of Silicon Valley Bank (SVB), not only lifted gold futures demand, but boosted silver futures demand from non-commercial users seeking to hedge their portfolios. The initial short covering sent silver prices considerably higher, from US$20.05/oz in early March to US$25.99/oz in early May. Silver prices, however, have pulled back since then to US$23.54/oz7.

With a number of financial, economic and geopolitical risks underpinning gold, and by extension silver, we believe investors will refrain outright bearish bets against the metal.

It’s yet to be seen if institutional investors will move meaningfully into silver ETPs. Given that economic headwinds harm silver where they support gold, we suspect investors seeking hedges will prefer the yellow metal. That being said, silver is often viewed as a leveraged play on gold, so may see more interest especially as gold reaches fresh highs.

Source: Bloomberg, March 1995 to May 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

Sources

1 World Silver Survey 2023, The Silver Institute, Metals Focus: 2014-2022.

2 World Silver Survey 2023, The Silver Institute, Metals Focus: 2014-2022.

3 Registered inventory is where a warrant has been assigned for delivery.

4 Eligible inventory meets all the specifications for delivery, in terms of size, quality etc, but has not been assigned a warrant, that is, the owner has not made it available for futures market delivery.

5 World Silver Survey 2023, The Silver Institute, Metals Focus: 2014-2022.

6 World Silver Survey 2023, The Silver Institute, Metals Focus: 2014-2022.

7 Bloomberg, 5 June 2023.

—

Originally Posted June 22, 2023 – Silver: the great retail vs institutional divide

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Complex or Leveraged Exchange-Traded Products

Complex or Leveraged Exchange-Traded Products are complicated instruments that should only be used by sophisticated investors who fully understand the terms, investment strategy, and risks associated with the products. Learn more about the risks here: https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView?formdb=4155

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.