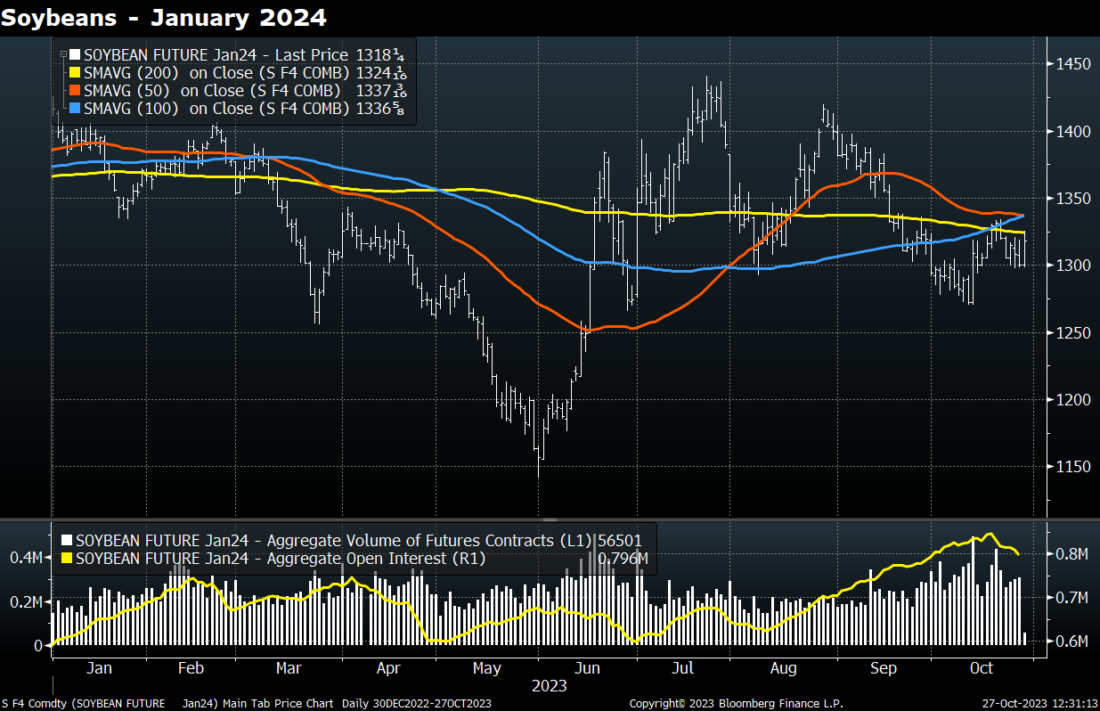

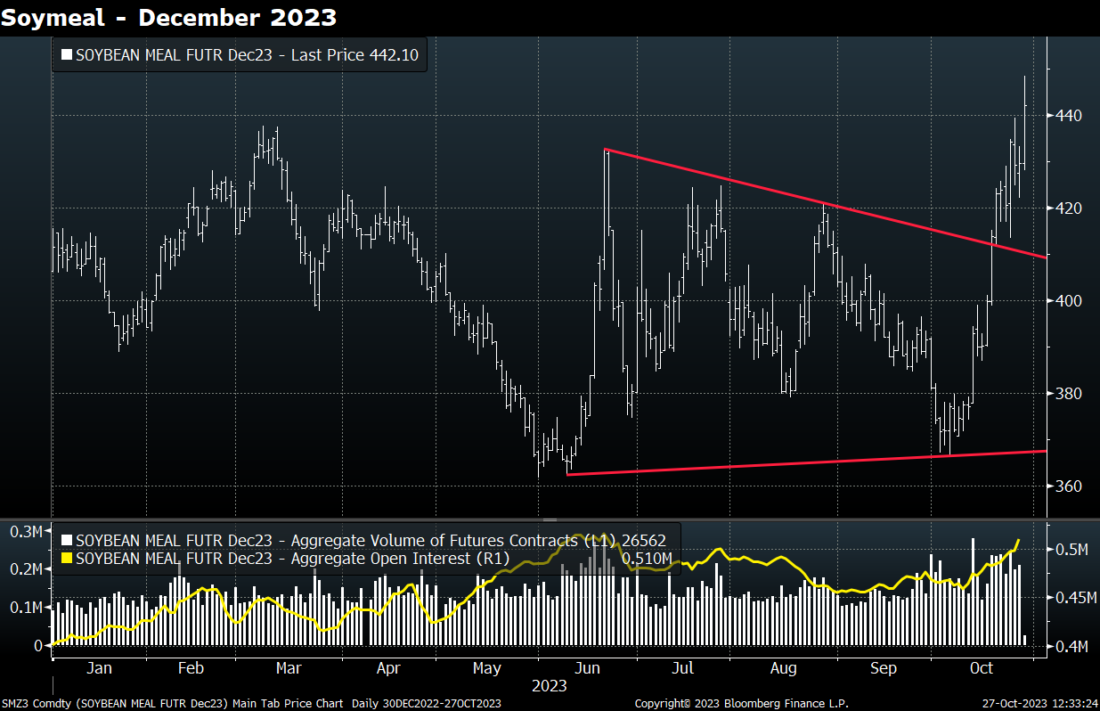

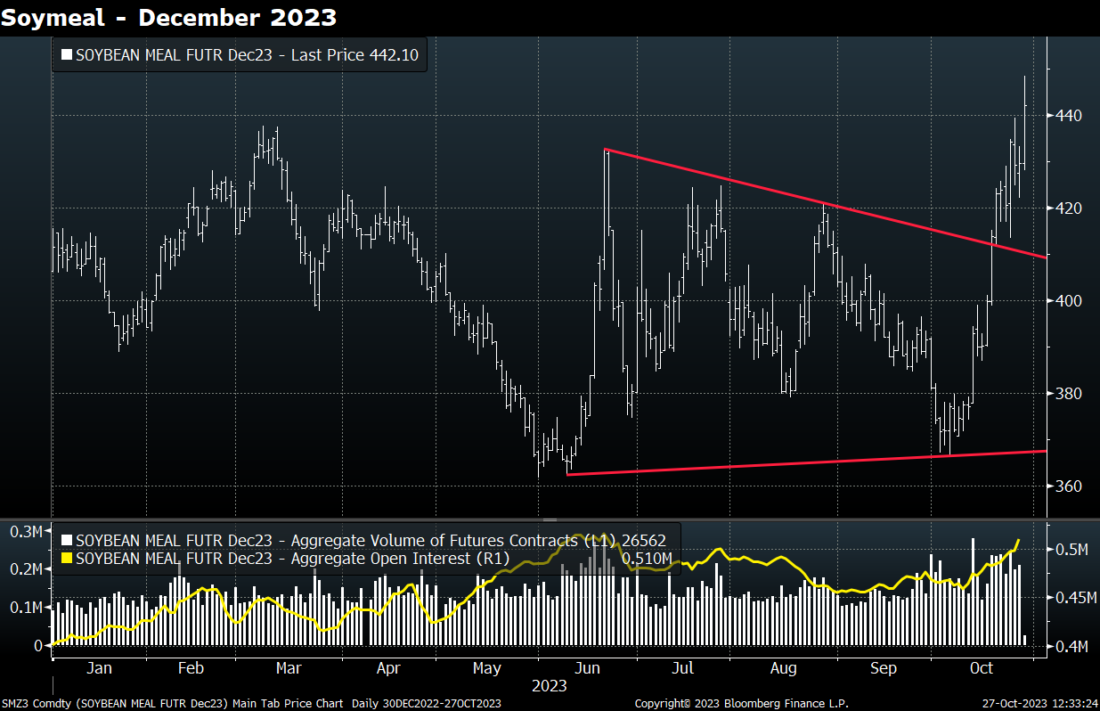

January Soybeans stayed in a 24-cent range this week but closed strong off support from export sales and soybean meal prices, which made new contract highs. Strong domestic crush margins and unusually high export sales of soymeal are driving those prices higher. ADM’s CEO said this week that Argentina could run out of beans to crush in November.

Source: Bloomberg

At an event in Iowa on Monday, a delegation of agribusiness leaders from China signed a letter of intent to purchase US agricultural products. It is common for China to sign these “framework contracts” which indicate their intention to buy significant amounts of US goods, but these agreements are not binding. China had not had any delegation visits since 2017 due to US/China political disagreements, so this visit is more significant than previous ones. Specific dollar amounts were not indicated, other than the contract was worth billions. US Agriculture Secretary Vilsack said this week that the US will spend $2.3 billion to promote US farm exports and to send grain to countries that are suffering food shortages. USDA also confirmed several cargoes of US beans bought by China this week. Weekly export sales were very strong, with China accounting for 85% of the total. Dwindling bean supplies in Brazil are opening a window for US exports, and US prices are competitive. US soybean meal exports are expected to continue to outperform through the winter, as Argentina’s soybean supplies will not be replenished until next spring.

Source: NOAA

Fall weather will arrive in the US Midwest this weekend, with temperatures plummeting to below normal and a chance of snow in the northern Plains. Good rains will move through the eastern Corn Belt over the next several days, resulting in harvest slowdowns but improvements in Mississippi River levels. Barge shipments on the Mississippi rose 13% this past week, partly due to the need to fill boats as demand picks up. We expect to see support on pullbacks in January Soybeans.

Source: Bloomberg

—

Originally Published October 27, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.