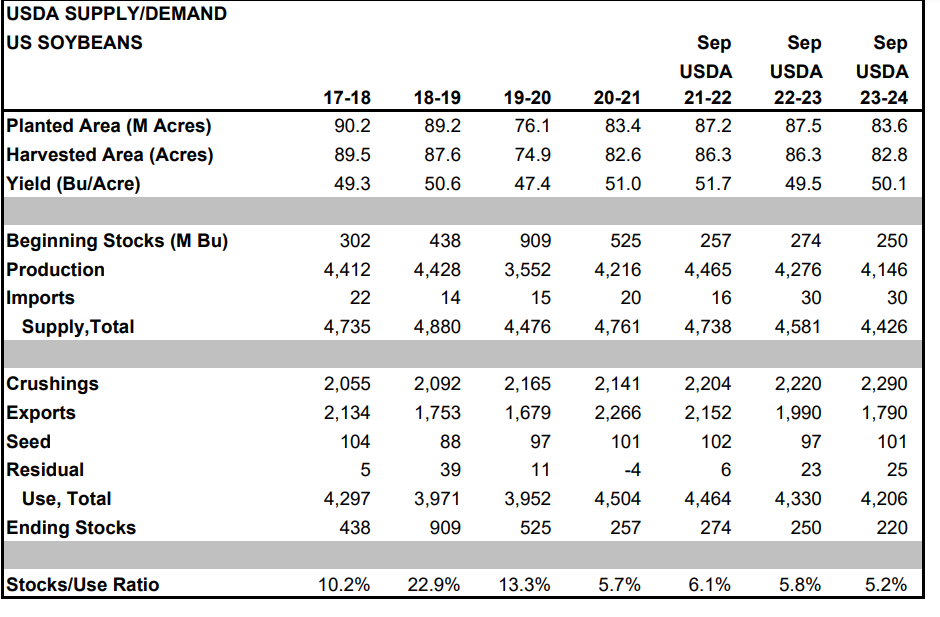

This week’s USDA supply and demand report did not give traders any major surprises, but it did offer some clarity on how the late-season weather has affected soybeans. US 2023/24 soybean yield was pegged at 50.1 bushels per acre, down from 50.9 in the August report and right on expectations. Pod counts were up 9% from a year ago. Cuts to exports and crush and a 100,000 increase in harvested acres pushed the ending stocks forecast to 220 million bushels versus an average expectation of 207 million.

Source: USDA

In the past, a 100-million-bushel ending stocks number was considered the minimum pipeline amount for soybeans, and the USDA rarely forecast a number below that level. Now, many analysts consider the minimum pipeline to be 200 million bushels and think USDA would rather massage demand numbers than release a report with a number below there.

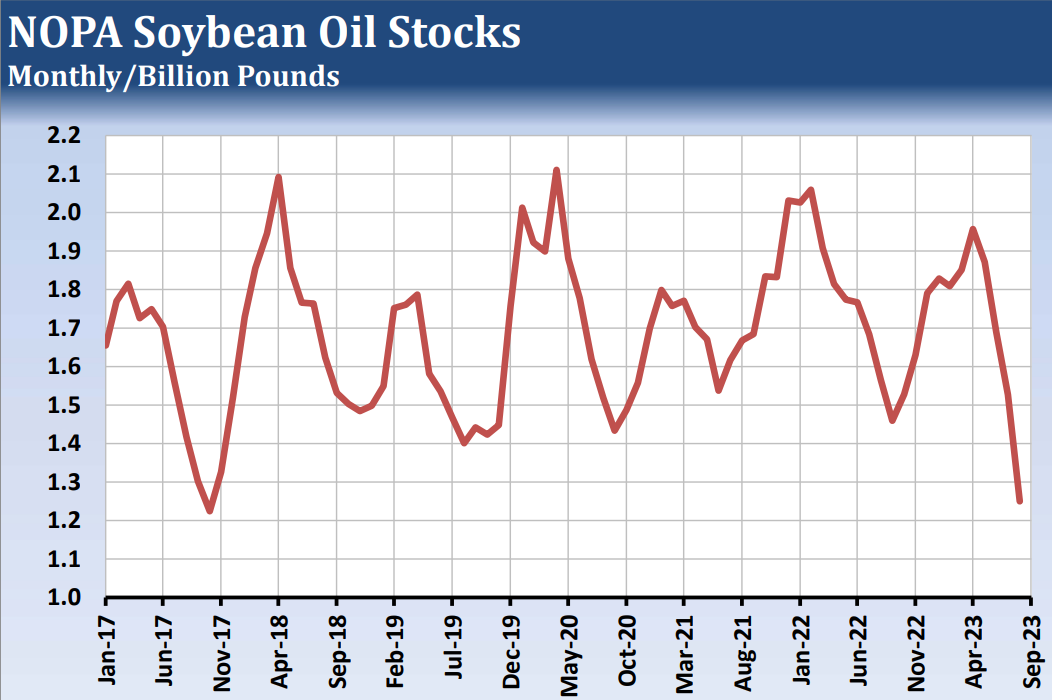

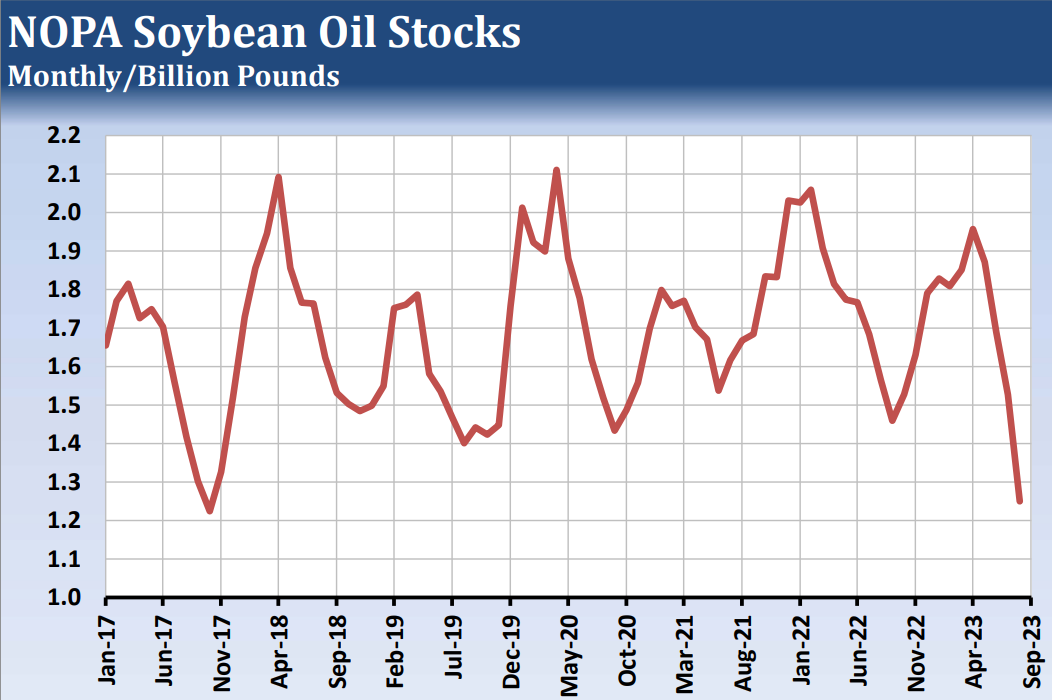

The NOPA August crush came in at 161.453 million bushels, well below the average expectation of 167.802 million and the lowest in 11 months. August 31 soybean oil stocks came in below expectations, and they were the lowest in six years. Widespread maintenance downtime in August typically means August crush is one of the lowest of the year. Our opinion is that new crush capacity and strong demand will bring crush rates back to record levels as we move into fall and early winter. We would not be surprised if USDA reverses course and increases its crush forecasts in the next few supply/demand reports. Notably strong crude oil and diesel prices lately have supported soybean oil, and continued high energy prices could become a bullish force for that market.

Source: NOPA

The South American planting window is open in Mato Grosso and surrounding areas. Southern Brazil is seeing favorable planting conditions, while the center-west and northern regions have seen infrequent showers. Mississippi River logistics will remain a significant problem next week, but updated forecasts have added rain to the central Midwest a week from now, which may give river levels a boost.

This week, China raised its maximum moisture specifications for imported beans from Argentina and the US to 13% and for Brazilian beans to 14%. This is important because Brazilian beans generally carry a higher moisture content than US beans, and Brazil typically does not have drying capacity at the ports. Details have not yet emerged on how China will deal with cargoes that are above their maximum moisture levels. We will update further as more information surfaces.

Source: Bloomberg and CME

—

Originally Published September 15, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.