The downtrend in the soybean complex accelerated this week into new contract lows. Extremely bearish sentiment has been difficult to shake, as Brazil’s harvest is ongoing and US spring planting is not close enough to give traders a reason to focus on the weather. Mato Grosso farmers have sold approximately 41% of their beans versus an average of 60% for this time of year. This suggests significant selling is still on the horizon.

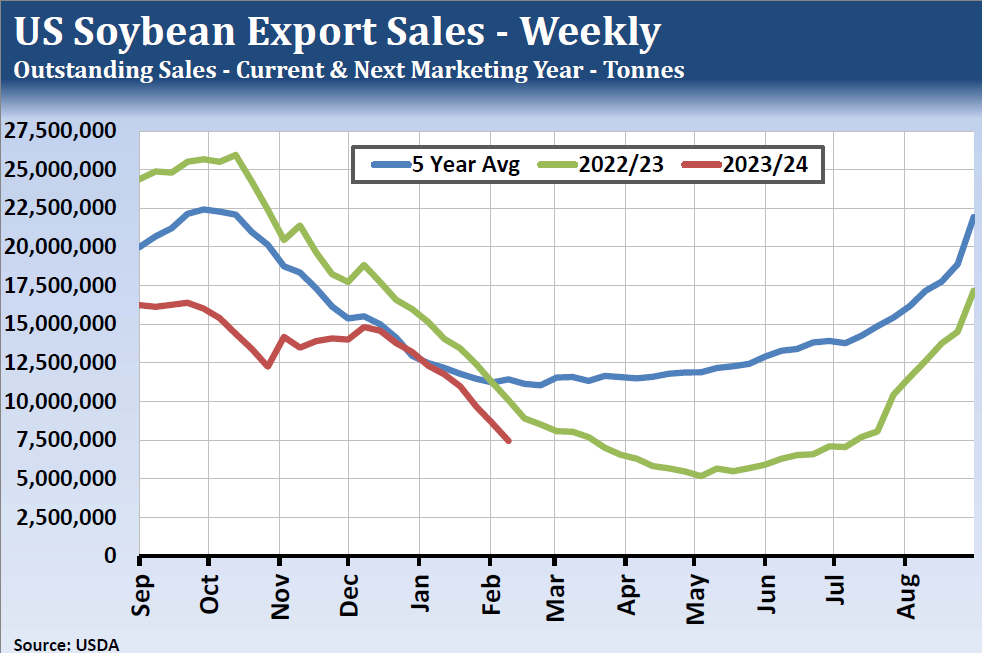

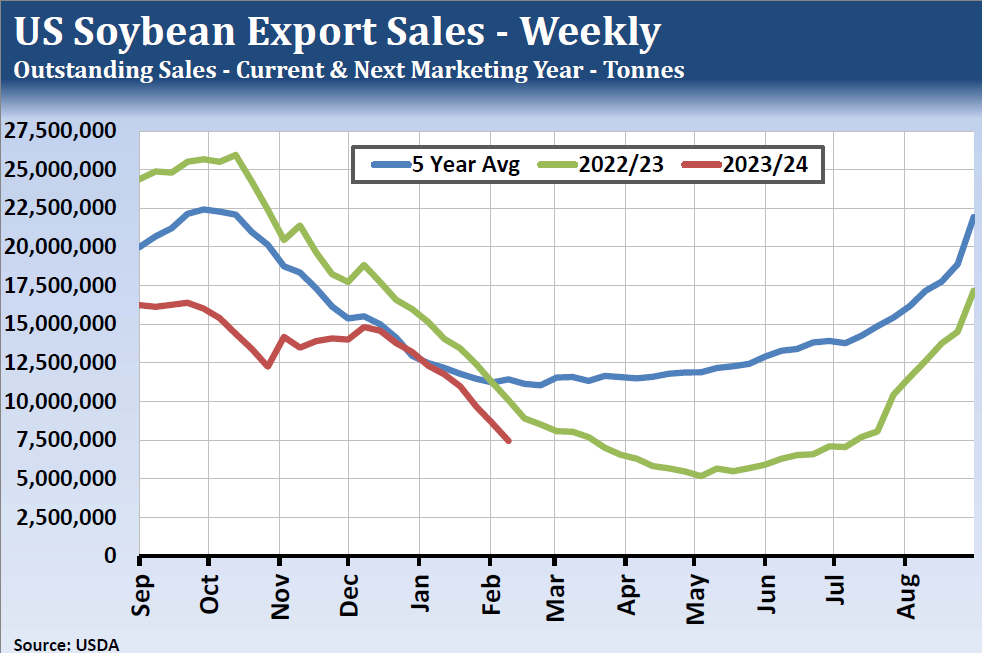

China has resumed buying now that the Lunar New Year holiday is over, but their purchases have been mostly for Brazilian soybeans, with nothing significant from the US. Weekly export sales were the fourth lowest in more than 30 years. In addition, 3-4 more Brazilian bean cargoes have reportedly been bought by US chicken producer Purdue for delivery to the US East Coast. Although Brazil soy premiums have risen sharply this week, FOB US Gulf prices are still $42 per tonne higher.

South American crop revisions have continued this week, but the changes have not been large enough to alter expectations for a large year-over-year gain in the Brazilian and Argentine output. In 2022/23 the two countries produce 187 million tonnes of soybeans. USDA is forecasting a combined total of 206 million for 2023/24, an increase of 19 million from last year. If Brazil’s production is closer to CONAB’s number of 149.5 million, the year-over-year combined gain would be close to 13 million tonnes, which is still significant. This is part of the reason why futures prices have not reacted bullishly to recent crop downgrades.

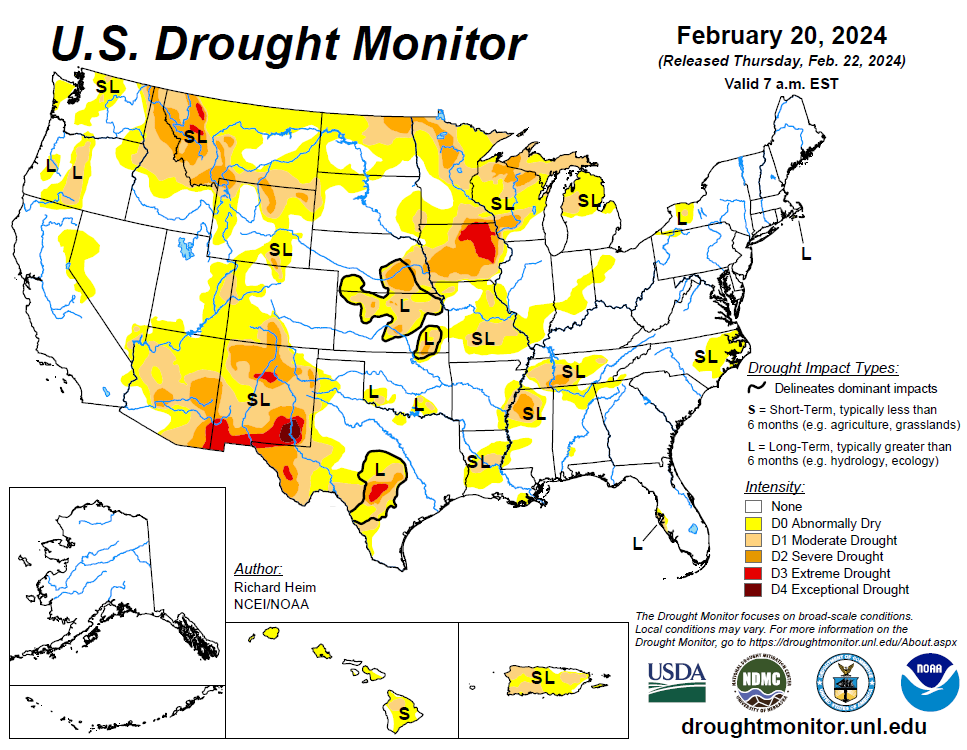

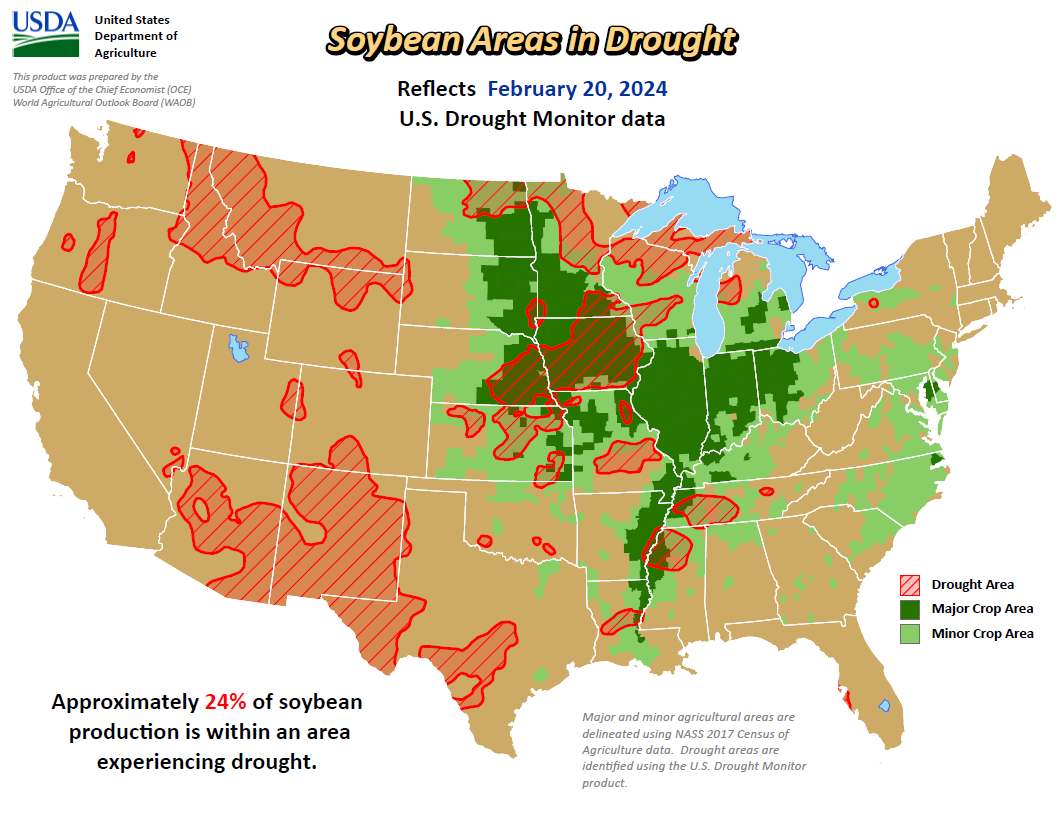

Very warm temperatures across the Midwest in the second half of February with similar conditions expected into March raise the odds of an early start for spring plantings. This scenario typically results in farmers planting fewer than expected acres of soybeans and more of corn. US soybean crop area under drought this week was 24%, compared to 25% the previous week and 32% a year ago. Iowa remains the major concern in the Midwest, as drought conditions remain in place there, especially across the northeast quadrant of the state. Spring rains will be needed to prevent critical subsoil moisture shortages during planting.

With US exports expected to suffer as Brazil harvest supplies increase, US domestic use must stay strong. Daily soybean crush rates in February have been at record levels due to increased capacity, a lack of transportation problems, and mild weather. February will likely be a record shipment month for soybean meal. Processor maintenance downtime should be minimal in March but more significant in April. More new processing plants will be coming online this spring.

US cash soybean oil has been weak this month, as biofuel plants filled tanks ahead of time and now need to work through their supplies.

Bottom Line: Mostly favorable South American weather, plentiful harvest supplies of soybeans, and first notice day for the March contracts may keep pressure on the market for most of next week. It is a couple of weeks too early to worry about US weather. A bounce may be more likely after first notice day on Thursday.

—

Originally Published February 23, 2024

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.