The El Niño weather phenomenon is back on the radar. A new update from the World Meteorological Organization (WMO) forecasts that there is a 90% probability of the El Niño event continuing during the second half of 2023.

What is the El Niño phenomenon?

The El Niño Southern Oscillation (ENSO) is an oceanic-atmospheric phenomenon with origins in abnormal variations in surface water temperatures in the Central and Eastern Pacific (Latin American coast). It comprises two opposing phenomena (La Niña and El Niño) that historically occur every 2 to 3 years. La Niña brings colder, wetter weather (lasts between 1-3 years), while El Niño brings warmer, drier weather (lasts between 9-12 months).

Typical impacts of El Niño

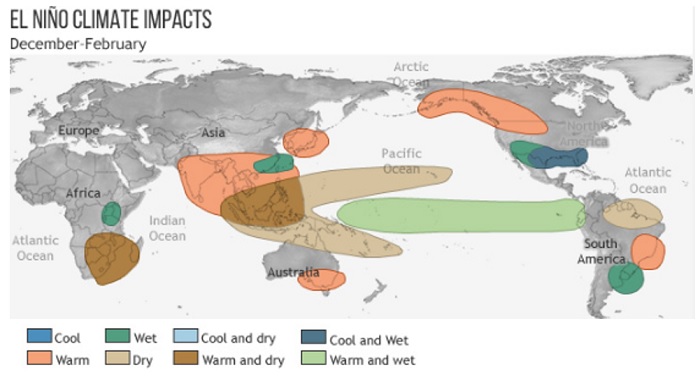

When El Niño starts picking up, trade winds slow down and the warm water near Asia starts moving back eastward across the Pacific, reaching the coast of South America. The drift in warm water also moves evaporation and rain such that southeast Asia and Australia tend to get drier while Peru and Ecuador tend to see more precipitation. El Niño typically picks up over the summer and shows its strongest effects over the winter in the Northern Hemisphere. However, the characteristics of the El Niño vary according to its timing and amplitude.

Figure 1: El Niño climate impacts December – February

Source: National Oceanic and Atmospheric Organisation (NOAA). Historical performance is not an indication of future performance and any investments may go down in value.

World sees hottest July on record

El Niño weather disturbances, which affect the entire Indo-Pacific region, lead to heatwaves and droughts. This is why the developing El Niño is likely to amplify the negative effects of climate change in Asia-Pacific, South and East Africa and the Americas. So, it comes as no surprise that large parts of the Northern Hemisphere have witnessed intense heat and devastating rainfall in the first half of 2023. July is expected to be the hottest month on record1; China set a new national daily temperature record in July and was hit by record-breaking rainfall at the start of August2. Large parts of the USA were also gripped by extensive heatwaves, with high temperatures in numerous places3. Canada experienced its worst wildfire season on record, as did parts of the Mediterranean.

Implications for agricultural commodities

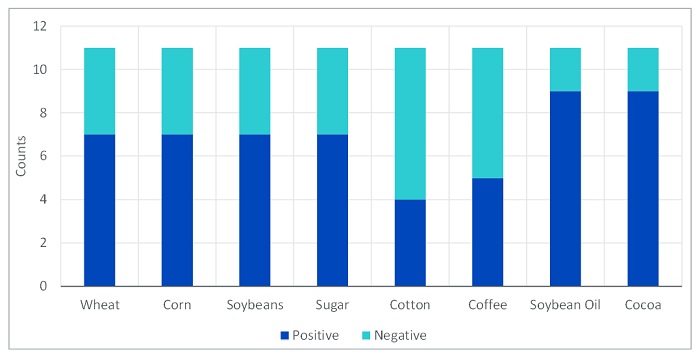

The growing of agricultural products is sensitive to weather patterns. For some crops, El Niño could boost production, while for others it could damage production. Should the weather event intensify, it could be a significant catalyst for price gains in cocoa, soybean oil, sugar and grains. Meanwhile it could be price negative for cotton and coffee.

We analysed prices of agricultural commodities over the past 11 episodes of El Niño’s, dating back to the 1960s. In 8 of the last 11 occurrences, wheat, soybean oil and cocoa traded higher by an average of 14%, 6% and 16% respectively, 6 months after the El Niño started. In 9 out of the past 11 occurrences, soybean oil and cocoa traded higher.

Figure 2: Price impact on agricultural commodities over the historical El Niño cycles

Source: National Oceanic and Atmospheric Organisation (NOAA), Bloomberg, WisdomTree, data from January 1963 to July 2023. Based on the last 11 El Niño episodes since 1963 for all commodities. Historical performance is not an indication of future performance and any investments may go down in value.

Soybean oil benefits from tight palm oil supply

In the past, El Niño has impacted the supply of agricultural commodities such as palm oil, sugar, wheat, cocoa, and rice. Based on the local weather agency Badan Meteorologi Klimatologi (BMKG)’s reporting, approximately 40 percent of Indonesia’s oil palm area experienced below-normal precipitation in June 20234. The BMKG also indicated that El Niño weather patterns are at weak-to-medium intensity and are expected to peak in August to September 2023. The shortage of palm oil tends to have a knock-on effect on demand for close substitutes such as soybean oil. This comes at a time when the escalation of attacks between Russia and Ukraine is also raising concerns on the supply of edible oils from the Black Sea region. Escalating tensions and the blockade of the Black Sea shipping routes are likely to aggravate the global edible oil and grain supply situation.

Rice supply at the mercy of El Niño

Dry weather has been threatening crops in the world’s second largest rice exporter, Thailand, with the country facing widespread drought conditions from early 2024. The government has already asked farmers to restrict their planting to just one crop this year. While monsoon rains have brought some relief to rice fields in parts of India (the world’s largest exporter), the country banned exports of non-basmati white rice5. Tightness in the rice market could have a knock-on impact on other staple substitutes, such as wheat.

Cocoa benefits from tight supply

The return of El Niño conditions is also supporting cocoa because the weather phenomenon tends to bring hot and dry conditions to West Africa. Cocoa growing is concentrated in Africa, with approximately 70% of production in the continent. Historically, El Niño has led to production shortfalls as the weather phenomenon leads to drier spells in Africa during key growing periods.

This year, farmers in Ivory Coast, Ghana and Nigeria have reported signs of black pod disease, which causes cocoa pods to turn black and rot. That could also affect the quality or curb the output of beans. The cocoa market is expected to be in a third year of deficit in the 2023-24 season which should keep cocoa prices well supported.

Conclusion

While an El Niño event is not guaranteed (it has less than a hundred percent probability), and the strength or the duration of the event remain uncertain, it comes on the heels of war which has caused significant disruption to the flow of grains and oilseeds. Inventories of many agricultural commodities (wheat, corn, soybean oil and cocoa) are trading below their 5-year averages, making it harder to absorb a production shock6. El Niño could, therefore, be price supportive for these agricultural commodities.

Sources

1 Source World Meteorological Organization.

2 Source China Meteorological Administration.

3 Source US National Weather Service.

4 Source United States Department of Agriculture, as of 3 August 2023.

5 Source Indian Ministry of Consumer Affairs as of 21 July 2023.

6 Source United States Department of Agriculture, as of 31 July 2023.

—

Originally Posted August 17, 2023 – What does El Niño’s return mean for commodities?

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.