Adrienn Sarandi, Head of ESG Strategy and Development, discusses why integrating natural capital related risks and opportunities can enable investors to recognise systemic risks early and allocate capital to solutions that will underpin a more sustainable economy.

Key takeaways:

- Nature provides trillions of dollars in economic value and its degradation poses systemic risk for governments, companies, and investors.

- The scale of biodiversity loss and ecosystem degradation is alarming and urgent action is needed to preserve vulnerable species and ecosystems that underpin our economy, our society and make human life possible.

- The imminent release of the TNFD framework should improve biodiversity-related disclosures and help investors evaluate biodiversity-related dependencies and impacts.

What is natural capital

Natural capital is the world’s collective stock of renewable and non-renewable natural resources, specifically, geology, atmosphere, sunlight, soil, air, water, and living organisms. From the air we breathe, to the food we eat, natural capital assets provide us with invaluable goods and services free of charge.

Natural capital includes all living organisms that we call ‘biodiversity’. As we explored in our 2022 Biodiversity – the other systemic crisis primer, biodiversity can be defined as the volume, variety, and variability of life on Earth, as well as how different species interact with each other and the physical world around them. Biodiversity enables the flow of ‘ecosystem services’ that we receive and depend upon. These ecosystem services underpin our economy and our society and make human life possible.

Figure 1: Ecosystem services

Drivers and impacts of nature loss

The scale and speed of the deterioration of world’s land and sea ecosystems is striking. Estimates suggest around 70% of animal species have disappeared since 1970 and one million species are currently at risk of extinction*. Meanwhile, humans, and domesticated livestock (mainly cows and pigs) now account for 96% of all mammal biomass.

The situation is equally concerning in the Earth’s waters. We dump eight million tonnes of plastic into the sea every year, around one garbage truck per minute. Coral reefs and marine ecosystems are becoming barren wastelands because of pollution and rising sea temperatures. The overexploitation of fish and other species for food has also led to their sharp decline.

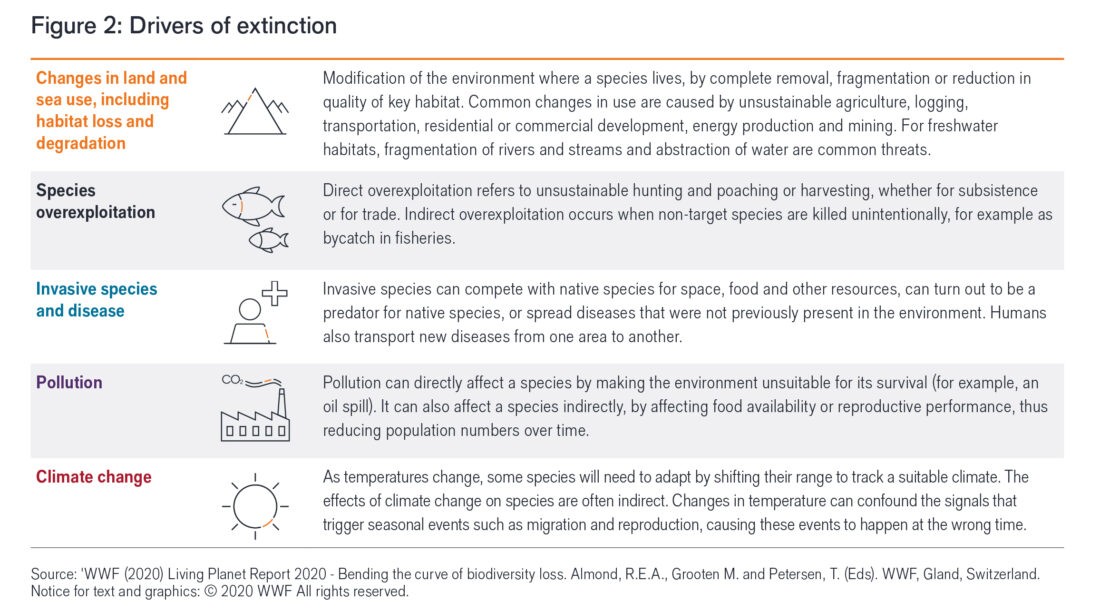

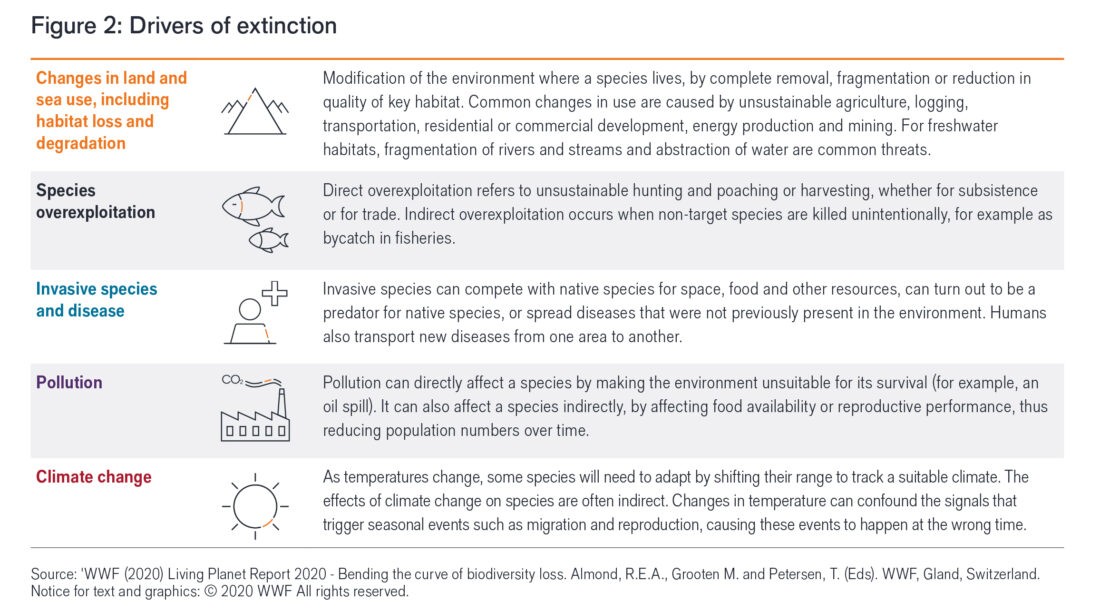

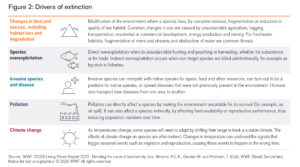

As a result, the ‘sixth mass extinction’ is underway, with five key drivers linked to human activity.

Figure 2: Five key drivers of species extinction

Like climate change, biodiversity loss represents both a systemic risk to entire economies and a risk to individual companies. Climate change and nature degradation are also deeply interconnected and mutually reinforcing. For example, deforestation results in habitat and biodiversity loss, and reduction of carbon sequestration capacity, worsening the climate crisis. Climate change reduces biodiversity through increased incidence and severity of weather extremes, which degrades habitats, and can result in desertification and ocean acidification. Marine ecosystems impacted by species loss absorb less carbon. Both challenges operate around tipping points that, once passed, lead to unpredictable and potentially devastating outcomes.

Why do we care?

Nature underpins our economy, society and makes human life possible. Over half the world’s total gross domestic product (GDP), US$44 trillion, is moderately or highly dependent on nature and its services, meaning ecosystem degradation could materially jeopardise the functioning of society and the global economy. Despite this, there has been an underappreciation of natural capital, compared to produced and human capital. For example, ecosystem services have historically been excluded from national balance sheets. Hence, we need global collaboration to start accounting for nature degradation.

To illustrate the challenge, Earth’s ‘Overshoot Day’ took place on 2 August 2023. This marks the date when humanity’s demand for ecological resources and services exceeds what Earth can regenerate in a given year. In the remaining 151 days of 2023, we are operating in overshoot. Estimates suggest we need 1.7 Earths to maintain humanity’s current way of life. Moreover, the Overshoot Day has been getting progressively earlier since the 1970s and we are depleting resources at an ever accelerating and unsustainable rate.

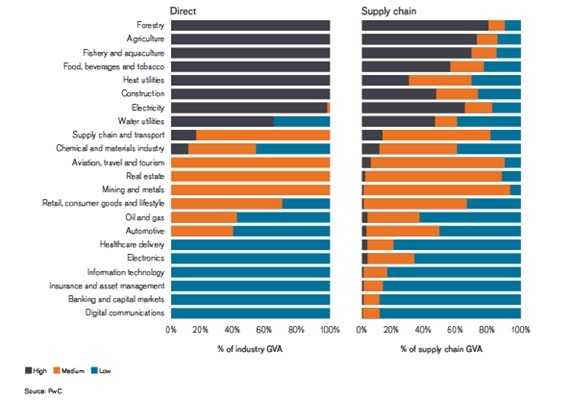

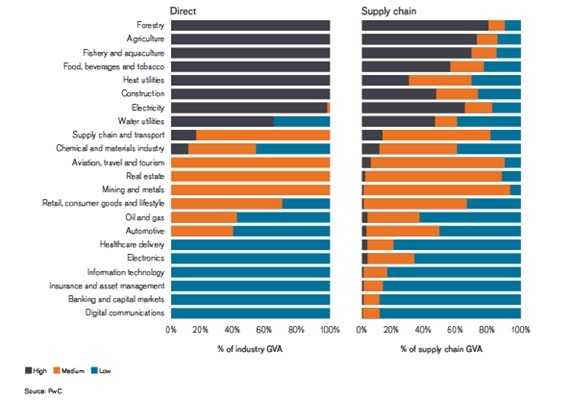

Healthy societal and environmental systems are critical to the functioning of economic systems. The gap between humanity’s demands on nature and nature’s ability to supply is widening and threatens continued provision of the critical ecosystem services underpinning key economic sectors, as shown in Figure 3.

Figure 3: Dependencies of industries on nature

Source: JHI, World Economic Forum and PwC 2020 ‘Nature Risk Rising: Why the Crisis Engulfing Nature Matter for Businesses and the Economy.’

Janus Henderson’s view and approach

At Janus Henderson, we view the scale and severity of the damage to nature and its many knock-on impacts as representing significant financially material long-term risks for certain sectors and issuers. Analysis shows these risks are concentrated in sectors with the greatest dependencies on nature, including agriculture, forestry, and fishing; water and heat utilities, food and beverage; mining; transport; and construction.

The risks are multi-dimensional, and some companies will have outsized exposure to the physical impacts of nature degradation, and others to transition risks due to policy and regulatory risks. Litigation risks, loss of reputation, brand damage, and shifting consumer demand also present meaningful risks, but also potential opportunities for companies to gain market share.

By integrating financially material risks associated with the decline of natural capital, investors have the opportunity to build more resilient portfolios, and also contribute to nature’s restoration by engaging with companies on reducing their harmful impact on biodiversity and formulating innovative solutions. They will need to be enabled by nature-positive government policies and a practical framework that enables implementation.

The quality and depth of data and disclosures on nature and biodiversity are still nascent, largely because mapping out dependencies and impacts is a complex and challenging undertaking for corporates, investors, and governments alike. However, with the TNFD framework we hope corporate disclosure will markedly improve in coming years and financial market participants can advance their journey faster to map out nature-related dependencies and impacts through their investments.

Forging a path ahead

Despite the stark statistics, there is hope. Nature is remarkably resilient and ecosystems and wildlife can regenerate, even in areas where one would think impossible. However, this is possible only if we respect planetary boundaries** (the limits within which humanity can develop and thrive) and don’t push ecosystems to the point of no return.

As biodiversity loss is one of the most critical planetary boundaries that we have already exceeded, time is of the essence. As with other market failures, such as polluting free of charge, we must start valuing natural capital appropriately in order to transition to a more sustainable economic model which recognises nature’s importance to the economy and our well-being. This will require systems change***.

* World Wildlife Fund (2022): 69% average decline in wildlife populations since 1970, says new WWF report | Press Releases | WWF (worldwildlife.org)

** Doughnut Economics, Kate Raworth 2017 – 9 planetary boundaries / environmental limits within which humanity can continue to develop/thrive for generations to come. In the Doughnut Model economist Kate Raworth argues that humanity must live within these ecological boundaries (or 9 thresholds that should not be exceeded to avoid natural degradation that would lead to unreversible consequences).

*** World Resources Institute – What is Systems Change: systems change can be defined as shifting component parts of a system — and the pattern of interactions between these parts — to ultimately form a new system that behaves in a different way.

Definitions:

Carbon sequestration: A process (either natural or artificial) by which carbon dioxide is removed from the atmosphere and held in solid or liquid form, such as trees.

Gross domestic product (GDP): The value of all finished goods and services produced by a country, within a specific time period (usually quarterly or annually).

Systemic risk: The risk of a critical or harmful change in the financial system as a whole, which would affect all markets and asset classes.

Taskforce on Nature-related Financial Disclosures (TNFD): A risk management and disclosure framework for organisations to report and act on evolving nature-related risks.

Originally Posted September 8, 2023 – ESG perspective: What is natural capital and why do we care?

Important information

Environmental, Social and Governance (ESG) or sustainable investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than, the broader market.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Janus Henderson

The opinions and views expressed are as of the date published and are subject to change without notice. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes and are not an indication of trading intent. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Janus Henderson and is being posted with its permission. The views expressed in this material are solely those of the author and/or Janus Henderson and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The following, from An Inconvenient Truth by Sanjai Bhagat. Harvard Business Review. March 2022.

“Researchers at Columbia University and London School of Economics compared the ESG record of U.S. companies in 147 ESG fund portfolios and that of U.S. companies in 2,428 non-ESG portfolios. They found that the companies in the ESG portfolios had worse compliance record for both labor and environmental rules. They also found that companies added to ESG portfolios did not subsequently improve compliance with labor or environmental regulations.”