Superconductivity, or the idea that certain materials are capable of conducting direct current (DC) electricity without resistance or energy loss, has been an elusive phenomenon for well over a century.

In 1911, a Dutch scientist named Heike Kamerlingh-Onnes found that mercury could superconduct electricity at very low temperatures, a monumental discovery for which he was awarded the Nobel Prize.

In the decades since, many more alloys and substances have also been shown to have superconductivity properties, but none so far has been able to work in a stable, room-temperature setting—the Holy Grail of physics.

That’s why it was such a big deal last month when a team of South Korean scientists claimed to have created a breakthrough material, referred to as LK-99, that could supposedly conduct electricity without any resistance at room temperatures and ambient (or normal) pressure. If confirmed, such a discovery could revolutionize the energy sector, address climate change and significantly reduce energy waste and costs, not to mention contribute to advancements in MRI technology, magnetic levitation trains, fusion energy and more.

The Rise And Fall Of LK-99

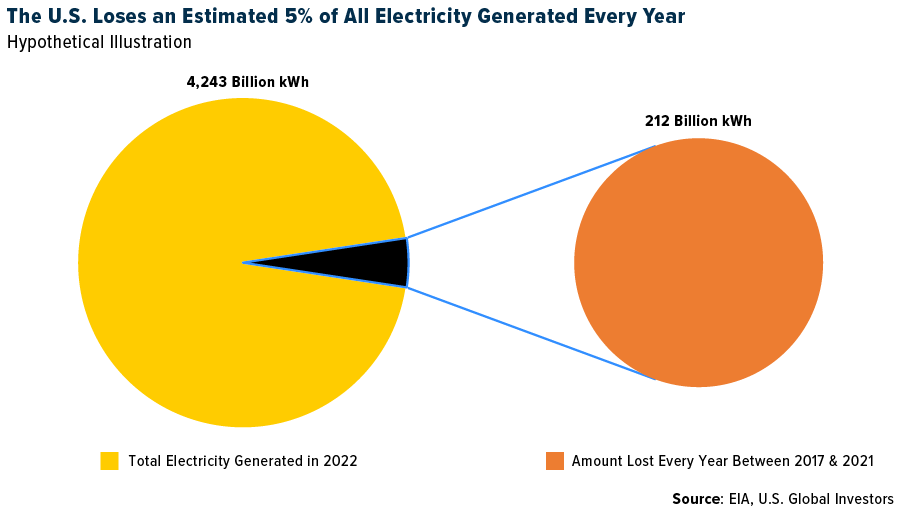

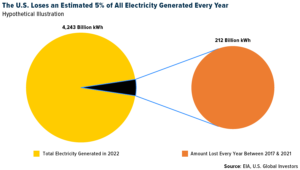

It’s impossible to overhype the significance of this allegation. Picture zero energy loss. The U.S. Energy Information Administration (EIA) has estimated that roughly 5% of electricity transmission and distribution is lost annually. That may not sound like a lot—until you learn that the U.S. generated over 4.2 trillion kilowatt hours (kWh) in 2022.

We’re talking billions and billions of dollars in recovered energy every year.

Following the startling announcement, shares of Korean and Chinese superconductor stocks soared, but as is often the case in any nascent technology that makes extraordinary promises (do Elizabeth Holmes and Theranos ring a bell?), LK-99’s validity came under fierce scrutiny. Many universities and labs around the world eagerly tried to replicate the experiment, to mixed results.

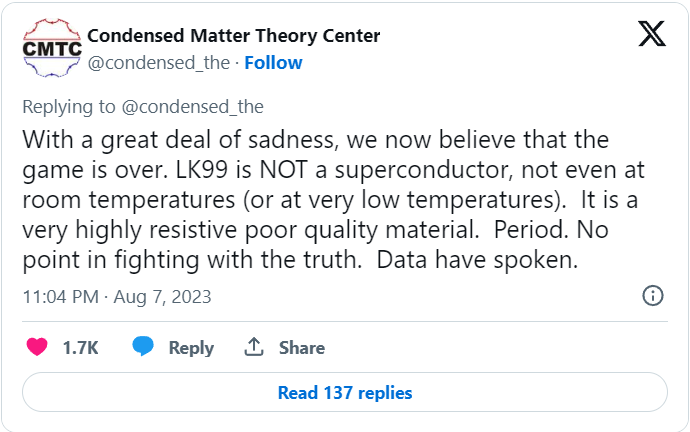

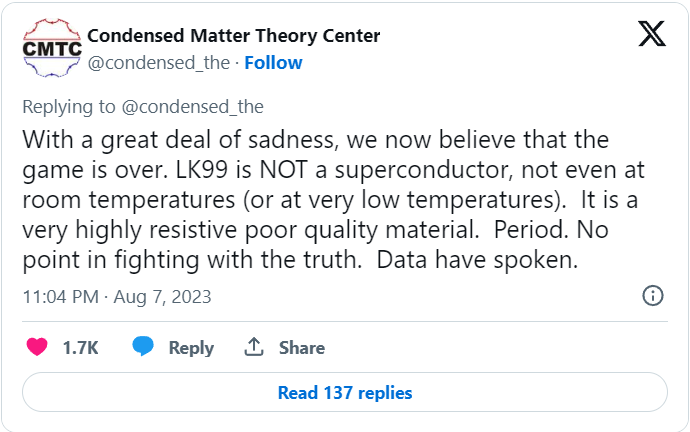

The final blow came last week when the University of Maryland’s Condensed Matter Theory Center (CMTC) tweeted, disappointedly, that LK-99 appeared not to be a superconductor after all. The researchers, in fact, found that LK-99 was “a very resistive poor quality material.”

This led to a swift downturn in South Korean superconductor stocks. Wire technology companies Duksung Co. and Sunam Co. both closed last Tuesday’s session down approximately 30%.

Despite the letdown, I don’t believe this is the last we’ll hear of a potential breakthrough in superconductivity. LK-99 may have been a failure, but humans are far too innovative and competitive to let the matter rest.

Fusion Ignition Is Lighting Up The Energy Landscape

On a related note, there have been strides in fusion energy, which could offer a clean, limitless source of power. In December, I shared with you that the Lawrence Livermore National Laboratory (LLNL) in California successfully demonstrated the first-ever fusion “ignition,” meaning the experiment yielded more energy than it took in.

Last week, the LLNL announced that it repeated the results, achieving a net energy gain from a fusion reaction and heralding a pivotal milestone toward the commercial realization of fusion power.

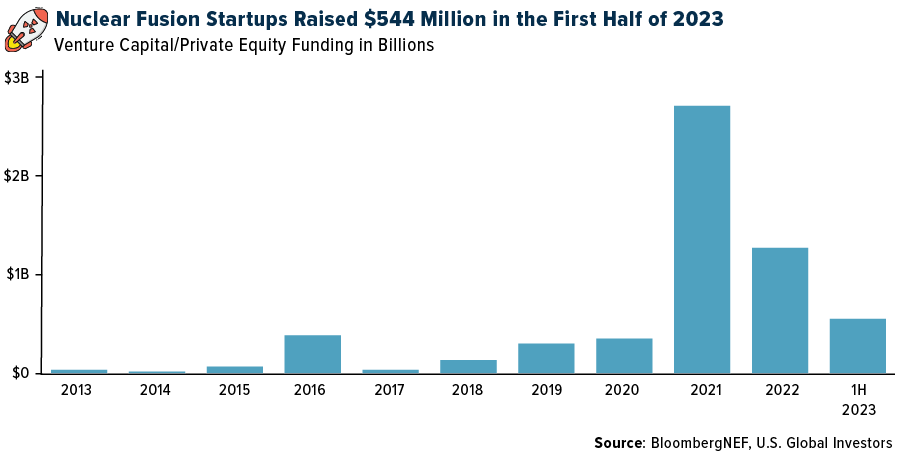

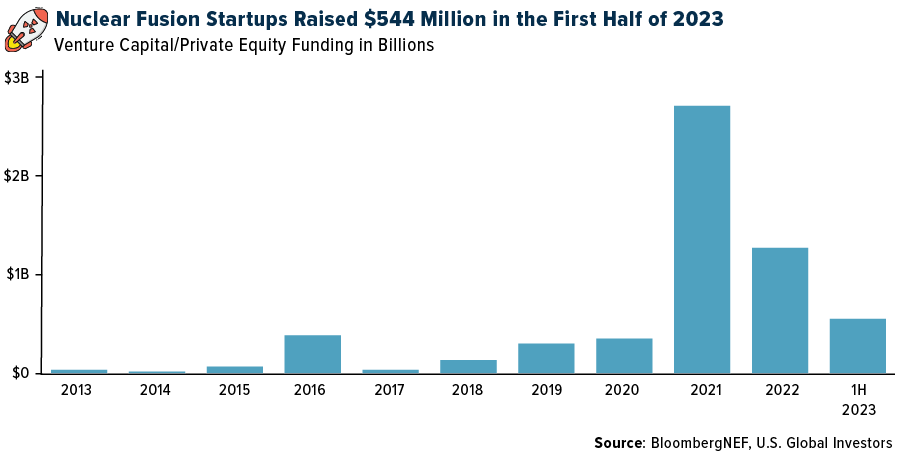

Given these breakthroughs, fusion-related investments have skyrocketed. In 2021 alone, investments surged to $2.6 billion from just $300 million in the prior year. Although 2022 saw a decrease to $521 million, 2023 is already showing promising traction, according to Bloomberg. In the first half of the year, nuclear fusion firms and startups secured $544 million in venture capital and private equity investments.

The world currently boasts 33 nuclear fusion startups, according to data provider Dealbook.co, all of them located in countries recognized for their contributions to international fusion research. Leading the pack, the U.S. is home to five of these startups, followed by the U.K. with four. Germany has two, while Japan, Canada, France and Australia each have one.

As a reminder, we’re still many years away from using and enjoying fusion energy on a commercial scale, but the news is exciting nonetheless, especially when paired with the promise of superconductivity.

Innovation Versus Practicality For Investors

Even with the anticipation swirling around fusion, we’re reminded of the costs and challenges involved in high-tech energy endeavors.

Late last month, a new nuclear reactor began operations in Georgia, the first such U.S. plant in decades. Georgia Power Co., a subsidiary of Atlanta-based Southern Company, announced the completion of Unit 3 at Plant Vogtle, which is now sending power to the grid. When operating at its maximum capacity of 1,100 megawatts, the reactor is capable of powering over 500,000 homes and businesses across Georgia, Florida and Alabama.

However, Unit 3 reportedly came seven years behind schedule and a whopping $17 billion over budget. It’s a salient reminder for investors to tread carefully, weighing the promise of innovation against practical challenges.

I urge investors to keep a keen eye on developments in the superconductivity and fusion sectors. They represent not just the future of energy, but also a realm of unique investment opportunities. Remember, in every challenge lies opportunity.

—

Originally Posted August 14, 2023 – The Promise And Perils Of Superconductivity And Fusion Energy

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content. Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 6/30/2023.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.