INDIVIDUAL INVESTORS AND ETFs

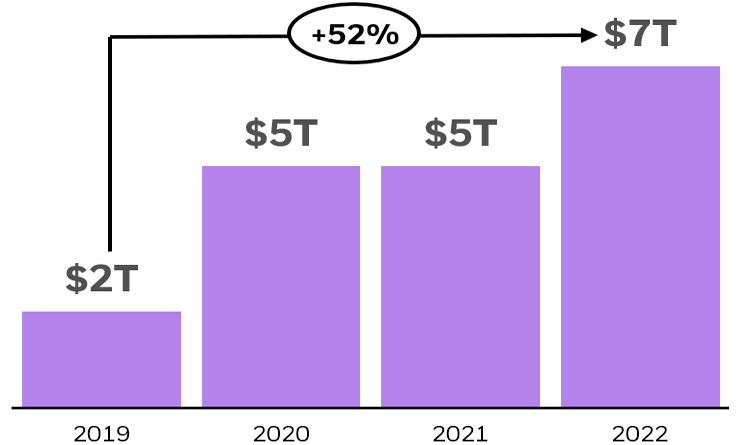

The number of individual investors — those who invest their own money to save for retirement or meet other financial goals — participating in financial markets has grown significantly in recent years.1 As a result, trading by individual investors in U.S.-listed ETFs has also increased, with trading volumes, measured by the number of ETF shares traded multiplied by the price of the ETF shares, growing at a three-year compound annual growth rate of 52% (Figure 1).

We believe individual investors’ increased use of ETFs has been driven by a few key factors: an industry shift to commission-free trading, improved digital experiences on direct platforms, and investor empowerment stemming from greater access to financial education through social media and other forums.

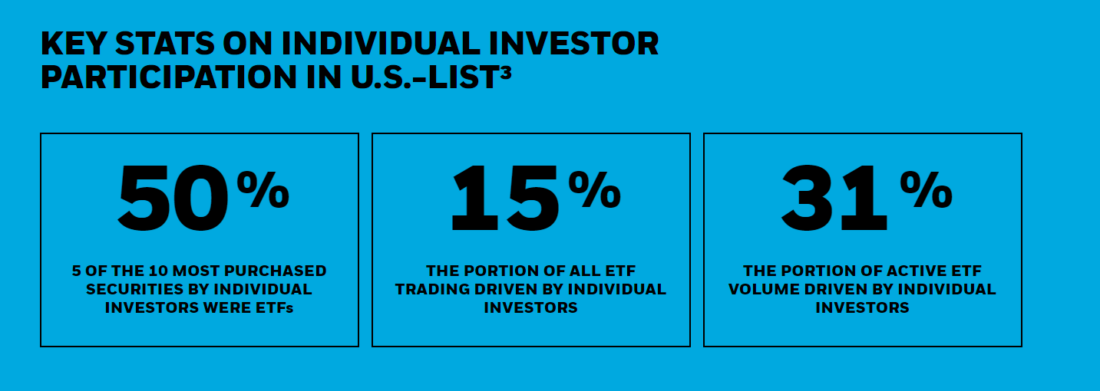

Below are some key statistics that illustrate how individual investors are engaging with the U.S. ETF market (Figure 2).

Figure 1: Growth of individual investor trading volumes in U.S.-listed ETFs²

Chart Description: Bar chart showing the growth in yearly volumes of retail investor ETF trading, measured in $ trillions. ETF volume is calculated by the taking the amount of ETF shared traded multiplied by the price each share was traded at.

FROM Q2 2023 TO Q3 2023: WHAT’S CHANGED?

As equity market volatility remained low in Q3 2023, total U.S.-listed ETF trading volumes and individual investor ETF trading volumes were in line with Q2 figures and down compared to Q1 volumes.4 Still, there were some notable takeaways:

- Individual investors increased their use of iShares ETFs. Individual investor trading activity in iShares and BlackRock ETFs represented 17% of all individual investor trading, up from 16% in the prior quarter and 15% in 2022.5

- Individual investors decreased their use of leveraged ETFs. Individual investor trading activity in leveraged ETFs accounted for over 31% of total leveraged ETF volume in Q3, down from 34% in Q2.6

- Individual investors continued to use actively managed ETFs. Individual investors accounted for nearly 31% of all actively managed ETF volumes in the quarter, in line with Q2 and up from 24% in 2022.7

- Individual investors continued to trade ETF options. Individual investors drove 22% of all ETF option activity, slightly down from Q2 (23%).8 Use of zero days to expiration (0DTE) options, which have become increasingly popular investment tools among individual investors, continued over the period.

—

Originally Posted November 16, 2023 – Three things to know about individual investor ETF activity

© 2023 BlackRock, Inc. All rights reserved.

1 For more information, see the 2023 Investment Company Fact Book.

2 As of December 31, 2022. Source: BlackRock analysis of SEC Rule 605 data.

3 As of September 30, 2023. Source: UBS Retail Market Making, BlackRock analysis of SEC Rule 605 data.

4 Equity market volatility is measured by the Cboe Volatility Index (VIX)—a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500® Index (SPX). Because it is derived from the prices of SPX index options with near-term expiration dates, it generates a 30-day forward projection of volatility. Volatility, or how fast prices change, is often seen as a way to gauge market sentiment, and in particular the degree of fear among market participants. As of September 30, 2023. Source: Bloomberg, BlackRock.

5 As of September 30, 2023. Source: BlackRock analysis of SEC Rule 605 data.

6 As of September 30, 2023. Source: BlackRock analysis of SEC Rule 605 data.

7 As of September 30, 2023. Source: BlackRock analysis of SEC Rule 605 data.

8 As of September 30, 2023. Source: Options Clearing Corporation (OCC), BlackRock analysis of SEC Rule 605 data. ETF option volume attributable to individual investors is based on orders of less than 11 contracts and excludes market maker volumes.

9 A zero days to expiration (0DTE) option is an options contract set to expire at the end of the current trading day. This means that the value of a 0DTE option is entirely determined by the underlying asset’s price movements on that day. All option contracts eventually become 0DTE options on expiration date. Recent data has shown that individual investors are seeking to trade shorter expiries. It is estimated that 30-40% of all 0DTE options volume was from individual investors. As of September 30, 2023. Source: Cboe.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

A fund’s use of derivatives may reduce a fund’s returns and/or increase volatility and subject the fund to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligation. A fund could suffer losses related to its derivative positions because of a possible lack of liquidity in the secondary market and as a result of unanticipated market movements, which losses are potentially unlimited. There can be no assurance that any fund’s hedging transactions will be effective.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of “Characteristics and Risks of Standardized Options.” Copies of this document may be obtained from your broker, from any exchange on which options are traded or by contacting The Options Clearing Corporation, One North Wacker Dr., Suite 500, Chicago, IL 60606 (1-888-678-4667). The document contains information on options issued by The Options Clearing Corporation. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. If you need further information, please feel free to call the Options Industry Council Helpline. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. The Options Industry Council Helpline phone number is 1-888-Options (1-888-678-4667) and its website is www.888options.com.

This material is provided for educational purposes only and is not intended to constitute investment advice or an investment recommendation within the meaning of federal, state or local law. You are solely responsible for evaluating and acting upon the education and information contained in this material. BlackRock will not be liable for direct or incidental loss resulting from applying any of the information obtained from these materials or from any other source mentioned. BlackRock does not render any legal, tax or accounting advice and the education and information contained in this material should not be construed as such. Please consult with a qualified professional for these types of advice.

Shares of ETFs may be bought and sold throughout the day on the exchange through any brokerage account. Shares are not individually redeemable from an ETF, however, shares may be redeemed directly from an ETF by Authorized Participants, in very large creation/redemption units.

There can be no assurance that an active trading market for shares of an ETF will develop or be maintained.

Buying and selling shares of ETFs may result in brokerage commissions.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2023 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1123U/S-3225744

Disclosure: iShares by BlackRock

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Markit Indices Limited, nor does this company make any representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with Markit Indices Limited.

©2022 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from iShares by BlackRock and is being posted with its permission. The views expressed in this material are solely those of the author and/or iShares by BlackRock and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Complex or Leveraged Exchange-Traded Products

Complex or Leveraged Exchange-Traded Products are complicated instruments that should only be used by sophisticated investors who fully understand the terms, investment strategy, and risks associated with the products. Learn more about the risks here: https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView?formdb=4155

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.