For those who have been blissfully out of contact for a while, we are bracing for another FOMC announcement and Chair Powell press conference this afternoon.

The last conference proved to be the trigger for a rally. In response to a question, Mr. Powell stated that he thought that the now-current 2.25%-2.50% Fed Funds target was in the range of neutral. Traders eager for good news seized upon that comment, ignoring the rest of the answer to that question, when he said that rates would be heading into restrictive territory. Since then, the Chairman has made it crystal clear that the Fed is determined to fight inflation even if further restrictive policies are detrimental to economic growth.

Heading into today’s 2PM EDT announcement, expectations are firmly for a 75-basis point hike. While Fed Funds futures are still showing a 19% chance of a full 1% hike, it means the market anticipates a far greater likelihood for a 75bp move. I stand by my previously stated opinion that while the Fed is committed to showing monetary resolve, they don’t want to spook the markets with an even larger hike.

We head into the meeting with 2-Year yields flirting with 4%. That is nearly a full percentage point higher than the period around the last meeting. After a downward move of such magnitude, I will be looking to the bond market for post-meeting clues. There is certainly room for an oversold bounce in fixed income. That said, the bond market sent messages after the last meeting that were being widely ignored just a week later, as we noted at the time.

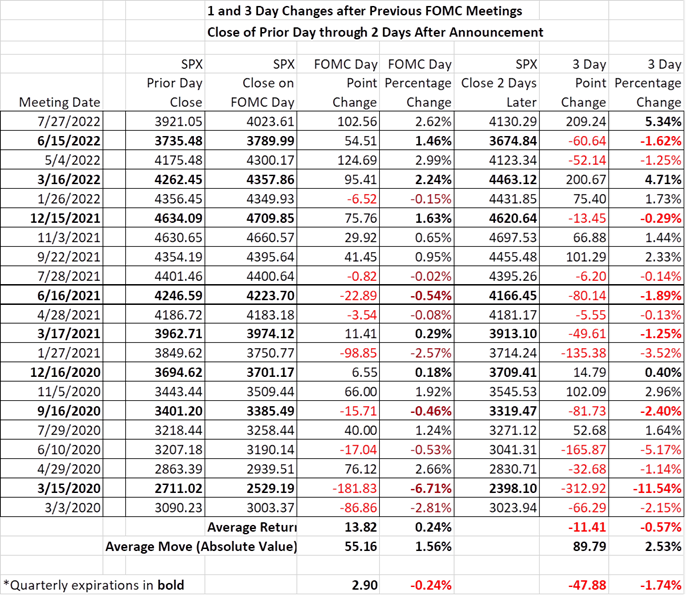

Ahead of prior meetings, we noted the changing pattern of market responses to FOMC meetings. We tended to focus on the three-day period encompassing the meeting and the subsequent two days. That is usually Wednesday – Friday and can include quarterly expirations. It is my belief that that the initial move is dominated by traders, but investors need a day or two to fully discount the messages.

That said, I’m a trader by nature, so it seemed silly to ignore the meeting day itself. A post-FOMC mantra that my colleagues tired of was “the first move is often the wrong move.” That can be particularly true right around the release of the FOMC statement; liquidity is thin and small orders can cause a disproportionate move. But the same can be true for the first day move versus the subsequent two days.

Note that the S&P 500 Index (SPX) rose on 5 of the past 6 FOMC days, and the 5th was a very modest decline. Yet that initial move was reversed in the ensuing two day in 4 of those 6 periods as shown in the table below:

Source: Interactive Brokers

My interpretation is this: markets tend to buy the rumor of the FOMC meeting and sell the news – and vice versa. When the Fed was busily adding liquidity into the markets during the post-Covid bull market, stocks tended to sell off. Investors were over-enthused about what the Fed might do. Since the Fed changed its rhetoric in late 2021, investors were appreciative that the Fed was not as restrictive as feared.

The path of least resistance for today is a knee-jerk rally in stocks and bonds. If nothing else, markets should appreciate if worries about a 1% hike are taken off the table. After the initial move, we will need to see which version of Chairman Powell shows up to the press conference, Goldilocks or a gorilla.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.