One question I get asked from time to time is, what are your thoughts on the U.S. budget deficit and its potential impact on Treasuries (UST)? Typically, the UST market takes its primary cues from the macro outlook, specifically the economic and inflation setting. Of course, an integral part of the puzzle is the prospect for Fed monetary policy as well. However, there are times when the U.S. government’s finances make headlines, and not just from a debt ceiling perspective. Last week was one of those times, so I thought it would be useful to offer some insights.

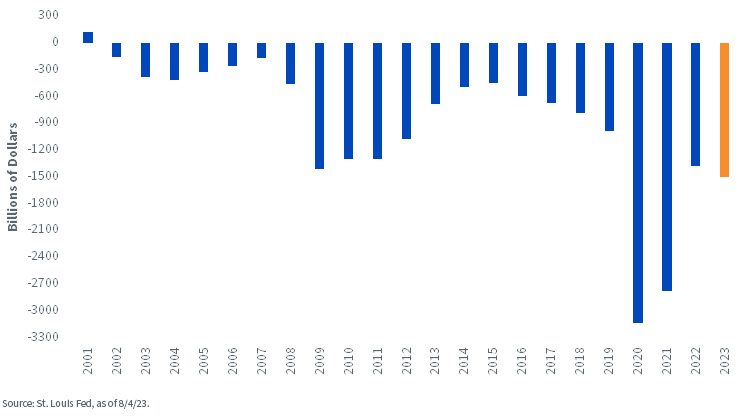

U.S. Budget Deficit/Surplus

Without a doubt, one of the more notable deficit-related headlines was that Fitch Ratings agency downgraded the U.S. government’s long-term rating a notch to AA+ from AAA. The rationale behind this move was summarized in three points: “the expected fiscal deterioration over the next three years, a high and growing general government debt burden and the erosion of governance.” The final point has to do with the dysfunction in Washington, D.C., highlighted by repeated episodes of debt ceiling debate.

For the record, I do not believe this downgrade will change the global investment community’s view of Treasuries as being the “store of value” and safe-haven asset of choice in periods of uncertainty and risk-off trade. Interestingly, this was the situation following Standard & Poor’s ratings downgrade for Treasuries in 2011. For the record, Moody’s and S&P currently have a stable outlook.

Back to the deficit. As the enclosed chart reveals, the budget shortfall following COVID-related issues did get cut by more than half in fiscal year (FY) 2022, but the deficit still remained at historical levels, coming in at just under $1.4 trillion. For FY 2023, the Congressional Budget Office (CBO) is estimating the red-ink total to increase by about $100 billion to $1.5 trillion. In fact, trillion-dollar deficits appear to be the baseline scenario going forward, unless the federal government implements some significant fiscal restraint measures.

That brings us to the next part of the equation, funding the trillion-dollar deficits. We had already seen increases in t-bill auction sizes following the debt ceiling deal, but the nation’s debt managers took the next step last week and increased nominal coupon auction sizes. According to the announcement, Treasury will be increasing issuance size anywhere from $1 billion to $3 billion per month for each issue through October. Treasury floating rate note auction sizes will be raised by $2 billion per month as well. In addition, the debt managers stated that “further gradual increases will likely be necessary in future quarters.”

Conclusion

While the recent run-up in UST yields had its genesis in the macro side of the equation, it appears that the secondary push higher may very well have been due to the aforementioned increase in auction sizes. One thing does seem for sure—UST yields will not be getting relief from supply issues any time soon.

—

Originally Posted August 9, 2023 – Budget Deficits Come into Focus

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.