Federal Reserve Chair Jerome Powell’s Jackson Hole speech has now come and gone, so the next big thing on the Fed calendar is the September 20 FOMC meeting. As expected, Powell didn’t offer up any groundbreaking headlines last week, but the overarching message from the chair still resounds loud and clear: rates will be “higher for longer.” That brings us to the next question: how high and how long?

Fed Funds vs. Treasury Yields

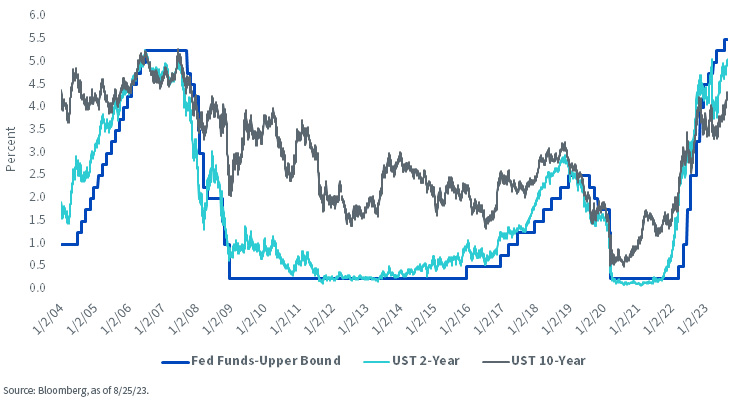

As I’ve discussed quite a bit recently, the recent sell-off in the U.S. Treasury (UST) arena seems to underscore the point that the money and bond markets have finally “come to the Fed” and accepted this higher-for-longer theme. It certainly has taken a while, but I do wonder if UST yields have truly embraced just what that might entail.

Based on the two most recent rate hike cycles, one could conclude that further increases in UST yields should not be ruled out. Specifically, I’m referring to the Treasury 2- and 10-Year notes. The accompanying graph outlines how UST 2- and 10-Year yields typically rise to levels that are either at or above the Fed Funds’ upper bound, especially as we’re around the peak level.

Early on, this rate hike cycle did follow in history’s footsteps, but more recently, things have changed considerably. In fact, other than for a brief period in early March when the UST 2-Year yield was above the Fed Funds target, both these Treasury yields have actually been well below the Fed Funds rate this year. Indeed, at one point, the UST 2-Year yield traded nearly 125 basis points (bps) below the Fed Funds target, while the 10-Year was a whopping 170 bps under the upper bound.

While some of these inversions were a result of the regional bank turmoil, this negative spread relationship has continued some four to five months later. Yes, the latest increase in Treasury yields has narrowed the gap, but the inversions are still at -43 bps and -125 bps, respectively.

While there’s a debate within the Fed regarding whether to stay put or if another rate hike or two will be needed, both the “pause” and “hike” camps have one thing in common; rates will remain in restrictive territory for the foreseeable future. Against this backdrop, it does not seem unreasonable to expect that UST 2-and 10-Year yields could still rise further from current readings. In fact, the 2-Year has now moved back over the 5% threshold, while the 10-Year yield is at its highest level since 2007, placing it in somewhat uncharted territory.

Conclusion

That is not even factoring in this question: what if another quarter-point rate increase does happen at either the September or November FOMC meeting? Such a move would bring the upper bound of the Fed Funds trading range to 5.75%. Even if the Treasury 2- and 10-Year yields maintain their current inverted status relative to Fed Funds, another leg up in Treasury yields, at a minimum, should be considered.

—

Originally Posted August 30, 2023 – Five Alive

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.