While the Fed has emphasized that future policy decisions—i.e., the potential for another rate hike—would be based on the “totality” of upcoming economic data, make no mistake, employment reports go to the front of the line. There is a variety of labor market-related data to choose from, with the monthly Employment Situation release offering the most encompassing insights. Taking in the totality of the recent jobs numbers, I come to the conclusion that labor market activity looks to be softening, not weakening. While some market observers may not draw a distinction between these two descriptions, you can bet the Fed, as well as the money and bond markets, does.

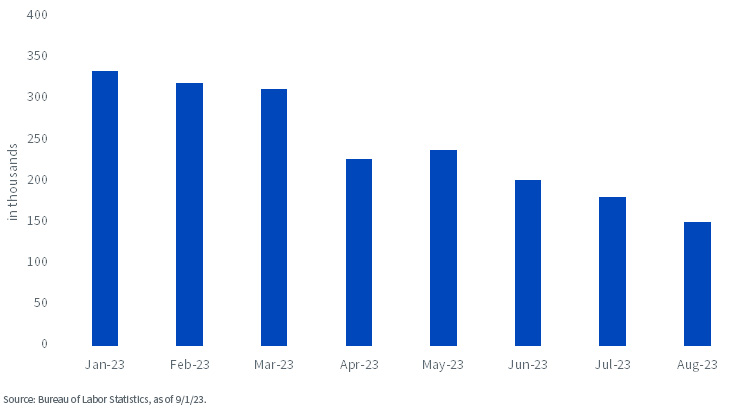

U.S. Total Nonfarm Payrolls – 3-Month Moving Average

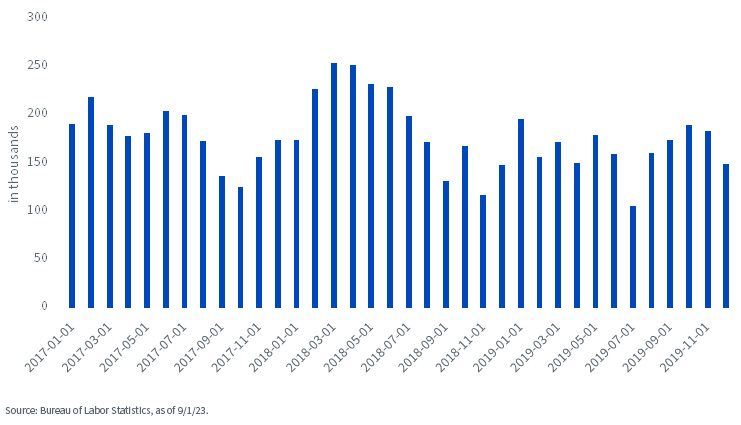

U.S. Total Nonfarm Payrolls – 3-Month Moving Average

Obviously, the first place to look at is the level of new job creation, as measured by total nonfarm payrolls. For August, overall payrolls rose a slightly better than expected +187,000. That headline number in and of itself could be considered a relatively good outcome, considering the economy has endured 525 basis points worth of Fed rate hikes since last March. However, in a less well-known stat, the prior two months’ tallies were revised downward by a combined -110,000.

In order to smooth out monthly volatility, a good practice is to look at three-month moving averages, and that is where a more visible slowing trend in new hiring becomes apparent. The most recent figure on that front put new hiring at +150,000, a decline of -31,000 from July’s +181,000 reading. In fact, as the top bar chart illustrates, the three-month moving average has been consistently edging lower throughout all of this year.

This is where it gets a little interesting, though. If you look at the three-month trend numbers from 2017 through 2019 (pre-COVID-19), the current level is not really all that bad and only 27,000 below the monthly average for that entire three-year period.

Another measure of employment that is closely followed is the jobless rate. In August, the unemployment rate rose +0.3 pp to 3.8%. However, this was due to a +736,000 surge in the civilian labor force, typically viewed as a good sign for labor market activity. Civilian employment (the alternate job creation gauge) actually rose a solid +222,000, but that was not enough to offset this large inflow into the labor force.

Conclusion

The expectation was for no Fed rate hike at this month’s FOMC meeting, and the August jobs data does nothing to change that narrative, but we do have one more CPI print before the September 20 convocation.

Either way, “higher for longer” with no rate cuts on the horizon remains the Treasury market backdrop.

—

Originally Posted September 6, 2023 – U.S. Labor Market Activity: Slowing, Not Weakening

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.