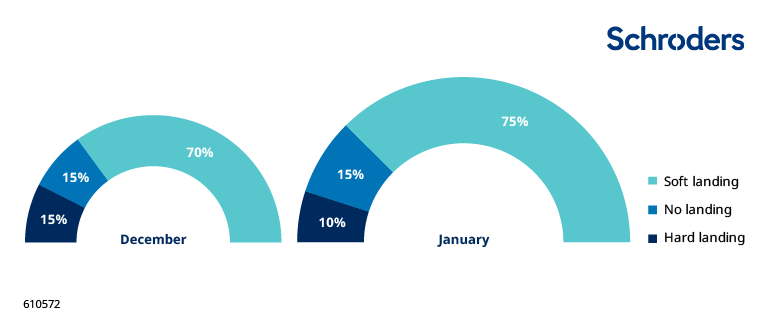

An improving inflation outlook, an easing of financial conditions and signs of economic stability have led us to raise the chance of a soft landing and reduce the possibility of a hard landing.

We assess the current macroeconomic environment, and where it might be heading by looking at the likelihood of various global economic scenarios.

Over the past month, we have increased the possibility of a soft landing and reduced the chance of a hard landing.

While risks of a hard landing haven’t vanished, a much-improved inflation outlook, an easing of financial conditions (which makes life easier for both consumers and businesses) and signs of stability in key leading indicators (bank lending being one such indicator) have led us to reduce the chances of this occurring.

The chances of hard landing are diminishing

Source: Global Unconstrained Fixed Income team as at 22 January 2024. For illustrative purposes only. “Soft landing” refers to a scenario where economic growth slows, but to a sustainable rate without experiencing recession; “hard landing” refers to a sharp fall in economic activity; “no landing” refers to a scenario in which inflation remains sticky and there’s a reacceleration of interest rate hikes.

The times they are a-changin’

Nowhere is this truer than with regards to inflation, where the slowing pace of price rises has gained momentum. Core metrics, on a six-month annualised basis, now hover close to 2% targets for both the US and the eurozone.

Furthermore, key drivers such as wage growth in the US continue to trend down and leading indicators such as the quits rate (a measure used by economists that represents the percentage of employees in a workforce who voluntarily leave their jobs over a given period) provide optimism that further progress can be made on this front.

All this has allowed policymakers to refocus their attention away from tightening monetary policy conditions to easing them.

The changing tone of central banks is most clear at the US Federal Reserve (Fed). For the first time since the tightening cycle began in 2022, the median dot (which represents the median projection of Federal Open Market Committee (FOMC) members for future interest rates) for the end of 2024 has moved downward compared to the previous projection. This is, indeed, a pivotal moment.

Changing of the guard(s)

A greater possibility of a soft landing is also in line with our improving cyclical growth scores for the US, eurozone and the UK. Indications of basing and an upward shift, coupled with a more favourable outlook due to the easing of financial conditions, are most apparent in the manufacturing sector, given its highly cyclical and capital-intensive characteristics.

A hard rain’s a-gonna fall? Maybe not

The ability of central banks to ease policy, due to lower inflation, is a key factor in the potential for a soft landing. However, the market has swiftly factored in an easing cycle, suggesting that the maximum effect of monetary policy tightening may already be in the past. As such, we have left our no landing probability unchanged from last month but have reduced the risk of a hard landing.

And what does this all mean for portfolio positioning?

Against this backdrop, yield curve steepening trades (for example, trades which look to capitalise on shorter bonds outperforming longer dated bonds) remain a favoured express of our views in rates.

While in terms of asset allocation we prefer high quality credit, remaining very positive on securitised credit, covered bonds and agency mortgage-backed securities. Elsewhere, US investment grade (IG) credit offers unattractive valuations, and we continue to prefer European IG instead.

In the foreign exchange market (FX), an expected improvement in the global manufacturing cycle as 2024 matures keeps us negative on the dollar, while we upgrade our view on emerging market currencies and selected cyclical currencies such as the UK pound and the euro.

—

Originally Posted January 21, 2024 – Unconstrained fixed income views: January 2024

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.