Like many of you, I have been somewhat obsessed with the ongoing 2-10 inversion. For those of you who are not familiar with that term, it refers to the situation we’ve been seeing where 2-year yields exceed 10-year yields. It is relatively unusual for that situation to occur, and it typically precedes recessions, hence many investors’ preoccupation with this market oddity. It is not an idle concern, especially because recent move movements may indicate further trouble to come.

It is typical for longer-term rates to exceed shorter-term rates. The economic term for that is called liquidity preference. In general, people prefer owning shorter-term fixed income assets to longer-term counterparts. Remember, a key factor in bond investing is whether you will receive all your promised payments in a timely manner. The longer the time to maturity, the higher the potential likelihood that something can go wrong to disrupt the present value of those payments. As a result, bond investors are usually willing to pay more for shorter-term notes, and of course higher bond prices result in lower yields.

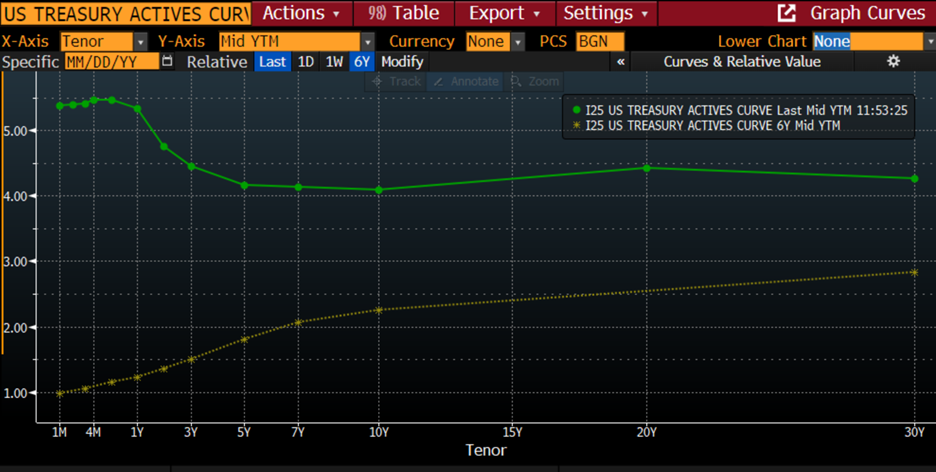

When one plots out all the various yields and maturities of government debt, it is called the yield curve. The yield curve is normally upward sloping at we read from right to left. Note the differences in the graph below, where the yellow line (the yield curve from 6 years ago today) has a normal upward slope, while the green line (today’s curve) has a downward slope from 6 months to 10 years, with 10-year yields about 70 basis points below 2-year yields:

US Treasury Yield Curves, Today (green), 6 Years Ago (yellow)

Source: Bloomberg

You should also notice that the current curve sits completely above its older counterpart. That shows how much higher current rates are than levels to which we had become accustomed.

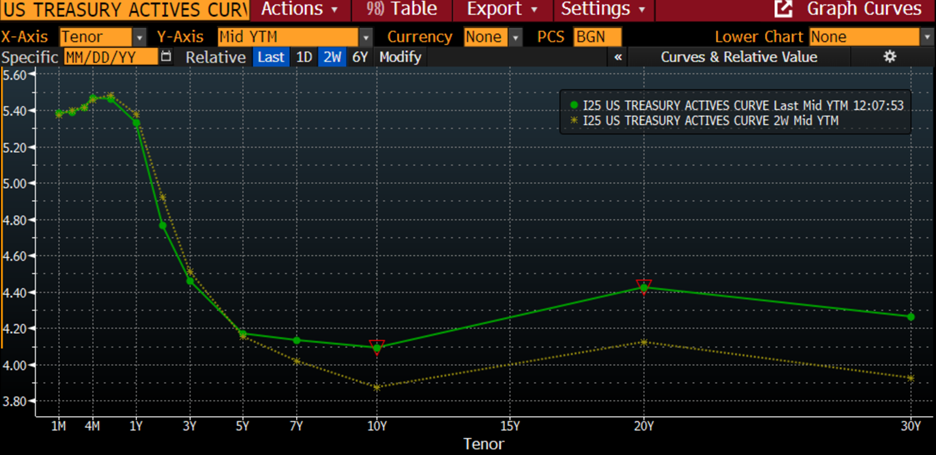

When we compare today’s curve with that of just two weeks ago, we see how much longer-term rates have moved, even as short-term rates are relatively unchanged:

US Treasury Yield Curves, Today (green), 2 Weeks Ago (yellow)

Source: Bloomberg

The inversion has shrunk from lows of about -1%, a level not seen since the early 1980’s to the current -0.7% almost strictly because longer-term rates rose. The bond market term is “bear steepener”, meaning the curve has steepened (or in this case, less inverted) because of rising rates at the long end rather than the short end.

In theory, this should be a welcome development. If steep inversions usually portend recession, then shallower inversions should indicate that recession fears are abating. We have seen several analysts at major banks pare back their probabilities of recession, which fits that rubric.

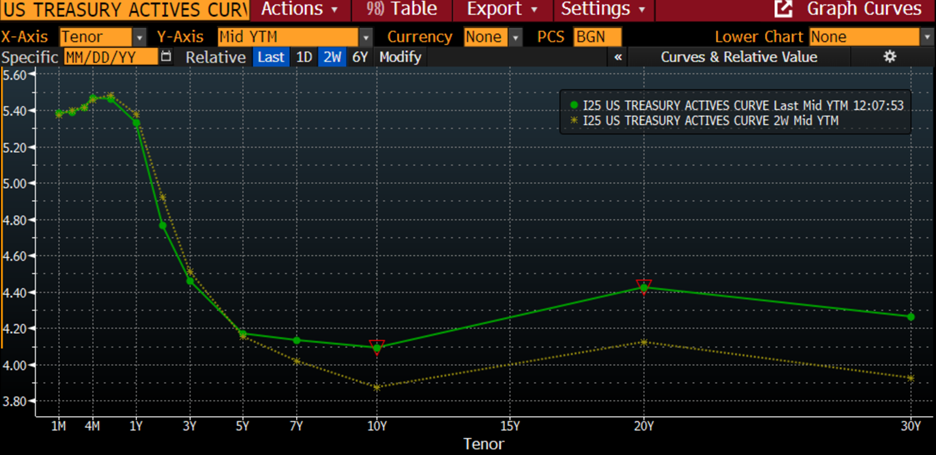

Except, history shows that shrinking inversions occur before the onset of recessions. In the graph below, we show the 2-10 spread on a monthly basis over the past 30 years. The onset of recessions are marked with vertical red lines and the ends are marked with vertical green lines. We used the National Bureau of Economic Research’s (NBER) definition for the timing of recessions.

2-Year / 10-Year Yield Spread, 30-Year Monthly Data, with Red/Green lines at the Beginning/End of NBER-defined Recessions, and 0% level highlighted (yellow)

Source: Bloomberg

When we look at the above chart, we see that recessions began after the 2-10 inversion had resolved. At present, we are far from seeing the yield curve return to its normal shape. But if we believe that 2-10 inversions are an excellent early warning system for recessions, a return to normalcy for the yield curve may actually be the more important recession signal.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Excellent analysis

Thank you, SJK!

I think it might also be important to consider how far (or not) each part of the curve is from the outright present policy rate.

During the last tightening cycle – which ended in June 2006 at 5.25% Fed Funds – every maturity had either traded through or briefly “kissed” that level before each started to turn lower.

Even today’s 2yr yield hasn’t quite made a new high at or through the mid-Fed funds target rate.

Do you think this is “normal”??

Today, even the 2yr note’s yield high

Thank you for sharing your thoughts, Sean. We hope you will continue to engage with our content.