Key takeaways

Narrow markets

Market performance has been driven by a handful of stocks, which signals that near-term improvement in economic growth is not expected.

Sticky inflation?

It’s hard to imagine that today’s elevated shelter prices are sustainable, so I’m not convinced that US inflation is as sticky as believed.

Artificial intelligence

New technologies, over the course of time, have led to remarkable improvements in the standard of living. I suspect AI will be no different.

These markets are so concentrated that it’s time for a new acronym. FAANG gets retired to the rafters now that Facebook and Google have changed their names. Allow me to offer MANNA—Microsoft, Apple, NVIDIA, Alphabet. I know, I know. I’m missing a second N, although Netflix has been rallying as of late.

Manna, according to the Bible, is the miraculous bread provided to the Israelites during their 40 years in the desert. The manna wasn’t much, and many missed the food in Egypt, but it sustained them during the Exodus. The current environment, with the economy slowing and the US Federal Reserve still tightening policy, hasn’t been a very fertile one for many stocks. The MANNA stocks, however, have been an oasis and are sustaining investors as we wander looking for direction. Can I copyright it?

A ‘keep it simple’ strategy

We start with three simple questions.

- Where are we in the cycle?

The recession obsession continues, and yet the US economy remains relatively resilient. Nonetheless, the red flags — inverted yield curve, tighter credit conditions — that emerge ahead of recessions are waving.1 The recession is unlikely to arrive this year, in my view, but this cycle will ultimately end. Remember, not all recessions are implosions. The crises of 2008 and 2020 are the outliers, not the norm.2 Markets appear to have already priced for a mild recession.3 - What’s the market telling us about the direction of the economy?

The narrow market performance, driven by a handful of mega-cap higher quality names, signals that near-term improvement in economic growth is not expected. The market has bad breadth. Improving economic activity and easier policy would be the mouthwash. #dadjokes - What will be the policy response?

The Federal Reserve would have us believe that more rate hikes are ahead even as US inflation is moving ever closer to policy targets.4 We can debate the merits of additional rate hikes all we want, but in the near-term I’m not inclined to fight the Fed.

Our view remains the same. We continue to favor higher quality stocks and bonds in the near term as the economy slows and the Fed stands ready for additional rate hikes.

It may be confirmation bias, but …

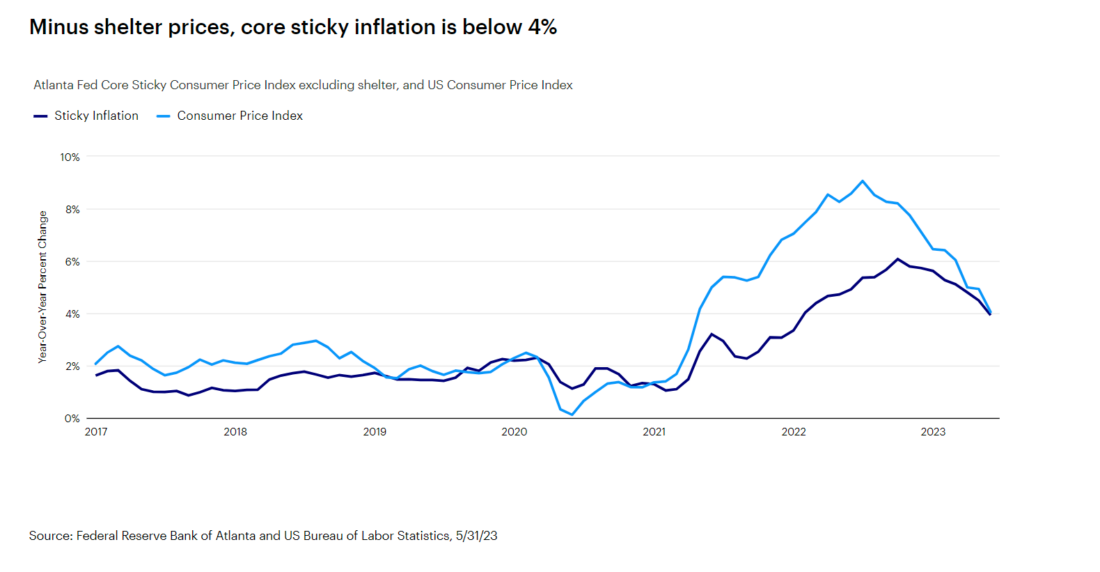

… I’m not convinced that inflation is as sticky as believed. If you strip out shelter (more on that in a moment), then the Atlanta Fed’s measure of core sticky inflation is below 4% and falling.5 Why strip out shelter when it’s currently the biggest driver of inflation? Because it’s hard to imagine that today’s prices are sustainable. US home prices are essentially flat over the past year6 and the US apartment rental market appears to be as soft as it has been in some time7. If shelter costs moderate, as I suspect they will, then the core inflation numbers that are currently so concerning to the Fed will become less so.

Since you asked

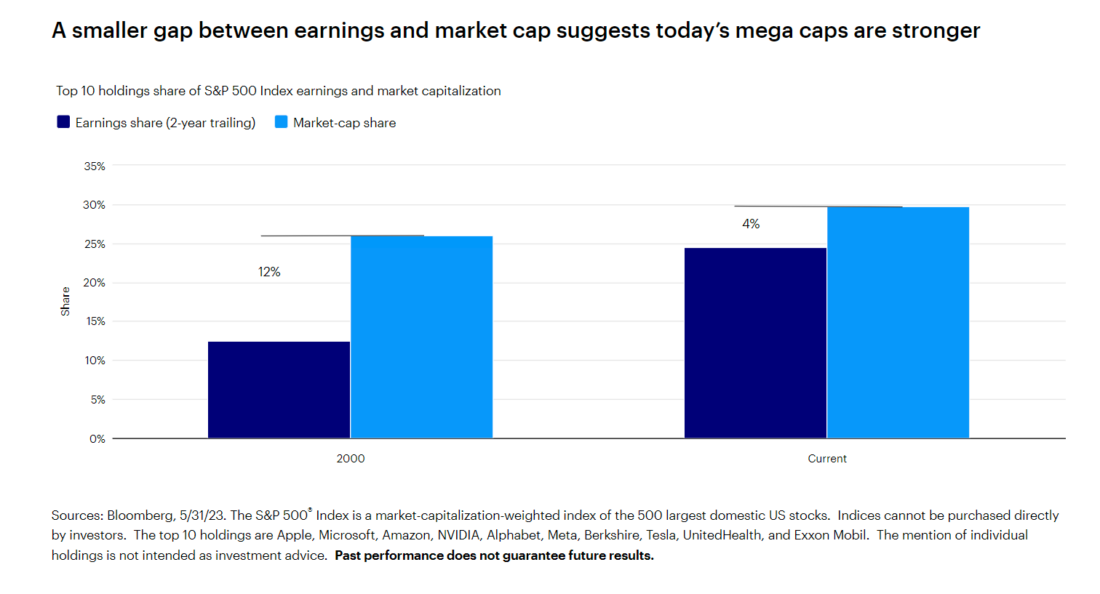

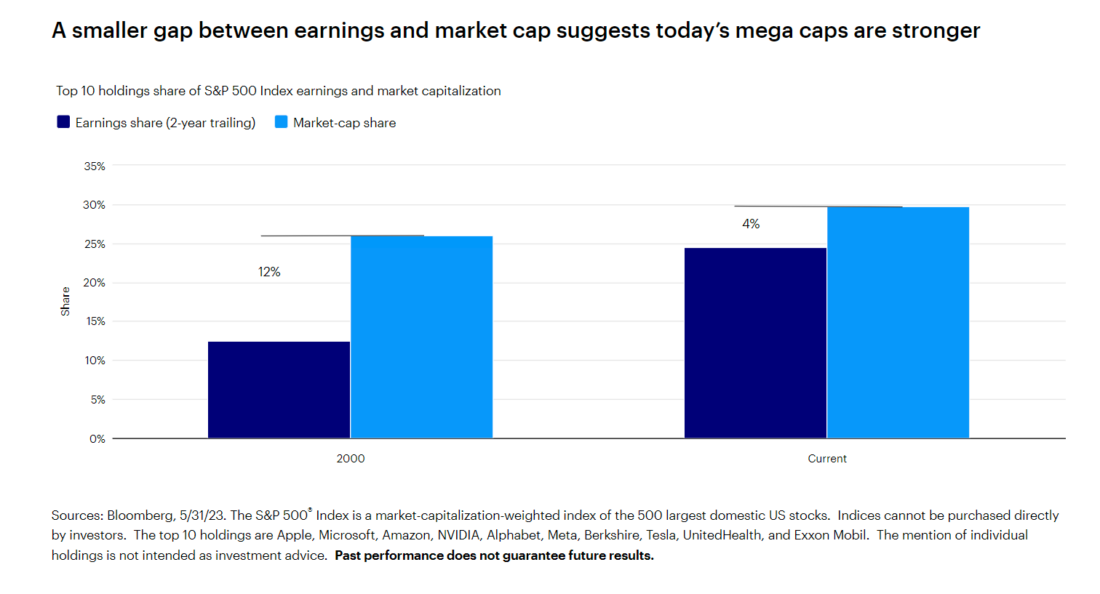

Concentrated markets make me nervous that a bubble could be forming. How does the current environment compare to the late 1990s in the run up to the tech wreck?

- Concentration. The S&P 500 Index is more concentrated in the top 10 holdings now than it was at the peak of the 2000 equity market bubble.8

- Fundamentals. However, as illustrated below, the gap between the market share and earnings share of the top 10 companies is currently only one-third of what it was in 2000. This suggests that the fundamentals of today’s mega caps are significantly stronger.9

- Valuation. The current valuations of the top 10 holdings in the S&P 500 Index don’t compare to the 1999 Nasdaq bubble. Then, the median price-to-sales of the top 10 largest NASDAQ Composite Index companies by market capitalization was 21.9x. Currently, for the S&P 500 Index, it’s 5.8x.10

Phone a friend

You may have noticed the recent excitement surrounding artificial intelligence (AI). Why now and what are the implications? I posed the question to Ashley Oerth, Senior Investment Strategy Analyst at Invesco. Her response:

AI is nothing new with already over a decade of real-world applications. We do not believe we are at the very beginning of an AI-driven transformation — rather, we believe we are at a point where we will see accelerating change. There are three primary reasons for that, all of which are inter-related:

1. More data that is captured and available

2. Greater and cheaper computing power, along with more intelligent systems like cloud computing

3. Better and more sophisticated models

The hope is that AI will increase productivity. The point is not to cut jobs, but instead to provide tools that make workers more efficient in what they’re doing. Human interpretation remains critical. I’d characterize the likely winners into three primary buckets:

1. Enablers: First, the designers of AI tools and the stuff that powers them. This includes data operations, computing hardware and solutions, and the companies creating the models themselves.

2. Adopters: What’s exciting about AI is that it may meaningfully increase productivity across a variety of workstreams. Applications may be broad. For my own job, I can imagine using automated summaries of policymaker speeches as one time-saving example.

3. Responders: AI may create new problems, such as deepfakes, better phishing attempts, and easier coding of malicious software by malevolent actors. Cybersecurity will be ever more important.

Automate my job?

Each month I pose a question to ChatGPT — the artificial intelligence-driven chatbot — and assess the response.

Q: Why are people afraid of artificial intelligence?

A: People’s fear of AI can stem from several factors:

1. Job displacement and widespread unemployment

2. Loss of control leading to AI making decisions that are beyond human understanding and control

3. Ethical implications including questions surrounding responsibility when AI systems make mistakes or cause harm

4. Security and privacy including the misuse of personal information

5. Science fiction depictions of AI systems turning against humanity

At least ChatGPT is self-aware. My take is that new technology is almost always initially feared but typically harnessed for good use. New technologies, over the course of time, have led to remarkable improvements in human standards of living. I suspect that this time will be no different.

It was said

“We have been seeing the effects of our policy tightening on demand in the most interest rate–sensitive sectors of the economy, particularly housing and investment. It can take time, however, for the full effects of monetary restraint to be realized, especially on inflation.”

– Jerome Powell

That’s right, but then why is the Federal Reserve projecting two more rake hikes this year, the June “skip” notwithstanding? Monetary policy tends to take 12-18 months to be felt in the economy. That’s because in many economic transactions, the prices and quantities agreed upon today last well into the future. One year ago, the fed funds rate was 1.00%. Eighteen months ago, it was 0.25%.11 Shouldn’t we wait to see what this unprecedented tightening has done to the economy before considering future rate hikes? This is the only cycle on record in which a financial accident happened (the regional bank failures) and the Fed continued to tighten policy.

Alas, my opinion doesn’t matter to the Federal Open Market Committee. I simply acknowledge that a new market cycle won’t emerge until the tightening has concluded.

Everyone has a podcast

Kristina Hooper and Alessio de Longis joined the Greater Possibilities podcast to discuss their mid-year outlook.

Here are my primary takeaways:

- It’s reasonable to expect a recession, but our guests believe several asset classes are already priced for recession.

- The US stock market in the first half has been driven by tech sector, mega-cap, quality names, and the cyclical and value-oriented sectors have been lagging. That type of market action needs to be respected. It’s the type of market rally that tends to not be indicative of a new cycle.

- Nonetheless, Alessio shared his belief that the second half of the year is likely to be one in which investors are waiting for something to break and it doesn’t. The markets welcome inflation decelerating. This scenario would likely give us another three to six months where the market does reasonably well because market participants simply get tired of waiting for that dreaded recession.

On the road again

It’s been a few weeks since I’ve been on an airplane. I’m half expecting United Airlines to call me and ask if I’m OK. The furthest I’ve gone this month (so far) is to midtown Manhattan. I was asked, in part, to speak about the poor behavioral decisions made by investors. How much time do you have? I introduced my session with a couple of quick points to highlight the opportunity cost of succumbing to fear (all based on returns of the S&P 500 Index12):

- Since March 13, 2020, the day the US shut down for COVID, the market is up 70%.

- Since the 2020 election, the market is up 35%.

- Since March 14, 2023, the day that Silicon Valley Bank failed, the market is up 12%.

- Since May 1, 2023, the day that Treasury Secretary Janet Yellen warned that the US could default by June 1 if the debt ceiling was not raised, the market is up 5%.

Should we continue beyond my introduction, or should we break early for lunch?

Enjoy the start of summer. Hopefully everyone gets some much needed rest and relaxation.

Footnotes

- Source: Bloomberg and US Federal Reserve, 5/31/23. Yield curve is based on the spread between the 10-year US Treasury rate and the 2-year US Treasury rate. Credit conditions are based on the Fed Senior Loan Officer Survey.

- Source: US Bureau of Economic Analysis, 3/31/23. Based on recession dates defined by the National Bureau of Economic Research: Aug. 1957 – Apr. 1958, Apr. 1960 – Feb. 1961, Dec. 1969 – Nov. 1970, Nov. 1973 – Mar. 1975, Jan. 1980 – Jul. 1980, Jul. 1981 – Nov. 1982, Jul. 1990 – Mar. 1991, Mar. 2001 – Nov. 2001, Dec. 2007 – Jun. 2009 and Feb. 2020 – Apr. 2020.

- Source: Bloomberg, 5/31/2023. Based on the returns of the S&P 500 Index associated with each of the recessions listed in footnote 2. The peak-to-trough decline of equities in periods associated with recessions has been -31.8%. The current peak to trough in the S&P 500 Index is -25.4% (1/4/22 to 10/13/22). It is not guaranteed that 10/13/22 will prove to be the trough for this cycle.

- Source: US Bureau of Labor Statistics. The year-over-year percent change in the US Consumer Price Index fell to 4% in May, down from 4.9% the prior month.

- Source: Federal Reserve Bank of Atlanta, 5/31/23.

- Source: S&P Case-Shiller, 5/31/23. Based on the year-over-year percent change in the S&P Case-Shiller 20 City Home Price Index.

- Source: Reis, Inc., 3/31/23. Latest data available.

- Source: Bloomberg L.P., 5/31/23

- Source: Bloomberg L.P., 5/31/23

- Source: Bloomberg L.P., 5/31/23

- Source: US Federal Reserve, 5/31/23

- Source: Bloomberg L.P., 5/31/23. Past performance does not guarantee future results.

—

Originally Posted June 29, 2023 – Above the Noise: A narrow market rally isn’t enough to stop ‘recession obsession’

Important information

NA2966554

Past performance is not a guarantee of future results. This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

All investing involves risk, including the risk of loss.

An investment cannot be made directly in an index.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

Many products and services offered in technology-related industries are subject to rapid obsolescence, which may lower the value of the issuers.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

The Consumer Price Index (CPI) measures change in consumer prices as determined by the US Bureau of Labor Statistics. Core CPI excludes food and energy prices while headline CPI includes them.

Tightening monetary policy includes actions by a central bank to curb inflation.

The yield curve plots interest rates, at a set point in time, of bonds having equal credit quality but differing maturity dates to project future interest rate changes and economic activity. An inverted yield curve is one in which shorter-term bonds have a higher yield than longer-term bonds of the same credit quality. In a normal yield curve, longer-term bonds have a higher yield.

The Atlanta Fed’s Sticky-Price Consumer Price Index is a weighted basket of items that change price relatively slowly. The core measure excludes food and energy. The price-to-sales ratio is a valuation metric calculated by dividing a company’s market capitalization by its total sales over a 12-month period.

The NASDAQ Composite Index is the market capitalization-weighted index of approximately 3,000 common equities listed on the Nasdaq stock exchange. The federal funds rate, or fed funds rate, is the rate at which banks lend balances to each other overnight.

The Federal Open Market Committee (FOMC) is a 12-member committee of the Federal Reserve Board that meets regularly to set monetary policy, including the interest rates that are charged to banks.

The Senior Loan Officers Survey is conducted by the US Federal Reserve to provide qualitative and limited quantitative information on bank credit availability and loan demand, as well as on evolving developments and lending practices in the US loan markets.

The S&P CoreLogic Case-Shiller 20-City Composite Home Price NSA Index seeks to measures the value of residential real estate in 20 major U.S. metropolitan areas: Atlanta, Boston, Charlotte, Chicago, Cleveland, Dallas, Denver, Detroit, Las Vegas, Los Angeles, Miami, Minneapolis, New York, Phoenix, Portland, San Diego, San Francisco, Seattle, Tampa and Washington, D.C.

The opinions referenced above are those of the author as of June 21, 2023. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

Disclosure: Invesco US

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial advisor/financial consultant before making any investment decisions. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

All data provided by Invesco unless otherwise noted.

Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s Retail Products and Collective Trust Funds. Institutional Separate Accounts and Separately Managed Accounts are offered by affiliated investment advisers, which provide investment advisory services and do not sell securities. These firms, like Invesco Distributors, Inc., are indirect, wholly owned subsidiaries of Invesco Ltd.

©2024 Invesco Ltd. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Invesco US and is being posted with its permission. The views expressed in this material are solely those of the author and/or Invesco US and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.