Key takeaways

Lower real return

After factoring in inflation and taxes, the real return of a money market is much lower than investors may expect.

Lower long-term performance

Longer-term government bonds, corporate bonds, and stocks have historically returned more than cash.

Reinvestment risk

One of the risks of short-term investing is not being able to reinvest the money at the same rate.

While it may seem like a no-brainer to stash cash in money markets right now because of their relatively high interest rates and low risk, it may not be as risk-free as investors think. Yes, there can be such a thing as too much cash. Choosing money markets over investments with more growth potential can impact long-term portfolio performance. Corporate bonds, core bonds, and stocks — and the funds that invest in them — may be better long-term options for some of this money, in my opinion. Here are three reasons why.

(For a deeper dive, see my chartbook Beyond money markets: Maximizing cash.)

1. Lower “real” return

When you figure in inflation and taxes, the income generated by money markets is less enticing. Consider this hypothetical example: $100,000 invested in a money market yielding 3.5% would earn $3,500 in interest a year. When factoring in 6.4% inflation and a 37% income tax rate, the real return on the investment is actually a loss of $4,658.1

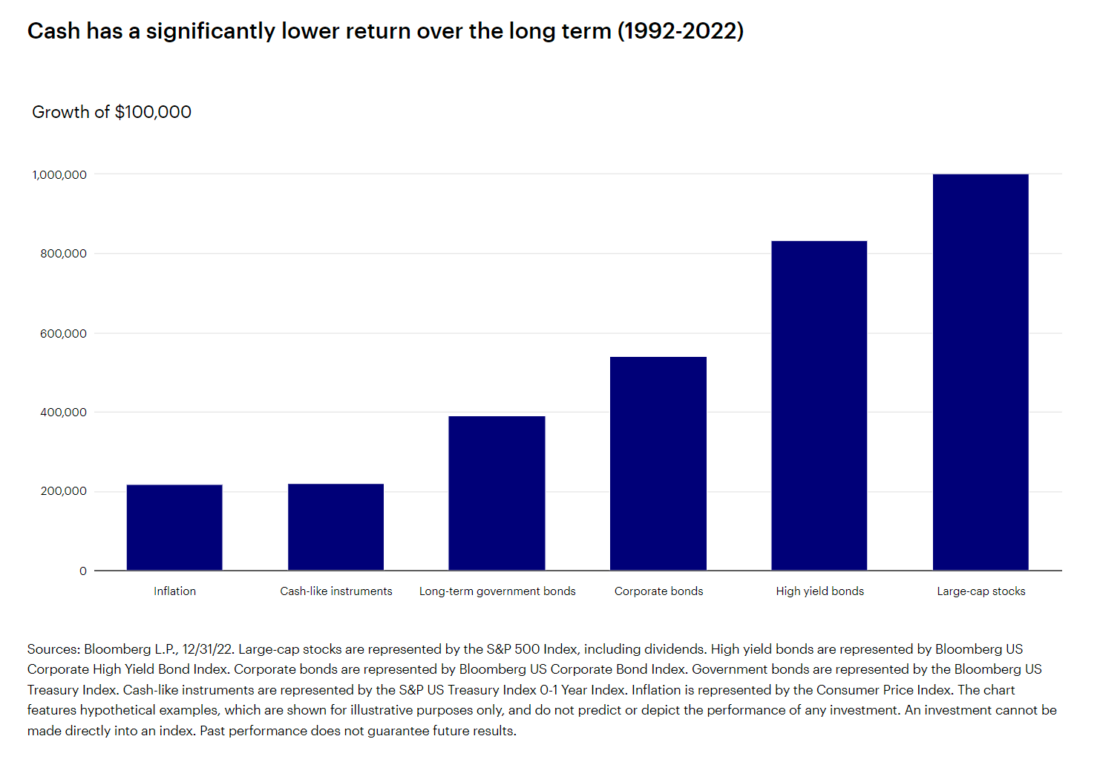

2. Lower return over time

Short-term cash-like investments have historically generated significantly lower return than longer-term government bonds, corporate bonds, and stocks, as the example below shows. Yes, cash-like investments may outperform Treasuries over short time periods, but using the same 30-year time period as the example below, Treasuries outperformed cash during 98% of the rolling monthly 10-year periods during the past 30 years.2

3. Locking in long-term rates may be better

Reinvestment risk is among the biggest challenges of investing in short-term securities, such as money markets, because that money generally has to be reinvested every few months. At some point, interest rates will fall from today’s elevated levels, and the money market will have to reinvest in lower-yielding securities. Investors who like today’s yields may be better off locking them in for the longer term with bonds.

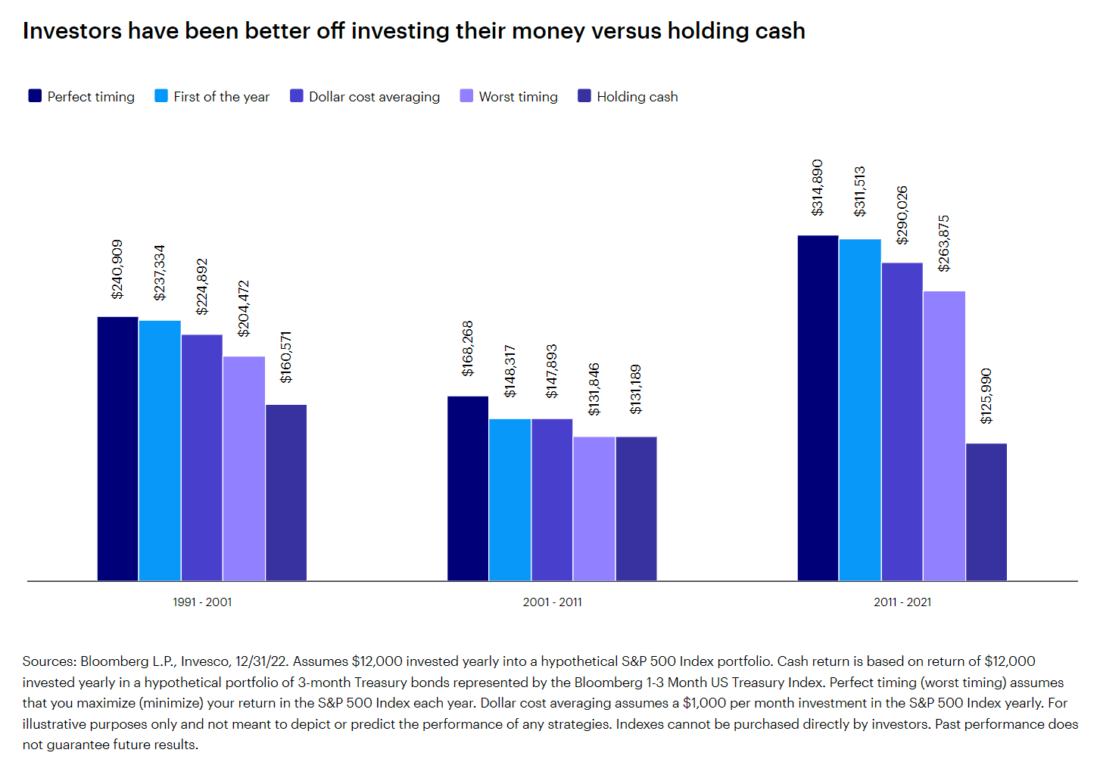

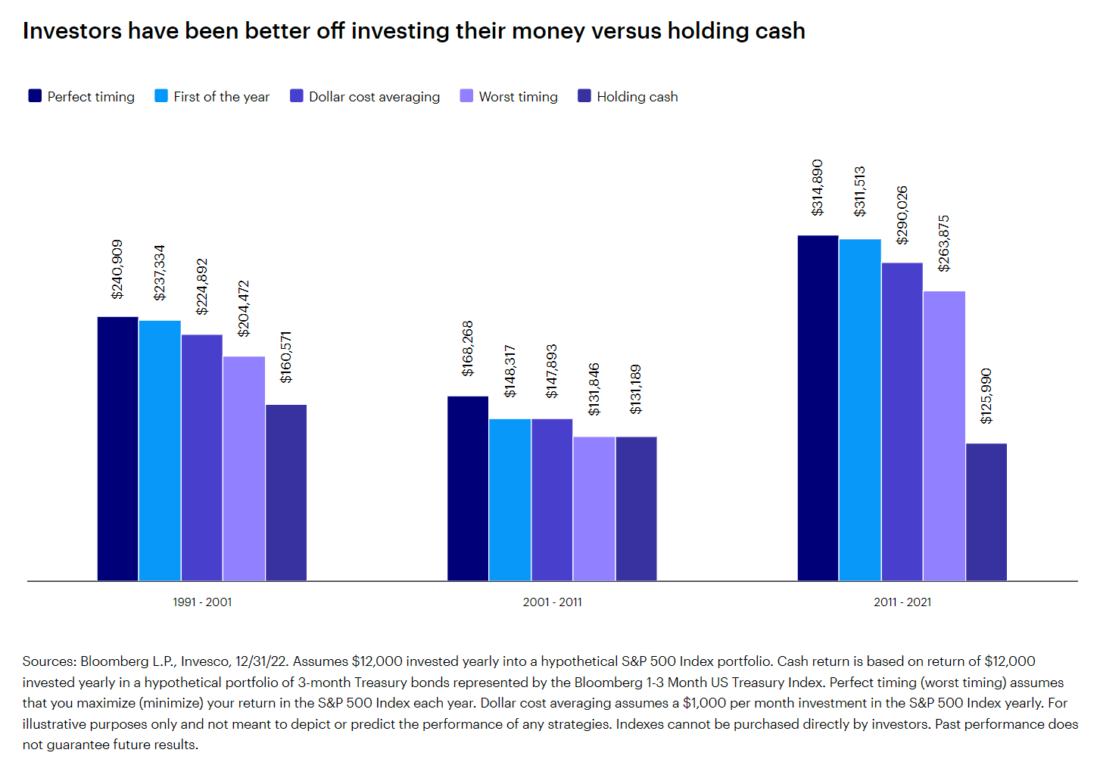

How might investors move out of cash?

Let’s look at three instances when cash balances were high — following the 1991 and 2002 recessions, the 2008 Global Financial Crisis, and the 2009 European debt crisis — and calculate what $12,000 invested yearly in the stock market for 10 years would have been worth. Since there are many ways to put cash back to work, I considered four investing scenarios:

- Perfect timing assumes that an investor maximized their return in the S&P 500® Index each year.

- Worst timing assumes that an investor minimized their return in the S&P 500 Index each year.

- First of the year imagines an investor moving the entire $12,000 into stocks as a lump sum at the start of each year.

- Dollar cost averaging assumes an investor made a $1,000 per month investment in the index yearly.

I compared each of these strategies with the returns an investor would have if they simply continued to hold cash (calculated using the Bloomberg 1- 3 Month US Treasury Index).

In each instance, investors would have been better off investing their money in stocks versus holding cash — regardless of how they did it. Investing a lump sum at the first of the year and dollar cost averaging were both sound strategies. While all investors would like perfect timing, even having the worst timing each year still outperformed cash.

Footnotes

- Sources: Bloomberg L.P. and Bankate.com, 12/31/22. Income is calculated using the interest rate on high yield money market accounts for investments of $50,000 or more from Bankrate.com. Inflation is the average for the year of the monthly year-over-year percentage change in the US Consumer Price Index. The Consumer Price Index (CPI) measures change in consumer prices as determined by the US Bureau of Labor Statistics. Hypothetical tax rate in the chart is 37%. The 4.3% Affordable Care Act surcharge was not included. Tax rates and brackets are subject to change. Changes in tax rates and tax treatment of investment earnings may affect the results shown. Investors should consult a tax advisor. An investment cannot be made directly into an index. Past performance does not guarantee future results.

- Source: Bloomberg, L.P., 1992 through 2022. Cash-like instruments are represented by the S&P US Treasury Index 0-1 Year Index, which is designed to measure the performance of US Treasury bonds maturing in 0 to 1 years. Treasuries are represented by the Bloomberg US Treasury Index.

—

Beyond money markets: Maximizing your cash by Invesco US

Important information

NA2965226

All investing involves risk, including the risk of loss.

Past performance does not guarantee future results.

Investments cannot be made directly in an index.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

Treasury securities are backed by the full faith and credit of the US government as to the timely payment of principal and interest.

The Bloomberg US Corporate High Yield Bond Index covers the universe of fixed-rate, non-investment grade debt.

The Bloomberg US Corporate Bond Index measures the investment grade, fixed-rate, and taxable corporate bond market. It includes USD-denominated securities publicly issued by US and non-US industrial, utility, and financial issuers.

The Bloomberg US Treasury Index is an unmanaged index of public obligations of the US Treasury with remaining maturities of one year or more.

The Bloomberg 1-3 Month US Treasury Index is an unmanaged index of public US Treasury obligations with remaining maturities of one to three months.

The Consumer Price Index (CPI) measures change in consumer prices as determined by the US Bureau of Labor Statistics.

The opinions referenced above are those of the author as of May 31, 2023. These comments should not be construed as recommendations, but as an illustration of broader themes.

Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Invesco US

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial advisor/financial consultant before making any investment decisions. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

All data provided by Invesco unless otherwise noted.

Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s Retail Products and Collective Trust Funds. Institutional Separate Accounts and Separately Managed Accounts are offered by affiliated investment advisers, which provide investment advisory services and do not sell securities. These firms, like Invesco Distributors, Inc., are indirect, wholly owned subsidiaries of Invesco Ltd.

©2024 Invesco Ltd. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Invesco US and is being posted with its permission. The views expressed in this material are solely those of the author and/or Invesco US and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

A well designed and informative handout.

Thank you for the positive feedback, Anonymous.