Stocks are rebounding from yesterday’s selling pressure and marching toward a five-month winning streak. Bonds are nearly flat, though, as investors look ahead to this Friday’s Personal Income & Outlays report, which is released on a day when many markets do not trade due to Good Friday, a part of the Easter holiday. Meanwhile, sluggish data released today on durable goods and consumer confidence is supportive of risk sentiment, amidst an upcoming cycle of synchronized monetary policy accommodation by global central banks.

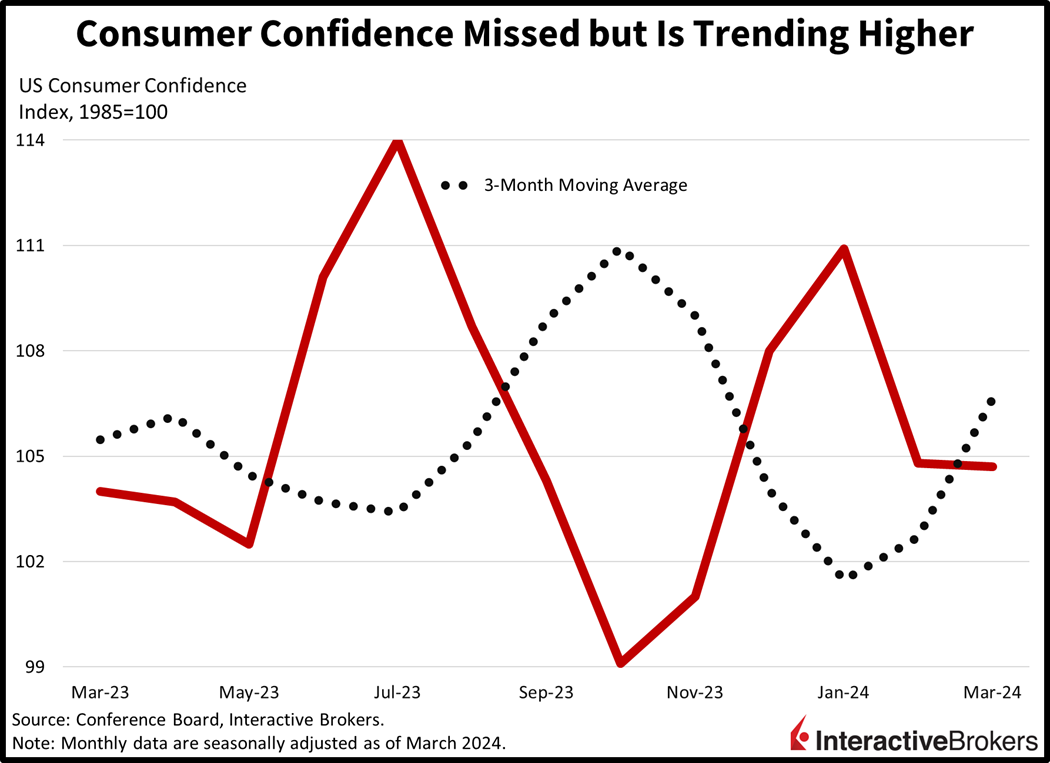

Consumers’ Outlook Dwindles

Consumers’ perception of the economy is down marginally from February, but nevertheless has hit its lowest level since November, with results dragged down by expectations, according to March’s Consumer Confidence Index from the Conference Board. This month’s reading of 104.7 dropped marginally from its downwardly revised 104.8 last month and the 106.9 result expected by analysts. Perhaps most strikingly, the Expectations Index, which measures consumers’ outlook for the next six months, sank to 73.8 from 76.3 in February—the lowest reading since October of 2023. The result was pulled lower by deteriorating expectations for business conditions, labor market conditions and income. Plans for interest rate sensitive purchases, such as homes, automobiles and big-ticket items, also weakened. From a longer-term view, consumer expectations for inflation of 5.3% during the next 12 months increased only slightly from the 5.2% expectation last month, a four-year low. Additionally, consumers were upbeat about stock prices but concerned that interest rates may rise over the next twelve months.

No Time Like the Present Though

In the meantime, consumers feel slightly better about current conditions with the Present Situation Index climbing from 147.6 last month to 151 this month. Consumers’ view of the labor market was favorable, but inflation continued to cause anxiety, with households concerned about rising costs for goods and services, particularly food and gasoline.

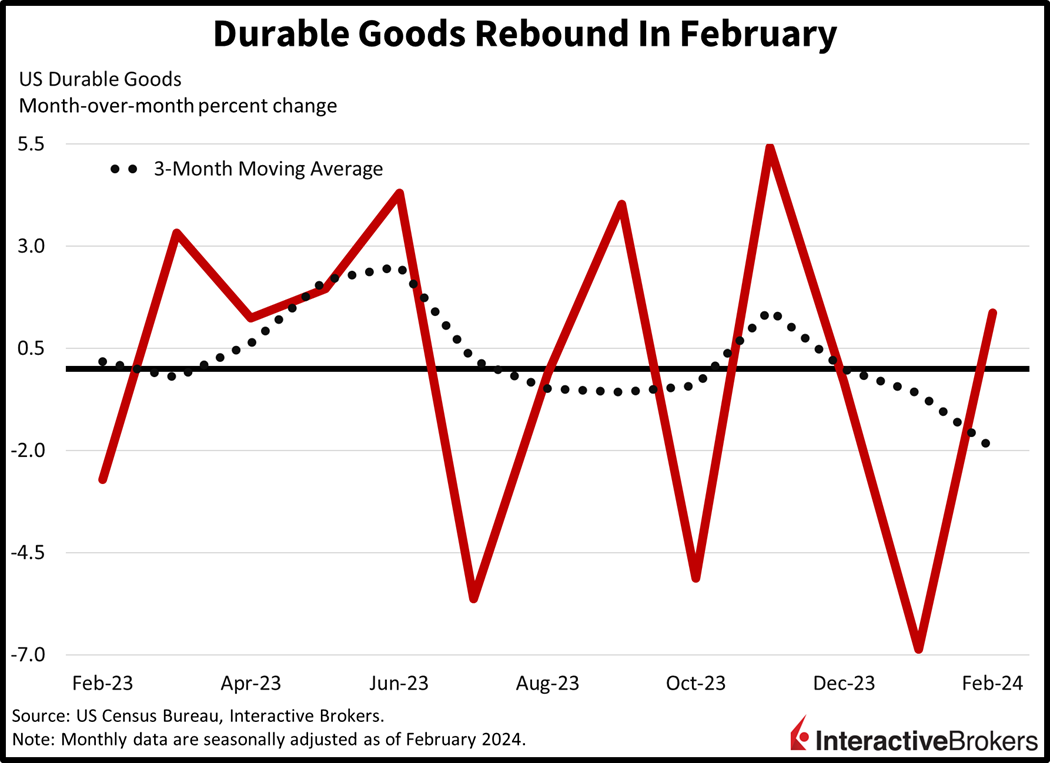

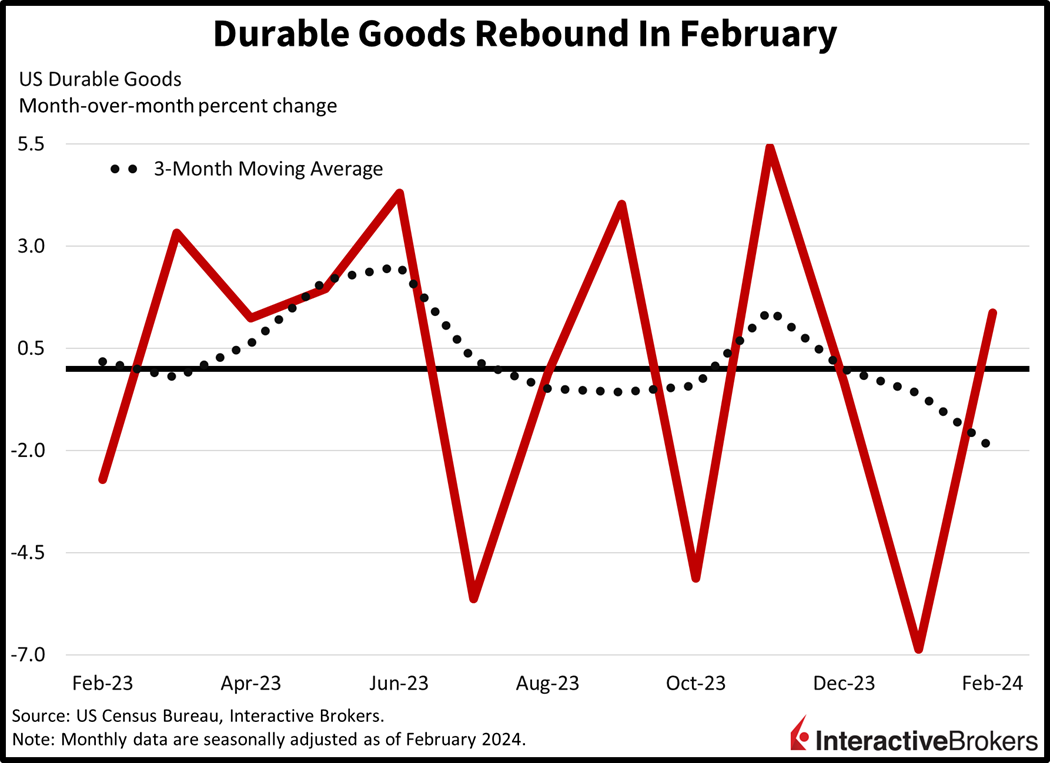

Aircraft Purchases Support Durable Goods Orders

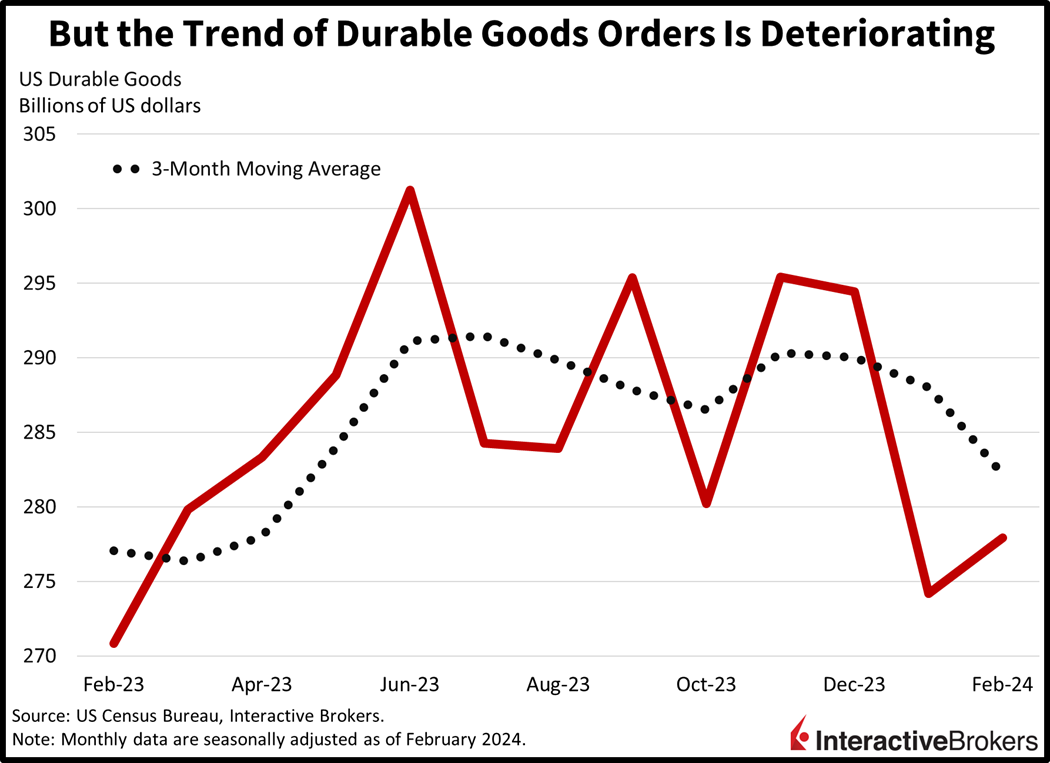

A sharp pickup in passenger aircraft orders drove a beat of expectations for Durable Goods last month. Durable Goods orders grew 1.4% month over month (m/m), exceeding the expectation of 1.1% but hardly offsetting January’s steep decline of 6.9%. Aircraft orders led the charge overall, with both passenger and defense categories sporting gains of 24.6% and 9.8% m/m. Categories with smaller increases included computers, machinery, automobiles, primary metals, fabricated metal products, and other durable goods with figures rising 3.1%, 1.9%, 1.8%, 1.4%, 0.8% and 0.3% m/m. The communications equipment and electrical equipment categories served to cap gains with orders declining 1.6% and 1.5%, respectively, during the period. Nondefense capital goods excluding aircraft, a proxy for business investment, rose a sharp 0.7% m/m, recovering from two consecutive months of declines.

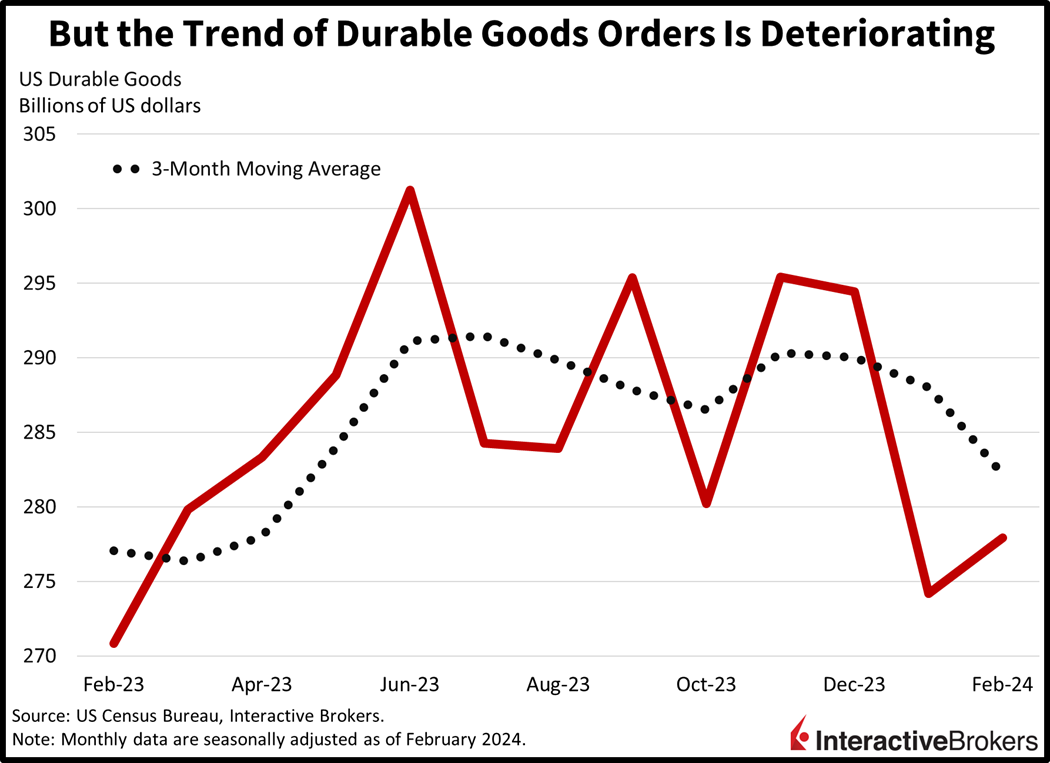

Boeing Needed for Upside Momentum

February’s gain in overall orders was the first in three months, but problems with Boeing production continue to weigh on the overall trend of durable goods, which remains troublesome. Boeing had appeared to have worked past the impact of two fatal crashes of its new 737 Max airliner in 2018 and 2019, only to have a cabin panel blow off one of the aircraft during a January 2024 flight, causing the FAA to halt the company’s planned production increase. In the aftermath, Boeing has received criticism for its quality control and just yesterday, the company announced that CEO Dave Calhoun will leave his post at the end of the year. Additionally, Larry Kellner, the company’s chairman, will not seek re-election and Stan Deal, CEO of Boeing Commercial Airplanes, is retiring. Boeing says it received 15 orders for commercial aircraft in February, up from January’s three orders, but still significantly below levels experienced at the end of last year. The January turmoil contributed to civilian aircraft orders declining 63.5% during the month compared to the 24.6% increase in February.

Stocks Rally After Two-Day Decline

All major US equity indices are higher following two consecutive days of losses. The S&P 500, Nasdaq Composite, Dow Jones Industrial and Russell 2000 benchmarks are all up roughly 0.3%. Sectoral breadth is positive with 9 out of eleven segments higher; consumer discretionary, financials and healthcare are leading with gains of 1%, 0.6% and 0.4%. Energy and utilities are the only segments lower on the session, with values down 0.7% and 0.2%. Fixed-income action is quiet today, with the 2- and 10-year Treasury maturities trading at 4.61% and 4.26%, within 2 basis points (bps) of yesterday’s close. The dollar is quite unchanged as well, with its index gaining 1 bp to 104.24. The greenback is gaining relative to the franc, euro, pound sterling, Aussie dollar, and yen but is losing ground versus the yuan and Canadian dollar. Crude oil is paring recent gains as traders examine the potential for supply constraints: WTI crude is trading lower by $0.19, or 0.2%, to $81.72 per barrel.

Boeing’s Fate is Crucial to Manufacturing

A resolution of Boeing’s production problems leading to an improved outlook for the aircraft manufacturer is essential for supporting the economy’s growth and efficiency going forward. While Boeing is just a single company, it represents a sizable share of US manufacturing, so its success is crucial to the many companies involved with the plethora of interconnected inputs and outputs that converge in the airline industry as well as the global flying experience. Investors, frequent travelers and economists hope that the company can turn a page and start its next chapter with the management restructuring potentially having positive results in the aftermath of quality control problems and the Covid-19 pandemic materially weakening the company.

Visit Traders’ Academy to Learn More About Durable Goods and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.