Stocks leaped out of the starting blocks this morning seeking to cement a nine-day winning streak on the back of cooling labor market data. They have since buckled and ducked into the red as bears appear unwilling to accept the longest series of consecutive daily gains in 19 years. If the run fizzles out today, the equity market’s eight-day run is still impressive and marks the longest streak since 2021. A dovishly-tilted Federal Reserve alongside a long list of soft economic data laid the framework for the bull stampede during a strong seasonal period after equities recorded three consecutive down months.

Periods of Unemployment Lengthen

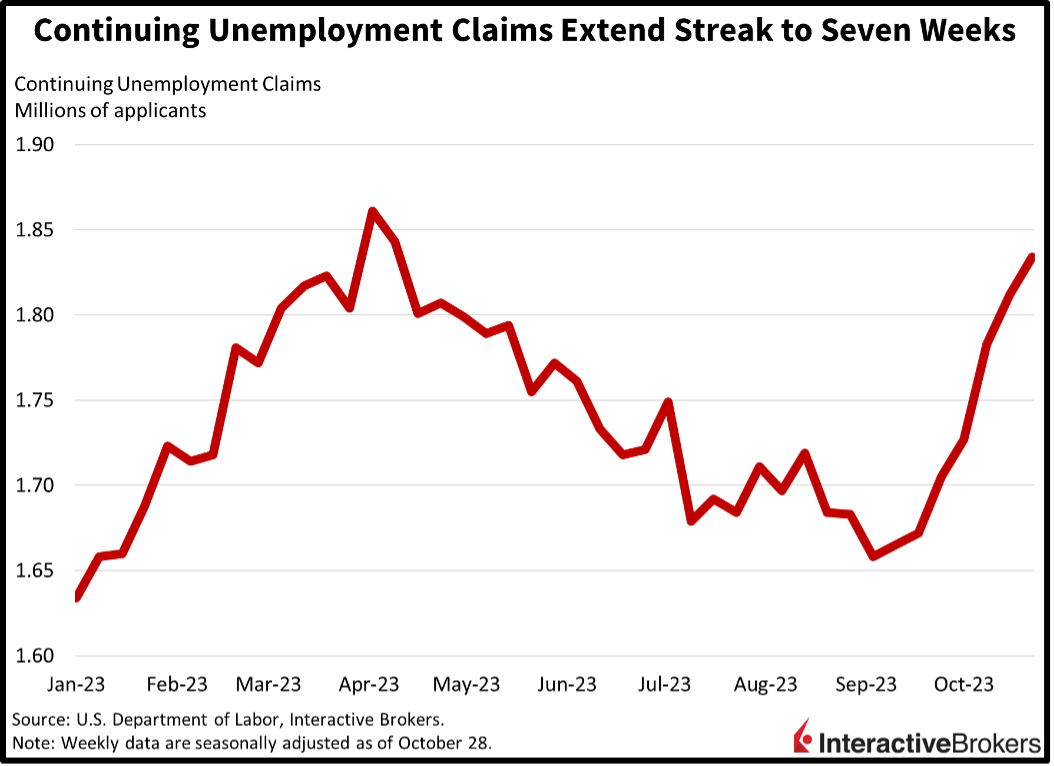

Speaking of streaks, continuing unemployment claims have risen for seven consecutive weeks, as laid-off workers take longer to reinstate themselves in the labor market. More positively, on the other hand, layoffs aren’t picking up steam, with initial unemployment claims coming in at 217,000 for the week ended November 4, lighter than expectations calling for 218,000 and down from the prior week’s 220,000. Continuing claims rose to 1.834 million during the week ended October 28, loftier than projections of 1.820 million and from the previous week’s 1.812 million. The incremental and controlled slowdown within the labor market is an incredibly favorable development for curtailing inflation.

Treasury Auction Could Strengthen Sentiment

Markets are generally softer as we await another long-term bond auction at 1:00 pm. Today’s auction is for 30-year bonds while yesterday’s 10-year auction performed reasonably well. A favorable auction at 1:00 pm may help propel equities into positive territory for the day and conquer the pivotal 4,400 level for the S&P 500 Index. Major stock indices are being led by the Nasdaq Composite Index which is up 0.1% while the S&P 500, Dow Jones Industrial and Russell 2000 indices are all lower by 0.1%. Sectoral breadth is mixed with communication services, energy, financials, industrials, technology and materials higher while the other five sectors are lower. Bonds are taking a break from their run as well, with yields on the 2- and 10-year Treasury maturities up 3 and 6 basis points to 4.96% and 4.55%. The dollar is roughly near the flatline, however, as the greenback gains against the euro, pound sterling, franc, yen, and yuan while depreciating relative to the Aussie and Canadian dollars. Crude oil is dead cat bouncing following its recent battering, with demand concerns mounting against the backdrop of declining Chinese exports, recessionary conditions in Europe and rising inventories in the U.S. The risk of declining demand is outweighing fears that a potential escalation of the Middle East conflict may disrupt energy supplies, with crude oil prices much lower today than when the conflict started, a shocking development. I discussed oil going “the other way” with Chuck Jaffe on the Money Life Show just yesterday. Meanwhile, WTI crude is up $0.67 per barrel or 0.9% to $76.22.

Moving Equipment Suffers while Theme Parks and Honda Motor Thrive

The stagnant housing market has caused demand for moving equipment rentals to fall off a cliff as consumers flock to theme parks and snatch up Honda automobiles.

U-Haul Holding Company, which provides moving equipment, self-storage facilities and various forms of insurance, posted disappointing results last night for its fiscal quarter ended September 30, with historically low housing affordability and high interest rates dramatically causing Americans to stay put rather than buy homes. This trend has crushed demand for the company’s products. U-Haul’s net earnings available to common shareholders of $273.5 million declined from $349.9 million generated in the year-ago quarter. U-Haul’s revenue of $1.56 billion declined from $1.64 billion in the year-ago quarter. The company’s revenue from rental equipment for do-it-yourself movers declined 8% year-over-year (y/y) and sales of moving and self-storage products declined 5.5%. However, revenues for U-Haul’s self-storage rental units increased 12.6%, a result of the company expanding its rental space by nearly 1 million square feet. U-Haul’s share price dropped 4.1% following the earnings release.

Walt Disney, however, demonstrated that consumers are still flocking to theme parks and consuming streaming content. On a less optimistic note, Disney’s advertising revenue from its ABC and Disney-owned TV stations declined. Nevertheless, Disney’s total revenue increased 5% y/y to $21.24 billion, just shy of the analyst consensus expectation of $21.33 billion. Disney is on track to trim $7.5 billion in annual costs, which has involved firing thousands of employees. The increased revenue and cost cuts pushed Disney’s adjusted earnings per share (EPS) to $0.82, which beat the analyst consensus expectation of $0.71. The EPS climbed significantly from $0.30 in the year-ago quarter. Increased visits to Disney’s theme parks and higher ticket prices pushed revenue up 13% for the company’s experience division, which also includes cruise lines, streaming entertainment and media, such as ESPN. Its Disney + streaming business added 7 million subscribers.

Honda Motor Company also generated favorable results with its international sales benefiting from a weak yen and strong demand for its automobiles in the U.S. and Japan. The company’s profit climbed 34% y/y for the July-through-September reporting period, reaching $1.7 billion (or 254 billion yen). Its revenue jumped 17% to approximately $34 billion during the same period and exceeded the consensus expectation of $32.12 billion. On an encouraging note, production in North America increased with supply-chain improvements, including the availability of computer chips. Meanwhile, Honda’s sales in China were weak because of consumers’ strong preference for electric vehicles, a market that is led by Tesla and BYD of China. Overall sales were also challenged by weak results in Europe and Asia ex Japan. Honda also increased its earnings guidance from $5.3 billion for the fiscal year ending in March to $6 billion.

Volatility Surges Often Follow Complacent Sentiment

While winning streaks are positive for markets, the longer the run, the closer we are to a turning point. I spoke to our Chief Strategist, Steve Sosnick, this morning for more clarity on the situation. Steve states that we’ve flipped from nervousness to complacency at a near-record pace without the benefit of any outright change in central bank policy. What changed is a more favorable interpretation of Fed rhetoric. Did anyone truly doubt that we’re “close to the end of the cycle” prior to Powell’s press conference? But the market did its usual job of selective listening, hearing what it wanted to hear while disregarding the rest. So, Fed Funds futures reduced their likelihood for a final hike, which lowered the 2024 terminal rate, which led to a rally in an oversold bond market, which led to a big rally in stocks, which led to a plunge in VIX and a full-on change in sentiment. All from selectively picking out the market-friendly phrases, sometimes out of context. For example, here is the follow-up to the “end of cycle” reference above: “So, you’re close to the end of the cycle. That was an impression as of, I believe, as of September. It’s not a promise or a plan of the future.”

Visit Traders’ Academy to Learn More About Unemployment Claims and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.