Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Russell 2000 Facing Resistance

The Russell 2000 is the small cap index followed widely in the US market. A good barometer of market participation, small caps have been performing well for a few months now, as sector rotation continues to play its part.

But the small cap index has been finding it difficult to break past the large overhead supply zone of 205. Multiple attempts have been made since 2022 to breach this level, but in vain. For the market rally to remain strong with participation coming through from all quarters, the rally needs this index to break out above 205. Suppressed below this level, the broader market could continue to grind sideways.

2/

Aerospace in New Air Space

Industrial across the globe have been driving the current market move, as we saw these sectors drive the Japanese and German markets to new all-time highs. Within the Industrials in the US market, the Aerospace and Defense sub-sector has picked up steam. The index is now trading at a new all-time high as the price closed at 128.13. Although the big base breakout came about earlier in late 2023, we can see that the price retested the base breakout level at 120, and bounced higher. These moves of retesting and resuming higher hint at the inherent strength in the trend. As long as the price remains above 120, the next level of resistance comes in at 160.

3/

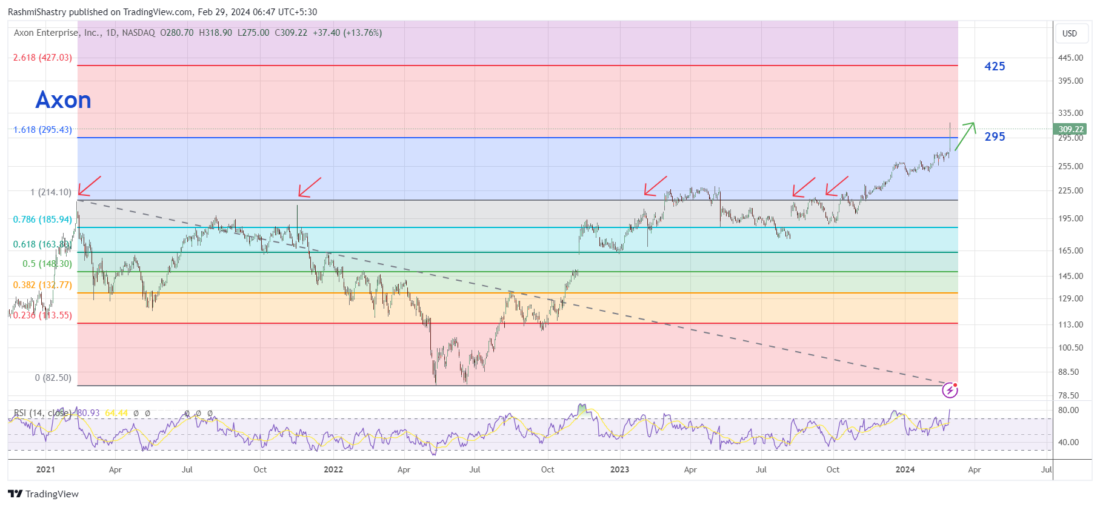

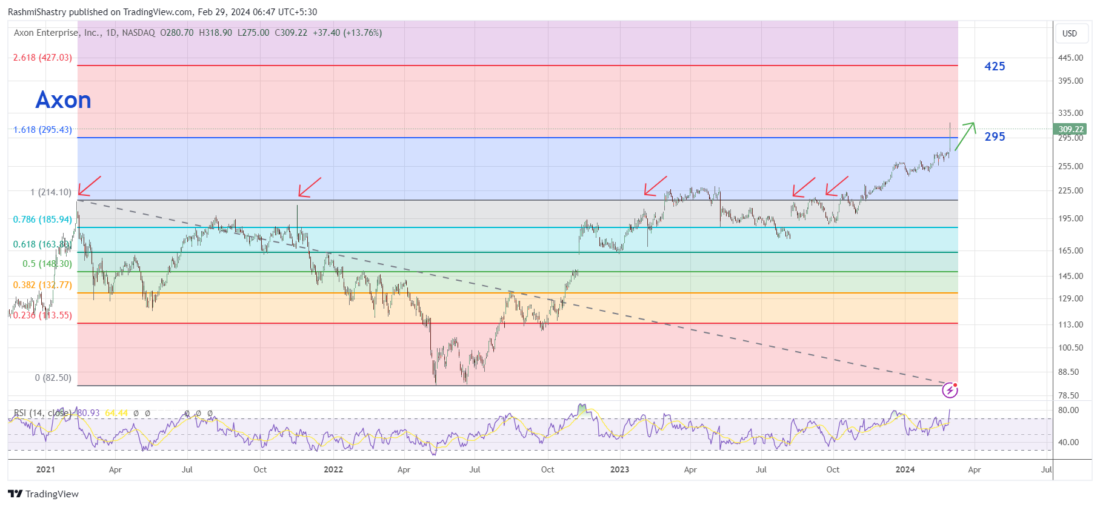

Axon Defending its Levels

Within the Defense sub-sector, one stock that stood out was Axon. With positive results, the price broke out above the resistance zone of 295, moving above the 161.8% retracement calculated from the peak of 2021 and trough of 2022.

With this breakout the price is now at a new all-time high, poised to move towards the next level of 295. Notice that the momentum has also moved above the previous peak (indicator) in December with this strong move.

4/

Biotech Stock – SANA

Sana Biotech is another stock that caught my attention. Although most stocks in the Biotech sector are outperforming the market, one reason why Sana stood out was because of the big base breakout that has come through in the price. The price has been moving sideways since 2022, with the stock building its ground. We know that the bigger the base, the higher in space!

With the price absorbing all the supply available at the level of 9.40, the next level of overhead supply comes in at 16.50.

—

Originally posted on February 29th 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.