1/ 11 Tests of 200-Week MA by Brent Crude

2/ 10/40 WMA Crossovers

3/ Where is Brent Oil Headed?

4/ Precious Metal Stays Equally Strong

5/ What Does Relative Strength Say?

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

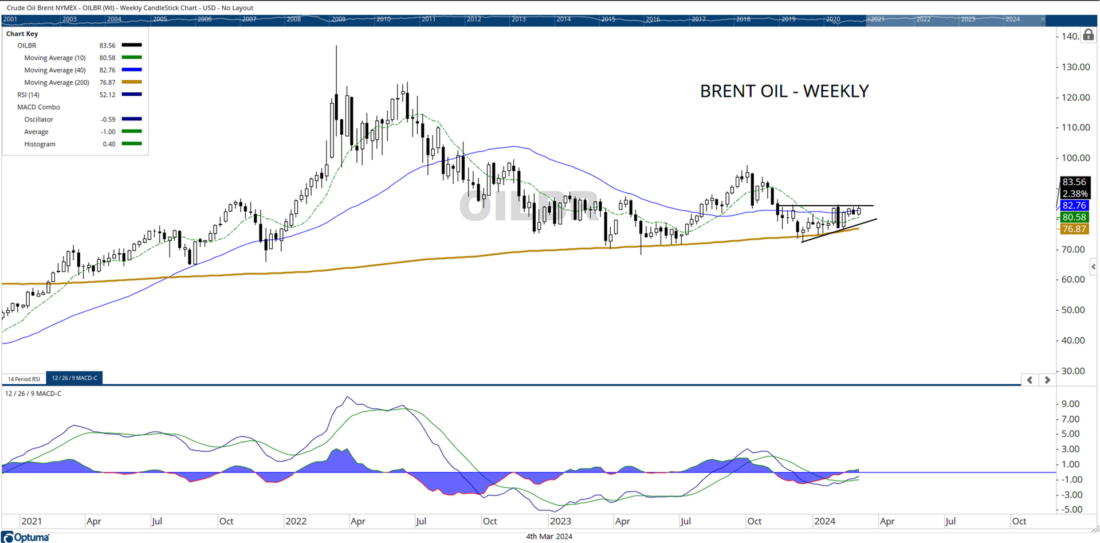

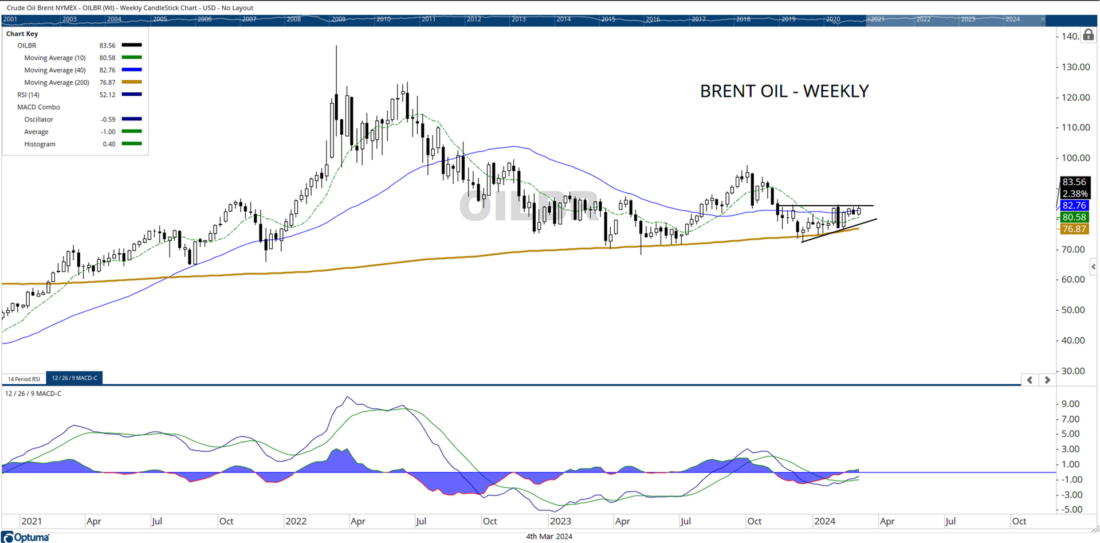

1/ 11 Tests of 200-Week MA by Brent Crude

While major momentum and directional moves are expected from Brent Crude by analyzing crossovers of 10- and 40-period Moving Averages, the attempt to look at a larger picture reveals important technical events over the past 12 months. After testing the high of $ 125.18 in June 2022, a corrective decline followed. Subsequently, Brent tested and found support at the 200-week MA for the first time in March 2023. From that time until today over 12 months, Brent has tested 200-week MA over 11 times and has bounced back from there. The 200-week MA presently rests at $76.87.

2/ 10/40 WMA Crossovers

Even a casual glance highlights the importance of 10- and 40-week moving average crossovers. Each time when the 10-week MA has crossed above or under the 40-week MA, it has led to a significant directional move in the Brent prices. The moves have stayed in the range of 19% to 73% each time this has happened; the largest one was the post-COVID move which was that of a massive 225%. This outlier aside, it is beyond doubt the crossover of 10- and 40-week MA can fairly be relied upon to establish potential directional moves.

However, at least as of now, the recent negative crossover of 10- and 40-week MA (i.e., 10-week MA crossing under 40-week MA) in December last year has failed to result in any directional downtrend. The reason for this is the existence of an all-important 200-week MA that has provided support at each time it was tested.

3/ Where is Brent Oil Headed?

Although Brent has tested 200-week MA 11 times over the past 12 months, the price action over the past quarter has led to the formation of a small bullish ascending triangle. The lower edge of this technically bullish formation coincides with the 200-week MA which is currently placed at $76.87. Going by the classical price measurement implications, Brent can be expected to test $89-91 over the coming weeks. Any close below 78 will negate this technical setup.

4/ Precious Metal Stays Equally Strong

Gold (XAUUSD) has stayed much stronger over time as compared to crude Oil. From a technical perspective, the precious metal made a high at $ 2079 in August 2020; after this, the zone of $2050-2075 has been tested multiple times. Each time the precious metal went near this zone, it found strong resistance. Importantly, this level has been tested once again; Gold has closed at its weekly high and any thrust that takes the precious metal above $ 2085 will infuse further strength. The longer it stays above $2075-2085, the stronger the chances of it moving higher. However, in the event of any retracement, a move below $1975 will push the commodity under prolonged consolidation once again.

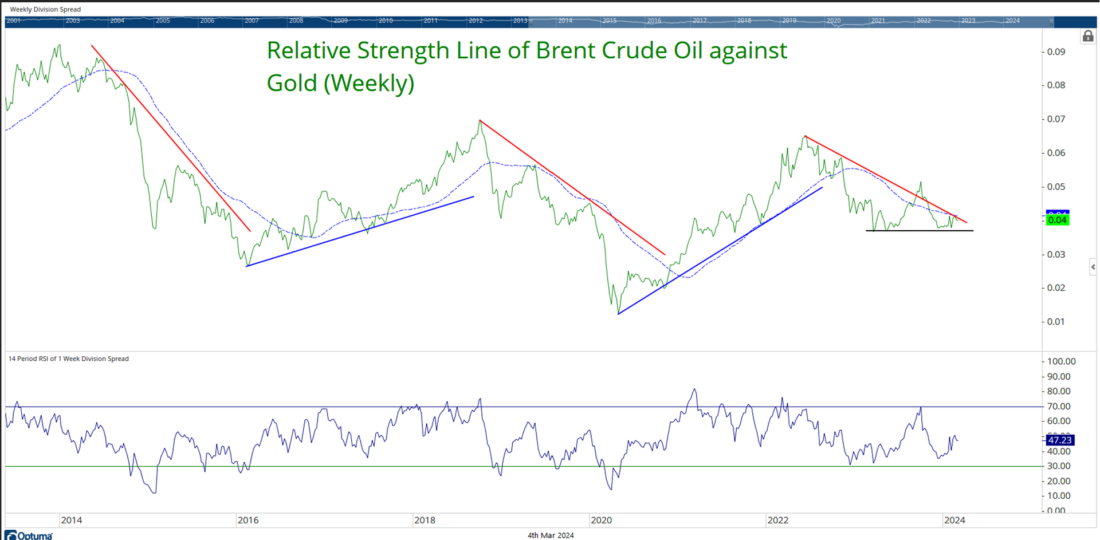

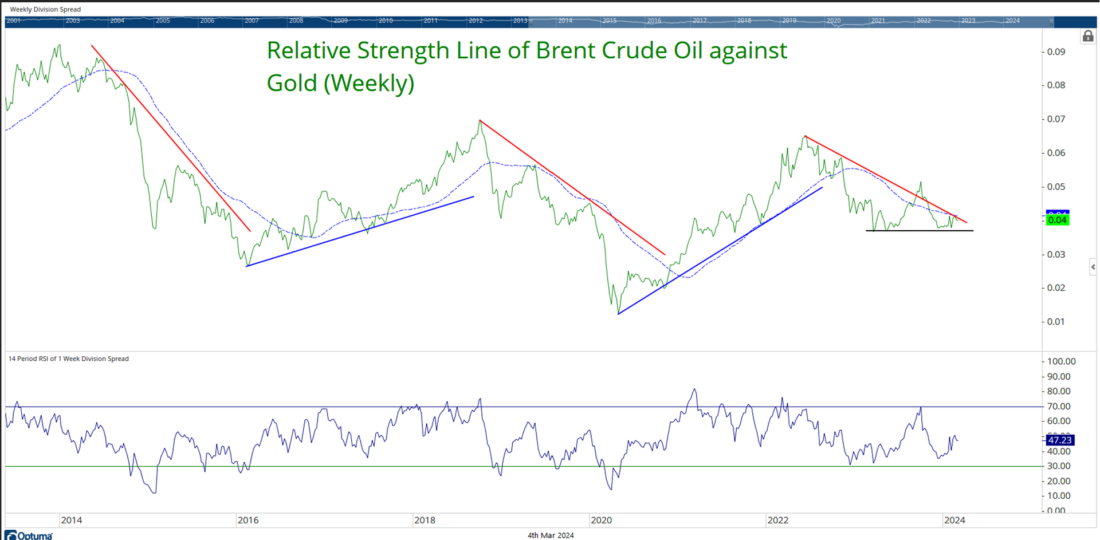

5/ What Does Relative Strength Say?

The relative performance of Brent Oil against Gold (XAUUSD) has its phases of up and down moves. Recently, by and large, while Gold has stayed relatively stronger against Brent, the RS line of Brent against Gold has flattened over the past couple of months.

——–

Originally posted on March 4th 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.