Wednesday, 13th October, 2021

1/ Indexes find support

2/ JPMorgan Chase results disappoint investors

3/ Investors cautiously optimistic on Bank of America

4/ The bottom line

1/ Indexes Find Support

Markets remained muted as investors mulled the beginning of third-quarter earnings and parsed through the statements from the Federal Open Market Committee (FOMC). Invesco’s Nasdaq 100 ETF (QQQ) added 0.8% as the U.S. 10-Year Treasury Yield (TNX) pulled back, making the tech sector more appealing. State Street’s S&P 500 Index ETF (SPY) rose 0.3% after BlackRock (BLK) rose more than 4% on strong earnings to kick off the season. iShares Russell 2000 ETF (IWM) added 0.4%, while State Street’s Dow Jones Industrial Average ETF (DIA) remained flat.

The five-minute candles in the chart below depict how the markets sharply sold at the open but rebounded steadily throughout the day. That seems surprising considering that the Consumer Price Index (CPI) numbers came in slightly higher than expected. The change in price of goods rose 0.4% in September, as rises in food and energy prices offset declining used car pricing. CPI increased 5.4% on a year-over-year basis, the highest since January 1991. Minutes released from the Fed’s September FOMC meeting showed that the central bank could begin tapering its $120 billion per month in bond purchases as soon as November.

Major averages have maintained relative levels after a September swoon. With multiple macro factors at play—tapering, inflation, supply chain issues, earnings—it is interesting that markets have remained range-bound. Investors could be waiting for definitive signs of directional movement before joining the fray. As it stands currently, the glut of factors cited for day-to-day results of individual equities have not cause a widespread selloff of indexes.

2/ JPMorgan Chase Results Disappoint Investors

the fiscal third quarter. JPM reported $3.74 in earnings per share (EPS) and $29.6 billion in revenue, beating analyst predictions of $2.98 in EPS and $29.4 billion in revenue. A key metric for JPM is net interest margin, a measure of the difference between the interest banks earn on their assets and the interest they pay out to depositors and other creditors. JPM missed on this metric, with the 1.62% reported coming in slightly below analyst expectations of 1.64%.

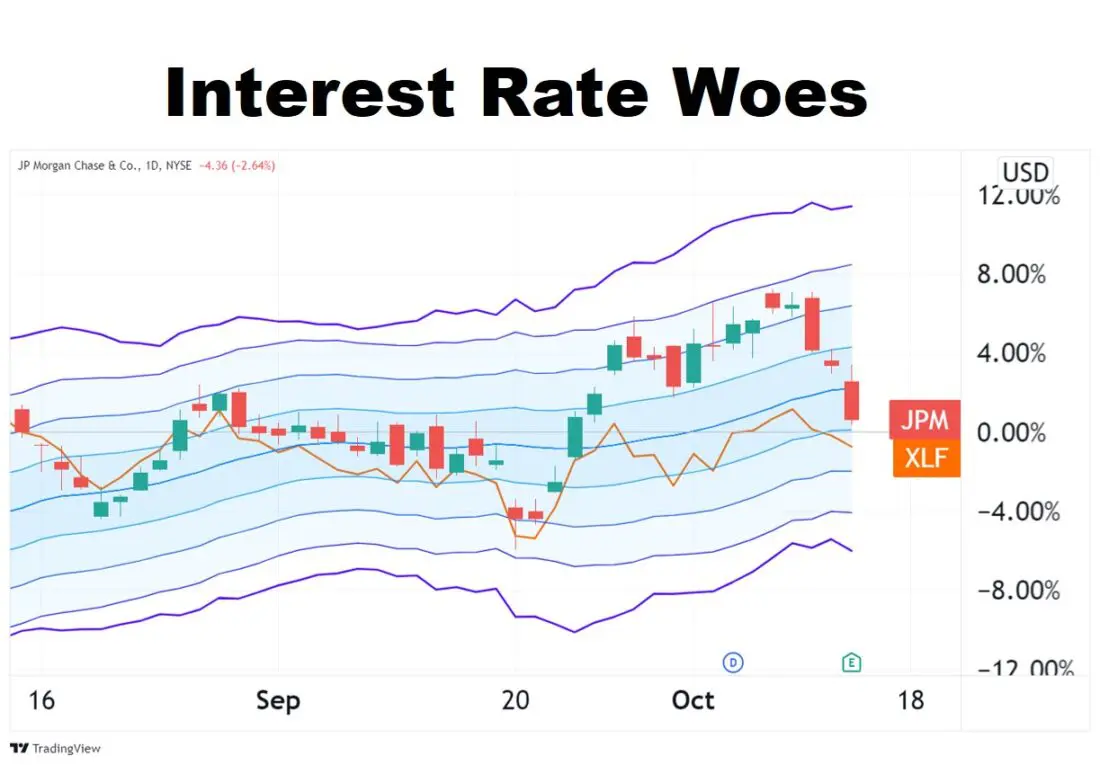

JPM earnings are significant as one of the first major dominoes of the earnings season to fall. The chart compares the recent performance of JPM with State Street’s Financial Sector ETF (XLF). Today’s results saw the JPM share price fall below its 20-day moving average, yet the stock is still slightly ahead of its sector. JPM earnings were largely impressive, but the company did not offer forward guidance, which could have factored into today’s share price movement.

3/ Investors Cautiously Optimistic on Bank of America

Perhaps taking note of the earnings results of JPM, investors have bid down the share price of Bank of America (BAC) ahead of the company’s fiscal third-quarter earnings announcement. A key component could be BAC’s net interest margin, which JPM lagged on based on analyst estimates. Analysts expect BAC to report $0.70 in EPS and $21.6 billion in revenue. However, as illustrated by JPM today, solely exceeding analysts’ estimates for these metrics alone does not translate into positive stock price movement.

As investors brace for BAC earnings, the stock’s share price shed 1%. However, it remains slightly ahead of XLF of late, as illustrated on the chart below. If BAC follows JPM’s post-earnings trend, it will be interesting to see if the stock can find support above key moving averages. Currently, option traders appear to be positioned for BAC to move higher after earnings, as recent trading volumes favor calls more than 2-to-1.

BAC is one of several major banks due to report earnings tomorrow before the market opens, alongside Wells Fargo (WFC) and Citigroup (C).

4/ The Bottom Line

Benchmark indexes sold off strongly today at the open but rebounded through the rest of the session with no major impact from the release of minutes from the previous FOMC meeting. JPMorgan kicked off earnings season and investors seemed disappointed with the news that net interest margins shrunk over the last quarter.

—

Originally posted on 13th October, 2021

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ