Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/ Looking at Bonds

I hesitated to write up a whole edition on bonds because not a whole lot has changed in the last few years, but for those who aren’t “in-the-know,” let’s start by getting up to speed.

If any of us received any financial education whatsoever, we were taught that stocks are risky, smaller stocks are even riskier, you’ve gotta’ be crazy to invest in commodities, and bonds… well, bonds are safe!

Perhaps this was true as interest rates fell from their highs in the 1980’s until the COVID pandemic began, but it’s definitely not the case today.

You see, bonds and interest rates have an inverse relationship. In other words, it’s not a matter of speculation or analysis… when rates go up, bonds go down – and when rates go down, bonds go up. That’s it. Pretty simple right?

Well, it makes you wonder then… why is it that so many investors owned bonds this past few years as interest rates were almost sure to rise (and man… did they rise!), and as a result they stood by and watched the “safe” portion of their portfolio get vaporized in less than three years?

Let’s take a glimpse at reality…

The above chart is a snapshot of the iShares U.S. Aggregate Bond ETF (AGG), which is a good representation of the overall bond market here in the U.S.

I start with this chart because it’s taken a milder beating than most bond investments out there, but being down -18% or more in what we’ve been taught is a “safe” investment over a three year period? No bueno.

As you can see today, a quick glimpse at this chart tells us that the bond market overall is printing lower-highs and lower-lows… the epitome of a downtrend.

2/ Corporate Bonds

The next chart is a look at corporate bonds, so we’re drilling down into different bond sectors now. Not much different here, is there? Again… higher rates = lower bond prices.

Similar to the AGG chart above, we can clearly see lower-highs and lower-lows (again, a downtrend in my book), but what’s worse here? Corporate bonds have been down more than -30% since their post-COVID peak. Ugh… that’s rough.

3/ Treasury Bonds

Alright, alright… maybe I’m not being fair. Surely United States Treasury Bonds are safe, aren’t they? I mean, they’re backed by the full faith of the U.S. government, so how bad could they really be?

Short answer: Bad.

Long(er) answer: All I see here are lower-highs and lower-lows (again), but worse yet, if you’ve held onto bonds since the post-COVID peak, this portion of your portfolio is down approximately -45% (FORTY-FIVE PERCENT!!!). <sigh>.

4/ The Bottom Line

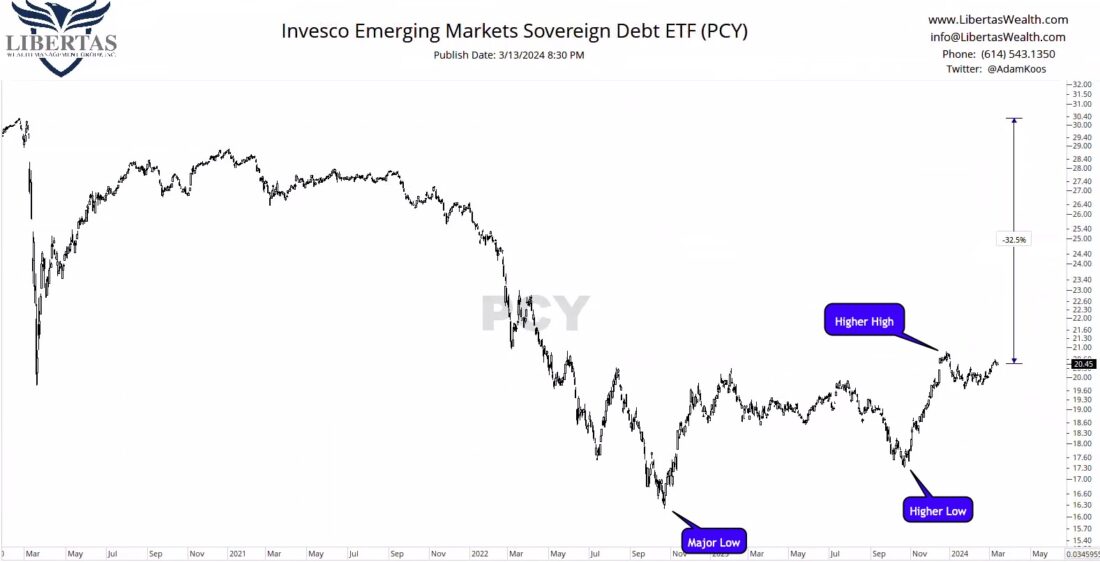

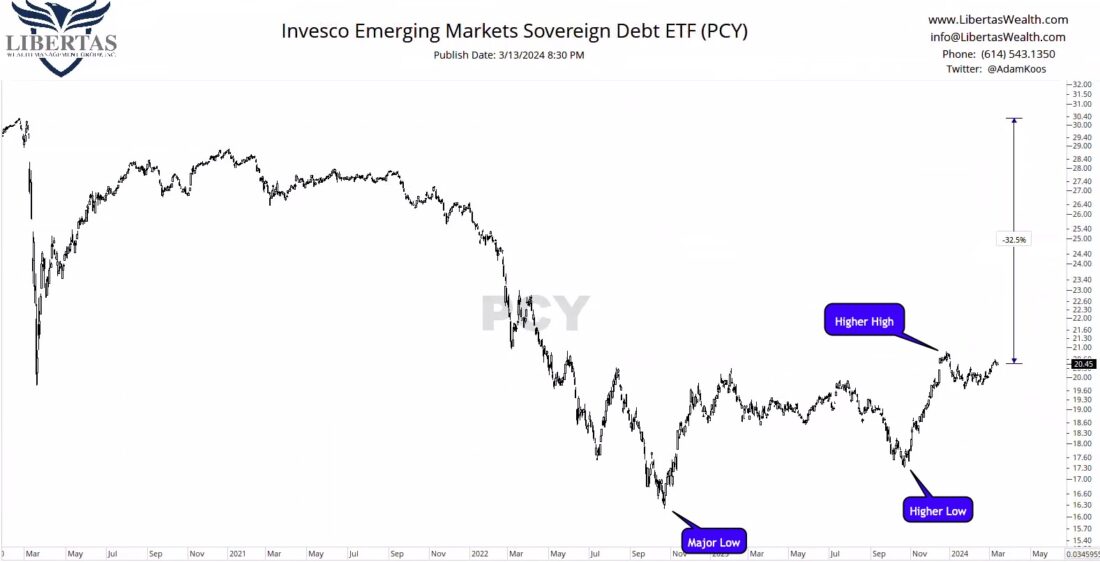

Enough is enough – isn’t there something in the bond market that doesn’t look and smell like, well… you know?

There are a few bond sectors that are showing some life, however, that doesn’t mean bonds are out of the woods yet. As you can see above, this chart of International Sovereign Debt is actually printing higher lows and just this year, printed a major higher-high, so perhaps this is a glimpse into “hope” for the bond market turning around, possibly later this spring or summer.

Could it be turning around soon as a result of the Fed pausing interest rates (or even cutting rates in the near future)? Possibly… but at the end of the day, until bonds “prove themselves” to me, they’re going to remain a no-touch in my book.

—

Originally posted on March 14th 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.