Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

A New Leadership…

Out of the four sectors leading the market, two have already broken out of their consolidation structures on their weekly equal-weighted charts and have reactivated the uptrend. However, the other two (Communication Services & Financials) have not yet done so.

If things continue as they are, it seems likely that the next breakout will come from Financials and Communication Services. If this materializes, it would indicate that the healthy rotation process is still in place.

The overall sentiment among investors remains above its historical average, according to the latest weekly survey by the American Association of Individual Investors, reflecting the market’s persistent optimism.

2/

Industrials Candidates

Advanced Drainage Systems, Inc., a company dedicated to manufacturing water management products and drainage solutions for use in the construction and infrastructure market, has reached a new 52-week high, breaking out of the price range it had been oscillating within since 2021.

The stock has recently maintained positive performance compared to the market, the sector, and the industry. Characteristics of a leader.

3/

Communication Services

From the Communication Services sector, we bring two candidates. The first of them is Go Daddy, Inc., a company that provides website creation, hosting, and security tools.

The stock has recently broken out of the price range it had been oscillating within since 2019, and session after session, it has been setting new highs. The stock continues to outperform positively compared to its peers within the industry and the sector.

The second candidate is Walt Disney Co., which has reached a new 52-week high, and its price has closed the session within an important resistance zone for the past year and a half.

The stock does not yet meet all the criteria of a total leader, but it is on its way, leading the industry and the sector. The only thing lacking is industry leadership within its sector. However, undoubtedly, the stock is at an interesting point to observe and evaluate if it finally manages to surpass the $120 zone.

4/

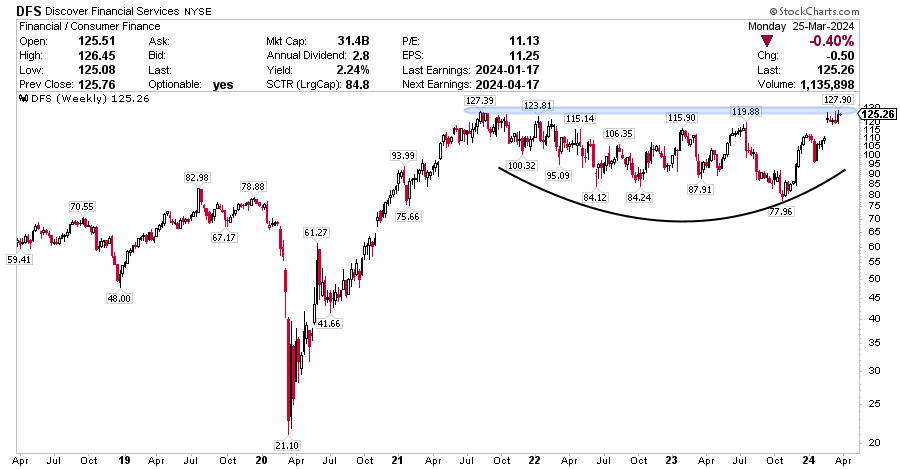

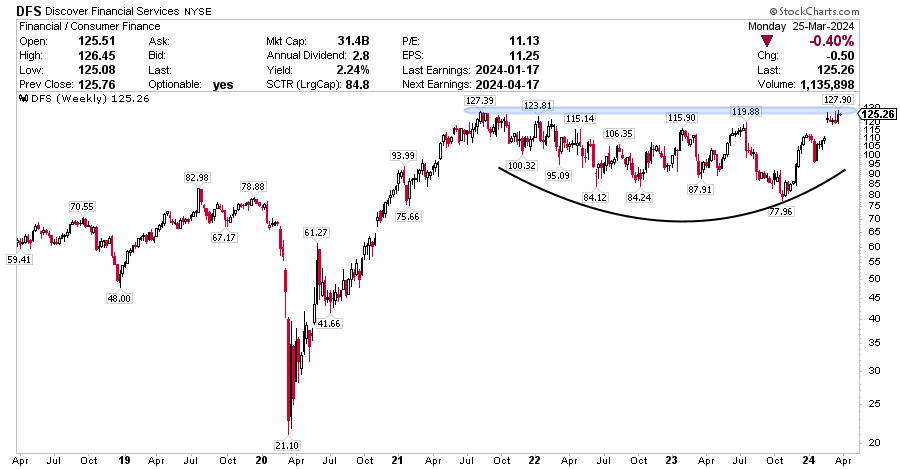

Financials

The candidate from the financial sector is Discover Financial Services, a holding company operating in the digital banking and payment services segments, which could be acquired by Capital One Financial.

The stock price has formed a multi-year base after reaching a peak around mid-2021, and following the announcement of the potential merger, it has returned to peak levels.

A crossover above this could represent an interesting opportunity, with a very favourable risk profile, for a company that has favourable performance within the industry and within a sector that has been gaining ground in the market.

—

Originally posted on March 24, 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.