Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

European Stocks

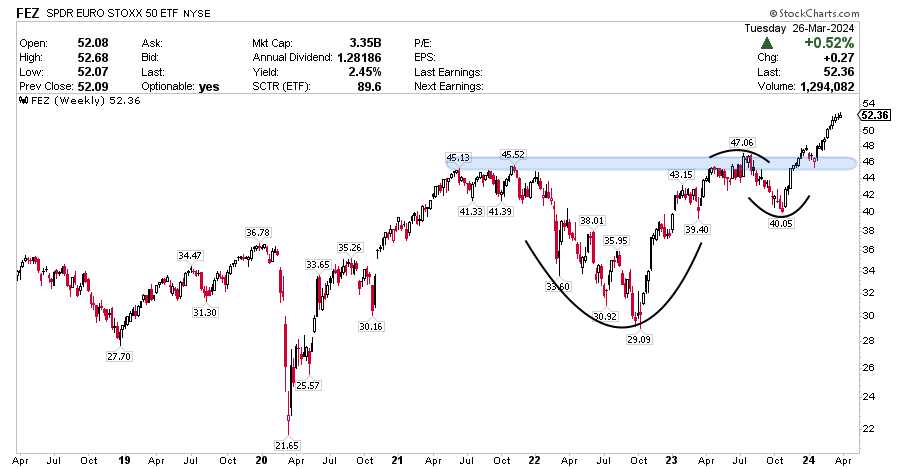

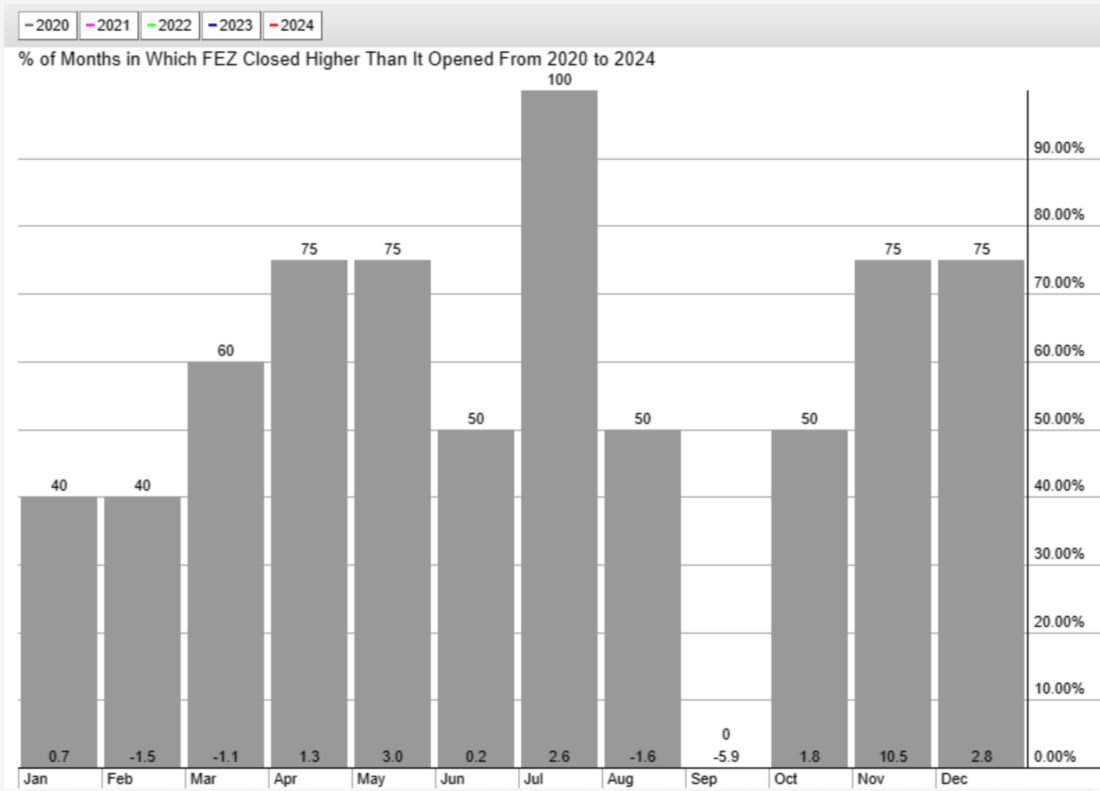

The European stocks continue to soar, as evidenced by the ETF FEZ, which holds the 50 largest companies in the Eurozone.

The ETF has already accumulated just over +26% in the last 6 months and, having surpassed the multi-year resistance at 45, it seems to still have room for growth.

There are two possible immediate targets, based on the Fibonacci retracement, drawn from the resistance to the low of late 2022 and another from the base distance. The first would be around $55, while the second would be around $65.

To try to assess which of the two scenarios would be more probable, we have looked at the FEZ seasonal chart over the past 20 years. The results have shown that the most profitable months have been April, July, and December. So it seems that both scenarios could be very feasible, considering that April is just around the corner.

Will we see a repeat this year of positive April for European stocks?

2/

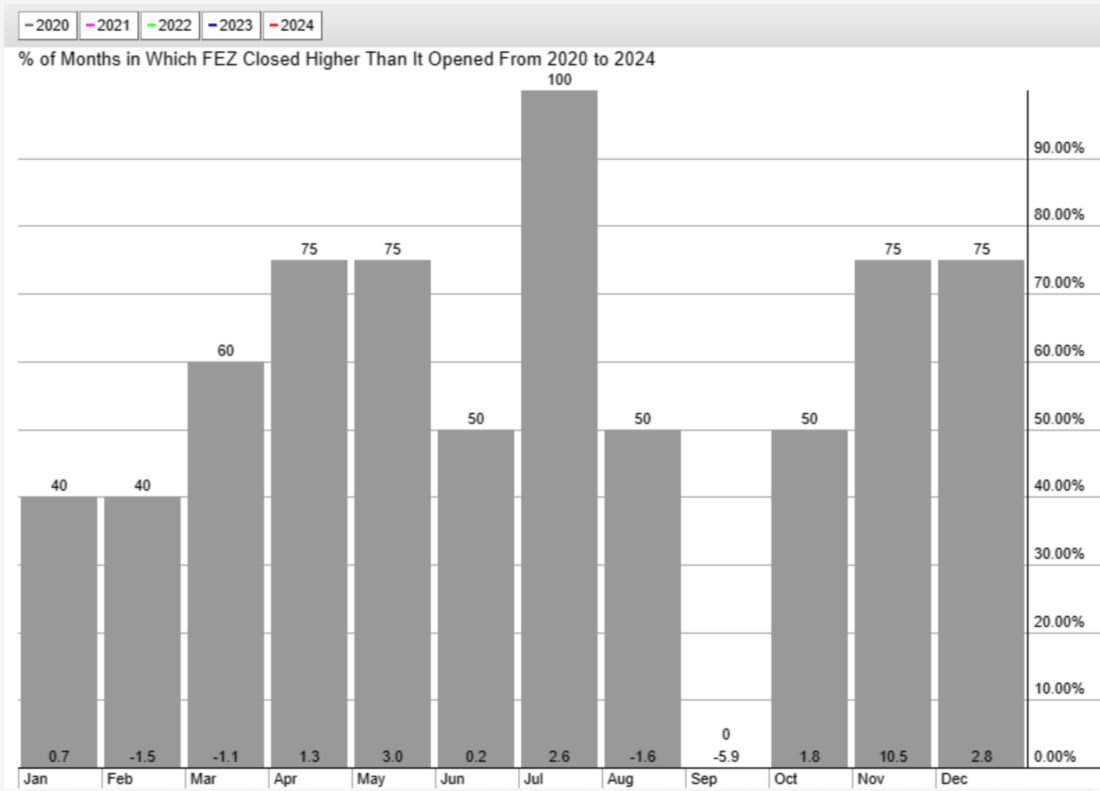

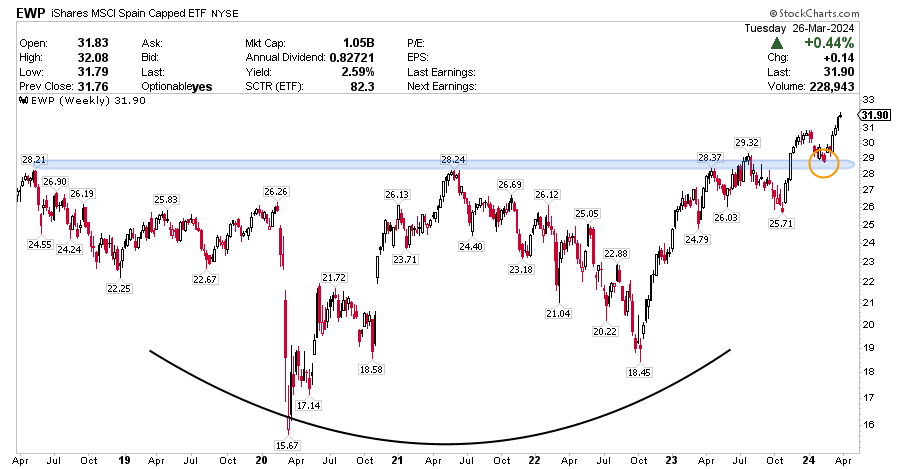

EWP (Spain)

EWP tracks an index of Spanish companies weighted by market capitalization. It covers 85% of Spanish companies by market capitalization. And its share price is reaching 2008 levels.

After overcoming the resistance level and retesting, the ETF has closed 3 weeks in a row in positive territory and has gained almost +10%.

We will keep our eyes open to see if we finally go for new all-time highs or, on the contrary, if we will stay within the huge multi-year range and look for support levels again.

3/

The New Luxury?

This year’s most bullish commodity continues to break records. Cocoa is leading the way in commodity price increases, far ahead of the rest: the price of the bean is up 135% so far this year and has just broken $10,000 per tonne for the first time in history.

The world cocoa price is up 110% compared to last Easter and almost three times higher (174%) than in 2022.

Cocoa prices have skyrocketed over the past two years and earlier this year we saw an increase of over 10% in a single week. Unfortunately, for chocolate lovers and families buying Easter eggs, this will translate into significant price increases in stores and supermarkets.

The price rise has led the agricultural resource to exceed, for the first time since 2003, the prices of one of the most coveted industrial metals at the moment, due to its importance in the development of electric vehicles and charging networks: copper.

4/

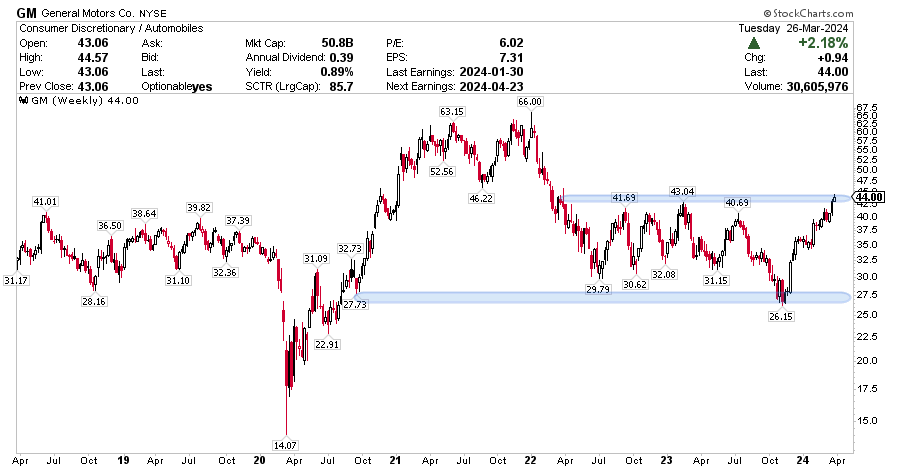

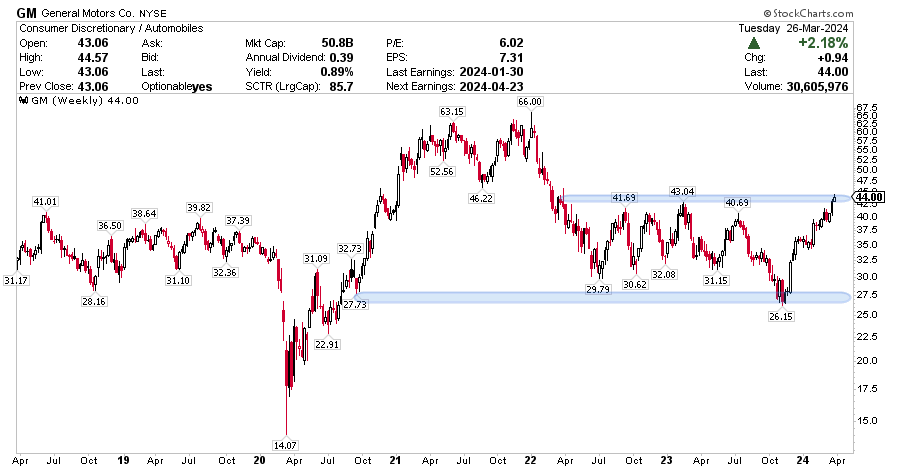

General Motors

The auto company has already accumulated just over +37% in the last 6 months and has reached the $45 area. This resistance zone has kept the price at bay since 2022.

A cross above this zone would put the $66 (All Time High) level back in play, with an entirely favorable risk profile. If, on the other hand, price were to fail to find sufficient demand above this zone, $34 would again be the next target.

—

Originally posted on March 27, 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.