1/ Argentina

2/ YPF S.A

3/ Interest Rate Cut

4/ And Still…

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/ Argentina

The Argentine market continues to offer interesting opportunities, both individually and collectively. It has been on the rise since mid-2022.

The positive momentum following the election of the new president has been sustained and looks set to continue, at least in the short-median term.

ARGT, an ETF that offers exposure to the Argentine stock market, set a new all-time high during today’s session.

After breaking the huge multi-year base, the price has grown by just over 50%.

2/ YPF S.A.

Argentina’s YPF SA, a company engaged in the exploration, production and distribution of oil and gas, has reached a new 52-week high. The price has reached levels it has not seen since 2019 and accumulated already, just over +600%, after bouncing off the 2020 lows.

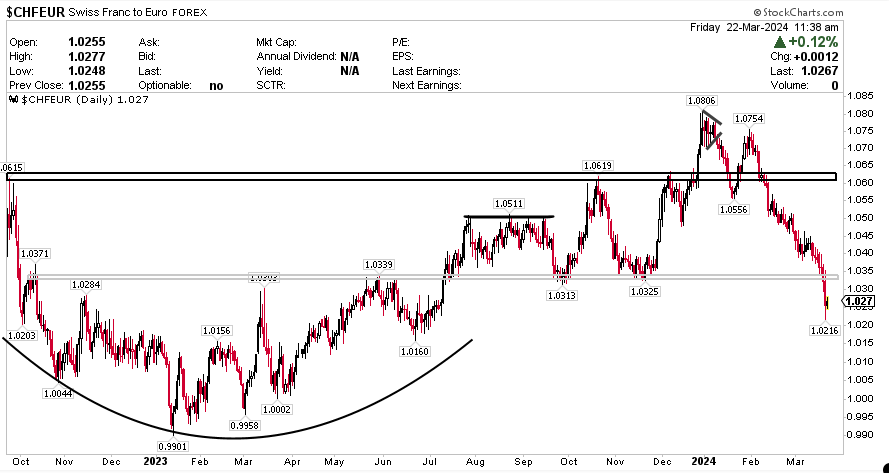

3/ Interest Rate Cut

The Swiss franc fell sharply against the euro and sank to its weakest since July 2023 after the SNB unexpectedly cut rates.

The Swiss National Bank cut its main interest rate by 25 basis points to 1.50%, becoming the first major central bank to reduce the tightening of its monetary policy to tackle inflation. This is the Swiss central bank’s first rate cut in nine years. Most analysts polled by Reuters had expected the SNB to maintain rates.

4/ And Still…

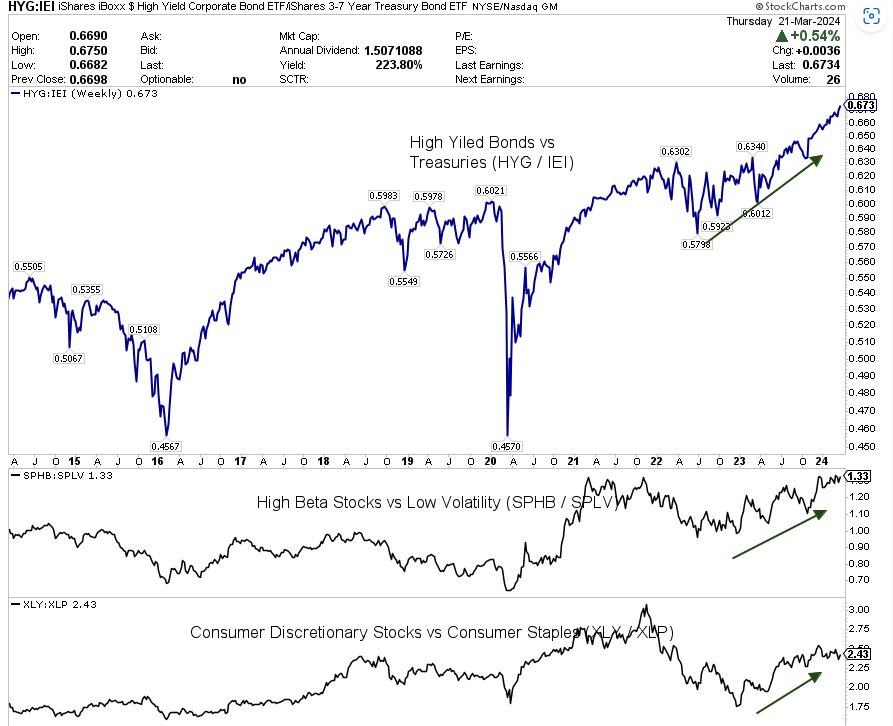

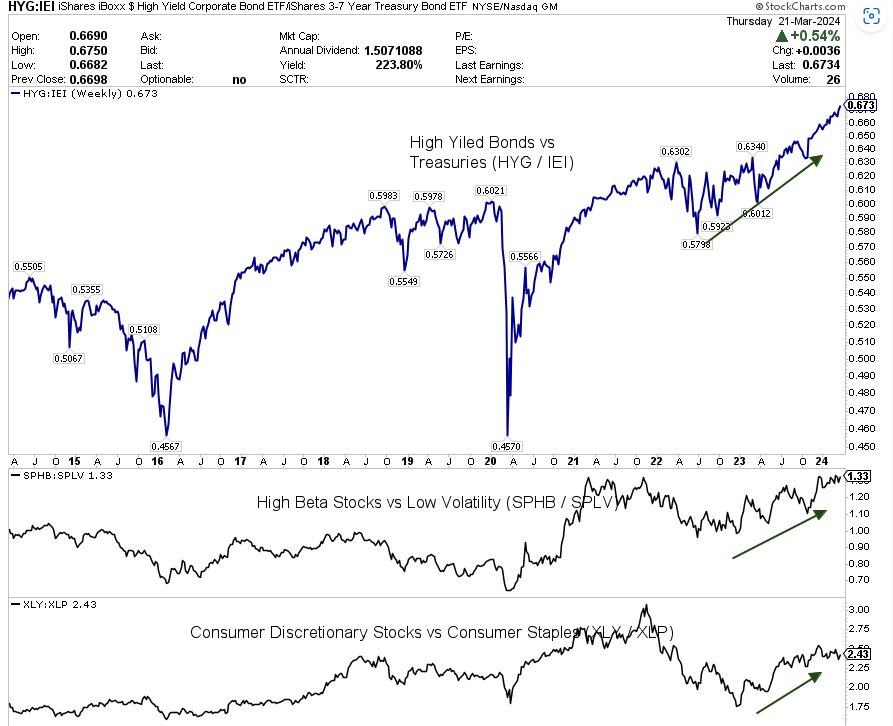

The appetite for risk in the market continues to gain strength.

The rotation between sectors continues and it maintains the bullish rally in the markets. Although some analysts continue to wait for a downturn, the truth is that investors’ appetite for risk is growing, and the defensive sectors won’t be the ones to benefit the most from this.

The rate of the trends in the graph show no signs of deterioration, but when they do, we can begin to take a more defensive posture. In the meantime, it’s time to go on the offensive.

———

Originally posted on March 22 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.