1/ Sweet Breakout

2/ Gold Points Higher

3/ Looking for Risk

4/ Biotechs Fall

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/ Sweet Breakout

Gasoline futures not only reached new 52-week highs today but also reached levels not seen since 2011. This marks their 7th attempt to cross above the 26-point threshold, which has acted as a resistance level for slightly over a decade.

Currently, it remains above this zone and, if the trend initiated after Covid pandemic continues, we might witness the price revisit the highs of 2011.

2/ Gold Points Higher

The precious metal is having another positive week and has finally broken out of its technical structure. Unless there are significant changes tomorrow, Friday, gold will be concluding its second week with gains exceeding 2%.

Looking at the chart, it’s evident that the critical level to surpass is around 195. Around this level, we’ve witnessed three unsuccessful attempts to push the price to higher levels. Will gold finally manage to break the multi-year support base that the price has been forming for slightly over three years?

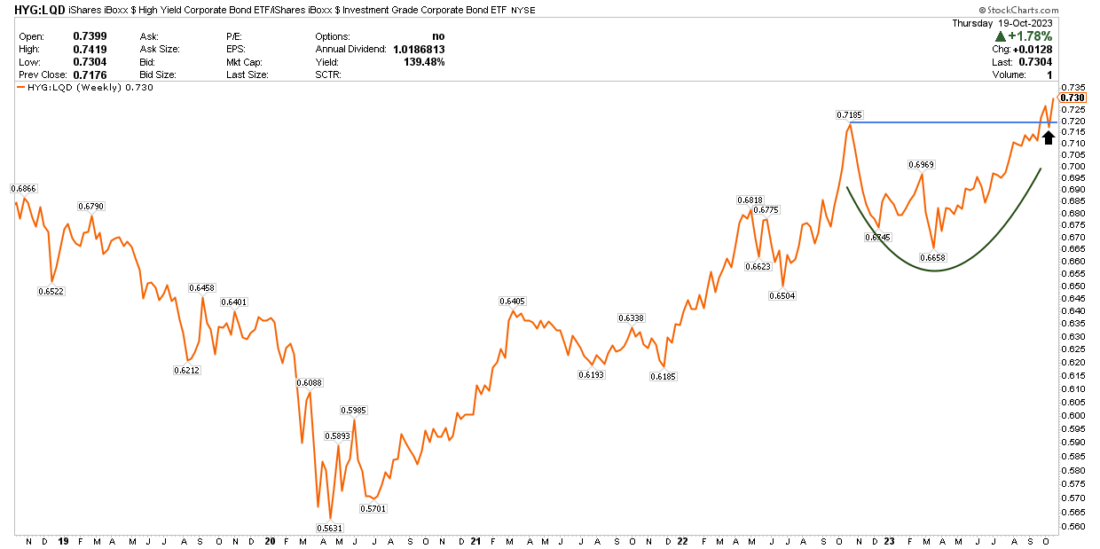

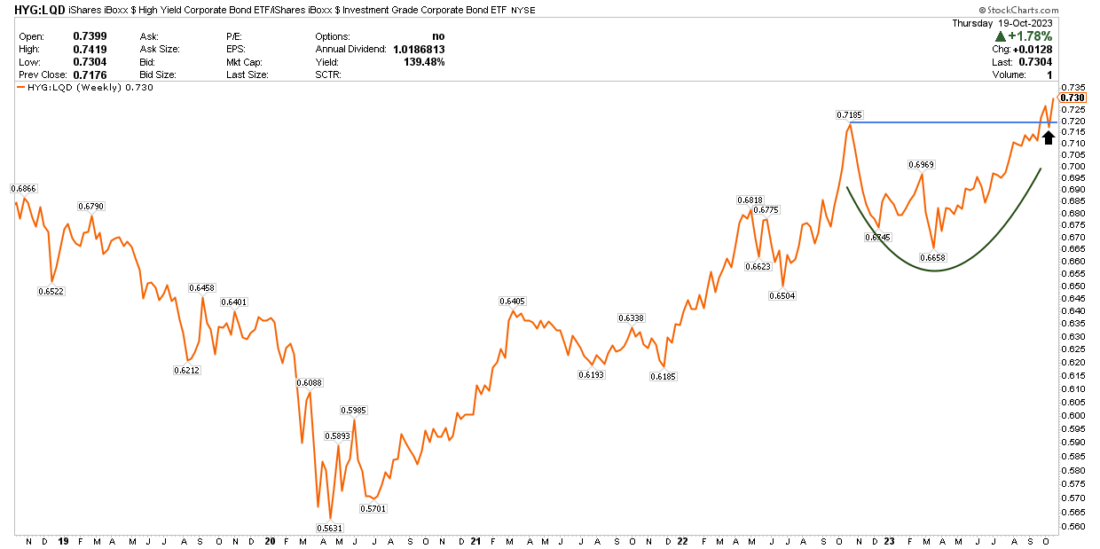

3/ Looking for Risk

The ratio comparing the yields of high-yield corporate bonds to investment-grade corporate bonds, which serves as a proxy for measuring risk appetite, is reaching new highs. As interest rates rise, investors are still searching for fixed-income investment opportunities.

Thus far, defensive postures are not in sight; rather, the ratio, which has been increasing since the second quarter of the year, has retraced to the highs of 2022, gathering strength for its journey into uncharted territory.

4/ Biotechs Fall

The biotechnology industry is not experiencing its best phase, and this trend has persisted since 2018. The index monitoring this industry within the S&P 500 appears to be undergoing a distribution phase, with a decline that began in early 2021.

With just one day remaining in the week, the index is reporting losses of nearly 4% and has hit 52-week lows today. A potential Head-Shoulders technical pattern is taking shape. I use the term ‘possible’ because confirmation will only occur if the price crosses below the neckline, situated between 5000 and 4900.

—

Originally posted 20th October 2023

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.