1/ Presidential Election Cycle

2/ Looking at Specifics

3/ The Theory’s Limitations

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/ Presidential Election Cycle

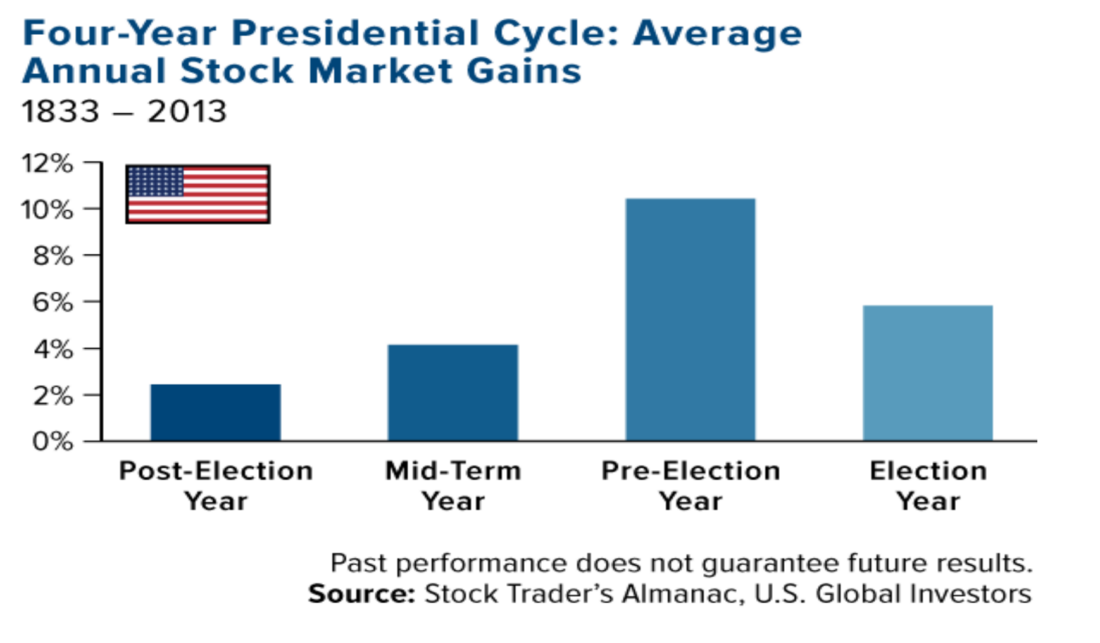

We are just one year away from the next US presidential election, a cycle that many sources tell us has bearing on the market. Last year finance expert Jennifer L. Cook wrote an article explaining just what the Presidential Election Cycle means for trends. Cook tells us that, “According to this theory, U.S. stock markets perform weakest in the first year, then recover, peaking in the third year, before falling in the fourth and final year of the presidential term, after which point the cycle begins again with the next presidential election.”

2/ Looking at Specifics

The theory was originally developed by Stock Trader’s Almanac founder Yale Hirsch, and perpetualed by his son and successor Jeffrey Hirsch. In 2021 Hirsch posted some of the data for our current presidential cycle, finding it to be in line with what he expected from the modern cycle.

In an interview with The Wall Street Journal in November 2019 (one year away from the last US presidential election) Hirsch explained that “the third year—this year—of the cycle is when things are good. First years and midterm years used to be when all major wars and bear markets seemed to occur, but they have been getting stronger. But the real strength is in the third year, as we are seeing with our own eyes right now.” He then expands on the fourth-year factors, saying that “the power of incumbency is critical. You have a president campaigning from a bully pulpit, pushing to stay in office, and that tends to drive the market up.”

3/ The Theory’s Limitations

Though there is strong data to support the Hirschs’ theory, there are many factors at play that give people pause. In her article, Cook calls the theory’s predictive ability “mixed” and says, “the direction of stock prices hasn’t been consistent from one cycle to the next.” Similarly, WT Wealth Management’s Chief Investment Officer John Heilner published a paper on the matter that said, “When considering Presidential Election Cycle theory, it’s likely more accurate to say that the relationship between the President’s actions (or inaction) is coincidental when it comes to financial markets,” and warns that it may be mere correlation at play. That doesn’t negate the case for the theory however, and both Cook and Heilner make a point of admitting the consistency of third-year highs.

Heilner goes so far as to say, “a prudent investor wouldn’t bet against repeatable patterns either and should consider the Presidential Election Cycle.” Though we wouldn’t call it the be all and end all, well researched investors agree that the Presidential Election Cycle Theory is something worth taking note of.

—

Originally posted 6th November 2023

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.