Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/ VIX Remaining Low

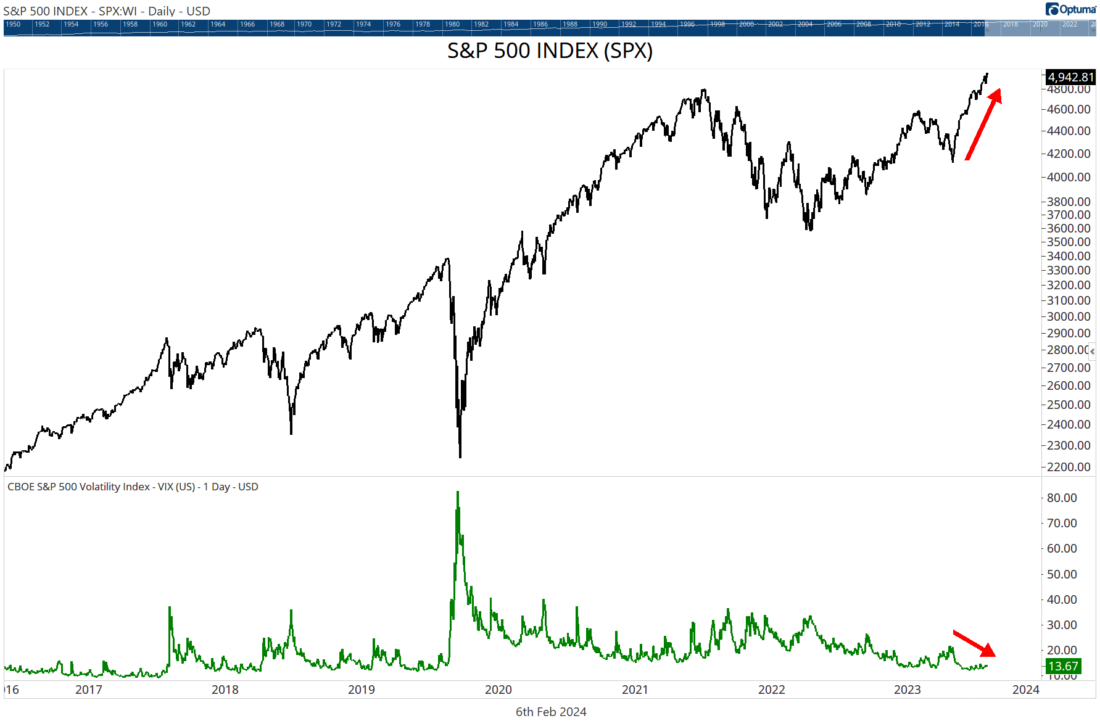

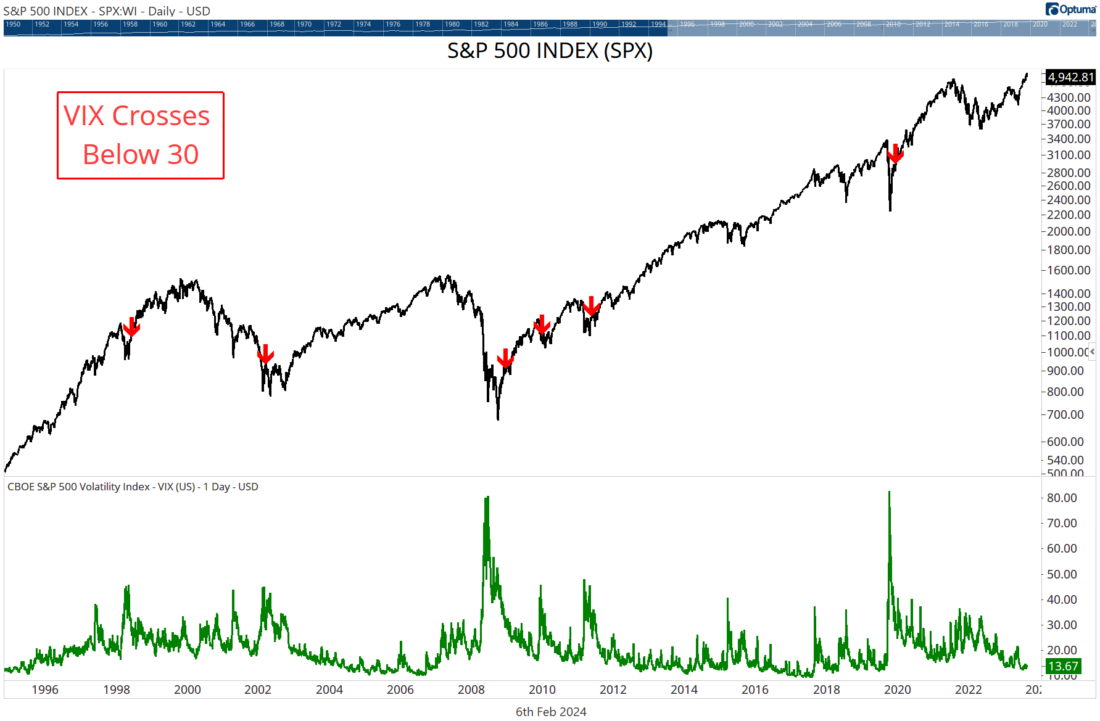

Despite all that is going on in the world (wars, inflation, natural disasters, & Taylor Swift’s latest album), Stock Markets around the world have just continued on their merry way seemingly oblivious to everything. Confidence is so high in the stability of the market that the VIX is continuing its general downtrend and is now approaching all time low levels.

Remember that the VIX is a measure volatility based on 30-day Options. When “old” funds cannot sell because of the tax that sale would attract, they add Put Options to their portfolio to hedge against the risk that the market will fall. It is the increased buying of Options that causes the VIX to rise.

The low VIX values tell us that there are not a lot of options being added to Portfolios right now (it’s a little more complicated than that, but the general principle holds). You can see quite clearly in Chart 1 that the trend of the S&P500 is up while the trend in the VIX is down.

2/ Low VIX Expectations

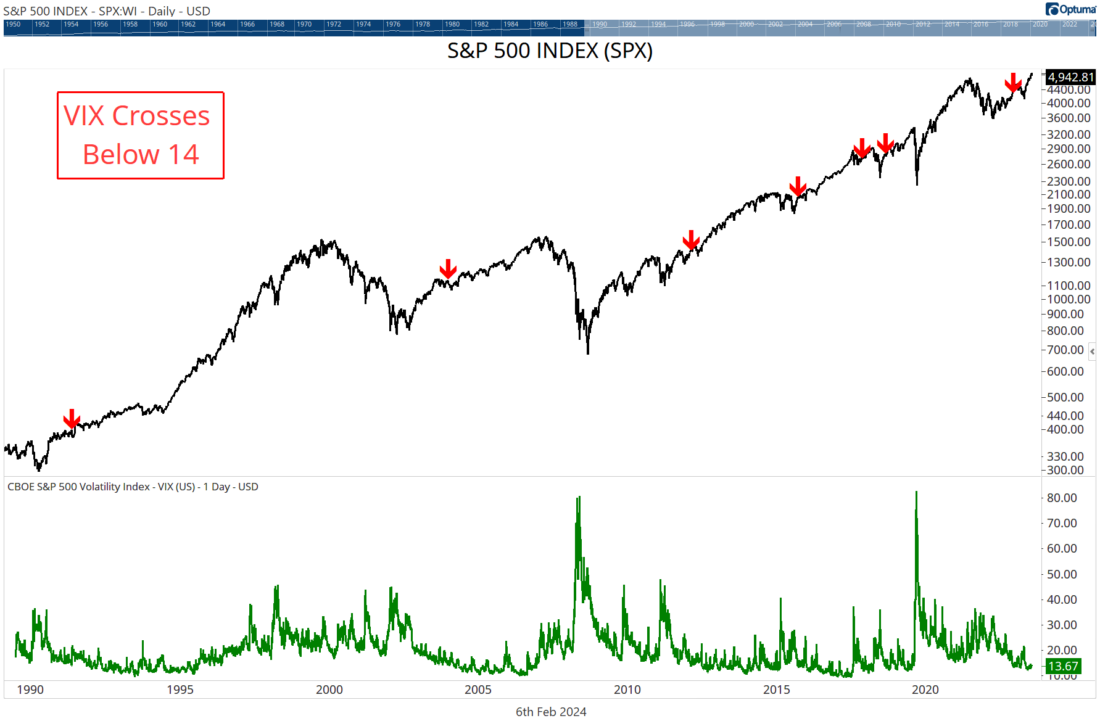

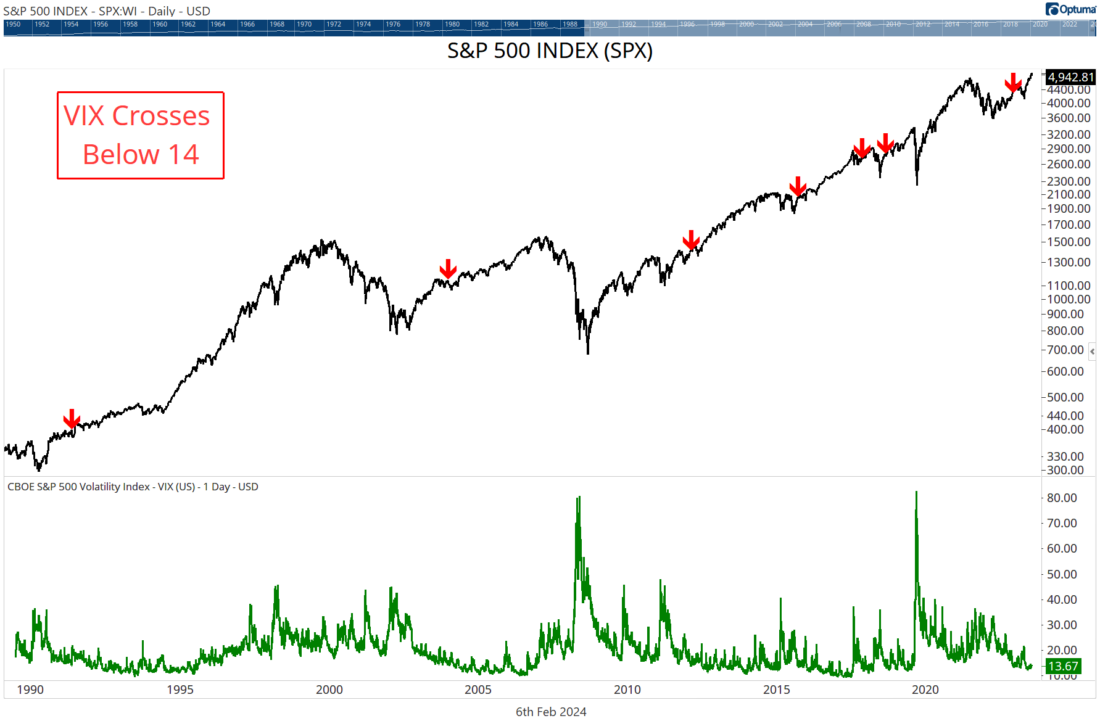

What can we expect from this environment of low VIX? Well, one thing is for sure, at some point in the future we’re going to have a spike in VIX as the market falls again—that’s inevitable. But we have no idea how long that will be away. This is when we look to history to give us a guide (not a prediction).

It is always interesting to look at the past to glean some idea of what we can expect in the future. When VIX falls to low levels, what can we expect?

In the short term, the signs are looking good for Stock Markets, values are increasing, volatility is falling, interest rates are also falling (or at least holding steady).

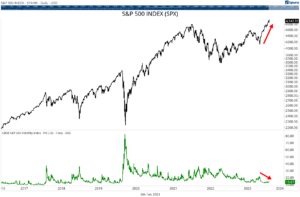

In Chart 2, I’ve added arrows to all the times that the VIX had been above 30 and then crossed below 14 for the first time. Just by looking at the chart you can see that it’s a nice signal that gives us confidence in the short-term outlook.

3/ VIX is Not a Sell Signal

You may, like most people, be tempted to think about the VIX in terms of a sell signal. Eg, when VIX spikes, SELL! Yet I’m presenting it as a Buy (or at least Hold) signal.

We’ve done a lot of quantitative testing on this, and we cannot find a single scenario where selling on rising VIX works.

The problem is that the Option buying is a reaction to a fall in price. So the spike in the VIX happens after the fall in the S&P500 and by then, it’s too late to sell.

4/ A Better VIX Signal

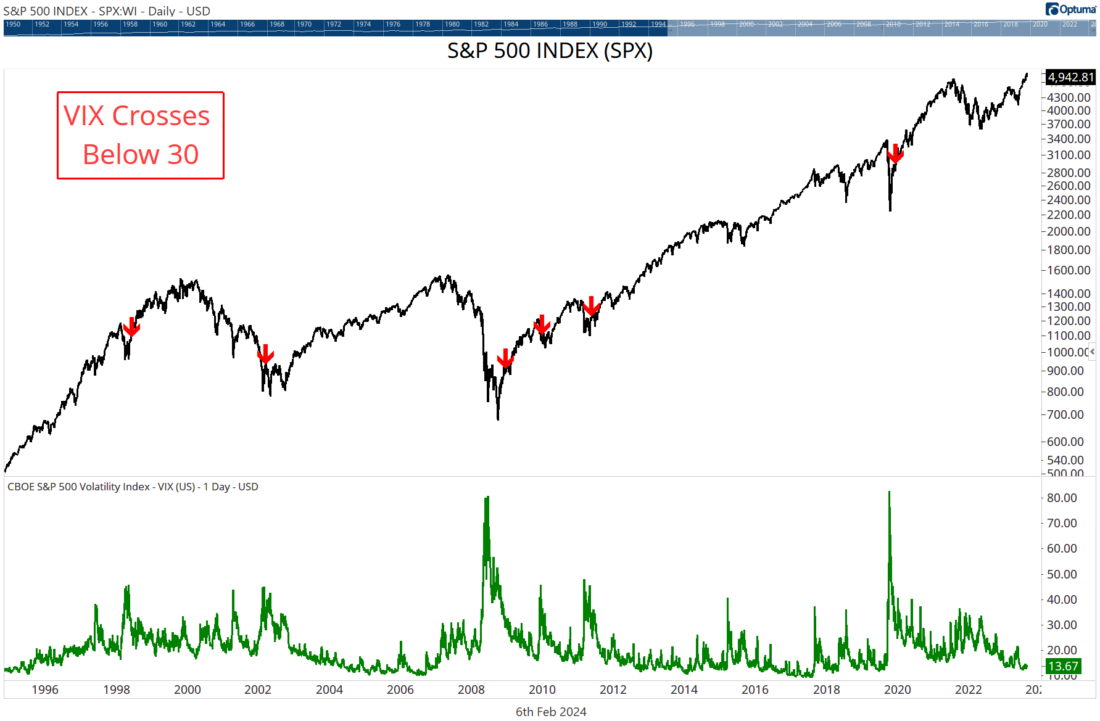

While we can find no suitable quantitative signal on rising VIX, there are some interesting Signals on falling VIX that you should lock away. It may be a few years before you can use these ones.

Firstly, we can use the VIX above 25 as a filter. When it’s above, we turn off any long equity strategies and look for Shorts. When it’s below, we turn back on our long equity strategy. So rather than being a “Sell” signal, it becomes a “Don’t Buy” signal.

Secondly, When VIX rises above 45 (major panic) and then Crosses Below 30 as things settle down again, we get the signals you can see in Chart 3. They don’t happen often, and we can see in 1990 and 2000 there was still some downward movement after the signal, but how many times have you wondered when is the right time to get back into Stocks after a major crash? This VIX signal is something you should pay attention to.

—

Originally posted February 7th 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.