1/ Value Index Peeking Out of Burrow

2/ Materials Make a 2-year High

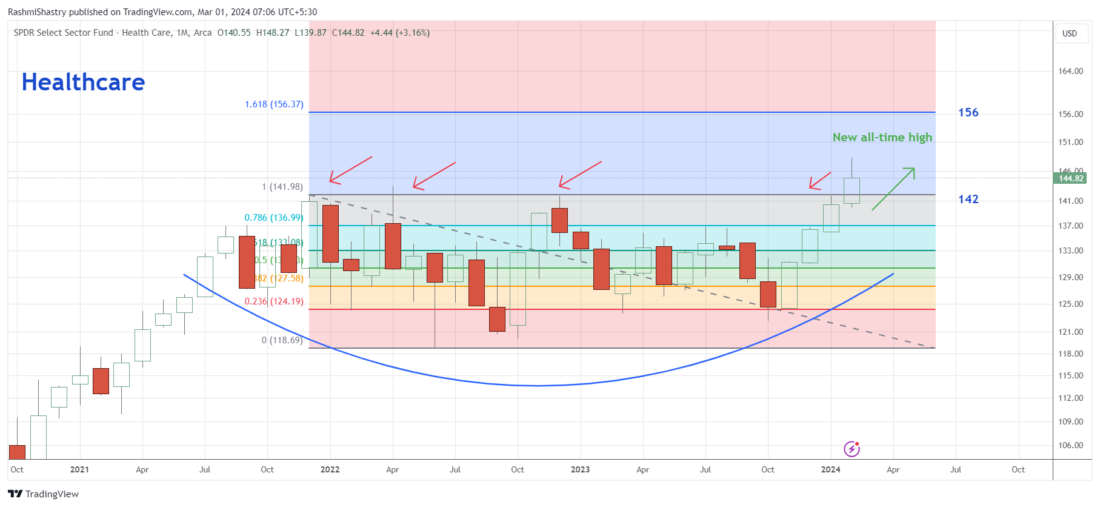

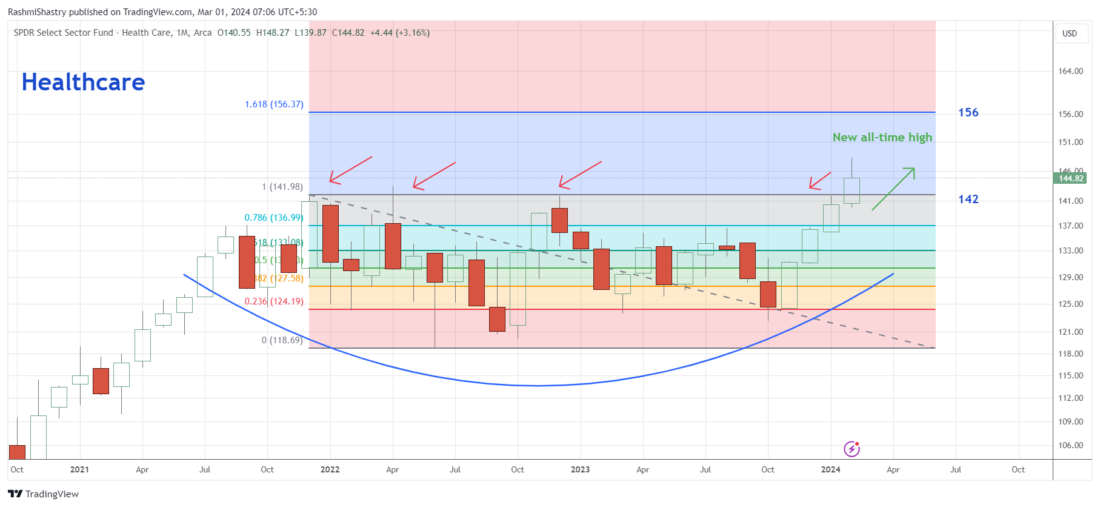

3/ Healthcare Poised for Greater Gains

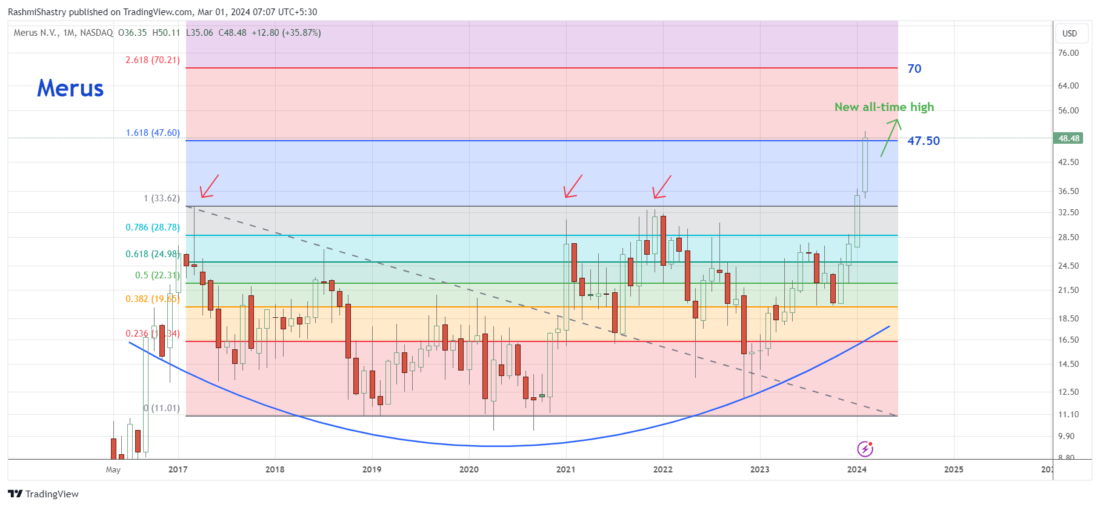

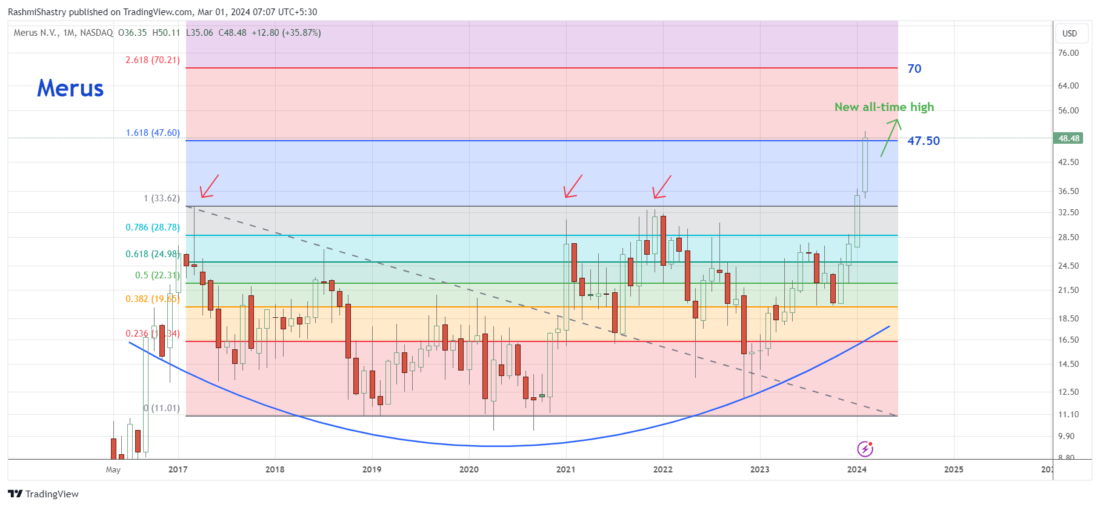

4/ Merus Sprinting Away

5/ JP Morgan Holding Down the Fort

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/ Value Index Peeking Out of Burrow

Analyzing the market involves going through multiple charts to identify strength or weakness indices, sectors, market capitalization, category, sub-category and so on. One chart that is among the list mentioned is the Growth vs Value ratio chart. Regardless of time horizon, risk profile, goals, and style, one must be aware of WHAT is moving the market.

Although the Growth is absolutely crushing Value at the moment and making new monthly all time high (you’ll have to take a look at IWF/IWD on your portal), the Russell 1000 Value ETF seems to be attempting to get out of hibernation. The index has broken out of its sideways consolidation of over two years and closed above the overhead supply zone of 170, on the monthly chart. For that matter value stocks like Berkshire Hathaway, JP Morgan Chase have been doing great! Growth areas such as Tech on the other hand, have certainly weakened. Value sectors typically tend to be financials, industrials, materials, energy. And there are some very good examples of strong bullish trends in these sectors.

If this breakout holds its ground, the IWD could be headed to the next resistance zone of 190, but it’s crucial that the price trade above the 170 for that to play out.

2/ Materials Make a 2-year High

XLB is the Materials sector that is now breaking out of a close to three-year base of a sideways trend. As can be seen in the chart, multiple attempts were made to break above the supply/resistance zone of 86.50, with two false breakouts.

Monthly charts give us a good perspective of the price move by leaving the noise out. We can see that since May 2022 the price hasn’t been able to break past the breakout level, let alone cross it. Incidentally, Materials has been the biggest gainer this week with 1.44% and the third biggest gainer this month with 5.60%.

It is imperative for the price to hold above 86.50, not just from the breakout perspective but also from the perspective of absorbing all the supply available at this level. History is evidence that the price has found it difficult to stay above this level consistently. But if it does, the next resistance to track will come in at 92.50.

3/ Healthcare Poised for Greater Gains

We have been speaking of the strength coming through in Healthcare and Biotechnology. We now have a confirmation of the same on the monthly chart. The price has closed above the resistance zone of 142, opening up to the next level of target close to 156.

With more participation coming through from sub sectors within this sector, it will be interesting to see which group takes the price forward.

4/ Merus Sprinting Away

Within the Healthcare segment, Merus has been a strong performer over the past few months, closing in the green for the fourth consecutive month.

The price has now moved past the 161.8% Fibonacci level at 47.50. With a sustained move, the next target to track could very well be 70. The price broke out of a sideways consolidation pattern and displayed more strength with a strong bullish candlestick in the month of February.

5/ JP Morgan Holding Down the Fort

When you spend enough time in the market (or listen to enough wise people), you identify certain stocks that act as an index all by themselves. Berkshire, Caterpillar, JP Morgan Chase are all examples of one-man army indices.

JP Morgan Chase has closed the month of February in the green and with a strong breakout. When you notice that the closing price of the candlestick is near the high of the time period, make a mental note of the strength of the move in that particular move. JP Morgan Chase has breached its two-year base, moving above the breakout level of 170. Currently trading at 186, the stock is poised to move higher towards 215.

Financials are an important segment of the market. And JPM is an important part of the Financials. So if this stock is making new all-time highs, just how bad could things be? When the strongest members of the sectors are performing well, the health of the market is definitely not questionable. Sure there is always sector rotation to watch out for, but these tell-tale signs coming through are important indicators of the market move.

———-

Originally posted on March 1st 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.