1/ Clusters of 1% Gains

2/ More Than a Spike?

3/ Is the Dollar Topping or Digesting?

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/ Clusters of 1% Gains

The S&P 500 now is +5.2% from the most recent October low point and up four straight days. The last two four-day winning streaks (from 10/6-10/11 and 8/25-8/29) ended abruptly, with strong multi-week declines soon to follow.

There is one key difference so far this time. The SPX just logged its second straight 1% advance and its third in the last four days. We haven’t seen a cluster of big advances like this since the index registered two straight 1% advances on June 1st and 2nd, which was part of three 1% gains in five days.

That’s important to remember because June ended up being one of the best months in recent history, and it materialized after the relatively tough month of May. We’ll recall that the SPX was flat in May, but 75% of the index declined month over month (as mega-cap Tech outperformed everything).

Right now, of course, the index is trying to break the current three-month losing streak, during which 70% of its components declined each month. Thus, it would be an opportune time to leverage this bullish start.

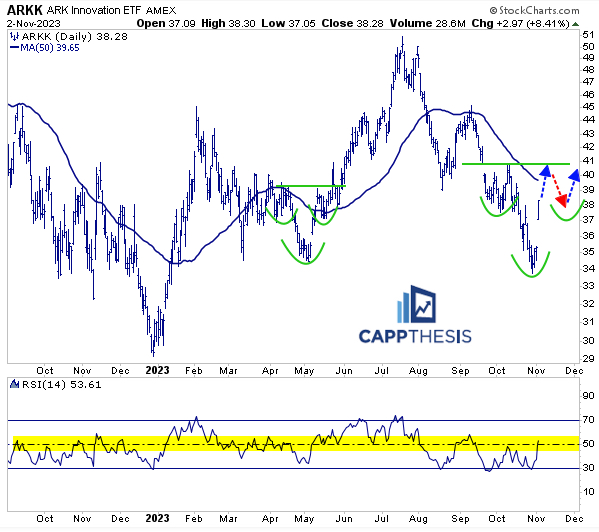

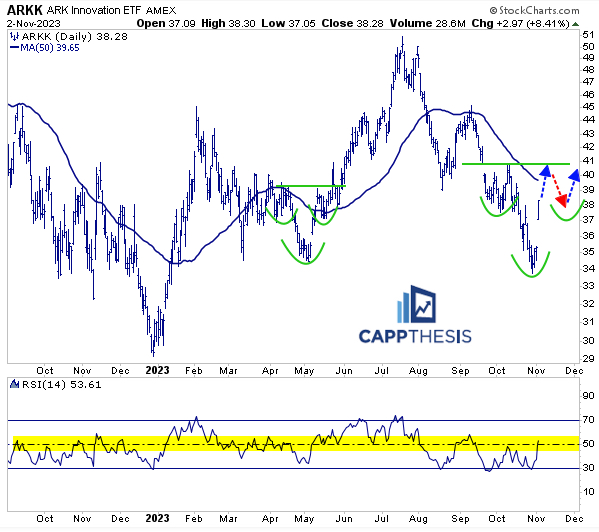

2/ More Than a Spike?

ARKK is no stranger to big moves, but on Thursday, the ETF ripped higher by 8.4%, which was its biggest advance since November 10, 2022. The question, of course, is “how much gas does it have left in the tank?”

As outlandish as it sounds, the monster move did not alter its chart structure, at least not yet. ARKK has been making lower highs since topping in late July. This is no different than many other ETFs and stocks. But we’ve seen the ETF come back before.

In fact, it rallied back from a sizable drawdown this past spring. Like now, that initial spike brought it right back to a noticeable supply zone, which it couldn’t break through right away. It digested the first up leg, formed a bullish pattern, broke out and extended higher from there.

For ARKK to extend this already big upswing again now, it would be helpful to replicate that same kind of behavior. One potential blueprint is noted below.

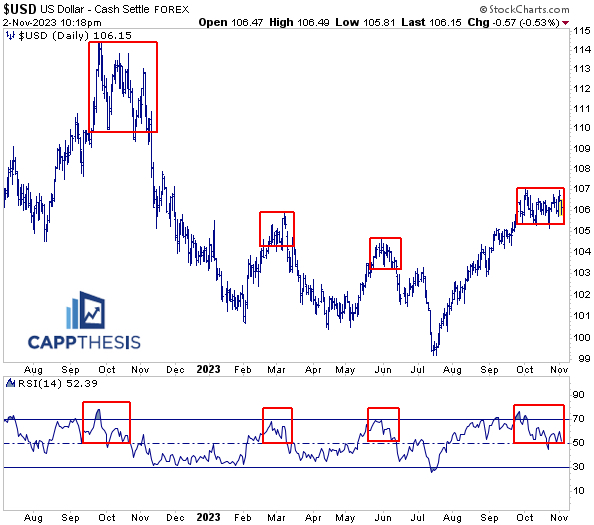

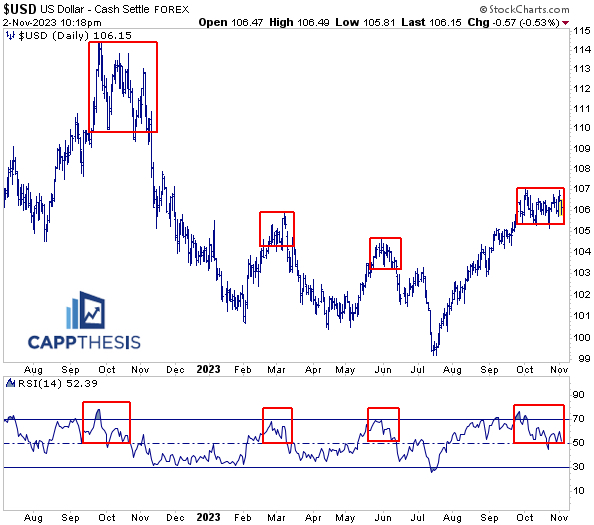

3/ Is the Dollar Topping or Digesting?

The US Dollar declined on Thursday, which helped risky assets do well across the board. If you haven’t noticed, the dollar actually has stopped going up in recent weeks. In fact, it’s now net flat since September 26th. Given what the stock market has done since then – mostly decline – we’ll need more than a continued pause for equities to continue much higher.

So, a lot will be riding on whether this slowdown in momentum actually intensifies and forces the dollar to more thoroughly reverse lower. While anything is possible, the Dollar took its time in forming a top the during the last three occasions. Sometimes that took longer and was a lot more volatile, like we saw at the end of 2022. Other times, it occurred more quickly, like what happened from earlier this year.

We also should watch the 14-day RSI closely, as the Dollar’s sell off intensified each time the indicator finally undercut the 50-threshold for good. Currently, the 14-day RSI is at 52.

—

Originally posted 3d November 2023

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.