By J.C. Parets & All Star Charts

1/ Overhead Supply Halts the Advance

2/ Defensive Stocks Catch a Bid

3/ Commodities Over Bonds

4/ Will Rising Yields Crush Gold?

Investopedia is partnering with All Star Charts on this newsletter, which both sells its research to investors, and may trade or hold positions in securities mentioned herein. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice.

1/ Overhead Supply Halts the Advance

The rally is running out of steam as the Nasdaq 100 (QQQ) is coming off its best first half in history.

As you can see, an overwhelming amount of selling pressure came in this week, rejecting prices in the $380 area:

This level represents a former high from mid-2021, making it our line in the sand for the QQQ.

If there is a place for growth to digest recent gains, this is it. We should not be surprised to see some corrective action in the coming weeks.

We continue to monitor the intermarket landscape and the recent base breakouts among tech names for insight into the extent of the potential coming correction.

For now, it’s nothing more than a welcomed pause after an explosive rally.

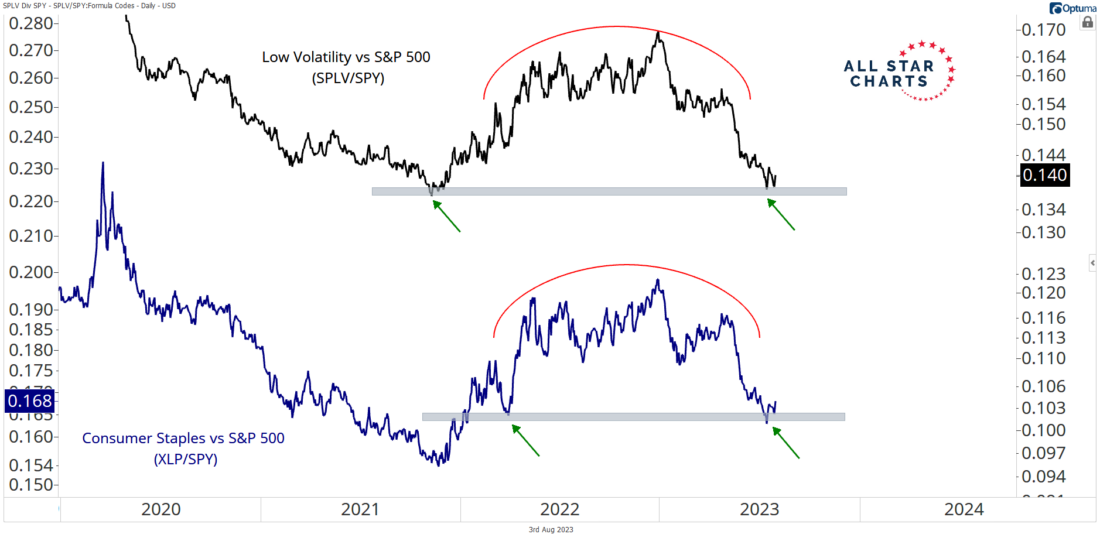

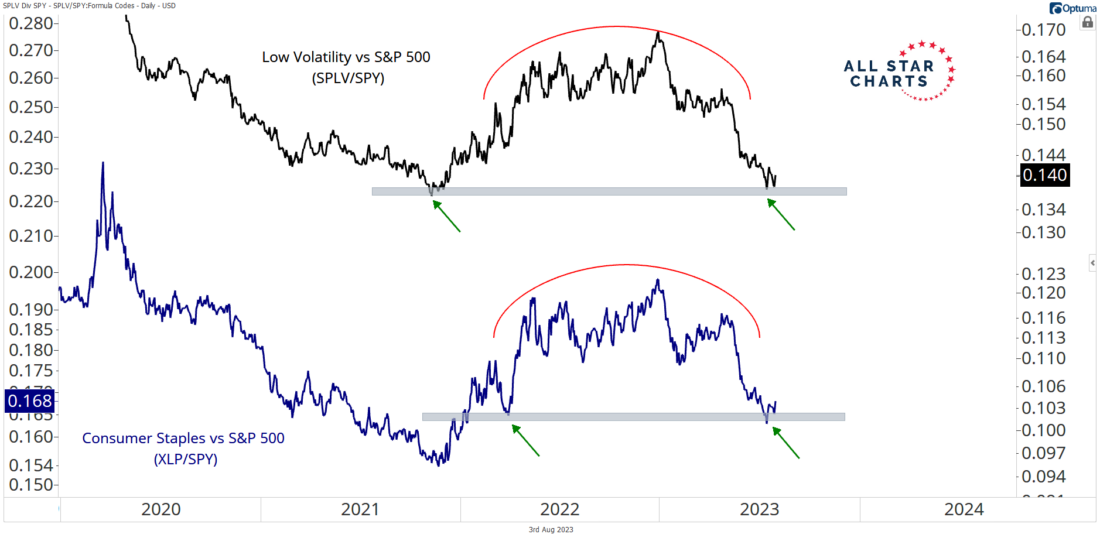

2/ Defensive Stocks Catch a Bid

When the overall market is under pressure, defensive groups tend to outperform.

As can be seen, the relative trends of Low Volatility (SPLV) vs. the S&P 500 (SPY) and Consumer Staples (XLP) vs. the S&P 500 (SPY) are testing key former lows:

If the most defensive stocks are going to start outperforming, this could be the spot to do it. If this is the case and these ratios rebound, U.S. stock indexes will likely face stiff headwinds.

Remember, price doesn’t move in a straight line. The major indexes are due for a correction.

As long as rotation continues to move down the market cap scale and into cyclical value-oriented stocks, our outlook will remain constructive despite strength from defensive sectors.

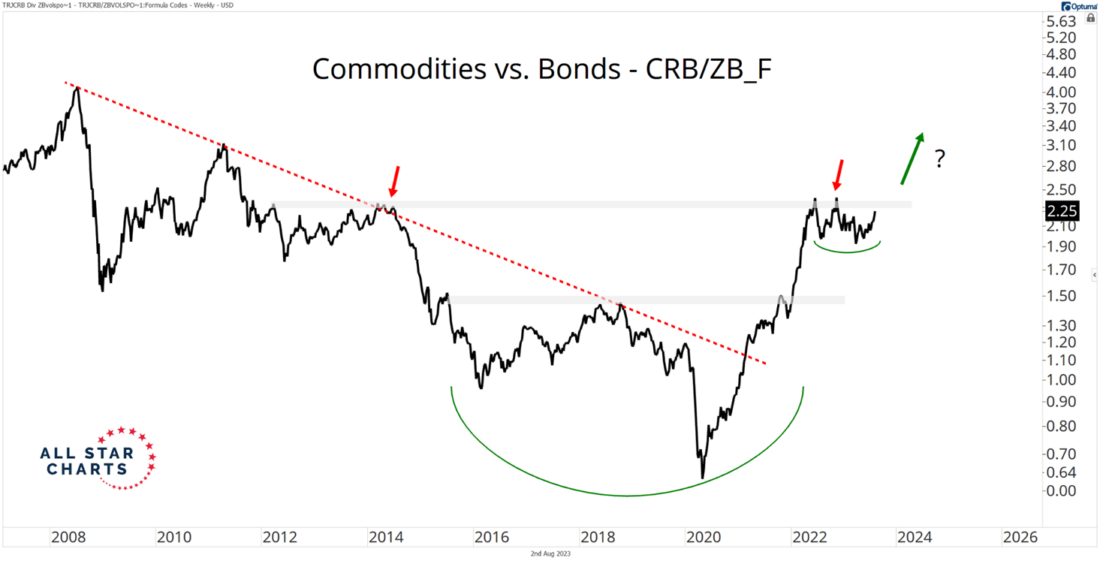

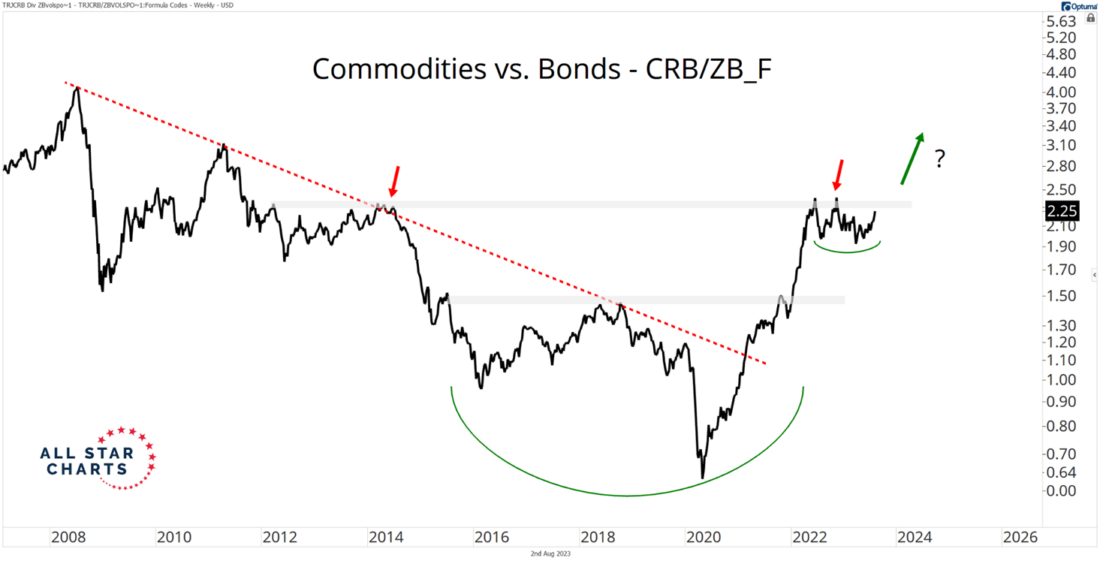

3/ Commodities Over Bonds

We consider the commodity versus bonds ratio one of the critical, and perhaps the most important, high-level intermarket ratios in our deck.

The reason: It reveals the inflationary backdrop that colors the entire market.

Notice that the commodity-bond ratio peaked in 2008 during the Global Financial Crisis, trending lower into the COVID sell-off:

Disinflation defined the decade as growth over value became a rule of thumb.

But that trend has reversed over the past few years. The ratio violated a decade-plus downtrend line, ripping higher into a logical level of supply.

After almost 18 months of consolidation, it appears that commodities are geared up to outperform as rates rise and inflation persists.

We’re monitoring “old economy” stocks or the cyclical sectors for relative strength as long as this secular trend remains intact—which could be well over a decade.

4/ Will Rising Yields Crush Gold

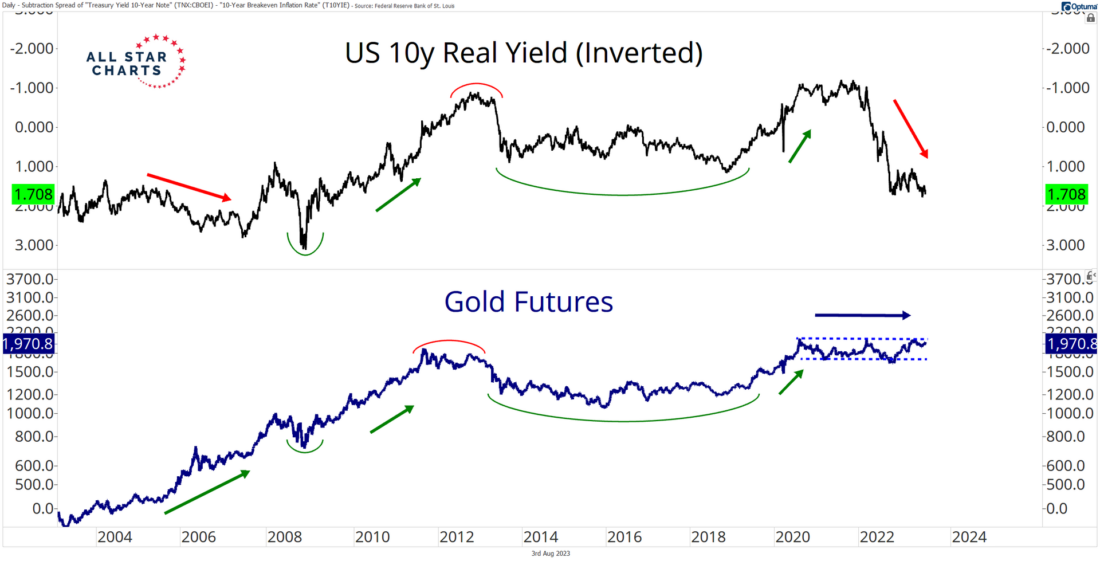

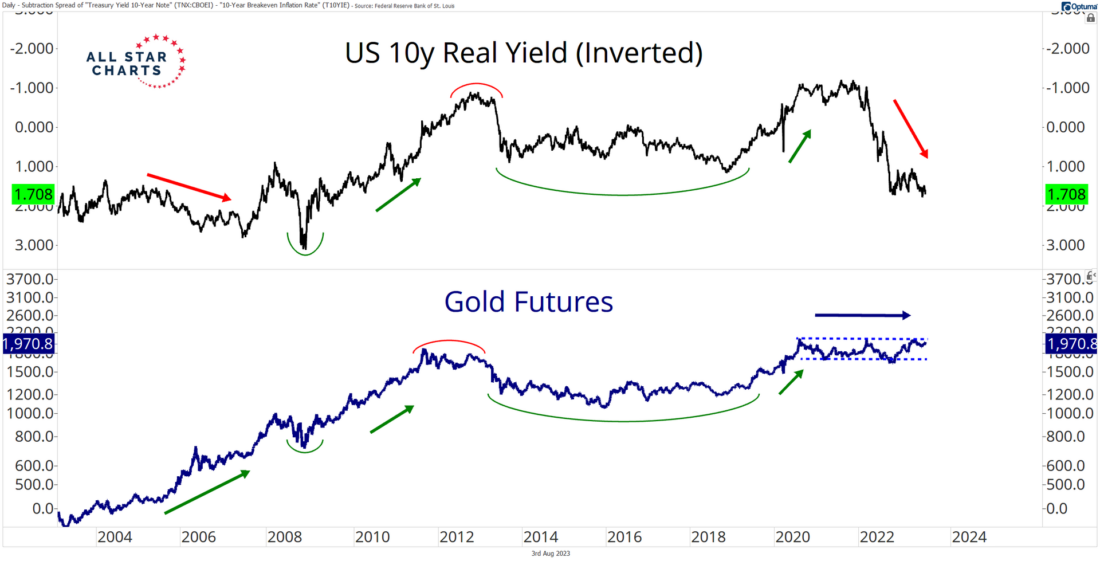

Nominal and real yields are rising. And the latter clearly disapproves of the next leg higher in gold. But does it matter?

Under most circumstances, we would lean toward yes, it does! But it might not be that straightforward if gold responds to anything like it did in the early 2000s.

Check out the overlay chart of the U.S. 10-year real yield and gold futures:

Notice the divergence between the 10-year real yield and gold at the beginning of the century (and the early innings of the previous commodity supercycle).

Gold rose more than 75% from the spring of 2004 to the summer of 2007 as the 10-year real rate climbed 150 basis points (bps).

Rising real rates didn’t pose much of a problem for gold bugs then. And the 300-bps rise in the 10-year over the past 18 months has acted more like a Debbie Downer than an angry bouncer.

Gold can rip higher in the face of increasing real rates. It’s in the historical record for all to see.

Nevertheless, gold bugs must overcome another major obstacle—a rising U.S. dollar.

—

Originally posted 3d August 2023

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.