1/ Strong and Positive Consolidation in the Energy Space

2/ RRG, Relative Strength, and More

3/ Exxon Mobil Corp (XOM)

4/ Valero Energy Corp (VLO)

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/ Strong and Positive Consolidation in the Energy Space

A relative underperformance is observed in the Energy space over the past year. Examination of the Relative Strength (RS) line of SPDR Energy Select Sector Fund ETF (XLE) is currently in a downtrend as evident from the lower pane of the above chart. Looking it closely reveals that the relative performance started to give up from January 2023; it continues to remain in a downtrend. However, over the past few weeks, while staying inside the lagging quadrant of the RRG, this space has been showing a strong improvement in its relative momentum against the broader S&P 500 index. Its rolling inside the improving quadrant would mean a potential beginning of its phase of relative outperformance against the benchmark.

Currently, XLE is seen in a broad consolidation following multiple tests of 93 – 93.50 levels over the past several quarters.

2/ RRG, Relative Strength, and More

The presence of Relative Strength in any instrument is of paramount importance for any portfolio. If the RS is strong or if it has started to improve, it will have two very obvious benefits. First, a holding with a strong or improving Relative Strength is largely expected to end up generating alpha over the benchmark when the markets are trending higher. The second benefit, which I believe is equally necessary, is that when the times are choppy and the markets are in a phase of corrective retracements, the holding with better Relative Strength ends up lending resilience to the portfolio.

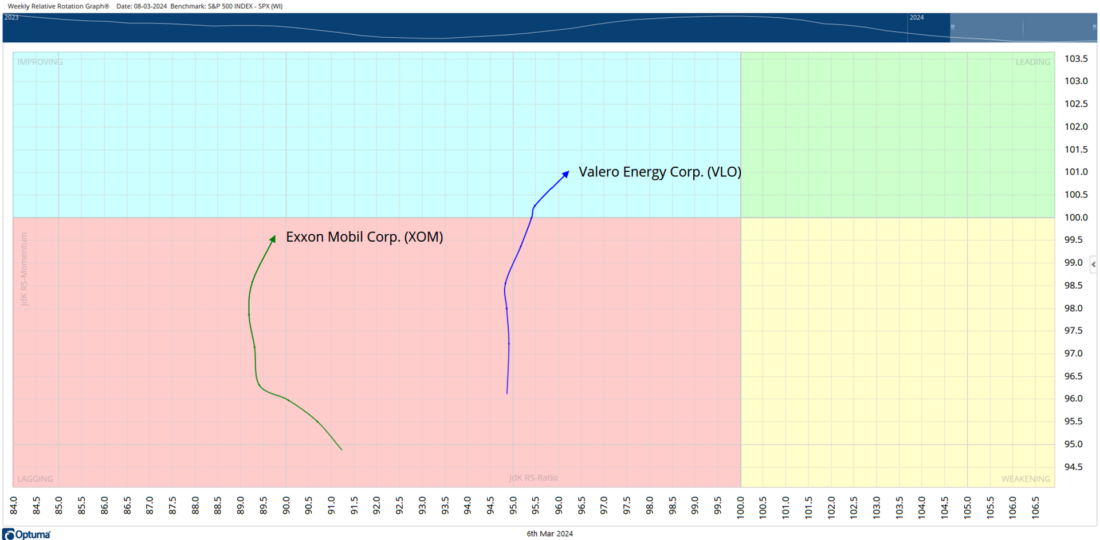

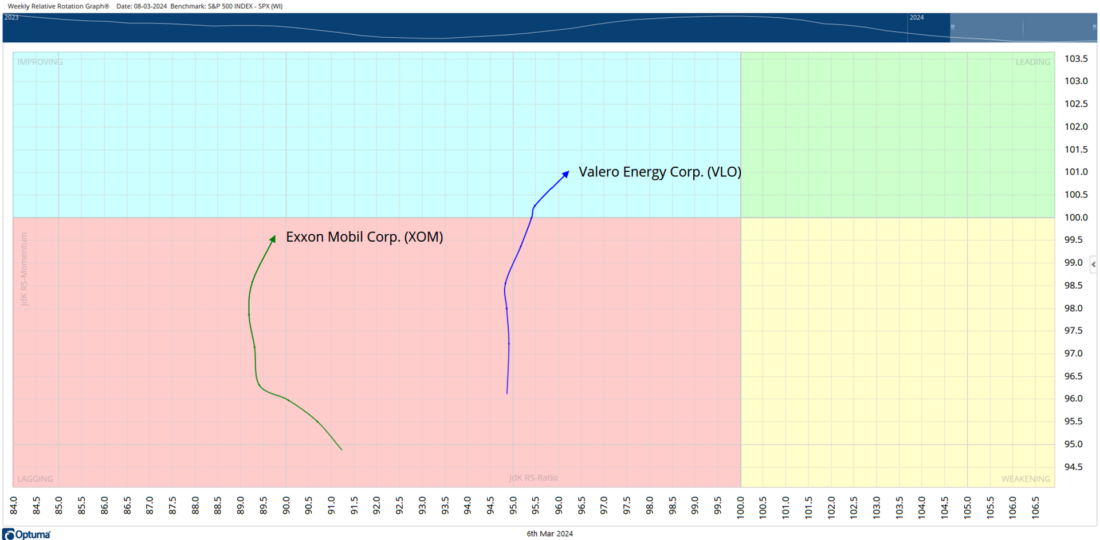

Within the Energy space, Exxon Mobil Corp. (XOM) and Valero Energy Corp. (VLO) are showing sharp improvements in their relative momentum against the broader markets. While XOM is rolling toward the Improving Quadrant, VLO has seen its Relative Momentum already crossing above 100 as it has rolled inside the Improving Quadrant.

With XOM particularly more distant from the center point, it is expected to generate a higher alpha.

3/ Exxon Mobil Corp (XOM)

After forming a classical double bottom support in October 2020, XOM has remained largely in an uptrend. The stock formed its high of 119.63 in February last year after which it has been consolidating in a sideways trajectory. After February 2023, the high point was tested twice each time in April and September 2023, but the stock stayed in a trading range failing to achieve any breakout. A few signs have emerged that hint at a likely resumption of the upmove toward the high point. The occurrence of a large bullish candle near multiple pattern support lays the ground for a potential reversal of the trend. The stock has managed to cross above the 100-week MA placed at 103.53. This stock enjoys the highest holding by the ETF. A retest of the previous high could mean a potential appreciation of over 13% from the current levels.

4/ Valero Energy Corp (VLO)

VLO tested its high in June 2022; after testing the levels of 146.80, the uptrend was halted. The price action over the past many quarters since then has led to the emergence of a bullish ascending triangle. The Relative Strength of the stock is seen improving. The RS line against the broader S&P 500 Index is seen inching higher after forming higher bottoms and is set to cross above the 50-period MA. While MACD stays bullish and above the signal line, RSI shows a mild bullish divergence against the price.

The stock has already rolled inside the improving quadrant of the RRG; it is likely to post resilient performance over the coming weeks. Going by the classical price measurement implications, the stock may show a meaningful upside from current levels if the anticipated breakout takes place. If that happens, the testing of the levels of 165-172 may not be ruled out. Any close below 122 shall negate this technical setup.

——

Originally posted on March 6th 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.