1/ Will Higher Oil Drive XOM?

2/ Does the Trajectory Change for BA Post Earnings?

3/ Breakout or Breakdown for META?

4/ Is There Enough Demand for HAL?

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/ Will Higher Oil Drive XOM?

Each week across Column E’s social channels, I post the 3L’s portfolio of stocks for the week. What started as an educational source has grown, and this week I am sharing with you four of the six stocks that are reporting earnings. Let’s begin with a quick review of XOM.

Exxon (XOM), which reports earnings on Friday, broke down about a month ago but has since found support along the 20-week moving average, and resistance from the range above. With oil prices strong this past quarter, it will come down to the outlook versus the actual earnings being released. A good earnings picture is probably priced in, so if the outlook argues for further oil price gains, this could push the stock through the above range. A sour outlook could know it back through the 20-week below.

2/ Does the Trajectory Change for BA Post Earnings?

I have never been a big fan of Boeing (BA) or its constant cheering by its CEO over the years and the market seems to think the same way as I do at the moment as BA has been falling consistently since the middle of August. With the stock moving lower, I believe the market believes orders are softening and the report will be weak.

One good proxy for BA is the XAL (airline Index shown in black behind the candles below) which tends to track with the stock well – it makes sense since much of the XAL are customers of BA. If they are moving lower, that argues demand and earnings are expecting to be lower as well. At the moment, thanks to the story in oil, the XAL has been tumbling and I think this will also support the stock lower.

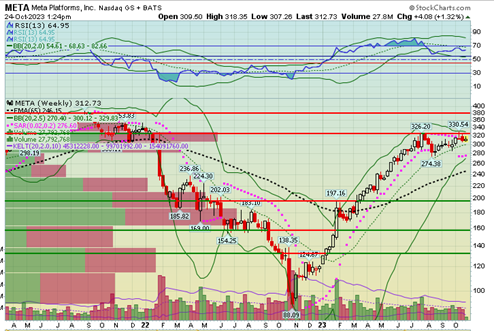

3/ Breakout or Breakdown for META?

Within the 3L’s strategies, every dip has been met with buying in the technology names over the past month. META has been one of those beneficiaries as I presume fund managers are window dressing early heading into year end. Also, a year ago at this time was the beginning of a surge in tech names, like META which drove higher till SIVB and the banks upended the story in March.

For META, heading into earnings on Wednesday, the trend is lower below the range resistance above. 325 appears to be a big point for the bears as they have sold twice, reversing last week’s breakout and sending it lower through Friday. The levels that I am watching are 300 (20-week moving average) and more significantly 250 which is the 65-week moving average. Thinking the market may be looking for a surprisingly better report which is why it is hanging out at the range above. We shall see.

4/ Is There Enough Demand for HAL?

In addition to featuring XOM, HAL is a a notable energy name this week. HAL has been struggling over the past few weeks to make any headway to the upside. This could be from the oil price rally slowing or the products not really following the upside. When the products are rallying, service revenue seem to be higher, but their moves have not been in line with the Crude barrel which has encouraged selling.

Heading into this week, I liked this stock to head higher but through two days of trade, I am a bit concerned heading into earnings. My thinking is that it would break higher from this range on the back of a better outlook but the current status of the chart argues that a reversal is in play and the stock is moving lower. The first support is nearly 6 points lower so if the earnings report is sour, then it probably is heading that way. A good report in my opinion would send it back over the range and continue to climb.

—

Originally posted 25th October 2023

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.