By Ryan Gorman, CFA, CMT, BFA

1/ A Pop

2/ A Flop

3/ A Look at Rates

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/ A Pop

Market action on Wednesday was driven by some large tech earnings (think GOOGL and AMD) and later a fed that does not look eager to cut rates in March. However, QCOM bucked that trend, closing up over 1%.

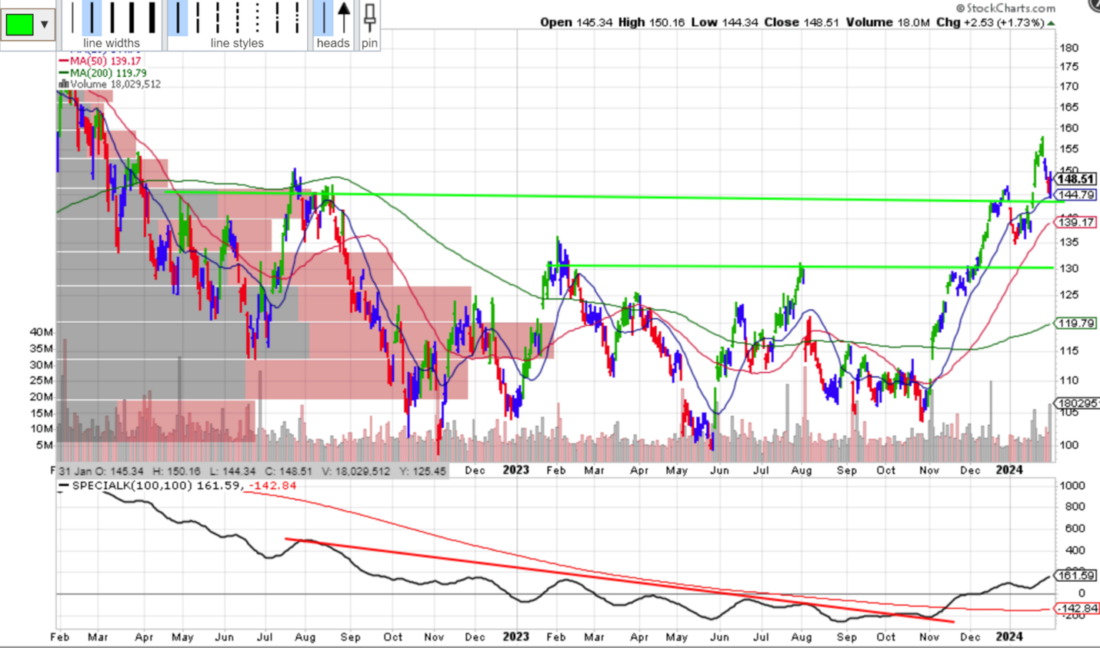

After a failed breakout in December, there was a solid breakout in January that has tested support along with the 20-day moving average. Elder bar is still blue, but after hours the stock was up another 2%. If that carries over, I would expect this to change.

After being largely range bound all 2023, something changed with the Pring special K indicator. This is a very long-term momentum indicator that in this case broke the downtrend and offered some favorable evidence that an upside breakout could occur.

Read more here: Martin Pring’s Special K [ChartSchool] (stockcharts.com)

2/ A Flop

After a few regional banks failed last March, the Federal Reserve set up a facility to shore up liquidity. Many regional banks have gone to previous and even new highs. One that struggled today was New York Community Bancorp. They announced an unexpected loss on an increase to loan loss provisions up to $550 or so million. About 10 times what the street was expecting, they even cut their dividend. This caused a quick move back to the March lows.

After a strong recovery from the March low, the Special K broke its downtrend. Largely NYCB remained stagnant until today. No indicator is perfect, investing and trading is a lot about probabilities. Whatever your investment philosophy, Trend, Value, etc, it pays to stick to your rules. Even if a stock you don’t own goes up, better to be consistent.

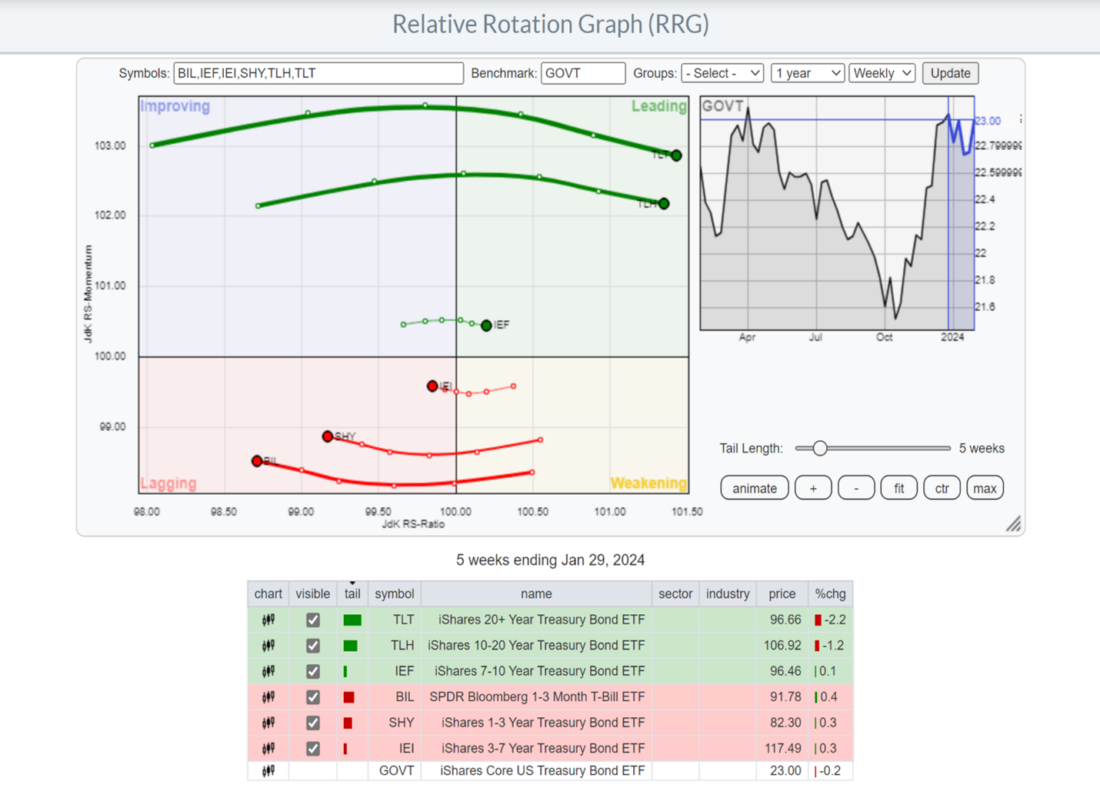

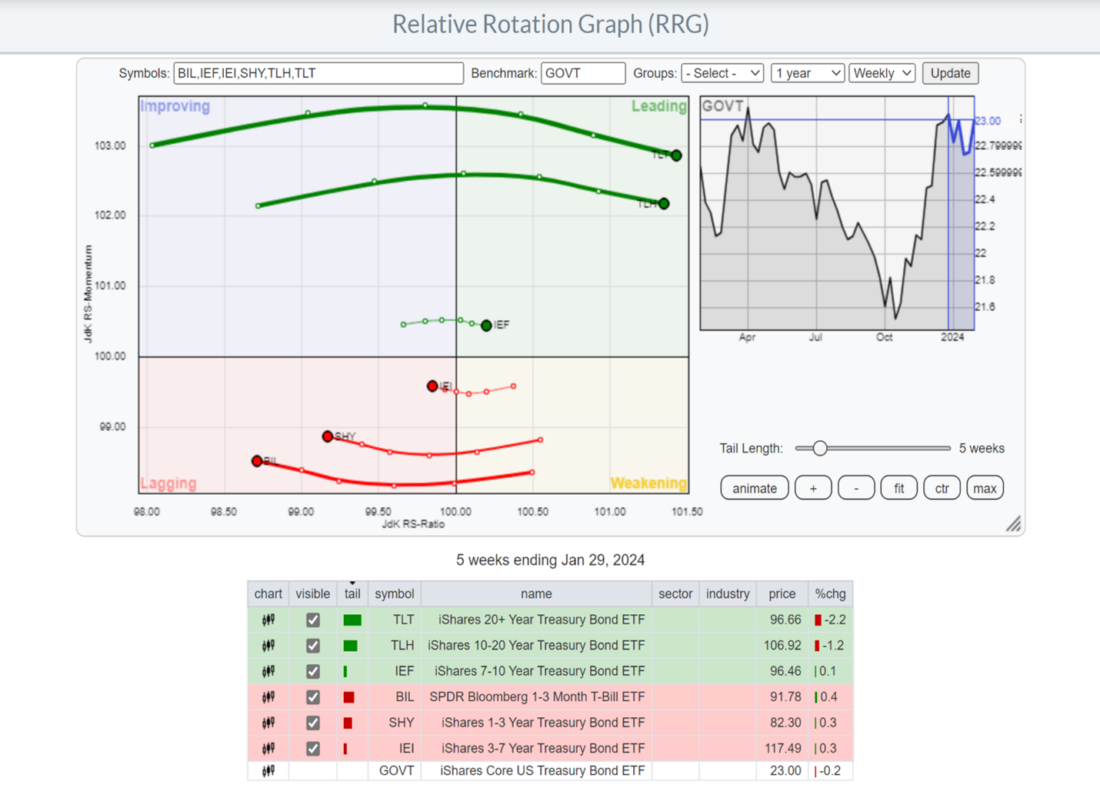

3/ A Look at Rates

The federal reserve held the Fed Funds rate steady today between 5.25-5.5%. The longer part of the curve remains below this, a so call inverted yield curve. In fact the 10 year went back under 4% today.

Historically the yield curve has been a solid predictor of recessions. Something has to get the short end back below the long end. Much of the rally in stocks could be attributed to Powell’s speech in fall where he indicated hiking was done and the next move was likely a cut. The fed’s internal forecast was for 3 cuts. There is no rule on the magnitude, but it is often in 0.25% increments, so 0.75%.

The momentum seems to still favor a rally in longer term bonds. When bond prices rise, yields fall. The market continues to believe the fed may be forced more aggressively.

—

Originally posted 1st February 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.