Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

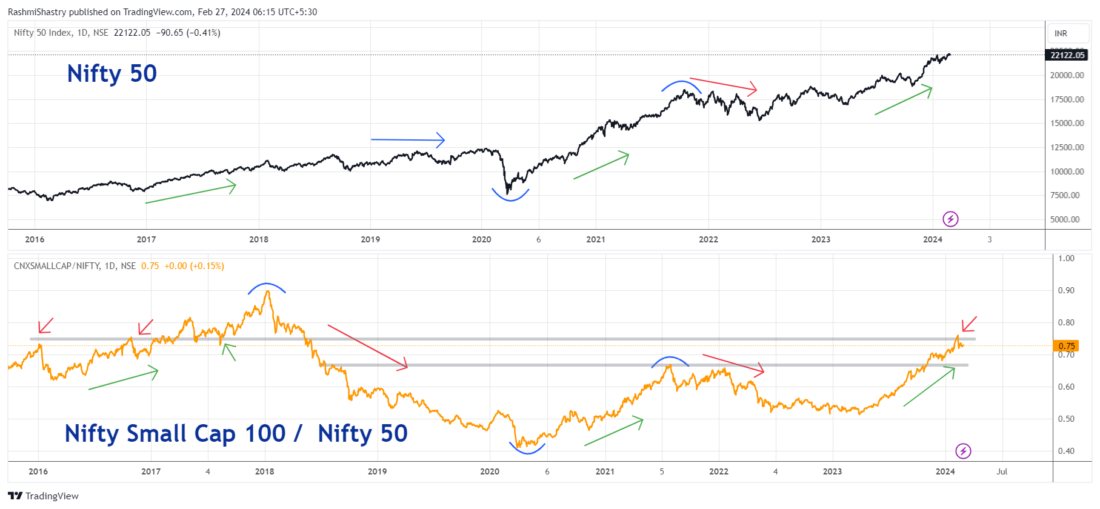

Risk On Indicator – India

Let’s take a look at some of the risk-on-risk-off indicators to be tracked in a market that seems to be giving some mixed signals.

From the Indian market context, the most prominent risk-on indicator I track is the ratio between the Small Cap 100 and the Nifty 50. The market gains strength and participation when the small cap index contributes to the move. When this ratio (bottom panel) is inching higher, the small caps are outperforming the large-caps and vice versa.

In the chart we can see Nifty 50 in the top panel and the ratio in the bottom panel. As can be observed by the annotations, a lack of outperformance by the small caps is often followed by a sideways move or correction in Nifty 50. In fact, the 2020 correction was preceded by a massive underperformance in the small caps whereby the bulk of the heavy lifting was being done by the large caps, resulting in a mere 1500 points move in over two years!

But as can be seen in the chart, even ratio charts have support and resistance zones that can be tracked. Although the ratio broke out of a five-year base, it is currently stuck under overhead supply. If, however, we do see a breakout coming through, the market will race away higher in the months ahead. But a consolidation at these levels cannot be ruled out at present.

2/

High Beta Stocks Taking a Breather

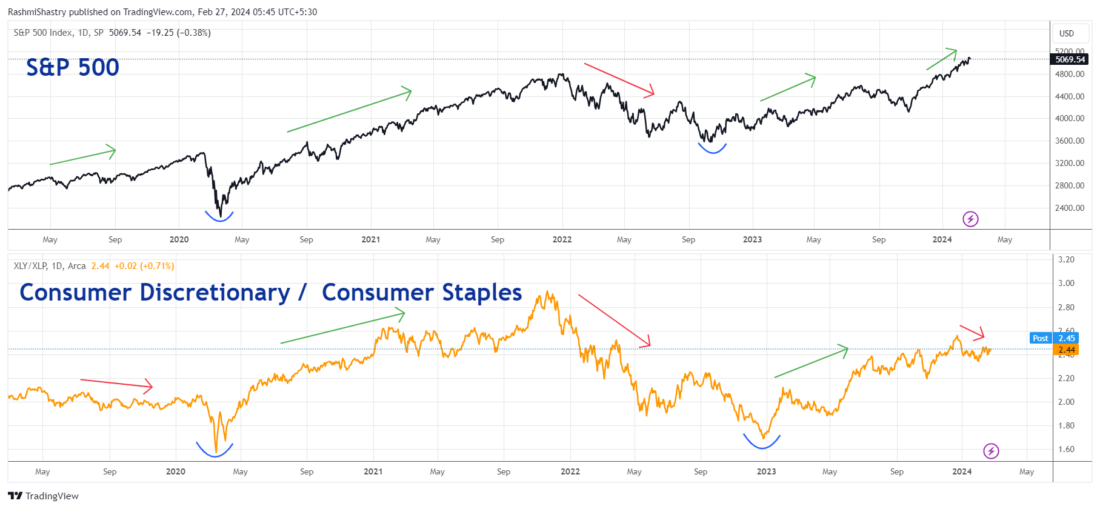

High beta vs. Low volatility is another favorite risk metric that gives me an idea of market drivers. And as you will notice the S&P 500 and the High Beta(SPHB) / Low Volatility (SPLV) move in the same direction for the most part. So what information does that leave us with?

It is when the top panel and the bottom panel move in different directions, that we get some new insights! In the most recent move leading up to this month, we can see that the high beta stocks are tapering off (since the ratio is moving lower) and the low volatility stocks are outperforming. But this is happening when the S&P 500 is rallying higher. This inverse relationship typically doesn’t last too long, and one of the two corrects itself to follow the same direction. This divergence in the relationship tells me that I need to be cautious of my outlook.

3/

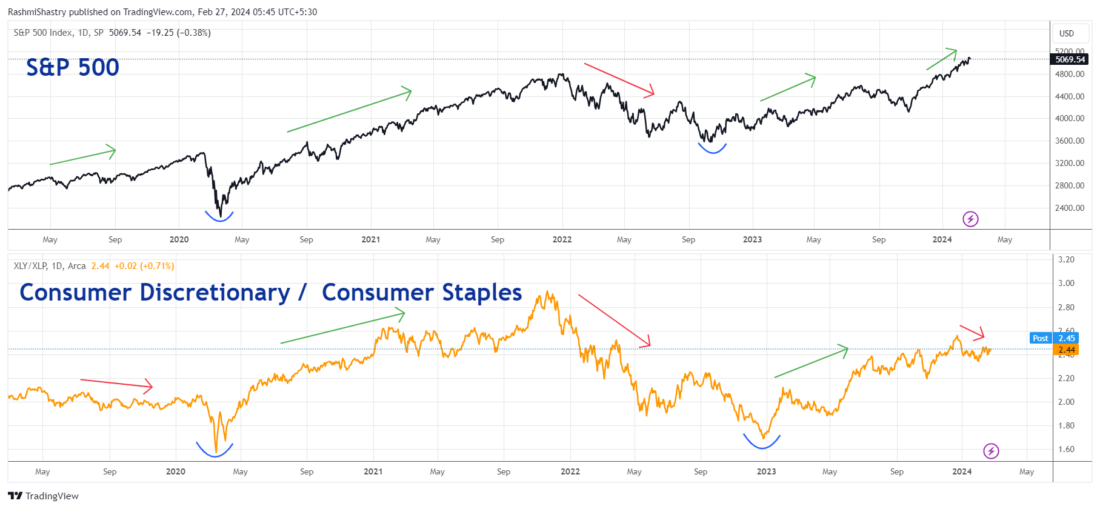

Consumer Staples Taking the Lead

The relationship between Consumer Discretionary and Consumer Staples, though belonging to Consumption, gives us information that helps us identify the market cycle as well as risk appetite. Are market participants taking on more risk, or standing by on the side?

Like the earlier chart, this ratio too moves largely in the same direction as the S&P 500. It is when this direction doesn’t match, that draws attention.

Consumer Staples are non-negotiable products that the consumer will buy regardless of the market cycle, inflation, etc. Discretionary products are what the consumers will indulge in when there is the option to consume them- discretionary income.

So this ratio between Discretionary and Staples is very simple. The market is risk-on when the ratio is moving higher and is risk-off when the market is moving lower. Most importantly the signal to look out for is the divergence of signal between the ratio and the S&P 500. Which is where we are at present. That makes it two risk metrics where the ratios are making lower highs and the index is making higher highs.

—

Originally posted on February 27th 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.