1/ 2-day streak

2/ Super Swiss

3/ Inverted Yield Curve

4/ Financials Holds

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/ 2-day streak

Gasoline futures have risen for the second consecutive day and are currently trading at around 2.33. For the second day in a row, we have observed a similar price trend. These trading sessions have been characterized by initial declines ranging from -1.44% to -2%, followed by swift recoveries that resulted in gains of over 2%.

Gasoline futures are now on the verge of closing the session in positive territory, marking three consecutive days of gains. Will we continue to witness this pattern for the remainder of the week?

2/ Super Swiss

The Swiss franc continues to appreciate against the euro and is poised to break through the annual base established by the currency pair after reaching 1.0615. Excluding the peak of 1.0583, which was reached in 2015 when the Swiss National Bank removed the minimum exchange rate of the Swiss franc against the euro, the pair is now approaching historically high levels.

The Swiss currency remains robust despite a euro that continues to display signs of weakness, and we may be witnessing a breakthrough of the resistance level, potentially leading to a continuation of the trend that has been in place since 2018.

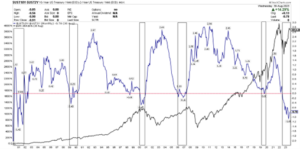

3/ Inverted Yield Curve

The yield curve remains inverted while the S&P 500 attempts to maintain the 4,350 level. The chart below illustrates past instances of yield curve inversion and the subsequent impact on stock markets when the curve reverts from a negative state to normal.

Such an inverted curve is often interpreted as a signal that investors are anticipating an economic slowdown or even a recession.

It is also correlated with a decrease in stock returns, as investors may become more cautious and shift their focus towards safer assets, such as government bonds, rather than stocks. During periods of yield curve inversion, investors tend to seek out stocks from companies considered defensive, i.e., companies that tend to be less sensitive to economic fluctuations.

4/ Financials Holds

The financial sector clings to the previous pre-covid maximum, which now plays a support role and continues to oscillate sideways.

Banks have been forced to maintain liquidity and tighten lending standards, granting fewer, less risky and more expensive loans. Bulls will need to hold the support zone to avoid massive selling that could drag the price down to the 22-23 area, which is the price level with the highest volume.

—

Originally posted 19th October 2023

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.