As we approach the end of the second quarter, propelled this morning by a furious bout of anticipation about late window dressing, it is tempting to look back at the theme for the past three months. It is tempting to simply say “AI Mania” and be done with it. But it is definitely more than that.

Sure, it is tempting to look at the 12+% gain for the NASDAQ 100 (NDX), note the fact that is has been propelled by the market-leading mega-cap techs, and leave it at that. But that would be simplistic. The S&P 500 Index is up over 8%, and while the mega-caps have been a huge part of that rally, they are not the only reason.

We have started to see nascent signs of rotation, with other sectors beginning to participate in the rally and with the Russell 2000’s quarter-to-date gains approaching 5%. European stocks, which posted double-digit gains in the first quarter, were only modestly higher on balance, while the Nikkei 225’s 20% gain was nothing short of stunning. Meanwhile, China’s re-opening failed to match the early enthusiasm, and both Mainland Chinese and Hong Kong indices fell.

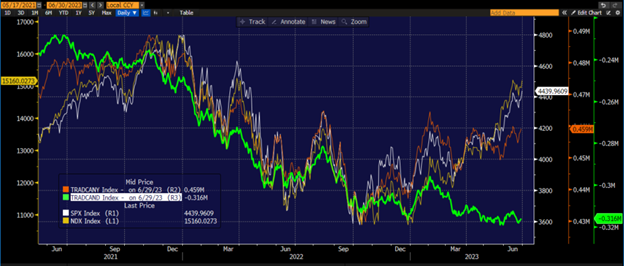

That said, the rotation is not complete yet. As the chart below shows, advance/decline lines have recovered somewhat, but they are far from fully confirming the recent moves:

1-Year Line Chart, SPX (white), NDX (yellow), NYSE Cumulative Advances-Declines (red), NASDAQ Cumulative Advances-Declines (green)

Source: Bloomberg

Strange as it may sound, the most notable catalyst for this quarter’s run, at least in the US, was the banking crises that crested last quarter. It is tempting to simply say that “whatever doesn’t kill you makes you stronger,” but while true in this case, it is insufficient. Instead, a key catalyst was the roughly fact that the Federal Reserve’s balance sheet expanded by $300 billion as the result of loans to the banking sector.

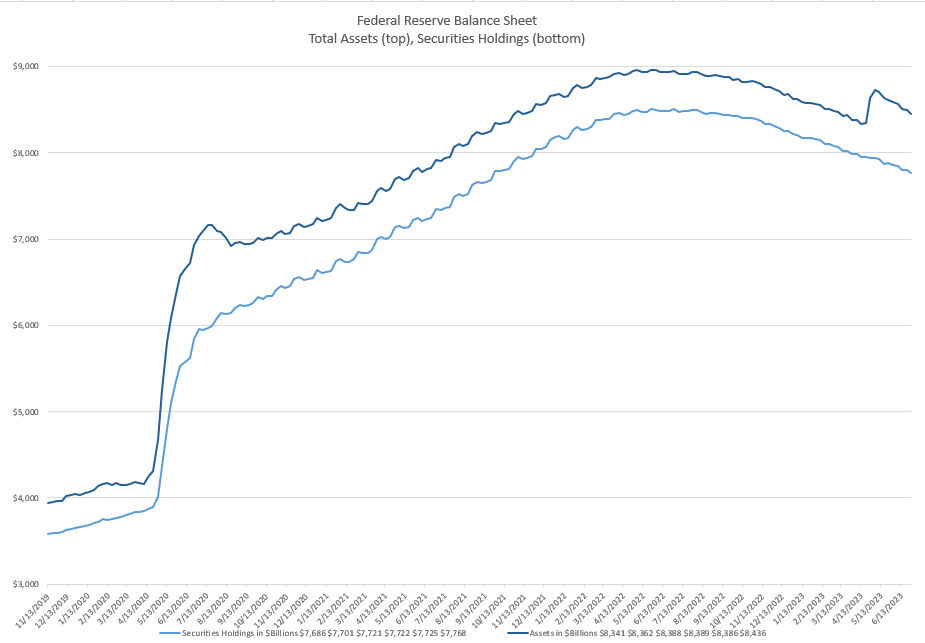

As we have noted previously, there is a huge asymmetry when it comes to monetary policy transmission. While there is indeed a long and variable lag when it comes to rate hikes and quantitative tightening (QT), markets react in a matter of weeks to any sort of monetary accommodation. In this case, even though the accommodation was not aimed specifically at markets, the balance sheet expansion reached already buoyant markets quickly. The almost instantaneous undoing of several months’ worth of QT clearly provided a jolt of caffeine to markets that were already primed to jump. Even though we have now reached a point where QT has brought the balance sheet back to prior levels (see the chart below), the equity market enthusiasm, or inertia, remains in place – even if it has worn off in the bond market.

Source: Interactive Brokers, Federal Reserve H.4.1 releases

Looking ahead, equities should get a stern test when second-quarter earnings season begins in about two weeks. Much of the current rally, at least in the tech sector, has been in the form of multiple expansion. That means that if we look at P/E ratios, the P, or price, has been outpacing the E, or earnings. Implicitly, it means that expectations for earnings have risen, whether or not the published estimates reflect them. A key factor to this quarter’s rally was a solid response to first-quarter earnings when they came out in April. Most companies met or modestly beat, while some like Nvidia (NVDA), rose dramatically on positive guidance. At some level we have to wonder whether the bar has been raised too high, at least in the near-term.

Speaking of the near-term, I was recently asked whether investors should take profits after the stellar rally and ahead of earnings season. I favored buying insurance instead. With VIX at around 13, volatility is around the lowest levels seen since February 2020 (ummm…). Bearing in mind that that VIX is designed to offer the market’s best estimate of volatility over the coming 30 days, which now encompasses the heart of earnings season, that tells us that volatility traders are quite sanguine. If you think of volatility protection like insurance, you don’t need to have your insurance pay off to make you sleep better at night. No one WANTS their fire insurance to pay off, but we are quite willing to pay the premiums necessary to insure our homes. When that insurance is cheap, it prove quite prudent — especially when the value of the assets it is designed to protect have appreciated over time.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Thanks. Very good advice.

Roy, thank you for being a dedicated follower of Traders’ Insight!

Markets are still in the “everything is good news” phase. Until that changes, all this is hype and hustle.

Can you give an example of the insurance next time and the auction market thank you very much

Thank you for the suggestion, Scott.